Certificate (financial product)

A certificate is a debt security that has derivative components so that its performance depends on the performance of other financial products . In contrast to a standard bond, a certificate does not grant a fixed rate of interest , but rather the participation in the success or failure of a stock exchange transaction . Certificates can therefore contain completely different income opportunities and risks of loss for the buyer.

Certificates are among the structured financial products . They are of Banks issued and predominantly to retail customers sold; they are therefore classic retail products. They represent an opportunity for private investors to pursue complex investment strategies and to invest in asset classes that are otherwise inaccessible to private individuals .

Basics

Certificates are a relatively new invention. The first certificate ever issued was an index certificate from Dresdner Bank in June 1990 , which replicated the DAX one to one. For the issuing bank, certificates are a means of refinancing . It takes on debt through the issue .

Due to their legal nature as a bond, there is an issuer risk with certificates , which means that in the event of the issuer's insolvency, a total loss of the invested capital can occur. In funds deposited funds, however, are by their status as special funds protected during the insolvency of the fund company. In the case of savings deposits, the deposit protection fund also provides extensive protection in the event of the bank's insolvency. In the course of the financial crisis from 2007 and the insolvency of Lehman Brothers , the opportunity was created to issue collateral secured instruments (COSI). The issuers deposit collateral (high-quality securities, e.g. government bonds) with a custodian.

As with all other investment products, there are also costs with certificates that are ultimately borne by the investor. The amount of the costs is often not immediately apparent to the investor. In contrast to investment funds, there is no obligation on the part of the issuer to disclose the expected or actual costs incurred with certificates. Profits from certificates are generally subject to the withholding tax in Germany . However, this does not apply to income from private individuals from existing holdings (purchase of the certificate before January 1, 2009).

In Germany, trading in certificates takes place primarily over the counter . They are also traded on the Stuttgart ( EUWAX ), Frankfurt (until 2013 Scoach ), Berlin and Düsseldorf stock exchanges. In Switzerland, certificates are known as structured products . Most of these are also traded over the counter and, to a lesser extent, on the Zurich Stock Exchange. In Austria, certificates are traded on the Vienna Stock Exchange.

Certificates can be divided into two groups:

| Participation certificates | Certificates with a defined repayment profile | |

|---|---|---|

| functionality | The value of the certificate follows the value of the underlying | At maturity the certificate assumes a value that depends on predetermined conditions. |

| Examples | Tracker, index, theme, strategy, basket certificates | Discount, bonus, outperformance, express certificates, warrants , reverse convertible bonds |

| running time | often endless | defined at issue |

Participation certificates

Participation certificates give the investor the opportunity to invest flexibly and inexpensively in all types of underlying assets without having to buy the underlying asset on the stock exchange . This is particularly advantageous if the underlying is an index, i.e. consists of many individual values, or if it is an exotic underlying that is not traded on a domestic stock exchange.

Index certificates

Index certificates have a share , security or commodity index as an underlying . Index certificates show the development of the underlying index one to one. They are particularly suitable for private investors who want to implement the investment strategy of index investing . An alternative to index certificates are index funds , which also track an index. In comparison to index funds, index certificates usually cause lower costs, but are subject to the issuer risk explained above.

If the certificate is based on a stock index, it should be noted whether the certificate relates to a performance index or a price index . In the case of a performance index , the dividend payments are included, but not in the case of a price index - this difference can mean a difference in return of several percent per year in individual cases. Investing in performance indices is therefore always more advantageous for the investor. There is also a currency risk for indices that are not quoted in local currency . This can, however, be excluded with so-called Quanto Index certificates.

Basket certificates

Basket certificates represent a basket of shares or other investment products and are a modification of index certificates. The certificates differ with regard to the distribution of dividends, the mechanism for maintaining the basket composition and the management fee charged for this. A variant of the basket certificates are REIT certificates, which show the price development of a listed real estate stock corporation ( Real Estate Investment Trust, REIT ) or a real estate index.

Tracker certificates

Tracker certificates show the price development of an underlying asset. However, no dividends are paid out; Instead, future dividend payments are discounted and thus taken into account in the market value in advance. Dividend income is thus converted into price increases. Until the introduction of the final withholding tax in 2009, a tracker certificate could be advantageous for stocks that pay out a generous special dividend.

Exchange-traded commodities

Certificates for the asset class commodities are offered under the name exchange-traded commodity .

