Tax system in china

The tax system in China essentially comprises four categories. The first category consists of direct taxes , i.e. income tax and corporate tax . The second category, indirect taxes, includes value added tax and consumption tax . The third category consists of stamp duty , document tax , property tax , and a tax on resources. The last category is customs duties .

history

The ancient tax system in China was primarily based on property tax. This fit in with the country's agricultural character for several thousand years. However, there were other taxes and sources of income such as salt and iron monopolies. In addition, forced labor was a source of income for the state. By the Han dynasty , China already had a complex social structure. The broad mass of the population was the bourgeois class; there were also two higher classes, namely officials and nobles. The lower classes included convicts and slaves. Citizens' taxes varied depending on their profession and place of residence. The tax for farmers was usually 1/30 of their harvest. Craftsmen and artists paid taxes based on the amount and value of goods sold. In addition to the property tax, adult citizens had to pay poll tax. Traders had to pay double the poll tax and high market fees.

The Han government was heavily influenced by Confucianism , a then new philosophy . Confucianism emphasized agriculture as the root of the Chinese economy. The Han government cut farmers 'taxes and increased traders' taxes. During the Sui and Tang dynasties, the administration of the country and thus also the tax authorities were decisively further developed. The basis for this were formalized national state exams. The Ming tax system was designed to reduce the economic differences between the provinces in order to secure the unity of the empire. The Ming tax system was very complex and influenced the systems of the subsequent Qing dynasty . The influence of the Ming can be traced back to the current tax system.

The social change in the transition period to the Republic of China was reflected in taxation. The property tax as the most important tax has been replaced by income tax , customs duties and consumption tax. In addition, the tax system was decentralized and responsibility passed from the central government to the local government. Direct taxes were also introduced. On the surface, the new tax system had many advantages, but it was underdeveloped.

During the civil war , high taxes were brutally collected. The communists wanted to break away from it. They decided to introduce a new tax system. The system, introduced between 1950 and 1957, focused on stabilizing the economy and uniting the country. In addition, the new system increased government revenues. From 1958 new regulations were introduced to simplify taxes for industry and taxes for trade. As the system was seen as simpler, staff in the tax offices were laid off on a large scale. This ensured that taxes from then on played a lesser role.

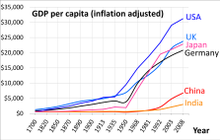

When the country opened up economically in 1978, elements of the old tax system were reintroduced to meet the needs of a market economy. The Chinese farmers had the highest priority. In 1979 the government increased the purchase prices for grain. This was an incentive for the farmers to produce more than the quotas required in order to earn money. The 1984 tax reform was intended to expand and improve the existing tax system. Income tax was introduced piece by piece and a tax was levied on the profits of state-owned companies. Further changes in the law allowed companies to determine the amount of goods produced themselves and to pay employees bonuses. Since the 1994 financial reform, China's tax revenues have increased steadily. The reform was carried out to create a leaner tax system that fits China's socialist market economy . The additional income is related, among other things, to economic growth in recent years. Revenue increased from 507.1 billion yuan (RMB) in 1994 to 13.6 trillion RMB in 2015. The economic growth and the entry into the World Trade Organization (WTO) in 2001 made it clear that the Chinese tax system had to be adapted to the new circumstances. In the following years several tax laws were passed.

Legal background

According to the Constitution of the People's Republic of China , the legislative competence lies with the National People's Congress . The Ministry of Finance is responsible for Chinese tax policy . Tax collection, on the other hand, is the task of the tax administration authority.

Chinese tax policy institutions

The State Council is the highest body of the executive branch. It controls the ministries and other administrative organizations and has 50 members. The Prime Minister , Li Keqiang , is the chairman of the State Council. The Council of State can issue administrative regulations. The council can have the regulations specified by ministries subordinate to it.

Local tax offices

Local tax offices in China can issue local regulations and statutes. However, these may not contradict the constitution, the laws of the People's Congress or the regulations of the Council of State.

Ministry of Finance and State Tax Administration

The Ministry of Finance and the State Tax Administration interpret laws, and the interpretations are published in ordinances . The key role in formulating and coordinating tax policy lies with the tax administration. She also oversees the provincial and municipal tax offices. The Tax Administration is responsible for collecting the taxes that go to both the central and local governments. Local tax authorities are responsible for collecting taxes at the local level. They also take care of day-to-day tax matters. The Ministry of Finance assists the Tax Administration in developing tax policy.

