Operational accounting

The operating bookkeeping, like the cost and performance accounting practiced today, creates data with the aim of gaining results from internal processes and substantiating decisions.

The operational accounting is closely related to the financial accounting . Both belong to accounting (which also includes statistics and planning calculations ). The operating bookkeeping receives its initial data from the financial bookkeeping, but cannot accept it unchanged. The procedure is shown below under the section on accrual calculation.

The operating bookkeeping is geared towards making decisions with the aim of greater profitability. It should provide a basis for answering the question,

- how either a given performance can be achieved with the lowest costs (minimization goal),

- or the greatest possible performance (maximization goal) can be achieved with given costs.

Operational accounting is often referred to as internal accounting. This should indicate that it is not intended for external addressees, but rather deals with internal company matters, which are often treated as trade secrets.

What is wrong, however, is the opinion, often held in the literature, that the operating bookkeeping has no relation to legal requirements. Rather, the valuation of finished and unfinished products as required by the German Commercial Code can only be carried out if the operating bookkeeping provides the necessary documents. That will be justified later.

The need for operational accounting

It is derived from the fact that future-related decisions can often not be justified directly with the data in the financial accounting. That doesn't diminish their importance. The financial accounting with its profit and loss account provides data from past periods - it cannot and should not do more.

The operating bookkeeping takes into account that the basis of the numerical values resulting from the entry of documents from the past may change in future periods.

It is possible that the market prices change during sales or purchase, that wages and salaries are redefined, that legally permissible hidden reserves have been created that are to be discovered internally. The company may have been confronted with complaints about production errors, which have since been resolved.

In addition, quite a few companies deny business areas that are not part of their core business. This can be the rental of company apartments or the execution of financial transactions with temporarily free funds.

The entrepreneur wants to recognize the results that the company's core business has brought. The secondary activities are kept out of the operating bookkeeping and assessed separately.

Accrual calculation

For the purpose of the accrual calculation

The objective of the accrual calculation is to determine the amount of the individual operational services and costs. The figures from financial accounting are the starting values. The operating result is determined from the summation and offsetting of costs and services .

The operating result is understood to be:

- Operating profit = performance - costs

An operating profit is achieved when the services exceed the costs.

If this is not the case, there is an operating loss.

In contrast, the financial accounting shows the overall results of the company.

The overall result is understood as follows:

- Total result = income - expenses

A total profit is achieved when the income exceeds the expenses.

If this is not the case, there is an overall loss.

Costs and services are terms from the business accounting.

Expenses and income are terms from financial accounting.

Expenses are listed on the debit side of the profit and loss account. They affect the entire company and are related to the past.

Costs are those expenses that

- concern the operation (the core business),

- are not due to extraordinary circumstances (damage, complaints, etc.) and

- corrected for foreseeable changes (prices, wages, etc.)

In order to make it very clear whether a certain issue is data from the financial accounting (Fibu) or from the operational accounting, the latter is often referred to as cost and performance accounting (KLR). This is not entirely exact because the operating bookkeeping also includes the contribution margin calculation (to be dealt with later) in addition to the KLR .

The distinction between financial and operational accounting must clarify

- which data, recorded as expenses, can also be included in the costs or how this data is to be changed or supplemented

- how actual operational services are to be defined in distinction from the figures contained in financial accounting.

Note for the following sections: Only basic features are shown. Proceeding from this, procedures and methods (tables) can be refined if this is in the company's interest and promises to gain further knowledge.

Cost accounting - 3 components

The cost accounting consists of 3 components

- Level 1 - The cost type calculation should answer the question of which costs have been incurred (recording).

- Level 2 - Cost center accounting answers the question of where costs were incurred (distribution).

- Level 3 - The cost accounting answers the question of what costs were incurred (attribution - which products - these are the payers ).

The cost center accounting must inevitably be placed between the cost type accounting and the cost unit accounting, whenever several products are manufactured in several production stages and there are central departments that work for the entire company or several areas (e.g. administration and sales). Without this link (cost center accounting) it would not be possible to calculate individual prices and to carry out the valuation of the unfinished and finished products with the manufacturing costs required for the balance sheet .

Cost type accounting

In the past, postings to accounts were used to show how the data from the income statement (financial accounting) were transferred to cost and performance accounting (operational accounting), i.e. which costs were incurred.

An accounting area I (Fibu) and an accounting area II (KLR) were created in the bookkeeping . In industry accounting for separate accounts are provided.

However, such a procedure is uncommon today.

