Price index

A price index is an economic indicator for the development of selected prices . It indicates how the prices of the goods and services in a shopping basket have changed, for example the consumer price index or the import price index . It is a measure of inflation, with its help a statement can be made about the level of inflation or deflation in an economic area. To this end, it is determined how the prices within a basket of goods representative for this economic sector change over time. A reference time is always defined with the price index 100, to which all other indices refer.

Price indices can be differentiated according to object and formation algorithm. After the subject is in the price statistics a whole bunch of price indices determined.

Two concepts of price index formation are widespread:

In the national accounts , on the other hand, a price adjustment is made with chain indices (chain prices) in accordance with international conventions . For this purpose, the price index is increased or decreased annually by the rate of price change.

- (For the sake of simplicity, the following considerations are only made for a purchase price index.)

Alternative definitions

"Consumer Price Index (CPI) [...] calculates the cost of a detailed list of goods and services in euros (formerly known as the cost of living index)"

"Measures the average price change of all goods and services that private households buy for consumption"

"To put it simply, price indices are functions that aggregate prices and their changes and summarize them into a measure that allows a statement to be made about price development as a whole."

classification

An important economic policy goal has always been price level stability . In order to check whether a price level is constant or how high its change is, an inflation rate is calculated:

so z. B.

With

- .

Only an exponential behavior of the CPI leads to a constant inflation rate.

What is of primary interest is how the purchasing power of consumers' money changes over time. For this reason, the consumer price index is mainly calculated in practice, since it only records goods and services that are intended for private households. In the German-speaking countries, the consumer price index is calculated monthly by the respective federal offices. Other possible price indices are, for example, the index of import and export prices, the index of producer prices for agricultural or industrial products, and the index of gross domestic product . Statements about regional differences in the price level can also be expressed with a price index, which is then structured in a manner analogous to the price index over time. However, such price indices are rarely determined.

In the case of a temporal price index, which will be considered in more detail below, it is first of all necessary to determine two points in time at which the price of the shopping basket is to be determined. These are called the base year (or base period ) and the reporting year . The base year is the year to which the investigation relates (the starting point of the observation) and the reporting year is the year in which the price index is created (the current year or the end point of the observation, so to speak). When determining changes in a price index, the base year is set equal to 100%. It should always be chosen so that it is as good as possible in line with the current trend of development.

The price of a shopping basket is the sum of the individual goods prices that it contains. These are multiplied by the respective consumption quantities of the goods, i.e. H. “Weighted with their share of total household expenditure.” The year from which these weightings come distinguishes the Laspeyres index and the Paasche index.

Laspeyres index

When calculating the price index according to Étienne Laspeyres , the selected weights (i.e. the consumption quantities) come from the base year . The index determines the price of a basket of goods in the composition of the base year at goods prices of the reporting year related to the price of the same basket of goods (same consumption quantities) at goods prices of the base year. This is expressed in a quotient:

With

- = Prices for the reporting year,

- = Prices for base year,

- = Consumption based on the base year.

The Laspeyres index is therefore a weighted arithmetic mean of the price indicators , with the weights being the real sales shares of the various goods from the base year.

It is therefore examined what the old shopping basket (consumption quantities of the base year) would cost in the reporting year (e.g. today) (prices of the reporting year) and what had to be paid for the same shopping basket in the base year (old prices and quantities of the base year). It is assumed that the quantities and qualities of the goods in the shopping basket are constant over time, so that changes in the index can only result from changes in the prices of goods.

The practical advantage of Laspeyres indices is that the weights only have to be determined for the base year and then remain unchanged. So that they can still be considered representative of the current price situation, they are updated in the official statistics - as is the composition of the basket of goods - regularly (usually every year, until 2005 every 5 years). However, the constant consumption quantities offer the advantage that the individual price indices that were created with the same base year can be compared very well.

Since consumers try to substitute cheaper goods for expensive goods , the Laspeyres index usually overstates the inflation rate.

The consumer price index for Germany is determined using a Laspeyres index.

Paasche index

In contrast to the Laspeyres index, the weights chosen when calculating the price index according to Hermann Paasche come from the current reporting year, not from the base year. It compares the price of a basket of goods in the composition of the reporting year at goods prices of the reporting year with the price of the same basket of goods (current consumption quantities of the reporting year) at goods prices of the base year. This can also be expressed as a quotient:

With

- = Prices for the reporting year

- = Prices for base year

- = Consumption in relation to the reporting year.

It is therefore examined what a current shopping basket (current prices and quantities of the reporting year) costs and what would have had to be paid for the same shopping basket (consumption quantities of the reporting year) in the base year (prices of the base year).

