Real estate financing

A real estate financing is a strictly using purpose-oriented financing for a property . It is an essential part of the establishment , the purchase or renovation of buildings . In banking , due to the very different systematics, a distinction is made between private real estate financing and commercial real estate financing .

Private real estate finance

Private real estate financing is the financing of a property (single-family house, condominium) that is mainly used by the owner for residential purposes. Due to the different risk profiles, a distinction is made between owner-occupier financing - the financier is the user of the property - and investor financing - the financier is the landlord of the property. Financing is therefore also private real estate financing for tradespeople or freelancers if the property to be financed is not part of the business assets .

For private real estate financing, equity such as bank and savings balances, realizable securities or personal contributions as well as borrowed capital such as loans from banks can be used. State subsidies such as employee savings allowances , senior citizens or subsidy programs from the state KfW Bank can also be used.

Loans for private real estate financing

Debt capital is provided in the form of loans

- Banks ,

- Building societies ,

- State funding institutes ,

- Reconstruction Credit Institute

- Insurance companies

made available. For the commercial granting of loans, the lenders require approval in accordance with the German Banking Act . According to statistics from the Bundesbank, the total stock of residential loans to private individuals as of December 31, 2007 was 791.6 billion euros. The granting of new loans in the context of private real estate financing in 2007 amounted to 181.8 billion euros.

Loans from

- other private individuals ( personal loans ) or

- Employers (in the form of employer loans )

used. Since the granting of loans is part of the regulated market under the Banking Act , these alternative lenders are strictly limited.

Loans for residential mortgages in principle with a mortgage , usually in the form of a land charge on which to be financed lending object hedged.

Distribution channels

While real estate financing was almost exclusively offered directly by banks and building societies until the 1970s, real estate loans are now sold through various sales channels . In 2007, 74% of real estate financing was sold directly by the banks. 26% of the market is shared by various credit intermediaries . In addition to the insurance brokers , who have also been offering banking products as part of the Allfinanz concept , especially since the 1980s, these are primarily financial distributors who are active in this area. Since the end of the 1990s, Internet sales, dominated by credit intermediaries, have been added as a sales channel and have been able to gain market share.

Process of a private real estate financing

Conception

From the lender's point of view, private real estate financing is one of the credit transactions with the lowest risk of bad debt , as the loans are secured by a land charge or mortgage . However, if the collateral is realized, the remaining obligations may not be settled in full with the proceeds from the sale or foreclosure of the property.

Another risk is the possible change in property prices if the fixed interest rate expires. If real estate prices fall, external financing acts as a lever on the borrower's financial situation. For example, if the property value falls in relation to the original mortgage lending value , the loan is no longer secured. If the loan value falls below the remaining debt, the lender can request additional collateral or set a higher risk premium. If no agreement can be reached between the borrower and the lender, the lender may terminate the loan. The borrower is entitled to negotiate with other lenders to take over the existing loan. If all deadlines have expired, the original lender can start the process of realizing the property.

repayment

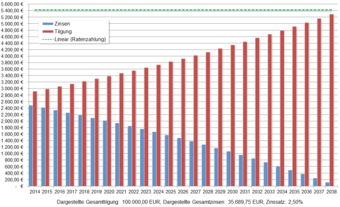

The loans for private real estate financing are to be repaid over a specified period . The annuity loan is one of the most common types of loan. With an annuity loan, the repayment flows directly into the loan and reduces the interest burden in the course of the financing. Typically, an annuity loan is not taken out for the entire period of time necessary to repay the loan in full (“full repayment loan”). Instead, fixed interest periods of 5, 10 or 15 years are common in Germany. As a rule, the shorter this period, the lower the interest rate. However, if the interest rate rises, short terms entail higher risks, which can later greatly increase the monthly burden ("rate").

Instead of the usual repayments, a suspension of repayment can be agreed. Here, the lender initially only receives the interest and the repayment flows into a repayment surrogate . This is saved with the repayment portion and used to (partially) repay the loan at the end of the term. Claims to investment funds , pension insurance or endowment insurance can be used as redemption surrogates .

