Economic welfare

Economic welfare referred to in the economics either the benefit of an individual (individual economic consideration) or a measure of the benefit of all individuals in an economy (overall economic consideration).

From a microeconomic perspective, economic welfare is subjective and clearly defined: the welfare of an individual increases when his or her benefit increases. In the macroeconomic view, the subjective element is included, but it is not clear a priori how one can summarize the benefits of numerous individuals into a macroeconomic welfare index.

Economic Welfare and Exchange

The paradigm of welfare economics and thus a necessary component for understanding economic welfare is exchange . Two individuals with a given initial supply of goods and given preferences voluntarily exchange two different goods. According to the definition, the benefit for both individuals has increased; in the worst case, the benefit has remained the same for both. Since economic prosperity is formed through the aggregation of individual benefits, the economic prosperity of the economy has increased.

The origin of the term can be traced back to a wrong translation of the English term “welfare”, which actually means “welfare” in German. “Welfare” is also defined as a technical term in economics about the comparison and exchange of bundles of goods.

Economic welfare and perfect market

Imagine a perfect market for a good. The supply and demand curves intersect at a point, the equilibrium point, an equilibrium price (price: Y-axis) and an equilibrium quantity (quantity: X-axis) are formed. There are no other customers who would buy at this price and no other providers who would offer the good at this price. The area between a straight line running parallel to the X-axis at the level of the equilibrium price ( ) and the demand curve is called consumer surplus, the area between this straight line and the supply curve is called producer surplus . The sum of the two areas (that is, the area to the left of the equilibrium point between the supply and demand curves) is the total pension. The total pension defines the maximum welfare sum ( welfare gain ) that occurs through the execution of all exchange transactions possible at the market price.

Since the maximum welfare gain occurs when exchanging at the market price, the equilibrium of a perfect market is viewed as an economic optimum. The economic optimum achieved in this way can be determined independently of how goods and income are distributed in the economy. That means, purely formally, a very unjust and uneven distribution can also be the basis of an economic optimum. Under certain circumstances and assumptions, the state can redistribute goods and income. Ideally, the goal is a social optimum . Among other things, such considerations provide economic justifications for the existence of the state and its interventions in economic activity.

This micro - economically sound basic concept of the market economy is used to analyze the effects of the activities of economic agents and the state and serves as a basis for economic recommendations in the face of political decision options.

Welfare and welfare loss

Under a welfare loss (including deadweight loss , allocation loss , excess burden of the tax , tax wedge , dead-weight loss , excess burden , Harberger triangle ) is meant in this context by a market disruption perfect compared to the situation competition loss caused on consumer and producer surplus. The cause of the loss of welfare is always that the traded (= produced) amount deviates from the Pareto-optimal amount, which is in equilibrium in a perfectly competitive market.

Since the loss of welfare can (at least theoretically) be calculated in terms of value, the costs of market interventions such as taxes , maximum prices, tariffs or market failures (e.g. due to monopolistic structures or external effects) can be calculated.

Welfare losses can also occur through externalities , i. H. by such effects of the decisions of one economic operator on other actors that

- reduce the benefit of the other actors and

- were not taken into account in the decision of the economic operator (Mishan).

Naturally, welfare losses are only determined partially analytically. I.e. Not all effects on the consumption possibilities and level of use of the population are considered (since these are in the future and cannot be fully known), but only a subset that is easy to determine and considered relevant. Such shortened calculations are naturally problematic.

Welfare gain

The welfare gain is the opposite of the welfare loss. Welfare gains can only be realized in imperfect markets, since in perfect markets the maximum of welfare has already been reached.

However, real markets are in fact never perfect. A welfare gain is z. B. according to the foreign trade theory of the economist David Ricardo achieved through increased free trade , since comparative cost advantages and thus an increase in economic prosperity are achieved. However, under conditions that are very different from those of the perfect market, it is difficult to demonstrate the welfare gain of free trade. The structuralist criticism of free trade points to a situation in Latin America in the 19th and early 20th centuries, in which a small upper class in particular benefited from the “free” export of raw materials.