Discount certificates

The basic idea of the discount certificate is to limit the risk compared to buying the underlying asset directly. In return, however, the achievable return is also capped with a product-specific maximum value. The construction is done by buying (long) and selling (short) one option each. If you want to bet on rising prices, the price of the underlying is higher than the price of the purchased option, and vice versa for falling prices. Theoretically, it is possible to bet on rising prices with put options. This can be explained because by selling a put option with a higher strike price one earns more money than buying a put option with a lower strike price.

Example: The DAX stands at 8000 points. A discount certificate that relies on rising prices, is capped at 8500 points and secured at 7500 points (risk limitation), can be constructed by:

Short Put mit Strike 8500 und Long Put mit Strike bei 7500.

The proceeds of the short put are 505, the loss from the long put is 5.

The following scenarios are possible:

- Dax> 8500: Both the long put and the short put are worthless, but the investor still has the proceeds from

505 - 5 = 500. - Dax <8500 and Dax> 7500, e.g. B. 8250: The short put has to be served and costs so

-8500 + 8250 = -250. The long put is worthless. However, the investor500 - 250 = 250made a profit of 500 from the sale proceeds . - Dax <7500, e.g. B. 7250: The short put has to be operated:

-8500 + 7250 = -1250. The long put can be exercised: 7500-7250 = 250. The total loss is:-1250 + 250 + 500 = -500.

Bonus certificates

Bonus certificates have a fixed term. A bonus certificate is also determined by two parameters, the barrier, also known as the security level, and the bonus level. Depending on the choice of these parameters, the value of the certificate reacts to the development of its base value .

The payment when a bonus certificate is due depends on the development of the base value over the entire term. There are two cases to be distinguished:

- The price of the underlying asset

- touched the security level or during the runtime

- is above the bonus level:

- The amount of the repayment then corresponds to the price of the underlying (if applicable, according to the subscription ratio ).

- The price of the underlying remained above the safety level during the entire term and is below the bonus level at maturity:

- The value of the bonus level is paid out (depending on the subscription ratio, if applicable).

A bonus certificate can be reproduced by purchasing a zero strike call on the underlying asset and at the same time a down-and-out put option (barrier option). The base price of the barrier option corresponds to the bonus level and the barrier to the threshold, after which the option expires and the bonus certificate only corresponds to the zero strike call. The fair, d. H. The arbitrage-free price of a bonus certificate can be calculated as the sum of the prices of these two components.

The level of security plays an important role: If the underlying asset touches or breaks the barrier even once during the term, the character of the bonus certificate changes completely: it becomes a normal tracker certificate and the bonus is irrevocably lost, even if the The underlying is above the barrier again. However, the return of a bonus certificate differs from that of a tracker certificate, since the price of the bonus certificate is the value of the barrier option above the price of a corresponding tracker certificate.

Distribution of returns from bonus certificates

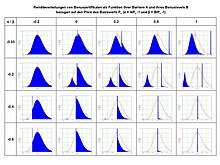

How the properties of a bonus certificate depend on bonus level B and barrier A can be illustrated with the help of the distribution of the total return on the certificate. The return distribution indicates the probability with which the bonus certificate a certain return on R B achieved.

The adjacent figure shows the distribution density of the returns for a fictitious base value (without interest and dividend payments, e.g. the DAX Performance Index) and for different types of bonus certificate. The distribution density of the returns on the underlying asset is shown as a red curve. Its development was calculated , as usual, with a Black-Scholes model , which has a mean annual return µ and an annual volatility σ as parameters (here: µ = 6% and σ = 20%).

The term of the certificate is one year, the risk-free return is assumed to be 2%. The values α in the first column are the percentage differences between the barrier A and the price of the underlying value P 0 at the time of purchase. The values β in the first line are the percentage differences between bonus level B and P 0 . The distribution densities of the certificate returns for the various combinations of values are shown by the blue, filled curve.

If the bonus level and the barrier are close to one another, the bonus level only rarely comes into play and the bonus certificate is similar to a tracker certificate (graph at the top left in the figure; the bonus certificate behaves in the case of the parameter combinations of the two upper graphs in the left column, which are more of a theoretical nature exactly like a tracker certificate). If the barrier is far below the bonus level ("Deep Bonus Certificate", graph at the bottom right in the figure), the certificate is similar to a fixed-income security: the bonus level is very likely to take effect and the investor receives a fixed return based on the ratio of the bonus level and purchase price results. With a small probability, however, there may be a crash in the underlying asset at which the barrier is reached. The investor then suffers correspondingly high losses.

In between there are cases in which the return distribution shows two clear peaks . In cases that are favorable for the investor, the barrier is not affected; he receives at least the return corresponding to the bonus level. If the investor touches or falls below the barrier, the return is worse than that of a tracker certificate or that of the base value, because the bonus certificate is more expensive than a tracker certificate due to the built-in option. The areas under the distribution peaks indicate how likely the respective exit is.