The delimitation calculation from the financial accounting - like the entire operating accounting in general - is practiced in the form of tables.

A first of these tables is called the results table.

The results table is the bridge between financial accounting and cost and performance accounting

| Results table ---- an example | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial accounting | Cost and performance accounting | |||||||||||||

| Profitability Analysis | Accrual calculation | Operating income statement | ||||||||||||

| account | ...Effort | ...... yield | neutral expenditure | neutral income | Expenses accounting | accounted for costs | costs | Services | ||||||

5000 0 930.000 0 0 0 0 0 930.000 5202 0 31.080 0 0 0 0 0 31.080 5300 0 39.000 0 0 0 0 0 39.000 5400 0 17.040 0 17.040 0 0 0 0 5460 0 49.920 0 49.920 0 0 0 0 5490 0 22.440 0 22.440 0 0 0 0 5500 0 13.500 0 13.500 0 0 0 0 5710 0 15.900 0 15.900 0 0 0 0 6000 162.720 0 0 162.720 140.000 140.000 0 6160 23.040 0 0 0 0 23.040 0 6200 233.640 0 0 0 0 233.640 0 6300 134.160 0 0 0 0 134.160 0 6400 53.160 0 0 0 53.160 0 6520 106.600 10.000 0 96.600 72.500 72.500 0 6900 9.720 0 0 0 9.720 0 6930 2880 0 0 2.880 6.000 0 6950 18.960 0 0 18.960 5.000 5.000 0 6960 9000 9.000 0 0 0 0 7000 25.560 1.500 0 0 24.060 0 7510 1.500 0 0 1.500 18.300 18.300 0 kalk.UL 0 0 0 0 62.000 62.000 0 Su 780.940 1.118.880 20.500 118.800 282.660 303.800 781.580 1.000.080 Salden337.940 98.300 21.140 218.500 Su 1.118.880 1.118.880 118.800 118.800 303.800 303 800 1.000.080 1.000.080

Die Bezeichnung der Konten ist folgende: 5000 Umsatzerlöse eigener Erzeugnisse 5202 Mehrbestände Fertigerzeugnisse 5300 andere aktivierte Eigenleistungen 5400 Mieterträge 5460 Erträge aus dem Abgang von Vermögensgegenständen des Umlaufvermögens 5490 Periodenfremde Erträge 5500 Erträge aus Beteiligungen 5710 Zinserträge 6000 Aufwand für Roh-, Hilfs-, und Betriebsstoffe 6160 Fremdinstandhaltung 6200 Löhne 6300 Gehälter 6400 Soziale Abgaben 6520 Abschreibungen auf Sachanlagen 6900 Versicherungsbeiträge 6930 Garantieleistungen 6950 Abschreibungen auf Forderungen 6960 Verluste aus dem Abgang von Vermögensgegenständen 7000 Betriebssteuern 7510 Zinsaufwendungen kalkulatorischer Unternehmerlohn

In the results table, the following is done:

1. Separation of non-operating expenses: These can be expenses for company housing, losses from securities transactions, losses from unusually high wear and tear of fixed assets, back payment of wages or taxes. The business economist speaks of neutral expenses - neutral, because they affect the company, but not the operation as a core business.

2. Carrying out cost accounting corrections

The expenses cannot in every case and in an uncontrolled manner as costs and be included in the cost accounting. Corrections for cost accounting are necessary.

It is a matter of

- Additional costs : these are costs that are not yet included in the financial accounting expenses, but will probably arise in the future.

- Other costs : these are expense items that have to be corrected in terms of value before they are included in cost accounting (e.g. due to price changes to be expected in the future).

- Basic costs that are actually congruent in the financial accounting and in the cost accounting. This could be wages or salaries, for example, if no significant changes are foreseeable.

Examples of cost accounting corrections

Additional costs as imputed costs

The purpose of recording such costs is to endeavor to answer the question of which cost picture would arise for a competitor in your company who works with normal costs while the situation in your own company may be more favorable.

An example of this:

Usually one works with an employed manager. In many small and medium-sized companies, however, the owner carries out this activity himself. In a private company, the owner is not paid a salary, but lives from the profit - therefore this activity is not recognizable as a service in the financial accounting. However, this service must be taken into account in the cost calculation - an imputed entrepreneur's wage in the amount of an industry-standard wage is inserted.

