Indicator (economy)

An economic indicator (also known as a business indicator or macroeconomic indicator ) is a measure that allows statements to be made about the economic development or the economic situation in general of economies and is derived in particular from macroeconomic theory or research . Such indicators can be the basis for making forecasts (see also econometrics ).

General

In the economy with its complex issues, the economic subjects need measurement parameters with the help of which companies , media , experts , financial analysts and laypeople can make an assessment of economic developments. The central banks , governments and business associations also use these indicators, which are calculated by the Federal Statistical Office or economic research institutes. Indicators provide a quick overview of economic development. To be generally recognized as an indicator, indicators should be theoretically plausible, statistically appropriate, reliable, representative and meaningful. In order to ensure that the indicators are up-to-date, data for economic monitoring must be available at least quarterly, or even better monthly. Indicators must be available as "long series" ( time series over several years) so that a long-term comparison of economic developments is possible in the context of a time series analysis . This in turn often requires a seasonal adjustment to the distorting seasonal effects off.

The Federal Statistical Office has had the goal since 1950 of drawing a statistical overall picture of the economic structure and the economic process. It was seen as the most important task to provide the basic data for the short-term and long-term economic observation, because all the indicators for the ongoing economic observation serve to describe the business cycle. Since August 1972 the Federal Statistical Office has published “Indicators for Economic Development - Time Series with Seasonal Adjustment”. The Bundesbank used the central bank money stock until 1987 and since then the money stock in its definition M3 as an indicator. The European Central Bank followed in 1994 with their "two-pillar strategy" on the one hand the real economy indicators (eg. As potential output , wages) and also longer-term in the monetary analysis, monetary indicators (eg. As the broad monetary aggregate M3).

species

Depending on whether an indicator cyclical turning points before, simultaneously or subsequently achieved with a reference number, we distinguish indicators ( english "leading indicators" ), presence indicators ( english "Roughly coincident indicators" ) and lagging indicators ( english "lagging indicators" ). In the area of economic forecasting, there have been many attempts to find leading indicators that lead the business cycle. Leading indicators provide information on how the economic situation will develop in the future. For them, the turning points are before the turning points of the economy. They therefore enable economic policy to take measures at an early stage that are supposed to take effect after the economic turnaround, in order to partially offset the delay in effect ( English "time lag" ). Presence indicators, on the other hand, show the current economic development, while lagging indicators reflect the past economic development.

A distinction is also made between individual indicators , which are based only on a single time series, and overall indicators , which are obtained from the aggregation of several time series. Individual indicators are, for example, incoming orders, the number of unemployed or the volume of money; they are prone to special influences. Overall indicators are the Harvard barometer or the economic indicator developed by the Council of Economic Experts.

One also differentiates the indicators according to

- the size described in quantity and price or cost indicators,

- absolute values (such as the level of a stock index) or growth rates ( inflation rate ).

Many indicators - for example the Ifo business climate index - are published regularly. Publication calendars provide overviews of upcoming publications.

Business indicators

The most important economic indicators are those indicators that have a significant influence on the development of economies or that are suspected by market participants. The great importance of economic key figures can be seen in the fact that the publication of such a clearly visible immediate impact on the national or international stock and bond markets , provided that these differ in their characteristics from the expectations of market participants. These expectations are published in advance by economic institutes, economic research departments in large banks and major business newspapers, among others.

Quantity indicators

Quantity indicators provide information on the amount of development of a reference object information.

Examples are:

Price indicators

Price indicators provide information about the price level or price development of a reference object.

Examples are:

- Share prices (market value of equity)

- bonds courses

- Real estate prices

- Inflation rate (growth rate)

- Cost of living

- Food prices

- Raw material prices

- currency rates

Leading indicators

Leading indicators (also leading indicators or leading indicators ) provide information on the future development of the economic situation.

Examples are:

- Stock index

- Incoming orders

- Building permits in building construction

- Book-to-bill ratio

-

Purchasing managers index

- Purchasing managers index for Germany

- Empire State Index (New York Region)

- Philly Fed Index (Philadelphia Area)

- Purchasing Managers Index (US purchasing managers index )

- Retail sales

- Money supply growth

- Business climate index

- Business climate index for Germany (ifo)

- NAHB / Wells Fargo Housing Market Index (US construction company business expectations)

- Earnings expectations

- Investment intent

-

Consumer climate index

- Consumer Confidence Index (US consumer confidence)

- Consumer climate index for Germany (GfK)

- University of Michigan Consumer Sentiment Index (US consumer sentiment index )

- Stocks

-

Logistics index

- Baltic Dry Index (worldwide shipping costs)

- Dow Jones Transportation Average (US transportation company)

- Commodity index

- Interest spread

Presence indicators

Presence indicators (also called concurrent indicators , present indicators or actual indicators ) show the current economic development.

Examples are:

- Current consumption figures

- Gross domestic product - GDP (in one month) or gross national income

- Human Development Index (English Human Development Index , HDI)

- Industrial production

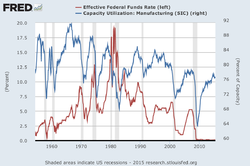

- Capacity utilization

- Short-time work

- Stocks

- Vacancies

- Prices

- Savings rate

- interest

Lagging indicators

Lagging indicators (also lagging indicators or lagging indicators ) show how the economy has developed in the past.

Examples are:

- Unemployment rate

- Employment situation within a trade

- Gross domestic product - GDP (one year) or gross national income

- inflation rate

- Bankruptcies

- Wage development

- Price level development

- State tax revenue

- Interest rate development

The classification is not always clearly possible, as can be seen in the case of gross domestic product (which belongs to a different group depending on the period included).

Others

- BERI index (index for country risk analysis )

- Big Mac index (indicator of the purchasing power of a currency)

- Economic Diversification Index (indicator of the economic strength of a state)

- Misery index (sum of inflation rate and unemployment rate)

- Real progress indicator

- Grubel-Lloyd Index (measures the extent of intra-sectoral trade)

- Rosenbluth Index (index for the absolute concentration on markets)

- Ship index

- Volatility index

The Stability and Growth Pact of the European Union , which has been expanded to include the so-called six - pack , contains a so-called scoreboard with indicators that are intended to warn of disruptions in the macroeconomic equilibrium.

Cross-disciplinary application

Economic indicators are also often used in the valuation of stocks , because conclusions can be drawn about the development of individual branches of industry from macroeconomic developments , which in turn influence the prospects for success of individual companies. Among other things, they serve to visualize macroeconomic developments and are particularly needed where complex causal relationships are to be represented in a condensed form.

Many business indicators also take on the role of business indicators to show economic developments in an individual company. These resources include employment levels as a measure of capacity utilization in a company or the break-even point for the determination of that capacity utilization in the first time a company profits earned.