Welfare effects of a tax

If a tax is now introduced, it does not matter who has to pay this tax for its welfare effects. From an economic point of view, the question of the tax incidence , i.e. the question of who pays the tax to what extent or to what extent (not who pays it), depends only on the elasticities of the supply and demand curves.

The introduction of a tax has the following effect: the supplier and the customer are faced with different prices, because the supplier is only interested in what he gets net (without tax = ), the customer is only interested in what he has to pay gross (including tax = ). The tax also has a volume effect. The amount sold decreases compared to the equilibrium without taxes ( ) .

The consumer surplus is now falling for two reasons:

- Consumers have to bear part of the tax burden, which reduces their pension. (Example: The good is always worth 200 to the consumer. Before the tax was levied it cost 100, after the tax it costs 120. The consumer surplus thus drops from 100 to 80.) This effect affects all consumers who continue to buy, they pay instead of now .

- The consumers now consume less of the good than in the original equilibrium. (Some consumers forego the consumption of the good due to the tax-related increase in price.) This corresponds to the decrease in .

The producer surplus is also falling for two reasons:

- The producers have to bear part of the tax burden, this reduces their pension. (Example: The production of the good costs the producer 20. Without tax collection, he achieves 100 on the market, after tax collection 120, but has to pay 40 tax - his profit (rent) drops from 80 to 60.) This affects all producers who continue to offer , instead of just receiving them .

- The producers can sell less than in the original equilibrium. (Example: The production of a good costs 90, without tax collection the producer makes a profit of 10, so he will offer, after tax collection (tax 40, price 120) he would make a loss of 10, so he does not offer). This corresponds to the decrease from to .

The negative effects on consumer and producer surplus are at least partially offset by higher government revenues as a result of the tax collection. The state receives income to the extent of . Most economic models assume that the state uses this income to increase welfare elsewhere. Therefore, they are part of the overall welfare in the model. Economists critical of the state argue, however, that the state can use its income far less efficiently than consumers and producers, which is why a complete integration into economic welfare appears questionable in reality.

However, the state does not receive the entire reduction in producer and consumer surplus. No tax is levied on goods that were traded before tax was levied, but no longer after tax levy (gross too expensive for consumers, too cheap for suppliers) (i.e. on the difference between and ). Only this decrease in the total pension is referred to as the net welfare loss or the additional tax burden (excess burden, deadweight loss of taxation or Harberger triangle) . Formally:

Conclusions on tax policy

Who has to bear a larger part of the tax burden depends on how elastic supply and demand are. With a completely inelastic demand (the demand for gasoline is (in the short term) very inelastic) the producers can almost completely pass on the tax burden. In the case of extremely elastic demand (food in Germany, see also discounters ), the producers must largely bear the tax burden themselves.

If the elasticity of demand is low, the additional tax burden is quite low, since the amount sold is only decreasing very little. That is why there is often the demand that goods with a very inelastic demand should be taxed (cigarettes and other addictive substances, gasoline and the like). An interesting counter-argument is put forward by representatives of the public choice theory : If different tax rates are levied on different goods (such as the reduced sales tax rate of only 7% instead of 19% on certain goods), then costs arise from the additional lobbying activity , as different industries will try to keep their products taxed as low as possible while these costs are lower with a uniform tax rate.

More about tax advantages and disadvantages in the article Tax .

Welfare effects of a tariff

The model of the welfare effect of a tax can also be transferred as a whole to the effects of an import duty. This represents a tax on imported goods and therefore increases the market price to the same extent as a tax. The model therefore comes to the same conclusions here as well: import tariffs hinder the free market process and therefore lead to additional burdens.

If a national welfare criterion is adopted in which advantages for consumers, producers and government revenues are equally desired, then, based on a situation of free trade, an improvement in welfare can always be achieved by introducing an import tariff that is not too high. Because a possible foreign competitor and its profits on the domestic market do not flow into the national welfare. It depends, among other things, on whether or not a distinction is made between domestic and foreign welfare.

If there is a monopoly abroad in the import sector under consideration, the demand for the foreign monopoly is reduced by an import duty. The domestic price is rising slightly, but the state could reduce or even more than compensate for the consumer’s loss of welfare with its customs revenue.