Inverse bonus certificates

Inverse bonus certificates are mirrored bonus certificates that can be used to make a profit if the underlying asset falls, and suffer (usually large) losses if the underlying asset rises above a certain threshold. Inverse bonus certificates thus offer the opportunity to hedge securities account against price losses.

As with the bonus certificates, there are freely selectable parameters of the barrier and the bonus level. In addition, there is another parameter, the reflection point, which, depending on the issuer, is referred to as “strike”, “base price”, “reference level” or “starting price”.

Leverage certificates (also: turbo or knock-out certificates, mini futures)

Leverage certificates are investments in an underlying asset with the inclusion of a securities loan. With leverage certificates, an exposure can be bought on a base value for a low stake. As a result of the leverage, a leverage certificate participates more strongly in price fluctuations than the underlying asset.

The value of a leverage certificate is calculated from the price of an underlying asset and a strike price set for the certificate: value = price - strike. There is a knock-out limit (price = strike) at which the leverage certificate becomes worthless. There are two main types of leverage certificates:

- Participation in rising prices, these are also known as bull, long certificates or wave calls.

- Participation in falling prices, these are also known as bear, short certificates or wave puts.

The functionality of a leverage certificate should be explained here in an example:

For example, if the DAX is at 4000 points, a leverage certificate with a financing level (also called a strike) of 3000 points would cost € 1000 in this case. However, the subscription ratio still applies; for the DAX this is usually 1: 100 (0.01). Since the bank still charges a premium (or discount for bear certificates), this must also be taken into account; In this example we simply assume a premium of € 10:

The following formula applies to long values:

- ((Base price + premium) - Strike) × subscription ratio = price of leverage product

- ((4000 + 10) - 3000) × 0.01 € = 10.10 €

Should the DAX rise to 4500 points, the value would rise to € 15:

- ((4500 + 10) - 3000) × € 0.01 = € 15.10

If the DAX falls below the financing level (3000 points in this example), the certificate becomes invalid and the amount invested (including the premium) is lost.

The financing level increases the opportunity for the investor to benefit more from the price increases than if he were to buy index certificates. In the previous example, the DAX rose from 4000 to 4500 points; that is 12.5%. However, the leverage certificate has risen from € 10.10 to € 15.10; that is 49.5%.

This higher percentage results from the so-called leverage. The leverage is calculated as follows:

- (Strike price ÷ price of the certificate) × subscription ratio = leverage

- (€ 4000 ÷ € 10.10) × 0.01 = 3.96

Therefore, with a price increase of 12.5%, the percentage is as follows:

Percentage of strike price × leverage = percentage of leverage product

- 12.5% × 3.96 = 49.5%

For short certificates, the base price is calculated as follows:

- (Strike - (base price + discount)) × subscription ratio = price of leverage product

This results in rising prices for the certificate with falling prices.

There is a deviation from the above calculation for the value of short certificates in the case of dividend distributions. In this case, the price of the underlying share falls by the value of the dividend. However, this price loss is not reflected in the price of most short certificates; H. the price of the short certificate remains unchanged despite the lower price of the underlying.

In addition to the knock-out threshold, various issuers also have a stop-loss rate, upon which the residual value of the certificate is paid out. The reason for this is a different construction method for the leverage certificate by the issuer, which is described as additional protection. The investor receives part of the premium paid from the issuer, so to speak, but also pays this with a higher premium when buying this certificate.

A special variant of the turbo certificate is the Long Rolling Turbo or Short Rolling Turbo . A rolling turbo, like a normal turbo, is a leveraged investment certificate (for example with a factor of 10). This means that a change in the base value (usually a stock index) of 1 percent causes a change in the value of the rolling turbo of 10 percent. With a Long Rolling Turbo, an investor relies on an increase in the underlying asset, with a Short Rolling Turbo on a decrease in the underlying asset.

The special feature of the Rolling Turbo Certificates is the constant leverage. Due to the daily fluctuations in share prices and the offsetting of financing costs by the issuer, the leverage changes with a normal turbo. This has the effect of diluting the leverage of long turbos when the underlying asset rises and diluting the leverage of short turbos when the underlying asset rises. This means that the investor only initially participates in changes in the underlying with the original leverage (for example, ten times). If the base value rises, the leverage of the Long Turbos becomes smaller and smaller. In contrast, when the price of the underlying asset falls, the leverage of the short turbo decreases.

