Currency board

A currency board (less often the currency office or monetary authority ) is an exchange rate arrangement in which a country unilaterally fixes the exchange rate of the domestic currency to a foreign currency. The difference to a simple system with fixed exchange rates is the strong institutionalization of the currency board. The aim is to build trust in the international financial and foreign exchange markets in order to improve integration into the markets and to obtain more favorable conditions for indebtedness. The prerequisite for this is that the currency board is viewed internationally as credible.

features

A currency board is essentially characterized by the following features:

- There is a fixed exchange rate between the home currency and a foreign currency (the anchor currency ).

- Every market participant has the right to change any amount of their home currency to the anchor currency at the fixed exchange rate at any time.

- The money supply in the domestic currency must be fully covered by the foreign currency (this is usually also determined by law). Since foreign securities can also lose value, the coverage is usually between 105 and 110 percent.

- The government is committed to this system for the long term. This system is therefore often prescribed by law, sometimes even in constitutional laws. As an important prerequisite for ensuring the credibility of the currency board, there must be consensus beyond the boundaries of political parties about its necessity. A currency board is no longer credible when it is questioned by decision makers.

functionality

The core of the mechanism with which a currency board can have a stabilizing effect on the domestic economy is the self-imposed obligation to cover the domestic money supply with foreign money or securities as well as the automatic control of the domestic money supply.

The Central Bank has in this system will not affect the money supply in the country, because it can not be higher than the stocks of foreign currency to cover. The amount of money is thus capped. The function of the central bank is therefore limited to changing money and monitoring cover.

Nor can the central bank influence the level of foreign exchange reserves . Rather, these can only be increased by a surplus in the current account . Conversely, a deficit in the current account leads to a reduction in the domestic money supply.

If the current account is negative, the reduction in the money supply leads to an increase in domestic interest , which in turn leads to a decrease in domestic demand. The falling goods prices are increasing the demand for domestic products abroad. The higher exports bring the current account back into balance. The same applies to a current account surplus.

In a flexible exchange rate arrangement, a devaluation of the domestic currency could make exports more attractive. However, since this is not possible in a currency board system, the adjustment must be made via the goods prices. The central bank of the anchor currency country thus determines both the money supply and, indirectly, the foreign exchange reserves in the country of the currency board. The government and the central bank in the currency board country have no way of influencing the economy with the help of monetary policy. For example, it is not possible to improve the economy by increasing the supply of credit.

The currency board must be well defined and free from political influence.

In contrast to a monetary union or the introduction of foreign currency as a means of payment domestically ( dollarization or euroization ), there is a seigniorage profit for the central bank .

Types of currency board

A distinction is made between a pure and a modified currency board. With a pure currency board arrangement, the central bank has no way of helping banks in trouble. It is therefore not performing its function as a lender of last resort . With a modified regulation, the domestic currency is not only covered to 100 percent, but a surplus reserve is created with which the central bank can intervene in an emergency.

Examples of currency boards

A currency board was originally a government agency in British colonies that was responsible for issuing the local currency, which was tied to the British pound.

The 20th century has around 60 examples of currency boards, including colonial institutions. Russia temporarily pegged its currency to the British pound. The Free City of Danzig introduced a currency board, also linked to the pound.

After that, for a long time the opinion was held that a currency board was a step backwards in the times of colonial empires.

Lately, however, interest in this exchange rate system has increased because it has proven itself particularly in crises. Thus, Hong Kong (single currency board in Asia) during the Asian crisis of its currency must not depreciate. This was attributed on the one hand to the relatively healthy banking system in Hong Kong, but on the other hand to the already long-established currency board. Another successful example of the application of the currency board is Estonia , which with the help of the currency board stabilized its economy and integrated it into the western economic system.

The Argentine Currency Board (1991–2002) is judged differently by economists in retrospect: On the one hand, it contributed to an enormous decline in inflation rates in the country, but since the Brazilian crisis at the latest, the system has no longer proven to be suitable for solving the country's problems , since high national debt eroded the credibility of the system and since the Argentine peso was increasingly overvalued in real terms , which greatly reduced the competitiveness of the Argentine export industry .

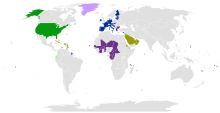

Currency boards to the euro

Some countries have pegged their currency to the euro with a currency board . Some of the countries already had a currency board with the D-Mark or the French franc before the euro was introduced . The following currencies are linked to the euro with a currency board:

- Bosnia and Herzegovina , 1 EUR = 1.95583 BAM (Bosnian convertible mark , corresponds to the rate of the German mark)

- Bulgaria , 1 EUR = 1.95583 BGN (Bulgarian leva , corresponds to the exchange rate of the D-Mark )

- CFA franc , 1 EUR = 655.957 XAF / XOF (100 CFA francs correspond to the rate of 1 French franc)

- CFP franc , 1 EUR ≈ 119.33174 XPF (1000 CFP franc = 8.38 euros, previously 55 French francs)

- Cape Verde , 1 EUR = 110.265 CVE ( Cape Verde Escudos )

- Comoros , 1 EUR = 491.9677 KMF ( Comoros Francs )

In addition to the currencies mentioned, there are others linked to the euro with a fixed fluctuation range.