Another case:

There are companies that work with a high proportion of equity. In contrast to outside capital, no loans are required for this, so there is no interest in the financial accounting. In the cost picture, however, this is made visible as imputed interest. (Intention: Inclusion in the prices that should be enforced with the customers if possible)

Other costs

If it is known exactly that the prices for the basic material will increase in the future, it would be wrong to use these outdated prices in the cost accounting. In this case, the cost of materials is corrected according to future-related costs. In-house transfer prices are used in larger companies. The same procedure is followed for other types of effort.

Complaints and imputed risks

Should complaints arise sporadically or accidentally in terms of content or timing, or if the causes of the complaint have been eliminated, the costs will not include the costs of the complaint, but rather calculated risks.

Balance sheet and imputed depreciation

Due to the regulations and standards of tax law , a very narrow framework is set for the depreciation ( deduction for wear and tear ) that may be included in the profit and loss account . The entrepreneur is free of this in the internal cost accounting. The actual consumption of the systems and machines is applied as imputed depreciation. In doing so, it can be taken into account, for example, that a certain system was purchased very cheaply, i.e. that there was little depreciation in the balance sheet, but that the competition must reckon with significantly higher costs.

The consideration of additional or other costs in the cost accounting serves to present a clear cost picture. This is necessary for future-oriented decisions. This cost picture must be as realistic as possible. Unrealistic assumptions both upwards and downwards distort the basis for decision-making.

Delimitation of income and services

The same applies to income and services as there are differences and connections between expenses and costs .

Income (term of financial accounting) is understood to mean the entire inflow of values that was made visible in the corporate accounting within the profit and loss account.

Services (term from the business accounting), on the other hand, are business-related. Neutral income not related to the core business is subtracted. Corrections are also made to keep irregular, extraordinary income away from the performance calculation. It should also be checked whether the price level for your products and services will also be sustainable in the future.

The cost center accounting

Cost center accounting answers the question of where (at which points in the company) costs were incurred.

The operational accounting sheet (BAB) is the bridge between cost type and cost unit accounting and thus an instrument of cost center accounting.

With the help of the operating accounting sheet , overhead costs are allocated to the individual operational areas and surcharge rates are determined that are used in cost unit accounting, especially price calculation .

First of all, a distinction between direct costs and overhead costs is necessary.

Individual costs:

- These are the costs that can be allocated individually and directly to a specific product (cost unit). It is particularly about basic material and basic wages.

Overhead:

- They cannot be directly attributed to a specific product. For this reason, surcharge rates are used for the cost calculation, which are added as a percentage in order to determine the total costs for a specific product.

Basic scheme of a business accounting sheet

| Operating accounting sheet (BAB) --- the basic scheme | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cost types | Main cost centers | ||||||||||||||||||

| material | production | administration | distribution | ||||||||||||||||

| Depreciation | |||||||||||||||||||

| wages | |||||||||||||||||||

| Social costs | |||||||||||||||||||

| Business taxes | |||||||||||||||||||

| rental fee | |||||||||||||||||||

| Total overhead | |||||||||||||||||||

Based on the data obtained from the BAB, surcharge rates can be calculated:

- Material overhead surcharge rate: = Material overhead as a percentage of production material consumption

- Manufacturing overhead rate: = Manufacturing overhead as a percentage of manufacturing wages

- Administrative overhead surcharge rate: = administrative overhead as a percentage of manufacturing costs (manufacturing material + material overhead + manufacturing wages + manufacturing overhead)

- Selling overhead surcharge rate = Selling overhead as a percentage of the manufacturing costs.

The simple operating accounting sheet outlined here is referred to as one-step.

The overheads that cannot be directly assigned to a product are distributed to the main cost centers in a calculation level .

A multi-level BAB is set up in most companies. In addition to the main cost centers, additional cost centers are set up.

There are

- General cost centers that provide services for the other cost centers, such as B. Vehicle fleet, heating, security personnel.

- Auxiliary cost centers that generally work for production cost centers such as B. Work preparation, toolmaking, repair shops

Procedure for drawing up the company accounting sheet (BAB)

- First, the overhead costs of the results table (cost type calculation) have to be copied into the left column of the BAB.

The values for the production material and the production wages are also taken from the results table. The payroll department tells you in which production locations (departments) the production wages were incurred.

- Now is the difficult task of distributing the overhead costs among the cost centers. The rule "As precisely as possible while avoiding unnecessary work" applies.

How can you proceed?

- For the auxiliary and operating materials, there are material withdrawal slips that provide information about the consuming departments.

- Salaries can usually be assigned fairly precisely to the cost centers.