With a Long Rolling Turbo, this effect of the change in leverage is compensated for by adjusting the financing level every trading day depending on the current price of the underlying, so that a constant leverage (of 10, for example) is guaranteed for the certificate. In this way, the Long Rolling Turbo combines the simplicity of index certificates, which always fluctuate one-to-one with the index, with the leverage effect of turbo certificates.

Leverage certificates differ from warrants in that there is little loss of time value and that fluctuations in value ( volatility ) of the underlying are irrelevant. The interest losses suffered by the issuer as a result of the issuance of the certificate are compensated for by adjusting the strike rate, usually overnight.

Basic adjustment for Open-End Turbo Long Certificates (no term limit):

- New strike = old strike × (1 + (reference interest rate + interest rate adjustment rate) × adjustment days)

Basic adjustment for Open-End Turbo Short Certificates (with no term limit):

- New strike = old strike × (1 + (reference rate - interest rate adjustment rate) × adjustment days)

The reference interest rate typically corresponds to the reference interest rate (1-month EURIBOR); the interest rate adjustment rate is determined by the issuer. If the holding period is longer, the impact of the strike adjustment is considerable.

Risks

The risk with leverage certificates is very high. On the one hand, the certificate expires worthless if the strike is exceeded or not reached. (See also barrier option # knock-out option .)

On the other hand, a factor certificate with constant leverage (rolling turbo) in particular can lose value in volatile sideways phases, although the underlying is stable.

Example: Assume the base value is 100 points. The certificate has a leverage of 4, ie a 10% increase in the base value increases the value of the certificate by 40%; similarly, a 10% loss in value of the base value means a 40% price decline for the certificate.

The base value now rises from 100 to 110 on one day, on the second day it falls back to the old value, ie it first rose by 10%, then it fell by approx. 9 percent.

The certificate quadruples the percentage values, ie first the value increases by 4 · 10% = 40%, then it decreases by 4 · 9% = 36%.

The certificate value rose from 100 to 140 points. The following decrease of 36% means a new value of 89.6. In other words, the bottom line was that the base value remained the same, the certificate value fell by more than 10%.

Bandwidth Certificates (Sprint Certificates)

The idea of the product is to leverage the change in the underlying asset within a price range. On the downside, the risk (in contrast to the Leverage Certificate) is the same as that of the underlying. The investor is no longer involved in price increases above the maximum amount (cap).

| General name | Sprint certificate |

| Goldman Sachs | Impact certificate |

| Deutsche Bank | Double chance certificate |

Due to the construction with options, the price development during the term has little correlation with the development of the underlying. Profits generated during the term can also be lost if the price of the underlying asset should fall again after rising. By not using digital options , the certificate never loses its properties. Identically equipped certificates are priced differently by different issuers during their term.

Three possible cases can arise at the end of the term:

- The price of the underlying is within this range: the buyer receives the leveraged price.

- The price of the underlying is below the initial amount: the buyer receives the correspondingly reduced value.

- The price of the underlying is above the cap: the buyer receives the amount of the cap and the difference between the initial amount and the cap (he does not benefit from the further price increase above the cap).

The certificates can be reproduced using the following investments : You acquire the base value and a call option on it (in the amount of the initial amount). At the same time, you sell two call options equal to the cap.

Bandwidth certificates can be used both for speculation (with the chance of a leveraged price development) and as an alternative to a discount certificate. For the first purpose one chooses a note from the money , for the second a note in the money . In the latter case, the investor benefits from the development of the time value of the option strategy. As long as the price of the underlying remains above the cap, the price development of the certificate is hardly dependent on the development of the underlying.

In addition to the bandwidth certificates, there is also the family of so-called corridor warrants, which are totally different from the procedure described here.

Airbag certificates (also: R-Bag or Protector certificates)

In the case of airbag certificates, the investor participates fully in price increases in the underlying. In the event that the price of the underlying should fall, there is a safety buffer (airbag) to prevent losses. If this buffer is completely used up, the investor will suffer proportional losses. The price of the certificate can, however, fall below the purchase price during the term of the product, as the buffer only takes full effect at the end of the term. The reason for this is that the hedge is created through the sale and purchase of options on the underlying asset, which means that volatility and interest rate effects must be taken into account.

Outperformance certificates

With outperformance certificates, the investor benefits disproportionately from an increase in the price of the underlying asset (share or index) above a specified threshold. The leverage effect of the certificate is represented by the respective participation quota or rate. The investor waives any dividend.

Components: One call option with a strike price of zero and another call option with a strike price equal to the threshold.