The building society loan , which has the character of an annuity loan after the allocation, offers a further possibility of financing . If, on the other hand, new home loan and savings contracts are concluded, the home loan and loan amount is pre-financed until it is allocated. Until then, the repayment portion flows into the home loan and savings contracts as a saving, while the interest portion is calculated on the entire pre-financed home loan and savings sum.

Opportunities and risks of buying a property

The acquisition of a property offers the chance of an increase in wealth, but also the risk of a loss of wealth. The decisive factor is the development of assets when purchasing the property compared to the development of assets when renting the property. If the advantages of the purchase outweigh the above, the purchase makes sense. The advantages include rent savings and a possible increase in the value of the property. Disadvantages are the loan costs, maintenance costs and possible losses in value, as well as the long-term commitment to a specific object.

In order to achieve a return that is higher than the average interest rate on fixed-income securities, the location of the property is primarily important. In preferred regions in Germany, real estate prices and rental income have seen a relatively stable upward trend over the past three decades. In addition to the permanent rental income, there is the possibility of realizing tax-free capital gains on a sale, assuming a continuous price increase . This is an advantage over stocks as taxes have been incurred on the sale of these securities since 2009. Furthermore, a property offers a certain protection against inflation. In the event of high rates of price increase and simultaneous taking out of a real estate loan, the borrower also benefits from falling loan rates in real terms, as inflation also decreases the value of the debt. This effect is particularly noticeable when the lending rates are fixed in the long term.

Contrary to popular belief, investing in a property does not always bring a secure return. In the 1990s, a number of real estate buyers lost capital because properties in poor locations and in a poor state of construction were purchased as tax-saving models , but the promised rental income could not be achieved. The risk of not achieving the desired return on the capital employed lies in possible vacancies during the holding period and losses when reselling the property. Buying real estate can turn into a financial fiasco, especially if the real estate financing has been calculated too tightly.

In the event of a significant increase in the interest rate at the point in time when the fixed interest rate expires, the borrower is threatened with over-indebtedness - he can no longer finance the sharply rising rates.

Comparison between rent and purchase

The argument of rent savings for taking up real estate financing only applies in the event that the rent savings are not used up by other expenses. It is therefore essential to relate rent savings to other figures. These include the interest payments and incidental loan costs for the provision of the loan as well as the expenses for the maintenance of the property.

Economic significance of private real estate financing

The framework conditions for private real estate financing have a direct impact on the employment-intensive construction industry and the development of the value of residential real estate.

Consumer protection regulations for real estate loans

A property purchase and the associated financing represent legal transactions in which sums are moved that typically amount to a multiple of the annual income of private property buyers. For this reason, the legislature has created a large number of consumer protection regulations. First, both the property purchase needs and the order of the liens of notarization . Special consumer protection rights apply to the real estate loan agreement. A right of withdrawal is essential here , to which the borrower must be informed separately. Even in the event that the borrower falls into arrears with his installments, he is protected against the bank terminating the loan too early. Since the Risk Limitation Act came into force in 2008 , a loan can only be canceled if the installments are in arrears of 2.5% of the loan amount. With a typical building loan with 5% interest and an initial repayment of 1%, this rule means that a borrower can be in arrears with up to 5 monthly installments without the bank being able to cancel the loan.

The possibility of selling the loan by the financing bank was severely restricted by the Risk Limitation Act . See: Loan trading .

New EU consumer protection guidelines

From April 2015, consumers must be fully informed about the risks and costs, including the subsequent interest and repayment burden, before taking out real estate financing. On March 16, 2016, the law for the implementation of the Residential Property Credit Directive and for the amendment of commercial law regulations of March 11, 2016 was promulgated in the Federal Law Gazette Part I, No. 12 of March 16, 2016, page 396.

Tax treatment of real estate financing

The tax framework conditions shape the respective national markets for real estate financing. If the respective national tax law recognizes the interest on real estate loans as tax-reducing, there is an incentive to use a relatively small share of equity. The tax treatment of real estate financing in Germany depends on the use of the property. Income from renting and leasing is subject to income tax . In the case of rented properties, the costs (interest, fees) of the financing (proportionately) can be deducted from the rental income as advertising costs . Special regulations apply when renting to relatives. Here the rent can be reduced to 66% of the local rent without affecting the tax deductibility of the interest.

