Repurchase agreement

| interest rate | height |

|---|---|

| European Central Bank (valid from: September 18, 2019) | |

| Deposit rate (deposit facility) | −0.50% |

| Base rate (main refinancing operations) | 0.00% |

| Marginal lending rate (marginal lending facility) | 0.25% |

| Swiss National Bank (valid from: June 13, 2019) | |

| SNB policy rate | −0.75% |

| Federal Reserve System (effective March 16, 2020) | |

| Federal funds rate target range | 0.0 to 0.25% |

| Primary Credit Rate | 0.25% |

| Bank of Japan (effective December 19, 2008) | |

| Discount rate (basic discount / loan rate) | 0.30% |

| Bank of England (effective March 19, 2020) | |

| Official Bank Rate | 0.1% |

| Chinese People's Bank (valid from: February 20, 2020) | |

| Discount rate (one-year lending rate) | 4.05% |

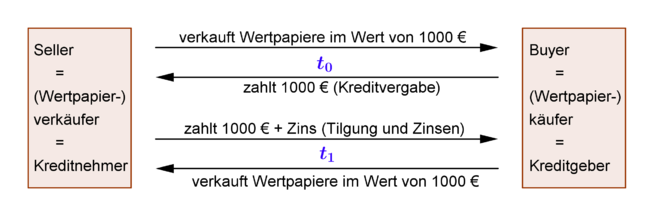

A repurchase agreement , or repo (short for English repurchase operational , English as a repurchase agreement referred to) is a financial transaction that combines the simultaneous sale and subsequent repurchase of a property (usually a security). This is a real repurchase agreement in which the seller's right of ownership of the goods is transferred to the buyer during the term. The repurchase agreement is a short-term financing instrument with a term of generally between one day (then also referred to as an overnight repo ) and one year.

The repurchase agreement is also referred to as a "real repo transaction" by the seller of the goods, particularly from the accounting perspective, and as a "fake" or " reverse repo " by the buyer .

structure

The roles of the two contracting parties are as follows:

- Lender = borrower = seller

- Borrower = Lender = Buyer.

In the case of a repurchase agreement, the seller undertakes to provide the borrower with assets - usually bonds - against receipt of an agreed amount of money and to take them back at the end of the term against repayment of the agreed amount plus interest. Since the borrower undertakes to deliver identical securities at the end of the term, this is a real securities repurchase agreement .

Repurchase agreements are part of the money market and are used by institutional investors, primarily banks, to obtain liquidity in interbank trading and with central banks as part of open market transactions . In addition, short-term repurchase agreements are often used by institutions in whose countries of domicile there is a risk-independent equity ratio ( leverage ratio ) to reduce the balance sheet total at the time of reporting in order to also lower the equity requirements ( balance sheet cosmetics ).

Price calculation

The purchase price to be paid at the start of the transaction corresponds to the market value of the underlying security (current price plus accrued interest ) minus a haircut.

The redemption price is calculated from the purchase price plus the agreed interest (the associated interest rate is called the repo rate ), which depends on the quality of the security. The interest is calculated pa ( per anno ; per year) with 365 days.

Additional payment obligation

Should the value of the security fall, there is an obligation to make additional contributions (" Margin Call " or "Variation Margin").

The haircut from the market value at the start of the transaction serves to protect against a decline in the price of the bond. If the value of the bond is revalued every trading day, the buyer can demand the additional payment if the price drops below the purchase price; the seller can reimburse this through an additional delivery of the bond or a cash settlement.

In the case of price increases, it is the other way around - here the buyer is obliged to make additional payments.

Repo rate

Due to the provision of collateral, repo rates are generally below the maturity-congruent interest rates for unsecured loans .

The motivations for repo transactions include short-term liquidity, secured investments, cheap loan rates and interest rate speculation.

When the seller repurchases the bonds, the buyer receives the interest (repo rate) for the loan granted by him, which relates exclusively to the identical purchase and sale price of the bond for the time of transfer (the amount was the market value on the date of purchase minus the a haircut known as a haircut). The seller is entitled to the accrued interest from the bond. The repo rate can thus be understood as the price for the provision of liquidity.

species

After the specification of the A distinction collateral (English collateral ) Securities used two types of repurchase agreements, which is a respective different motivation based on:

General repurchase agreement

In the general collateral repo , the focus is on the procurement of short-term liquidity. It does not matter which security is used as collateral, as long as it meets certain quality requirements in terms of debtor creditworthiness , market liquidity and the currency of issue . Due to the clear conditions, repos of this type can be easily standardized; their market share is around 70% of all repurchase agreements. The high quality of the underlying collateral is responsible for the fact that the repo rate is usually below the money market rate.

Special repurchase agreement

In the particular repurchase agreements (English special collateral repo ) is, the lending similar to the procurement of a particular security in the foreground. This is specified in the contract text.

market

The European Central Bank accepted up to the financial crisis for their repurchase agreements or refinancing operations of the banks, no securities with a rating lower than A- (in the name of Standard & Poor's ). This criterion was relaxed in the course of the crisis. Since then, securities with an investment grade rating (BBB- or Baa3 in the name of Moody's ) have been accepted, with poorer ratings leading to gradually higher safety discounts.

taxation

Real and inverse repo transactions are not subject to sales tax as financing transactions . The International Capital Market Association (ICMA) has drawn up a draft contract to distinguish it from sell-and-buy-back transactions .

See also

literature

- Moorad Choudhry: An Introduction to Repo Markets . Wiley, Chichester 2006, ISBN 978-0-470-01756-2 .

- Moorad Choudhry: The Repo Handbook . 2nd Edition. Butterworth-Heinemann, Oxford 2010, ISBN 978-0-7506-8159-9 .

- Jürgen Wagenmann: Securities repurchase agreements. The superior refinancing instrument . Centaurus, Pfaffenweiler 1991, ISBN 3-89085-560-1 .

- Roger Wechsler: The repo business. An innovation on the Swiss financial market . 2nd Edition. Swiss Bankers Association, Basel 1998 ( online version ( memento of January 30, 2012 in the Internet Archive ) [PDF]).

Individual evidence

- ↑ Financial Times Deutschland, June 17, 2010, p. 16.

- ↑ tagesschau.de : ECB accommodates Spanish banks . Retrieved December 9, 2016.

- ↑ ECB: Collateral Eligibility Requirements: A Comparative Study Across Specific Frameworks (PDF); Retrieved December 9, 2016.