Conclusions on foreign trade policy

The model presented fundamentally calls into question the economic efficiency of an import tariff. More extensive models show, however, that the tariff collection can still be welfare-promoting, especially for large countries, since they can shift part of the burdens on to other countries via price effects (better terms of trade ). However, the global economy always suffers from welfare losses.

Apart from that, the criticism B. the collection of an educational duty .

Welfare effects of a monopoly

Deadweight losses also arise in the private sector through monopolies and oligopolies , since consumers in a monopoly situation are forced to pay prices that are higher than competitive prices.

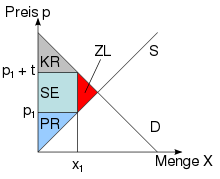

While the equilibrium in the polypole is / , in the monopoly case a higher price ( ) has to be paid, which leads to a lower consumption amount ( ). The consumer surplus ( KR ) falls significantly due to the price increase and the decrease in volume. Two opposing effects have an effect on producer surplus: On the one hand, it decreases because the monopoly can only sell a smaller amount compared to the polypolist. On the other hand, he benefits from the possibility of being able to raise monopoly prices.

Overall, however, a net deadweight loss can be seen (indicated by the red area ZL ). The same applies to monopsones and oligopsones, i.e. competition disruption on the procurement side.

Conclusions on competition policy

The statements of the welfare model for the monopoly case are largely undisputed - in most cases the disadvantages of a monopoly compared to a polypole are beyond question. However, further efficiency disadvantages are not taken into account here: For example, a monopoly leads to U. also via other channels to loss of welfare: Scientific studies show

- an often declining Innovations -Freudigkeit at monopolist (ie, it develops slowly new, better quality products)

- lower productivity of the monopolist (i.e. large parts of his monopoly profits may be consumed by inefficiencies in manufacturing)

- worse service than in polypol markets

- fewer product variations (ie, the monopolist usually offers its customers fewer variations of the product that might be more suitable for the respective customer needs). From this point of view, it appears to be an important task of competition policy to prevent monopolies.

It should not be forgotten that in certain cases a monopoly can be optimal for welfare; so is z. For example, it is conceivable that a national monopoly is more competitive on foreign markets due to its domestic monopoly profits and thus possibly creates additional jobs in Germany (an example of this could be cited, for example, the narrow oligopoly on the German energy market). Furthermore, it is conceivable that in some markets, due to high fixed costs, sufficient sales can only be achieved for one company.

Net welfare

The net welfare is the total benefit (or net advantage) that both producers and consumers derive from their activities in the market.

literature

- Peter Bofinger : Fundamentals of Economics. An Introduction to the Science of Markets. 2nd updated edition. Pearson Studium, Munich et al. 2008, ISBN 978-3-8273-7222-2 .

- Hans Gerd Fuchs, Alfred Klose , Rolf Kramer (eds.): Goods and Ungüter. A friend's gift for Gerhard Merk on his 60th birthday. Duncker & Humblot, Berlin 1991, ISBN 3-428-07089-5 .

- Stefan Homburg : General Taxation. 3rd, revised edition. Vahlen, Munich 2003, ISBN 3-8006-2991-7 , p. 160 ff.

- N. Gregory Mankiw : Fundamentals of Economics. 3rd, revised edition. Schäffer-Poeschel, Stuttgart 2004, ISBN 3-7910-2163-X , p. 175 ff.

- Hal R. Varian : Fundamentals of Microeconomics. 5th, revised edition. Oldenbourg, Munich et al. 2001, ISBN 3-486-25543-6 .

Individual evidence

- ^ Gerhard Rübel: Basics of real foreign trade . Oldenbourg Verlag, Munich / Vienna 2004, ISBN 3-486-27560-7 , p. 131.

- ^ E. Wesley F. Peterson, A Billion Dollars a Day, Wiley-Blackwell, Chichester 2009, p.25

- ^ E. Matzner: The welfare state of tomorrow. Campus, Frankfurt am Main / New York 1982, ISBN 3-593-33065-2 , p. 68.