- Depreciation can be broken down by the value of the asset

- If heating and rental costs are incurred, the reference basis would be the converted room or the floor space that is used by the individual departments.

The allocation of the general cost center and the auxiliary cost center in production poses a particular problem.

The general cost center could, for example, be a central vehicle fleet, property management or a boiler house.

The auxiliary production center could be a small workshop that does some of the repairs operationally in the main production centers. These shares can be obtained from secondary records of the fleet manager or the fitters of the production support center. Sensible estimates are better than excessive work here.

The cost unit accounting

The cost unit accounting determines the prime costs for the individual cost units. It is used to carry out cost controls and to determine offer prices.

The basic tool of cost unit accounting is the overhead calculation .

The scheme is structured as follows:

Calculation scheme

- 1. Production material (FM)

- 2. Material overheads (MGK) according to BAB as a percentage of FM

- 3. Material costs (MK) 1. + 2.

- 4. Manufacturing wages (FL)

- 5. Production overheads (FGK) according to BAB as a percentage of FL

- 6. Production costs (FK) 4. + 5.

- 7. Manufacturing costs (HK) 3. + 6.

- 8. Administrative overhead costs (VwGK) according to BAB as a percentage of HK

- 9. Distribution overheads (VtrGK) according to BAB as a percentage of HK

- 10. Costs of the cost bearer (SK)

Full cost accounting - possibilities and limits

The previous sections of this article dealt with cost type, cost center and cost unit accounting. These three areas taken together are called full cost accounting . This term arose because all costs are fully allocated to the cost bearers (the products) and are compared with the services (prices) recognized on the market.

In summary, it can be stated that full cost accounting gives the entrepreneur data and work equipment that he soon recognizes as essential for decisions to be made.

- The results table shows him what results his core business brings and what can be attributed to non-operational and extraordinary factors.

- He can determine cost ratios, which he can use as a basis for the calculation of offer prices in the case of a simple form of service provision (craft, etc.). He anchors certain cost relationships (calculation surcharge, trading margin, calculation factor) in his memory and uses them when negotiating purchase and sales prices.

- The company accounting sheet enables him to determine surcharge rates for step production (the product passes through several departments), which can be used to calculate prices. The valuation of unfinished and finished goods becomes possible.

- It is possible to calculate prices that should be aimed for in sales. The use of the traditional calculation scheme (cost unit accounting) ensures that those prices are named in the offers with which direct and overhead costs are collected and a reasonable profit is achieved.

The contribution of traditional full cost accounting for decisions of the entrepreneur summarized here shows the great potential of this area of cost and performance accounting. Solutions and answers are offered for many practical problems and questions.

However, problems cannot be overlooked. In particular, in many companies, the distribution of overhead costs to the cost centers and the allocation to the cost units has proven to be difficult and labor-intensive.

A particular problem lies in the distribution keys, where compromises in terms of accuracy are inevitable. For example, it is not possible with absolute precision to attribute the accountant's labor costs to each individual product. Working with the operating accounting sheet has shown how practice helps in this and in other cases.

Nevertheless, in many companies, full cost accounting was and is an indispensable basis in order to be able to answer the pending business questions. This is especially true for companies with a production range that has been stable over several years, secure sales and high capacity utilization.

However, if these conditions do not exist or are insufficient, the full cost calculation must be supplemented by further business management instruments. This is provided by the contribution margin calculation.

The fact that full cost accounting cannot provide answers to all business questions is not a defect. Unfortunately, this is often expressed in the specialist literature. So this area is underestimated.

Partial cost accounting as a prerequisite for contribution margin accounting

Partial cost accounting breaks down the cost types not only according to whether they are direct costs (directly attributable to the product) or overhead costs (only generally attributable via a key), but also according to

- whether costs rise or fall in proportion to the volume of production or

- whether they are constant - even if production rises or falls.

The partial cost accounting therefore breaks down the costs into

- variable costs (variable and proportional to the volume of production) and

- Fixed costs (fixed and constant even if the scope of production changes).

Variable costs change with different levels of production. For example, the cost of manufacturing materials and manufacturing wages rise or fall in proportion to the volume of production (level of employment). Unchanged production technology is assumed.

Fixed costs remain unchanged for different levels of employment , fixed - i.e. fixed. It is assumed that the entire company organization will not be redesigned. Imputed depreciation can be an example of fixed costs . They do not change whether the capacity is used to 60 or 70 percent. The same applies to administrative costs , research and development costs and many other types of costs.

