Real estate index

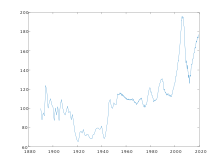

A real estate index is an index that indicates changes in price or value on the real estate market or in its segments. Real estate indices can form the basis for derivatives .

General

While the creation of stock market indices is possible for everyone, since the prices are publicly known and transactions are continuously made due to the liquidity of the markets, the procurement of the basic data is a difficult task with real estate indices .

In principle, real estate indices can be created based on transactions or valuation.

Transaction-based indices

In the case of transaction-based indices, the purchase prices for the transactions actually carried out in the investigation period are used as a basis. Since the number of transactions (compared to stock exchanges) is relatively small, the index is not calculated daily, but at larger intervals, often annually.

The purchase prices are not public in Germany. Only the purchase prices for land are reported to the district expert committees and can be used for calculations. Therefore, real estate indices can only be determined by sellers themselves or associations of the real estate industry.

There are also systematic distortions in this approach: In many cases, only the sales of new buildings are taken into account. There is also no representative distribution of properties across regions and property types.

Valuation-based indices

In the case of valuation-based indices, the values of existing properties are determined analogously to the valuation in valuation reports . The drivers of the change in value are primarily the change in rents . This approach has the advantage of being independent of random transactions. However, evaluating a large number of properties is time-consuming and the accuracy of determining the values is low.

Individual indices

Germany

In Germany, a large number of providers with different databases and concepts compete. A leading index has not emerged. So consist:

| index | providers | method | since | Database | frequency | |

| DEIX index | Gewos | Transactions | 1989 | Purchases of approx. 210,000 EFH and 230,000 ETW | yearly | |

| Dix (German Real Estate Index) | IPD | reviews | 1996 | Provider of open real estate funds | yearly | |

| Real estate index | bulwiengesa | Transactions | 1975 | Own surveys in 125 cities | yearly | |

| EPX index | Europace | Transactions | 2005 | approx. 20,000 real estate financings per month | per month | |

| IMX index | Immobilienscout24 | Offer prices | 2007 | Own homepage | per month | |

| IWIP index | IndustrialPort & Institute of the German Economy (IW) | Offer prices, reviews, current rental contracts | 2012 | Database with rental prices including detailed property information | yearly | |

| S-IM (Sprengnetter Real Estate Market Monitoring) | Sprengnetter real estate valuation | Transactions | 1987 | Database with several 100,000 purchase prices including detailed property information | yearly | |

| VDP index | VDP | Transactions | 2003 | Approx. 60,000 real estate financings from Pfandbrief banks per year | quarterly | |

| Victor (Valuation Performance Indicator) | Jones Lang LaSalle | Transactions | 2003 | Own transactions | quarterly |

United States

In the US , the Case-Shiller index is the leading real estate index . The index distributed by S&P is published monthly for various sub-markets: a nationwide residential property index, an index for the 10 or 20 most important cities and 20 individual indices for individual metropolises.

Another important real estate index is the FHFA House Price Index from the Federal Housing Finance Agency (FHFA). The Federal Building Finance Agency is the regulator of mortgage financiers Fannie Mae and Freddie Mac .

The NAHB / Wells Fargo Housing Market Index (HMI, also known as the NAHB House Market Index ) is published by the National Association of Home Builders (NAHB). It reflects the business expectations of construction companies specializing in single-family homes.

UK

In the UK , the IPD index is the leading real estate index.

Real estate stock indices

In contrast to real estate indices, real estate stock indices do not reflect the performance of the real estate, but of those stock corporations that specialize in real estate management (e.g. REITs ). Examples are the German Real Estate Stock Index ( DIMAX) or the Real Estate Austrian Traded Index (IATX).

Individual evidence

- ↑ Barbara Knoflach, Axel von Goldbeck: Many indices and no market picture ; in: FAZ of August 28, 2009, p. 37.

- ↑ Deutsche Bundesbank - Konjektiven in Deutschland 2/2009 page 54/55 ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ↑ Archived copy ( memento of the original from March 27, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Peter Salostowitz: Scarce space - significant rent increase! In: Institut der deutschen Wirtschaft (Ed.): Issuu . Cologne ( issuu.com [accessed on March 23, 2018]).

- ↑ New index for industrial real estate shows record year 2017. Accessed on March 23, 2018 .

- ↑ Copyright Haufe-Lexware GmbH - all rights reserved: Industrial properties : Modern halls in great demand . In: Haufe.de news and specialist knowledge . ( haufe.de [accessed on March 23, 2018]).

- ↑ to the Pfandbrief