Harberger triangle

The Harberger triangle measures the loss of welfare when a new consumption tax is introduced . It is named after Arnold Harberger , who introduced it to finance .

presentation

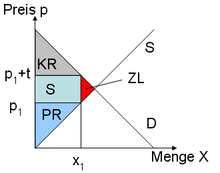

Based on the market equilibrium ( Marshall's demand function ) without tax (intersection of demand and supply ), a tax is introduced. This increases the price to be paid by the consumer of on line while the proceeds of the producers on back. At the same time as the price rises, demand falls from the original market equilibrium to . In addition to tax revenue , consumer surplus and producer surplus, the Harberger triangle (highlighted in red) shows the welfare loss (additional burden ) of the tax.

The broader the tax base , the lower the additional burden for the individual, because then the tax rate does not have to be increased so much in order to achieve a certain tax revenue.

The additional burden corresponds to a loss of welfare , which is made up of reductions in producer surplus and consumer surplus. Depending on how flexibly supply or demand react to the tax, the higher proportion of the additional burden, which reacts less flexibly to the tax, in principle carries the higher proportion of the additional burden. The additional burden increases almost exponentially with the tax increase. It is therefore advantageous to meet a particularly large number of taxpayers with a low tax rate.

literature

Stefan Homburg : General Taxation . 6th edition Munich 2010: Vahlen-Verlag, p. 141.