Open investment fund

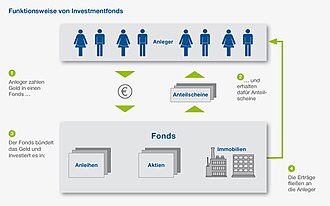

An open investment fund, referred to as a fund for short , is a construct for investing money . An investment company (German technical term: capital management company ; before the introduction of the KAGB in July 2013: capital investment company) collects investors ' money , bundles it in a special fund - the investment fund - and invests it in one or more investment areas. As a rule, the unit certificates can be traded every trading day. The money in the fund is based on predefined investment principles in financial products such as stocks , bonds , money market securities or real estate created. As a rule, investment funds must observe the principle of risk diversification when investing, i.e. the entire fund assets may not be invested in just one share or one property. By spreading the money over various assets ( diversification ), the investment risk is reduced.

With the purchase of investment fund units , the investor becomes a co-owner of the fund's assets and is entitled to profit sharing and unit redemption at the current redemption price . A legal peculiarity applies to open real estate funds: Here the investment company is formally the owner of the fund assets and is therefore entered in the land register as the owner of the real estate.

The unit value is based on the value of the total fund assets divided by the number of units issued. The managed fund assets are special assets according to German law , which means that the investments must be kept strictly separate from the assets of the company. This regulation guarantees the preservation of assets even if the capital management company becomes insolvent. The investment fund rises through new deposits from investors and through price, dividend or interest gains, and conversely it falls through the return of units or through losses.

history

The first mutual fund (then called mutual fund) that still exists today was launched in the United States in 1928 under the name Pioneer Fund . In Switzerland, the then Schweizerische Bankgesellschaft (now UBS ) launched the first fund in 1943, in the middle of the war.

Categories and distinguishing features

Common ways to categorize funds are:

- Instruments in which to invest

- Geographical distribution of investments

- Special strategies

- Investment horizon

- Cost structure

- Management type

- Listing

- Target group (investors)

- Risk structure

- Domicile (of the fund company)

- Special forms

One of the most common categorizations of open-ended investment funds is based on the instruments in which the fund invests. The most common instruments are stocks, funds, bonds, money market papers, currencies, commodities and real estate. This results in the fund types equity funds , fund of funds (invest in other funds), bond funds , money market funds , open-ended real estate funds , etc., as used in common fund rankings. In the case of so-called mixed funds, reference is also made to this categorization: Mixed funds invest in different asset classes , mostly in stocks and bonds.

Another differentiation option is the geographical spread of the assets in regions, countries or continents in which a fund may invest according to its investment conditions.

Special strategies relate to a certain content focus of management, e.g. B. ethical aspects or the replication of a certain index. Ethics funds also make their investment decisions under ethical or ecological aspects. For example, you invest in wind and solar energy or in compliance with religious regulations. Index funds form a specific index , such as B. the DAX - such funds are usually passively managed (without active management ).

Open-ended investment funds can be sorted according to the investment horizon (if the fund assets are invested in the short term & often reallocated or invested in the long term). There are mutual funds with a short-term, medium-term or long-term investment horizon. The investment horizon is also relevant for the investor's time plans.

A typical example of funds that are particularly suitable for long-term investors are open-ended real estate funds. In contrast, many money market funds, for example, can be used well to only “park” money for a short time. Term funds are limited in time and are dissolved at the end of the term.

Open funds also differ in their cost structure (see costs ). There are funds with no sales charge ( agio ). These are often referred to as trading funds (also called no load funds). These funds typically have higher annual management fees. On the other hand, there are funds with a front-end load (max. 5% to 6%), these are sometimes referred to as classic funds (CF) or unit class A. Multi-class funds are a specialty in this context . A multi-class fund has several unit classes, each with their own cost structure. However, all classes of the Multi Class Fund invest in the same portfolios.