In this representation, the Paasche index, like the Laspeyres index, is a weighted arithmetic mean of the price indicators , with the weights this time being the fictitious sales shares of the goods at current consumption quantities at the old base prices.

The Paasche index can also be represented as a weighted harmonic mean of the price indicators if the real sales shares from the reporting year are used as weights, because the following applies:

A (pure) Paasche price index is seldom calculated by official statistics , as it is resource-consuming and time-consuming due to the necessary regular updates of the consumption quantities and the constantly changing weights have a negative effect on the comparability of individual years. But he is in deflation required by sales trends to see "real" volume developments as Laspeyres quantity indices.

“If you are faced with a similar dilemma with the Paasche index as with the Laspeyres index - long time series with high information content about the inflation rate, but problematic quantity structure (Laspeyres) or exact quantity structure, but little informative value about the inflation rate (Paasche) - it is consequently to choose the less complex Laspeyres index. "

Other indices

In addition to Paasche and Laspeyres, there are other indices.

Fisher price index

The Fisher price index (named after Irving Fisher ) is the geometric mean of the price indices according to Paasche and Laspeyres. The Fisher price index is also called "Fisher's ideal price index" in statistics:

Regarding the Fisher index, it is worth mentioning that it calculates real inflation with unusual accuracy compared to the indices according to Laspeyres and Paasche. This is because he picks the middle between the two, taking into account that the Laspeyres index tends to overstate true inflation while the Paasche index tends to be an understatement.

The fact that the Fisher Index was still barely able to establish itself in statistical practice is primarily due to the fact that it is too poorly descriptive for the general public, difficult to understand and difficult to communicate by the public authorities.

Chain price index

Chain prices determine for each year how much the goods bought in the previous year cost in the current year (in the Laspeyres form) or how much the goods bought in the current year cost in the previous year (in the Paasche form). As a result, a different shopping cart is used as a basis for each year and the current consumption habits are taken into account when determining the price changes. The disadvantage of the procedure is that the results cannot be directly compared from year to year, as the basket of goods is constantly changing, and longer-term observations are only possible by linking the annual results - hence the name of the index.

The harmonized index of consumer prices is calculated as a chain index (Laspeyresform). It is collected by all member states within the EU. This enables the price development to be compared across countries.

Examples

Shopping baskets:

| 1995 (base year, 0) | 2000 (reporting year, t) | |||

|---|---|---|---|---|

| price | consumption | price | consumption | |

| Cigarettes | 4, - | 10 | 5, - | 7th |

| Pizza | 5, - | 4th | 6, - | 3 |

| movie theater | 8th,- | 2 | 12, - | 1 |

| beer | 0.60 | 10 | 1,- | 8th |

(Prices in GE, consumption in ME)

The representative shopping basket is supposed to consist of only four goods, i.e. H. typically only these four goods are bought by consumers in the specified quantities at the specified prices. As can be seen from the table, the consumption quantities of the shopping basket had to be adjusted from 1995 to 2000 in order to continue to be representative. This is due to changes in consumer habits.

Laspeyres index

- Result : Since the base year 1995 corresponds to 100%, this is a price increase to 131.7% (ie by 31.7%) in the year 2000 in relation to 1995. The basket of the year 2000 behaves like the basket of 1995 as 1.317 to 1.

Paasche index

- Result : Since the base year 2000 corresponds to 100%, this is a price increase to 130.8% (ie by 30.8%) in the year 2000 in relation to 1995. The basket of the year 2000 behaves like the basket of 1995 as 1.308 to 1.

Fisher index

The deviation between the two above calculation types of 0.09% is averaged by the Fisher index:

rating

The price index can only be specified exactly for items whose "quality", i. H. whose price-determining properties remain unchanged. If these properties change, their estimated price influence must be deducted in order to be able to compare the same with the same price. Since the quality of some goods changes rapidly and the price index in this case depends very heavily on (subjective) estimates, the statistical offices are increasingly going over to collecting hedonic prices . However, there are other internationally recognized and recommended quality adjustment procedures (e.g. equipment adjustment), with the help of which quality changes can be calculated. As a rule, certain procedures are particularly recommended for special groups of goods, i.e. no quality adjustment procedure is suitable across the board for all goods.

The informative value of a price index is relativized by various problems associated with its determination:

- no differentiation is made according to individual social groups of the population, which can be affected to different degrees by price level changes

- The formation of different index households increases the accuracy, but these indices also merely represent refined average values that do not have to correspond to the actual individual consumption habits of individual households

- the actual consumption structure can change over time, while the composition of the basket of goods used remains unchanged until a new base year is set for reasons of comparability (with Laspeyres)

- no consideration of price elasticities

- constant structural changes in the supply of goods

Because of these factors, which influence the price index and lead to inaccuracies, it is necessary to define a tolerance range within which there is still monetary stability. In Germany, this is estimated by the Bundesbank at one to two percent, i.e. H. if a price index fluctuates less, it is regarded as constant.