Example: We consider a certificate on the underlying asset Xy AG. A threshold of 100 euros and a participation rate of 150% were set for the issue. If the Xy AG share is quoted at 80 euros at the end of the term, the investor will receive exactly this amount. If, on the other hand, the share has risen to 126 euros, the investor receives 139 euros (100 + 26 · 150%).

Guarantee certificates (also: capital protection certificates)

The issuer guarantees that the buyer will receive at least the capital invested back at the end of the term. The capital guarantee always refers to the nominal amount of the certificate (i.e. 100% or 100 euros). If a purchase is made above this price, for example because a front-end load ( agio ) or a trading spread is charged, the investor bears a risk of loss for this price difference. The price of the certificate can fall below the issue price during the term because the guaranteed repayment only takes effect when the certificate becomes due.

Alpha Certificates

Alpha certificates (α certificates) are certificates that show the difference between two base values. The base values can be stocks, indices, commodities, foreign exchange or real estate, for example.

Since alpha certificates do not show the absolute development of one value, but only the difference to another, they are also referred to as market-neutral. Alpha certificates can also gain if both underlying assets fall in absolute terms. This behavior can be particularly advantageous in falling markets.

Sports certificates

In the case of sports certificates, the issuer refers to organized sports games and issues certificates on them. The certificates are issued in the form of no-par value bearer bonds.

The certificate holders have the right to request the issuer to pay the redemption amount or the early redemption amount on the payment day. As a rule, payouts on championships or placements are guaranteed. So far, certificates have been issued for Formula 1, the Bundesliga, Euro League and the Champions League.

After admission to the regulated market of the Berlin Stock Exchange and the Tradegate Exchange, listed sports certificates can no longer be assigned to the gray market products . They are only partially comparable with certificates issued by banks and are only listed here for the sake of completeness.

Certificate indices

A benchmark for comparing certificates with other asset classes has existed from the Scoach ( Deutsche Börse ) certificate exchange since 2008 . This shows the average further development of the most important certificate categories for Germany.

There is a total of four indices: Discount Index, Outperformance Index, Bonus Index, Guarantee Index. In 2009, a benchmark for reverse convertible bonds was also created.

The starting value and starting time of all four indices is 1,000 points each on January 2, 2006 (January 2, 2009 for the bond index). The calculations are based on certificates on shares.

Taxation of certificates in Germany

Income from the investment in certificates is taxable for private investors residing in Germany. The date of purchase is particularly decisive for the type and amount of tax liability.

- Income from certificates purchased after January 1, 2009, is taxable regardless of the investment period and is subject to the withholding tax . The custodian bank pays 25% of the income plus a 1.375% solidarity surcharge to the tax office (for church members, the tax payment is increased by the church tax ). The investor's tax liability is thus settled - regardless of his or her other income situation. If the investor is subject to a personal tax rate that is lower than that of the final withholding tax, he can voluntarily state the income in his income tax return. The income is then taxed at the lower personal tax rate.

- Income from Certificates purchased before March 15, 2007 is tax-free, provided there is at least one year between purchase and sale. If the holding period is shorter, the income is taxable at the personal tax rate. Certificates that have been classified as financial innovations by the tax authorities are an exception . Since 2009, income from such certificates has always been subject to withholding tax, regardless of the holding period .

- In the case of income from certificates that were purchased after March 14, 2007 and before January 1, 2009, different tax cases are possible:

- The certificate is considered a financial innovation - income is subject to final tax

- The certificate is not considered a financial innovation and was held for less than a year - income is subject to the personal tax rate (private sales transaction)

- The certificate is not considered a financial innovation and was held for less than a year and sold after June 30, 2009 - income is subject to the personal tax rate (private sales transaction)

- The certificate is not considered a financial innovation, was held for more than a year and sold after June 30, 2009 - income is subject to withholding tax

- The certificate is not considered a financial innovation, was held for more than a year and sold before June 30, 2009 - income is not taxable.

Individual evidence

- ↑ Nils Lohndorf: Certificates Reloaded: Transparency, Trust, Return - An asset class is repositioning itself. 2010, Gabler, ISBN 978-3834916525 , p. 189 ff

- ↑ Lutz Johanning, Marc Becker, Mark Seeber: Differences and similarities between listed, passive investment products. 2011, Deutscher Derivate Verband , p. 17 ff

- ↑ http://www.godmode-trader.de/artikel/vorsicht-vor- Faktor-zertifikaten, 2946642

- ^ Certificate indices from Scoach

- ↑ Bernd Grimm, Dieter Weber: The tax advisor . Akademische Arbeitsgemeinschaft Verlag, ISBN 978-3-922146-35-3 , p. 5b30 (4) .