The distinction between fixed and variable costs is essential for operational decisions.

This is the only way to answer:

- What is the minimum price that must be achieved so that accepting an additional order is worthwhile?

- When should the production of a product be dispensed with if the full cost accounting shows a loss?

- Which products should the marketing efforts be focused on?

- When is in-house production or external procurement cheaper for the company?

The contribution margin calculation is used to answer these and other decision-making questions.

The contribution margin calculation

The contribution margin (DB) is determined as the difference between revenue and the variable costs required for it.

This DB is the amount with which a contribution is made to cover fixed costs and to achieve a profit.

The contribution margin calculation also sets up the work tables differently than the full cost calculation.

The basic structure is:

Umsatzerlöse - variable Kosten = Deckungsbeitrag - fixe Kosten = Betriebsgewinn

This structure also provides the explanation for why we speak of contribution margin accounting.

It is calculated what contribution is left after deducting the variable costs (mostly material and wages) in order to provide a contribution to cover the fixed costs (which are connected with the existence of the company) and possibly also leave a profit.

The following steps are taken:

- 1. All costs are recorded that are caused by a certain product or a product group, that is, that can be allocated directly (variable costs). In most industrial companies, they are the same as the direct costs and are called direct costs. Direct costs are primarily personnel costs and direct material costs that are dependent on the number of pieces. They only occur when the product in question is actually produced.

This procedure explains why in practice and in the literature the terms

- Partial cost accounting or

- Direct Costing (direct cost accounting )

be used.

- 2. Then the contribution margin is determined.

Example: Sales revenue per unit minus variable unit costs = contribution margin

- 3. The impact of measures to expand or reduce production on revenues, variable costs and profit margins is then calculated.

Contribution margin calculation as a basis for decisions

This step shows that full cost accounting is not sufficient for making decisions.

The following example should illustrate this: (Numbers in thousands of euros)

Produkt A Produkt B Gesamt Fertigungsmaterial 3000 1000 4000 + Materialgemeinkosten 10 % 300 100 400 Fertigungslohn 2500 800 3300 + Fertigungsgemeinkosten 110 % 2750 880 3630 Herstellkosten 8550 2780 11330 Verwaltungsgemeinkosten 12 % 1026 333,6 1353,6 Vertriebsgemeinkosten 5 % 427,5 139 566,5 Selbstkosten 10003,5 3252,6 13256,1 Umsatzergebnis 12000 3000 15000 Gewinn/Verlust 1996,5 -252,6 1743,9

A decision based solely on the details of the full cost calculation could lead to product B being withdrawn from production.

Whether this is the right decision in the company's interest can only be answered by the contribution margin calculation.

Contribution margin calculation

Produkt A Produkt B Gesamt Umsatzergebnis 12000 3000 15000 minus variable Kosten 5500 1800 7300 = Deckungsbeitrag 6500 1200 7700 Fixkosten 6190,1 Gewinn 1509,9

Consequences

If the sale and production of product B were foregone, the variable costs of 1,800,000 euros would not arise. At the same time, a contribution margin of around 1200,000 euros disappears. There then only remains a contribution margin of 6500,000 euros. After deducting the fixed costs, there is only a profit of EUR 309.9 thousand.

It is therefore clear that not producing and selling product B would be a big mistake. Unless other better variants are still open, such as shifting the capacity from product B to product A, if the sales conditions permit.

Decision rule

As long as a product is still generating a positive contribution margin, it is uneconomical to remove it from the production program without further considerations and investigations.

Profitability analysis as the basis for profit centers

The contribution margin calculation with step-by-step fixed cost coverage has proven itself in practice. It is therefore becoming more and more widespread.

The procedure can be illustrated using the numerical example that is presented in the Wikipedia keyword contribution margin. The example is prepared as follows in a calculation table under this keyword:

The fixed cost coverage calculation looks like this:

| Area A | Area B | ||||

|---|---|---|---|---|---|

| Costing object | Product a1 | Product a2 | Product b1 | Product b2 | Product c |