Many countries have not pegged their currency entirely to the euro, but with a currency basket , at least in part. According to the Deutsche Bundesbank , this applies to around 50 countries worldwide. Most of the time, the euro is only a small part of the currency baskets, with the US dollar holding the largest share .

Sense of the currency board

There is disagreement about when the introduction of a currency board makes more sense than another exchange rate system. A currency board tends to be more suitable for small countries, as the system contributes to greater political credibility, which leads to a lower assessment of the risk by foreign market participants. As a result, the country can borrow abroad more cheaply because it has to pay a lower risk premium . In addition, the free convertibility limits the risk of an outflow of invested capital abroad ( capital flight ), because it is always ensured that every amount of domestic money can be exchanged for foreign currency. The demand for foreign currency is therefore falling.

If a currency board works well and is credible, it offers the country a number of advantages:

- The country will be integrated into the world capital markets . Trading between the currency board country and the anchor currency country is simplified by eliminating the exchange rate risk.

- The country can build a reputation for itself relatively quickly by adapting the political and economic system to which it is forced by the introduction of the currency board. This encourages investments from abroad, especially from the anchor currency country. This point applies especially to economies of transition .

- Once a currency board is in place, a strong political majority in parliament is usually required to enforce changes to laws related to the currency board. This makes it more difficult, for political reasons, to influence currency policy in the interests of short-term success.

- The currency board is forcing the cycle of wage and price increases to be broken. This cycle, which leads to inflation , is not possible in a currency board system because the money supply cannot be increased at will. In a managed floating system, the central bank would respond to such a cycle by devaluing it. If there is a currency board system, employers and employees must be aware that wages and prices must be competitive and agree accordingly. As mentioned above, the stability of the exchange rate means that domestic prices and wages must be flexible.

The disadvantages and risks of a currency board are:

- No monetary policy can be pursued domestically that is independent of the country of the anchor currency. For example, the government cannot set the domestic interest rates; instead, the same interest rates apply as in the country of the anchor currency, possibly with a certain risk premium.

- If inflation is higher in the currency board country than in the country of the anchor currency, there is a real appreciation of the domestic currency. This means a competitive disadvantage for the country with currency board.

- In a currency board system, the central bank or government has no way of helping with loans in the event of a banking crisis .

implementation

Preconditions

To successfully introduce a currency board, the following requirements must be met:

- The central bank's position as lender of last resort must be abolished.

- Banking supervision must be sound, and the commercial banks themselves must hold adequate reserves.

- The central bank's reserves must be converted into the anchor currency.

credibility

Like the system of a fixed exchange rate, the use of a currency board requires a high level of discipline in the country which unilaterally ties its exchange rate to that of another country. The greatest threat to a currency board is that market participants do not expect the fixed exchange rate to persist in the long term. It can then be assumed that the country cannot borrow on such favorable terms as with a fixed exchange rate, which is expected to last for a long time.

activities

Political instability in the country is also a threat to the fixed exchange rate as it too leads to a reduction in systemic credibility.

To gain credibility, the government can take the following measures:

- Commitment to a change in the real economic system, if necessary (as in the earlier planned economies of Central and Eastern Europe).

- Creation of a solid banking system and functioning banking supervision.

- Staffing of the currency board with credible people.

- legal anchoring of the currency board system, which makes it difficult to change something in the exchange rate policy once chosen due to daily politics. For example, the foreign currency reserves could be located abroad.

- Reduction of the national debt .

- The wages and prices of goods need to be flexible so that when the current account is negative they can fall in order to stimulate the offsetting imports of capital and exports of goods.

If the currency board works, the domestic currency and the anchor currency are perfect substitutes . The owners of the capital are then indifferent to holding domestic or foreign money .

credentials

- ^ Eckart Koch: International economic relations . Vahlen, Munich 2006, ISBN 978-3-8006-3357-9 , p. 320

- ↑ Deutsche Bundesbank: 10 years of the euro: euro established as the world's second most important currency after dollars. (No longer available online.) Archived from the original on February 7, 2009 ; Retrieved July 30, 2011 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

literature

- Ralf Kronberger: Euro or Dollar for Argentina? , 2001, in: Wirtschaftspolitische Blätter 4/01, Vienna: Österreichischer Wirtschaftsverlag (to download: PDF )

- Nenovsky. N , JB. Desquilbert (2004). "Credibility and adjustment: gold standards and currency boards compared?" (PDF; 391 kB). William Davidson Institute Working Paper, No. 692

- Nenovsky. N , M. Berlemann (2004). "Currency Boards and Financial Stability: Experiences from Argentina and Bulgaria" , in: Sovereign risk and financial crisis, Frenkel, M., Karmann, A., Scholtens, B., Eds: Springer-Verlag, pp. 237-257