Case-Shiller index

The S & P / Case-Shiller Home Price Index , calculated by Standard & Poor’s , reflects the price development on the US real estate market.

concept

The Case-Shiller Home Price Index, distributed by Standard & Poor’s , is the leading real estate index in the United States. It is published monthly for various sub-markets. Here, 20 individual indices, each of which depict the development of house prices in an American metropolitan region , are aggregated into 2 groups : One index for the 10 most important regions and one index for all 20 regions. There is also a nationwide residential property index that is collected quarterly and contains 9 different US census divisions . The index family thus consists of 23 indices in total.

The concept developed by the economists Karl E. Case , Robert J. Shiller and Allan Weiss in the 1980s. Standard & Poor's has been calculating the index since 2002. Options and futures based on the Case-Shiller Index are traded on the Chicago Mercantile Exchange . Because the index focuses on real estate in metropolitan areas with correspondingly high prices, it is more volatile than national indices. For example, the FHFA House Price Index (formerly OFHEO House Price Index), published by the Federal Housing Finance Agency (FHFA), better maps rural areas.

A disadvantage of all house price indices is that they are detailed, but due to the amount of data they are only published two months after the end of the investigation period. House price indices have a slightly negative correlation with stocks and bonds, and a slightly positive correlation with commodities and real estate investment trusts (REITs). The financial markets react sensitively to unexpected changes in the index; it is perceived as an indicator of developments in the US real estate market. Case-Shiller-Index, FHFA House Price Index or NAHB / Wells Fargo Housing Market Index belong to the group of indicators, the development of which has a noticeable influence on the stock indices .

composition

overview

- 10-City Composite Index: The index includes house prices in the metropolitan areas of Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco, and Washington DC

- 20-City Composite Index: In addition to the prices of the 10 metropolitan regions of the 10-City Composite Index, the index also includes the prices of the regions of Atlanta, Charlotte, Cleveland, Dallas, Detroit, Minneapolis, Phoenix, Portland, Seattle and Tampa.

- US National Home Price Index:

- This index broadly covers 8 US states and the capital district : Connecticut, District of Columbia, Hawaii, Maryland, Massachusetts, New Hampshire, New Jersey, Rhode Island and Vermont.

- Some data from 29 states are included: Arizona, Arkansas, Colorado, Delaware, Florida, Georgia, Illinois, Iowa, California, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Mexico, New York, North Carolina , Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Utah, Virginia, and Washington.

- Does not include data from 13 states: Alabama, Alaska, Idaho, Indiana, Maine, Mississippi, Montana, North Dakota, South Carolina, South Dakota, West Virginia, Wisconsin, and Wyoming.

Metropolitan regions in comparison

The table shows the highs and lows in the metropolitan regions during the real estate crisis.

