Robin Hood Effect

The Robin Hood Effect is an economic event in which income is redistributed in order to reduce economic inequality. This effect is named after Robin Hood , who was known to steal from the rich to give to the poor.

Causes of the Robin Hood Effect

A Robin Hood effect can be caused by a variety of policy areas and economic decisions that are not necessarily aimed at reducing inequality. The following are the relevant decisions.

Natural development of a country

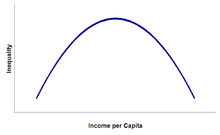

Simon Smith Kuznets claimed that a major factor affecting levels of economic inequality is a country's level of economic development. As shown, Kuznets describes a curve-like relationship between income levels and inequality. The theory is that countries with a low level of development will have a relatively even distribution of wealth .

As a country develops, its capital inevitably grows and the owners of that capital gain more income and wealth, which creates inequality. Nonetheless, various possible redistribution mechanisms, such as trickle-down theory and welfare, lead to a Robin Hood effect with a redistribution of wealth to the poor. More developed countries therefore operate on a lower level of inequality.

Uneven income tax

Many countries have an income tax system whereby the first part of workers' wages is either taxed or not taxed at all, while those on higher wages have to pay higher tax rates above a certain threshold, the so-called tax progression . In this way, the better-off population pays higher tax shares in order to subsidize the less well-off, which creates the Robin Hood effect.

In particular, a tax progression is a tax that increases the tax rate as the tax base amount increases. “Progressive” describes the redistributive effect of the distribution of income and expenditure by reference to the way in which fees are increased, whereby the average tax rate is lower than the marginal tax rate. This also applies to individual taxes or to an overall tax system; annual, perennial or for life. Tax progression seeks to reduce the tax incidence of those with fewer payment options by transferring the incidence to those with higher payment options.

Cross-subsidization of cellular telephony

The cellular networks of many developing countries usually do not have broad network externality . The mobile operator is trying to compensate for this by subsidizing contract customers with high call termination rates. This enables the less well-off to have access to communication services, often free of charge (for prepaid tariffs). The additional costs are charged to the contract customers who call the newer contract customers; those who make the calls tend to be better off financially. This creates a Robin Hood effect, whereby the wealthy subsidize the poor even though there is no direct money transfer.

See also

Web links

- A Robin Hood effect caused by affirmative action

- International roaming charges argued to make the rich subsidize the poor ( Memento from May 14, 2014 in the Internet Archive )

Individual evidence

- ↑ Webster (4b): increasing in rate as the base increases (a progressive tax)

- ↑ American Heritage ( Memento of April 12, 2001 in the Internet Archive ) (6) - Increasing in rate as the taxable amount increases.

- ^ Britannica Concise Encyclopedia ( Memento of January 12, 2009 in the Internet Archive ): Tax levied at a rate that increases as the quantity subject to taxation increases.

- ↑ ( Page no longer available , search in web archives: Princeton University WordNet ): (n) progressive tax (any tax in which the rate increases as the amount subject to taxation increases)

- ^ Ray M. Sommerfeld, Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson: Concepts of Taxation. Dryden Press, Fort Worth, TX 1992.

- ^ David M. Hyman: Public Finance: A Contemporary Application of Theory to Policy. 3. Edition. Dryden Press, Chicago, IL 1990.

- ↑ Simon James: A Dictionary of Taxation. Edgar Elgar Publishing Limited, Northampton, MA 1998