Conglomerate (companies)

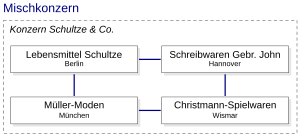

A conglomerate in connection with company structure is a highly diversified company with subsidiaries that have different value chains , operate in different industries and are not in competition with one another. Other names are conglomerate , multicompany or mixed combine . Diversification is mostly achieved through business activities in different industries (e.g. simultaneous activities in the areas of energy technology , medical technology , telecommunications , financial services ). The term conglomerate is also used colloquially for extremely nested, opaque participation structures.

Examples

Conglomerate / multi-group

A prominent example is GE , formerly known as General Electric. GE has expanded into a variety of other industries in addition to traditional electrical engineering (both industrial and household appliances). An early example of a German conglomerate is Hugo Stinnes , who, under Hugo Stinnes GmbH, founded in 1892, bought a vast conglomerate and, especially during the inflation from 1923, took over theaters, hardware stores, oil trading and tire services to his group. As early as 1920 he controlled a quarter of the production in the Ruhr area . Another example is Siemens AG . The founding family has often held a dominant position for generations, for example with the Tata Group in India. In South Korea, family-controlled conglomerates are called Jaebeol . (e.g. Samsung , Hyundai , Hanjin ).

In Japan, the keiretsu developed after the Second World War , after the zaibatsu (family-controlled conglomerates), which still had a powerful parent company with several daughters, were banned. These holding companies were banned by the occupying power until 1997, which is why the former Zaibatsu daughters were now informally linked through cross-shareholdings , with a house bank at the center.

Mixed combine

From 1948 to 1990 NAGEMA was a mixed combine of mechanical engineering companies with headquarters in Dresden . In the socialist / Comecon countries (e.g. East Germany ), combines were formed around 1950 that represented the counterpart to the corporations in the capitalist / OEEC countries (e.g. West Germany ).

Advantages and disadvantages

The conglomerate construct is controversial. Proponents argue that by spreading, cluster risks , i.e. H. one-sided dependencies on individual industries can be avoided. Due to the concentration of power, equity can be invested quickly. Without lengthy debates with banks / investors, loss-making sub-areas can be restructured, possibly sold, or new business areas can be opened up quickly . In addition, through the uniform application of professional management, they can achieve greater efficiency in corporate management, as, for example, General Electric has shown with the introduction of the Six Sigma method .

With the derogatory use of the term “general store”, critics accuse the conglomerates of causing unnecessary friction between the individual business areas by fragmenting their activities. In addition, conglomerates would achieve insufficient synergy effects, because a homogeneous group that is only active in one industry can B. buy jointly required third-party services in large quantities and thus achieve better prices. In addition, because of the excessive concentration of power, important operational decisions are made by people who have little expertise in a particular industry. This programmed expensive wrong decisions, as in the case of Edzard Reuter . A minimization of the investor risk via diversified investment funds is more efficient.

Successful conglomerates like the Tata Group or General Electric manage to walk this tightrope. You act under the umbrella of a head office with a comprehensive corporate identity as a financial holding , i.e. with little interference in day-to-day operations.

Regional differences

While conglomerates continue to be of great importance, especially in the Asian economic area, there has been a strong tendency in the American and European economic world since the 1990s to disentangle the remaining conglomerates under the motto "focus on core competencies" and to only maintain those parts of the company that serve the defined corporate purpose directly.

Cross-shareholdings with the financial sector, i.e. banks and insurance companies, are typical of German conglomerates. The term Deutschland AG was coined for this. Up until a few years ago, considerable taxes were levied when investments were sold. When the sale was made tax-free, the unbundling of Deutschland AG began. Shares and subsidiaries were acquired to a large extent by private equity firms, which then also increased corporate earnings by cutting jobs.

See also

Individual evidence

- ↑ Otto Breicha, Protocols , 1976, p. 166