International comparison

| index | |

|---|---|

| European Union | European Index of Consumer Prices (EVPI) Harmonized Index of Consumer Prices (HICP / HICP) |

| Eurozone | Eurozone consumer price index (CPI-EMU) |

| European Economic Area | Consumer price index for the European Economic Area (CPI-EEA) |

| United States | Personal consumption expenditures price index (PCE) |

| Great Britain | Harmonized EU consumer price index (HICP) |

| Switzerland | National consumer price index (LIK) |

"The EMU CPI is used by the European Central Bank (ECB) , among others, as a main indicator for the implementation of its monetary policy in the euro zone." The US Federal Reserve System uses the personal consumption expenditures price index to measure inflation. Since 2008, the Swiss Federal Statistical Office (FSO) has been calculating the EU's harmonized consumer price index in addition to the national consumer price index.

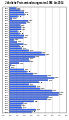

Development of the consumer price index in Germany from 1991 to 2012,

reference year 2005

Indexes by subject

Depending on the object of investigation, the economy can be structured horizontally and vertically as desired. Frequently viewed or published are indices about:

- Commodity prices - CRB index , CCI , DJ-UBSCI , RICI , S&P GSCI , oil price , gold price , silver price , platinum price , palladium price

- Wages

- Producer prices charged by manufacturers (from wholesalers or commercial customers); to be distinguished from the manufacturing costs .

- Agricultural prices (agricultural producer prices) - FAO Food Price Index

- Wholesale prices

- Retail Prices ~ Consumer Prices

- Foreign trade prices

- Rent

literature

- Peter Balastèr: Consumer price indices: theory and practical calculation . Haupt, Bern 1990, ISBN 3-258-04288-8 .

- Peter Hein van Mullingen: Quality aspects in price indices and international comparisons - applications of the hedonic method . Statistics Netherlands, Voorburg 2003, ISBN 90-357-2698-7 .

- Klaus Lange: A theory of price statistics: price, price relation, price index . Vandenhoeck & Ruprecht, Göttingen 1979, ISBN 3-525-11279-3 .

- Irving Fisher, William J. Barber (Eds.): The making of index numbers . Pickering & Chatto, London 1997, ISBN 1-85196-232-8 .

- Wolfgang Eichhorn , Joachim Voeller: Theory of the price index: Fisher's test approach and generalizations . Springer, Berlin 1976, ISBN 3-540-08059-7 .

- Peter von der Lippe: Chain indices - a study in price index theory . Metzler-Poeschel, Stuttgart 2001, ISBN 3-8246-0638-0 .

- Bernd Schmidt: The price index for the cost of living in all private households in the form of a chain index . Metzler-Poeschel, Stuttgart 1997, ISBN 3-8246-0528-7 .

Web links

- Price indices of the Federal Statistical Office - Federal Statistical Office: destatis.de

- Selected articles from the monthly magazine "Wirtschaft und Statistik" - Federal Statistical Office: destatis.de

- Consumer price index Austria

- Consumer Price Index (Switzerland)

- International Monetary Fund (IMF) manual for the methodology of a producer price index

- International Labor Organization (ILO) manual for the methodology of a consumer price index

- Cost of living price index - Germany - since 1881

- Consumer Price Index (CPI)

Individual evidence

- ↑ Blanchard, Olivier and Illing, Gerhard :: Macroeconomics . 4th edition. Pearson Studies, 2006.

- ^ Sieg, Gernot: Economics. 2007

- ↑ Hanusch, Horst and Kuhn, Thomas: Introduction to Economics. 2nd edition, Berlin; Heidelberg; New York; Tokyo, 1992

- ↑ Compare Hewel, Brigitte and Neubäumer, Renate: Volkswirtschaftslehre. Wiesbaden, 1994, page 482

- ^ Hewel, Brigitte and Neubäumer, Renate: Volkswirtschaftslehre. Wiesbaden, 1994

- ↑ Olivier Blanchard, Gerhard Illing: Macroeconomics . 5th edition. Pearson, 2009, ISBN 978-3-8273-7363-2 , pp. 912 .

- ^ Woll, Artur: General Economics . Vahlen, Munich 2007, p. 520 .

- ↑ Compare Hewel, Brigitte and Neubäumer, Renate: Volkswirtschaftslehre. Wiesbaden, 1994, p. 484.

- ↑ EU Info. Germany