Financing costs and other expenses associated with owner-occupied real estate cannot be deducted for tax purposes. The rent saved is irrelevant for tax purposes. Historically, there were different models of tax incentives for owner-occupied real estate in Germany: the builder model , Section 7b of the Income Tax Act - depreciation and the home ownership allowance . Today, anyone who wants to build up equity for a property they use themselves or finance it directly can use the income-independent “Wohn-Riester” subsidy , typically in connection with home loan and savings contracts.

Commercial real estate finance

Commercial real estate financing includes the financing of commercially used real estate or residential real estate if these belong to business assets. Due to the different risk structure, the following classifications can be distinguished:

- Residential real estate

- Commercial real estate (e.g. shopping centers, office buildings, medical practices, etc.)

In addition, there is also a large number of mixed properties, whereby the type of property financing depends on the weight of the individual types of use.

Different financing markets have developed for the financing of the individual types of property due to the risk profile.

Commercial residential property finance

The main owners of commercial residential real estate are housing companies . Local, mostly urban companies and housing associations dominate the market. Only a few profit-oriented, mostly larger companies are active in this market in Germany. These housing companies usually have a substantial equity base and a positive cash flow from a portfolio of residential properties. Since the real estate to be financed has only low risks due to the high spread of rental income across many individual tenants, classic long-term debt financing with high equity proportions is used in the area of commercial residential property financing.

Act as a lender in what is considered to be a very safe market

- Credit institutions , Landesbanken , mortgage banks and

- Life insurance companies (as an investment).

As of December 31, 2007, loans to housing companies totaled 165.0 billion euros. The volume of new business will have been around 10 billion euros in 2006 due to the decline in new construction activity.

Financing of office and retail real estate

Financing office and retail real estate is significantly more complex than private real estate financing or commercial residential real estate financing. The evaluation of the long-term rentability of the property, the current tenants and the rental contracts requires special know-how. In this respect, special providers have developed for the financing of such properties.

These include:

- special credit institutions from the area of Landesbanken and mortgage banks ,

- Real estate funds ,

- Real estate companies ,

- REIT ,

- Leasing companies

financed.

In the development of such projects , special financing such as B. mezzanine capital with equity kicker , participating mortgage financing, joint venture financing or non-recourse financing are used, in which the lenders also expect a share in the project profit for the risk from their unsecured part of the financing.

The largest German credit institutions in this area are the

- Eurohypo AG

- Deutsche Pfandbriefbank AG (formerly Hypo Real Estate AG )

- Aareal Bank

- Westdeutsche ImmobilienBank .

Financing of public real estate

Town halls, schools, fire stations , police stations , swimming pools and all other types of public property are generally financed from public budgets. In addition, the public-private partnership model is also used in real estate financing .

See also

Individual evidence

- ↑ Time series PQ3201: Housing loans to domestic economically uneven. u other. Privatp. / total / all bank groups. In: bundesbank.de. Archived from the original on February 27, 2009 ; accessed on February 13, 2015 .

- ↑ Interest rates and volumes for the portfolios and new business of the German banks (MFIs) *) a) Portfolios o). (PDF) In: bundesbank.de. Archived from the original on October 2, 2007 ; accessed on February 13, 2015 .

- ↑ BelWertV with attachments

- ↑ Ulrich Seubert, Martin Weber : 5, 10, or 15: Maturity Choice of Private Mortgage Borrowers , Working Paper, University of Mannheim (English)

- ↑ Buy or rent: How to find out what you can afford , test.de from March 17, 2015, accessed on March 17, 2015

- ↑ Critique of this in the Bundesbank's statement ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ^ Real estate loan cost trap - VZBV. In: vzbv.de. July 4, 2014, accessed February 13, 2015 .

- ↑ afp, dpa: EU improves consumer protection. In: handelsblatt.com . December 10, 2013, accessed February 13, 2015 .

- ↑ BGBl I 2016, 396ff.

- ↑ Time series PQ3185: Loans to housing companies / total / all banking groups. In: bundesbank.de. Archived from the original on February 27, 2009 ; accessed on February 13, 2015 .