| Net sales | 1000 | 5000 | 750 | 200 | 500 |

| ./. variable costs | 100 | 1000 | 250 | 50 | 80 |

| = Contribution margin I. | 900 | 4000 | 500 | 150 | 420 |

| ./. Fixed product costs | 100 | 800 | 100 | 40 | 20th |

| = Contribution margin II | 800 | 3200 | 400 | 110 | 400 |

| = Subtotal | 4000 | 510 | 400 | ||

| ./. Product group fixed costs | 1900 | 210 | 110 | ||

| = Contribution margin III | 2100 | 300 | 290 | ||

| Subtotal | 2100 | 590 | |||

| ./. Area fixed costs | 1100 | 290 | |||

| = Contribution margin IV | 1000 | 300 | |||

| = Subtotal | 1300 | ||||

| ./. Company fixed costs | 800 | ||||

| = Contribution margin V / operating result | 500 | ||||

The practical application could look like this: The manager responsible for product a1 receives as a requirement that he has to generate at least a contribution margin II of 800,000 euros. In this context, he can determine himself whether he claims more variable costs with higher sales or lower variable costs and lower product fixed costs with lower sales. He is only credited with the fixed product costs that he overlooks, causes himself in the area and can also influence within certain limits.

In the higher management levels, planned contribution margins for the product group, the area and the top management level are then specified as a benchmark.

For the individual manager, such a procedure is usually much more insightful than if cost costs (full costs) for the product manufactured in the area of responsibility are calculated in advance. The keys used to allocate costs, which the manager cannot influence at all, are barely understood and mostly not internalized and accepted in daily practice.

When setting up profit centers in companies, it has proven to be indispensable to only confront managers with the fixed and variable costs that they can really see through and influence.

Determining the breakeven point

Break-even means equality of revenues and costs for a certain production volume.

A simple example should show this.

The fixed costs of a company are 4,000,000 euros

Machines are manufactured at a price of 50,000 euros per piece

Variable costs (material, wages) per item 30,000 euros

What is the minimum number of machines that have to be produced to cover the costs? There are 200 machines:

- variable costs: 200 machines * 30,000 euros = 6,000,000 euros

- Fixed costs: 4,000,000 euros

Total costs 10,000,000 euros

Revenue: 200 machines * 50,000 = 10,000,000 EURO

In the various areas of application of contribution margin accounting, calculations are very often made with formulas.

To calculate the breakeven point, the formula is as follows:

- Kf

- Break-even point = --------------------

- (p - kv)

The symbols mean:

- Kf = total fixed costs of the company

- p = price per product unit (piece, kg, etc.)

- kv = variable costs per product unit

Capital letters (K, P) are always used to express values for the entire operation.

Lower case letters (k, p) are used to express values for a product unit.

The subscript (indexing) makes it clear whether fixed or variable costs are specified.

When using the formula, the following is calculated:

- Break-even point = 4,000,000 / (50,000 - 30,000)

- 4,000,000 / 20,000

- 200 machines

It's easy to understand why the formula has to be as stated above.

If the revenue (quantity * p) is as high as the costs, then:

- Quantity * p = Kf + quantity * kv

- Sample: 200 * 50,000 = 4,000,000 + 200 * 30,000

- 10,000,000 = 4,000,000 + 6,000,000

The rearrangement of the equation results in: quantity * p - quantity * kv = Kf

- Quantity (p - kv) = Kf

The next change results in the formula for the breakeven point:

- Quantity = total fixed costs / (unit price - variable costs per unit)

The information in brackets is also referred to as the piece contribution margin and is given as a symbol:

- db

- (Lowercase db).

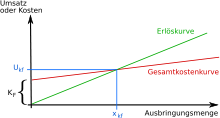

The relationship between the volume of sales, the fixed costs, the variable costs and the profit can be shown graphically.

This illustration is taken from the Wikipedia keyword break-even.

Let it be:

- K (x) = k v x + K f is the cost function

- E (x) = px is the revenue function

in which:

- k v , the variable costs are

- K f the total fixed costs are

- and p is the price per piece (x).

The following tips may be useful for the course of the individual lines:

- Fixed costs: Even if there is no sales, the fixed costs still apply.

- Revenue: This line starts at x = 0. It rises because every product sold brings revenue.

- Variable costs: They increase because the production of each product has variable costs.

- Total costs: the fixed costs are added to the variable costs. The total costs result. This line goes up.

- Intersection: the total costs and the total revenues are the same.

So this is the breakeven point. Only a sale beyond that leads to profitability. If the sales stay below that, there is inevitably a loss.

English speaking business economists like to refer to the breakeven point as

- Break even point

In this case, a very meaningful term was found in the English language.

The even point of revenues and costs is broken - the profit zone is reached.

The relationship between the scope of production, variable costs, fixed costs and profit has increasingly become the focus of business decisions in the last few decades. The struggle for new markets leads in many cases to better coverage of fixed costs and higher profits.