Direct taxes

In the case of direct tax, the tax debtor and the taxpayer are the same person.

Income tax

Chinese citizens and foreign nationals living in or earning income in China may be taxed. Two factors determine whether a person is taxed. These are the place of residence and the length of stay in China. Non-resident individuals who have been in China for less than a year will be taxed on income earned in China. If a non-resident stays in China for more than a year and less than five years, income earned in China and income earned abroad from Chinese sources will be taxed under the Chinese Income Tax Act. If a person has lived in China for more than five years, the worldwide income is taxed through the Chinese income tax.

The tax rate is between 3% and 45% in nine progression levels, depending on the income level and type of income. However, the tax burden can decrease if part of the income is paid as a bonus. Germans are taxed in the People's Republic of China according to the double taxation agreement between Germany and the People's Republic of China . There is also a double taxation agreement with Taiwan.

The individual income tax is calculated as follows:

(Gross monthly income x tax) - deduction

| Gross monthly income in RMB | tax | Deduction |

|---|---|---|

| 0 to 1,500 | 3% | 0 |

| 1,501 to 4,500 | 10% | 105 |

| 4,501 to 9,000 | 20% | 555 |

| 9,001 to 35,000 | 25% | 1.005 |

| 35,001 to 55,000 | 30% | 2,755 |

| 55,001 to 80,000 | 35% | 5,505 |

| Over 80,000 | 45% | 13,505 |

Corporate tax

The new corporate tax law came into force in 2008. It was passed to prevent different treatment between local and foreign companies. Corporate tax is levied on income from the sale of goods, delivery services, transfer of ownership, and income from dividends, interest and royalties. As a result of the reform, all companies will have to pay a flat tax of 25%. The tax drops to 20% for small businesses and 15% for companies with high investments in new technologies.

Indirect taxes

With indirect taxes, the person who owes the tax (tax debtor) and the person who bears the tax economically (taxpayer) are not identical.

value added tax

Value added tax is levied on legal entities that sell goods, perform repairs, perform transportation services, and import goods. The tax rate is 17%.

Excise tax

The excise tax is paid on products that are considered luxury or non-essential. These include, for example, alcohol, cosmetics, fireworks and luxury watches. Taxes are divided into 14 categories and taxed differently.

Other taxes

Other taxes include a variety of different taxes. Other taxes include stamp duty. This tax applies to contracts, company documents and books. Stamp duty is paid either as a flat tax or per document. Deed tax is levied on the transfer of property rights, such as ownership of land or buildings. Resource tax is paid by legal entities engaged in mining or salt production.

duties

Customs duties are paid on imported goods by the recipient and customs duties on exported goods are paid by the shipper. The tax rate is different, a value tax and a quantity tax are possible.

further reading

- Brean, Donald JS (2013): Taxation in Modern China: Routledge.

- Riccardi, Lorenzo (2013): Chinese Tax Law and International Treaties. Heidelberg: Springer International Publishing.

- Liu, Zuo (2006): Taxation in China. Singapore: Cengage Learning Asia.

Individual evidence

- ↑ a b c China Tax System , accessed July 3, 2018

- ↑ a b c d e f g h i Xu, Y 2009, 'No taxation without representation: China's taxation history and its political-legal development, Hong Kong Law Journal, vol. 39, no. 2, p. 515-540, accessed July 4, 2018

- ↑ State Administration of Taxation of the People's Republic of China: Revenue Statistics , accessed July 3, 2018

- ^ WTO successfully concludes negotiations on China's entry , accessed July 3, 2018

- ^ A b Lorenzo Riccardi: Chinese Tax Law and International Treaties . Springer, Heidelberg / New York / Dordrecht / London 2013, ISBN 978-3-319-00274-3 , doi : 10.1007 / 978-3-319-00275-0 (270 pages).

- ↑ a b c State Administration of Taxation of the People's Republic of China: The Organizational Structure , accessed July 3, 2018

- ^ Ministry of Finance of the People's Republic of China , accessed July 3, 2018.

- ↑ a b Individual Income Tax Law of the People's Republic of China , accessed July 3, 2018

- ↑ Enterprise Income Tax Law of the People's Republic of China , accessed July 3, 2018.

- ↑ Provisional Regulations of the Peoples Republic of China on Value-Added Tax , accessed July 3, 2018.

- ↑ Interim Regulations of the People's Republic of China on Consumption Tax , accessed July 3, 2018.