| Metropolitan area | Peak | date | Lowest point | date | Changes in % |

|---|---|---|---|---|---|

| Boston , MA | 182.45 | Sep 2005 | 145.83 | March 2009 | −20.07 |

| Chicago , IL | 168.60 | Sep 2006 | 102.76 | March 2012 | −39.05 |

| Denver , CO | 140.28 | Aug 2006 | 120.21 | Feb. 2009 | −14.31 |

| Las Vegas , NV | 234.78 | Aug 2006 | 89.87 | March 2012 | −61.72 |

| Los Angeles , CA | 273.94 | Sep 2006 | 159.18 | May 2009 | −41.89 |

| Miami , FL | 280.87 | Dec 2006 | 136.99 | Apr. 2011 | −51.23 |

| New York , NY | 215.83 | June 2006 | 157.43 | March 2012 | −27.06 |

| San Diego , CA | 250.34 | Nov 2005 | 144.43 | Apr. 2009 | −42.31 |

| San Francisco , CA | 218.37 | May 2006 | 117.71 | March 2009 | −46.10 |

| Washington, DC | 251.07 | May 2006 | 165.94 | March 2009 | −33.91 |

| 10-City Composite Index | 226.29 | June 2006 | 146.46 | March 2012 | −35.28 |

| Atlanta , GA | 136.47 | July 2007 | 82.54 | March 2012 | −39.52 |

| Charlotte , NC | 135.88 | Aug 2007 | 108.22 | Feb. 2012 | −20.36 |

| Cleveland , OH | 123.49 | June 2006 | 94.22 | Feb. 2012 | −23.70 |

| Dallas , TX | 125.70 | Aug 2006 | 112.26 | Feb. 2009 | −10.69 |

| Detroit , MI | 127.05 | Dec 2005 | 64.47 | Apr. 2011 | −49.26 |

| Minneapolis , MN | 171.12 | Sep 2006 | 105.82 | March 2011 | −38.16 |

| Phoenix , AZ | 227.42 | June 2006 | 100.22 | Sep 2011 | −55.93 |

| Portland , OR | 186.51 | July 2007 | 129.01 | March 2012 | −30.83 |

| Seattle , WA | 192.30 | July 2007 | 128.99 | Feb. 2012 | −32.92 |

| Tampa , FL | 238.09 | July 2006 | 123.91 | Feb. 2012 | −47.96 |

| 20-City Composite Index | 206.52 | July 2006 | 134.07 | Feb. 2012 | −35.08 |

history

Historical overview

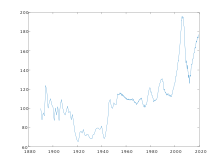

The US National Home Price Index was first published in 1987. The calculation was carried out until 1953 (quarterly) and until 1890 (annually). From 1890 (3.66 points) to 1925 (6.50 points) house prices rose by 77.6 percent in the United States. It should be noted here that all data refer to the nominal prices in US dollars for the respective survey period, i.e. are not adjusted for inflation .

Four years before the global economic crisis began, prices began to fall. In 1933 they reached a low of 4.52 points. The decline since 1925 is 30.5 percent. In the decades that followed, the value of residential real estate in the United States rose steadily. In June 2006 the US National Home Price Index reached an all-time high of 189.93 points. Thus house prices rose by 4102 percent over the entire period. The index for 20 metropolitan regions (Composite-20) marked an all-time high in July 2006 at 206.52 points.

A long period of price increases in the real estate market had turned into a real estate bubble in the USA . With the falling property prices, the financial crisis became acute from 2007 onwards. At the same time, more and more borrowers could no longer service their loan installments, partly because of rising interest rates, partly because of a lack of income. Initially, these problems in the real estate sector primarily affected subprime loans , which were mainly granted to borrowers with low credit ratings . The speculative bubble burst. The banks stayed on their loans.

The real estate crisis caused the US government to take control of the two largest US mortgage lenders , Fannie Mae and Freddie Mac , in 2008 . There were price falls on the global stock markets. Because bad loans were resold ( securitization ) and they were scattered all over the world, the crisis spread globally due to the close interlinking of individual economies and financial flows. In March 2009 the US National Home Price Index hit a low of 129.17 points. The 20-City Composite Index reached a low of 139.26 points in April 2009.

In March 2012, the national Case Schiller index fell to 124.01 points, its lowest level since June 2002. Since the all-time high in June 2006, the decline in national house prices has been a nominal 34.7 percent. It is the biggest drop in prices on the US real estate market since 1890. The index for 20 metropolitan regions fell in February 2012 to 134.07 points, to the level of October 2002. The loss since the all-time high of July 2006 is 35.1 percent . Numerous potential homebuyers in the US were over-indebted. Because the value of their properties had fallen, they could no longer service their mortgages . Foreclosures and distress sales rose to record levels nationwide. The high unemployment rate and the strict criteria for awarding mortgages put a strain on the market.

Annual development

20-City Composite Index

The table shows the development of the non-seasonally adjusted data of the 20-City Composite Index since 2000.

| year | Peak | Lowest point | Final stand |

|---|---|---|---|

| 2000 | 111.58 | 100.00 | 111.58 |

| 2001 | 120.53 | 112.39 | 120.43 |

| 2002 | 135.15 | 120.64 | 135.15 |

| 2003 | 150.49 | 135.64 | 150.49 |

| 2004 | 174.83 | 151.69 | 174.83 |

| 2005 | 201.97 | 176.44 | 201.97 |

| 2006 | 206.52 | 202.44 | 203.33 |

| 2007 | 202.31 | 184.97 | 184.97 |

| 2008 | 180.68 | 150.54 | 150.54 |

| 2009 | 146.63 | 139.26 | 145.89 |

| 2010 | 148.88 | 142.39 | 142.39 |

| 2011 | 142.97 | 136.60 | 136.60 |

| 2012¹ | 146.17 | 134.07 |

¹ October 30, 2012

US National Home Price Index

The following shows the development of the non-seasonally adjusted data of the US National Home Price Index, calculated back to 1890.

