Accruals and deferrals

In commercial bookkeeping, accruals and deferrals are a step in the period-end closing (usually annual financial statements ) with which values in the income statement and balance sheet are assigned to the correct accounting period (e.g. fiscal year , quarter ).

Purpose and legal requirements

A delimitation is necessary in order to be able to determine the success of a company even if business transactions require several postings and these relate to different accounting periods. This is usually the case, for example, when payment terms have been agreed with customers or suppliers, i.e. when the delivery and service (and thus the time of transfer of risk ) on the one hand and the payment on the other hand do not take place in the same period. Accruals and deferrals also ensure that taxes can be paid correctly for the relevant periods.

Accruals and deferrals are therefore the accounting delimitation of expenses and income in an accounting period, the corresponding (consideration) services of which will only take place in a later period. Prepaid expenses represent a type of liability or claim .

Examples:

- We have already paid, the service will only be provided in a later period - or vice versa: We have already received a (down) payment or prepayment from a customer, but will only provide the service in a later period (= deferred income).

- We have received a service, but will only settle the supplier's claim in a later period, or we will only receive payment for a service already provided by us in a later period (= anticipatory accruals).

In contrast to provisions , the exact amount is always known when accruing expenses, so it is neither estimated nor calculated. The legal basis is regulated for Germany in § 250 and § 252 HGB , for Austria in § 198 Paragraph 5,6 UGB and for Switzerland in Art. 958b OR .

"Expenses and income of the financial year are to be taken into account in the annual financial statements regardless of the time of the corresponding payments."

Active accruals and deferrals

Active accruals and deferrals (abbreviation ARA; the ARA items are abbreviated according to ARAP) is a benefit claim. It occurs when an effort of the New Year one already in the old year output represents. The prepaid expenses account is an asset account.

Mnemonic: A dition now A ufwand later = A ktiver Prepaid expenses

For example, if an advance payment is made in December for the January rent, the booking is made as follows:

1. When paying

| Rental expenses | on | Bank |

2. in the annual financial statements (the effort is neutralized, ARAP is formed)

| ARAP (or transitory assets) | on | Rent expenses (= space expenses) |

3. in January (the effort is posted in the correct period, ARAP is resolved)

| Rent expenses (= space expenses) | on | ARAP (or transitory assets) |

In automated accounting systems, rents are initially posted to the credit balance independently of the payment. The payment is then posted against the vendor account with no effect on income. In practice, the following booking rates can result:

1. Upon receipt of the invoice (in this case: the "long-term rental invoice ")

| Rental expense (= room effort) | on | Liabilities from delivery u. Performance (= Creditors ) |

2. When paying

| Liabilities from delivery u. Performance (= Creditors ) | on | Bank |

3. in the annual financial statements (the accounts payable balance is neutralized, ARAP is formed)

| ARAP (or transitory assets) | on | Rent expenses (= space expenses) |

4th in January (the effort is posted in the correct period, ARAP is resolved)

| Rent expenses (= space expenses) | on | ARAP (or transitory assets) |

Accruals and deferrals

Income from the new year that is already income in the old year , for example prepayments from customers, is posted to accounts for deferred income (abbreviation: PRA). They establish performance obligations, i.e. claims by customers or other creditors to the company's services. The posting to the revenue and receivables accounts corresponds to the posting logic shown above.

Example 1:

A fitness studio (business year from January 1 to December 31) sells an annual pass on December 1, 2008 for € 600. The money is paid immediately in cash. The studio then actually took € 550 "too much" for 2008. These pro rata 550 € for the period from January to November 2009 do not belong in the 2008 financial year, but in the year 2009 (especially since the customer also used the showers in 2009 and incurred costs for it in 2009, without having to do so again in 2009 to pay for it.)

However, since the full 600 € have already been received in the studio's account, the proportionate 550 € are accounted for as prepaid expenses for the next year.

The fitness studio has a kind of "liability" in performance on December 31, 2008 - it still owes the customer the right to use the studio for 11 months without having to pay again.

Example 2:

An advertising company undertakes to present its advertising to a client for 5 years. The advertising contract begins on January 1st. The client pays € 10,000 for this in the first year. The advertising company receives 8,000 € for a service that has not yet been provided and undertakes to also provide the service in the next 4 years. In the first year, the accruals for the advertising company resulted in income of only € 2,000, as the € 8,000 will be spread over 1/4 of the next four years. The creation of the advertising media (€ 1,500) and the commissions to be paid (€ 2,500) to an independent commercial agent are already carried out in the first year in the amount of € 4,000. The accruals and deferrals for the first year result in a loss of 2,000 (loss carryforward), as the expenses can be claimed immediately (4,000 €) and only 2,000 € (1/5 of the total amount for 5 years) are booked as income become.

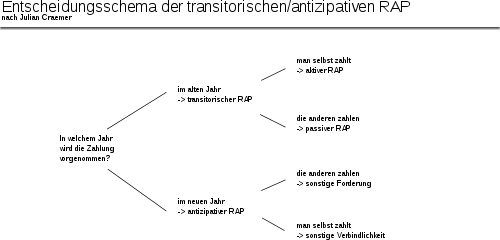

Transitional and anticipatory items

In the balance sheet , deferred values are shown separately as so-called prepaid expenses on both sides. These balance sheet items are also called transitory items because they transfer expenses and income for services still to be performed in the old year to the new year (cash effectiveness - i.e. cash flow - in the old year, for profit effectiveness - i.e. performance - in the new year).

The opposite case is shown using the so-called anticipatory items. These are services made in the old year that only lead to income and expenses in the new year (cash flow in the new year for a service in the old year). The effectiveness of success is anticipated here. An example of this is interest income for the old year that is only due for payment in the new year. According to § 250 HGB and § 5 Abs. 5 EStG , anticipatory items are not to be carried as RAP. In the balance sheet structure, the items “other assets” (on the assets side ) and “other liabilities” (on the liabilities side ) are provided for this.

Legal regulation and exceptions

While there is usually an obligation to post prepaid expenses in the balance sheet, Section 250 (3) HGB provides for an activation option for the discount . Is this included in the RAP, it can over the entire term of a loan written off are. This is appropriate because the discount is an interest equivalent that is distributed over the period of capital use.

literature

- Manfred Deitermann, Siegfried Schmolke: Industrial accounting. Winklers, Darmstadt 1999, ISBN 3-8045-6652-9 , pp. 237–245.