|

|

|

|

| year | Quarter I. | Quarter II | Quarter III | Quarter IV |

|---|---|---|---|---|

| 1953 | 14.66 | 14.71 | 14.76 | 14.77 |

| 1954 | 14.77 | 14.77 | 14.87 | 14.89 |

| 1955 | 14.87 | 14.77 | 14.93 | 14.93 |

| 1956 | 14.81 | 14.76 | 15.05 | 15.04 |

| 1957 | 15.18 | 15.34 | 15.34 | 15.46 |

| 1958 | 15.51 | 15.63 | 15.55 | 15.52 |

| 1959 | 15.50 | 15.54 | 15.51 | 15.60 |

| 1960 | 15.61 | 15.58 | 15.61 | 15.70 |

| 1961 | 15.67 | 15.64 | 15.71 | 15.78 |

| 1962 | 15.83 | 15.88 | 15.92 | 15.88 |

| 1963 | 15.93 | 16.03 | 16.06 | 16.15 |

| 1964 | 16.26 | 16.20 | 16.30 | 16.41 |

| 1965 | 16.52 | 16.44 | 16.47 | 16.64 |

| 1966 | 16.73 | 16.77 | 16.79 | 16.86 |

| 1967 | 16.87 | 16.94 | 17.06 | 17.23 |

| 1968 | 17.33 | 17.35 | 17.52 | 17.85 |

| 1969 | 18.21 | 18.43 | 18.79 | 19.17 |

| 1970 | 19.59 | 19.93 | 20.32 | 20.74 |

| 1971 | 20.88 | 21.10 | 21.40 | 21.65 |

| 1972 | 21.84 | 21.97 | 22.36 | 22.37 |

| 1973 | 22.35 | 22.41 | 22.61 | 23.02 |

| 1974 | 23.56 | 24.00 | 24.47 | 25.17 |

| 1975 | 26.33 | 26.96 | 26.84 | 27.29 |

| 1976 | 27.67 | 28.65 | 28.93 | 29.37 |

| 1977 | 30.33 | 31.72 | 32.43 | 33.54 |

| 1978 | 34.61 | 36.03 | 37.06 | 38.17 |

| 1979 | 39.97 | 41.18 | 42.07 | 42.93 |

| 1980 | 43.63 | 44.30 | 45.67 | 45.78 |

| 1981 | 46.07 | 47.17 | 47.81 | 47.96 |

| 1982 | 48.47 | 48.70 | 48.40 | 48.75 |

| 1983 | 49.64 | 50.24 | 50.55 | 50.74 |

| 1984 | 51.49 | 52.33 | 52.84 | 53.34 |

| 1985 | 54.09 | 54.94 | 55.88 | 56.55 |

| 1986 | 57.65 | 58.85 | 59.82 | 60.76 |

| 1987 | 62.03 | 64.09 | 65.32 | 66.18 |

| 1988 | 66.67 | 69.27 | 70.50 | 71.22 |

| 1989 | 72.43 | 74.40 | 75.22 | 75.37 |

| 1990 | 75.58 | 76.42 | 75.84 | 74.59 |

| 1991 | 73.43 | 74.75 | 75.16 | 74.65 |

| 1992 | 74.30 | 75.48 | 75.40 | 74.74 |

| 1993 | 74.46 | 75.48 | 76.06 | 75.91 |

| 1994 | 76.46 | 78.06 | 78.23 | 77.89 |

| 1995 | 77.74 | 79.28 | 79.87 | 79.51 |

| 1996 | 79.61 | 81.11 | 81.72 | 81.18 |

| 1997 | 81.82 | 83.55 | 84.37 | 84.80 |

| 1998 | 85.71 | 88.30 | 90.10 | 90.81 |

| 1999 | 92.08 | 94.75 | 97.03 | 98.29 |

| 2000 | 100.00 | 103.77 | 106.33 | 107.90 |

| 2001 | 109.27 | 112.69 | 115.50 | 116.23 |

| 2002 | 118.00 | 122.24 | 126.13 | 128.58 |

| 2003 | 130.48 | 134.20 | 138.41 | 142.29 |

| 2004 | 146.26 | 152.92 | 158.53 | 163.06 |

| 2005 | 169.19 | 176.70 | 183.08 | 186.97 |

| 2006 | 188.66 | 189.93 | 188.11 | 186.44 |

| 2007 | 184.83 | 183.17 | 180.01 | 170.75 |

| 2008 | 159.36 | 155.93 | 150.48 | 139.41 |

| 2009 | 129.17 | 133.19 | 137.51 | 135.99 |

| 2010 | 132.08 | 138.28 | 135.61 | 130.89 |

| 2011 | 125.62 | 130.78 | 130.90 | 125.99 |

| 2012 | 124.01 | 132.81 | 135.67 |

Web links

- S & P / Case-Shiller Home Price Indices at Standard & Poor's

- S & P / Case-Shiller Composite-10 Home Price Index at Bloomberg

- S & P / Case-Shiller Composite-20 Home Price Index at Bloomberg

Individual evidence

- ^ Standard & Poor's: Methodology

- ↑ a b Standard & Poor's: Home Price Index Levels

- ↑ Manager Magazin: US House Prices Fall To New Low , February 28, 2012

- ^ Robert J. Shiller: Irrational Exuberance. Princeton University Press, Princeton 2005, ISBN 0-691-12335-7

- ↑ Yale University: US National Index Levels from 1890 ( MS Excel ; 156 kB)

- ^ Standard & Poor's: US National Index Levels since 1987