Another distinction is the way the fund is managed. In an actively managed fund, fund managers decide which securities or other assets to buy for the fund. In doing so, they try to “pick out” investments that promise to be profitable within the framework of the investment conditions. The increase in value of the fund depends largely on the assessment and skills of the fund management . In the case of so-called passively managed funds, however, a specific index is precisely replicated, or the fund's assets are invested on the basis of defined formulas. This enables lower costs because fund management is less complex. On the other hand, in contrast to active management, there is no possibility of “ cherry picking ”. Multi manager funds form another sub-category of the management type . These are administered by different managers, which should further reduce risks.

One can also differentiate between open funds according to whether they are approved for trading on the stock exchange ( exchange-traded funds , ETF for short) or not. If fund units can be traded on the stock exchange, they have greater fungibility . That means they're easier to buy and sell. Outside the stock exchange, units can be purchased by the investment company directly or through banks or financial distributors (see Acquisition of fund units ). If you want to sell the shares again, you can usually only return them to the investment company. The resale of units to another person is permitted; in practice, however, this happens very rarely.

Another possible classification is the target group of investors for whom a fund is created. According to the Investment Act, special funds are funds that are set up exclusively for legal persons, institutional investors such as insurance companies, foundations or banks. Individuals may not acquire shares in these funds. In contrast, mutual funds funds whose units also small investors may be offered for sale.

For classification according to the risk of funds, there are sub-categories of open-ended investment funds. B. Hedge Funds and Guarantee Funds . Hedge funds (official name: "Special assets with additional risks" or "umbrella assets with additional risks") have only been allowed to be launched in Germany since the beginning of 2004. However, direct shares in hedge funds may not be publicly distributed. This is only possible with fund of hedge funds, i.e. with funds that in turn invest in units of different hedge funds. In the case of guarantee funds, the investment company or a third party promises the investor a certain minimum result from the fund investment, such as B. the capital preservation within a certain investment period.

Open-ended investment funds can still be differentiated according to the country in which they were launched. In Germany, not only German funds are offered, but also a large number of units in foreign fund products, especially from Luxembourg. Only the public sale of fund units in Germany is regulated by the German InvG and is subject to the supervision of BaFin. The foreign fund, on the other hand, is structured according to the rules of its home country and is under the supervision of the local authorities.

Ultimately, new types of open-ended investment funds will always emerge, which develop due to innovations or legal framework conditions. An example of the latter are retirement funds. These AS funds contain at least 51 percent shares and shares in open-ended real estate funds . They are regularly linked to the investor's long-term savings plan for private retirement provision.

costs

The costs of a fund are made up of the following items:

- Issue surcharge and redemption fee,

- Management fee of the investment company,

- if applicable, performance-related remuneration of the investment company,

- Custodian fee.

When setting the issue price for new fund units, the investment companies usually add an issue surcharge to the unit value. The surcharge is calculated as a percentage of the unit value. For example, if the unit value is € 100 and the front-end load is 3%, the investor pays € 103 for one unit. Of this, € 100 goes to the fund and € 3 to the investment company or its distribution. The front-end load is essentially a remuneration for the sale of the units. Often the front-end load for equity funds and real estate funds is 3% to 7%, in bond funds around 3% and in money market funds 0%. In some cases, front-end loads are waived in direct sales via the Internet, although the fund's management fee may then be higher. The administration fee includes, among other things, a portfolio commission from which discount providers are essentially financed.

If the investment conditions of a fund provide for redemption fees, a type of "reverse sales charge" will be charged when fund units are returned to the investment company. If, for example, € 100 and the redemption fee are 3%, the investor only receives € 97 for his share. € 3 remain in the fund's assets and are mostly used to cover transaction costs in connection with the redemption of units. This redemption fee is called "disagio" in technical terms.

The annual management fees of the investment company represent their remuneration for the management of the fund. They are generally between 0.1% and 1.75%, which are calculated from and taken from the net asset value of the fund. The annual management fees of index funds averaged only around 0.45%.

In the case of some funds, the terms and conditions of investment also provide for special performance fees for the investment company in addition to the management fee. The investment company receives these success bonuses from the fund assets only if specified events occur, e.g. B. Outperforming a certain benchmark or achieving a certain profit for the fund.

In Germany - as in many other countries - it is a legal requirement that the assets of a fund must be deposited with a custodian bank. The custodian bank charges the fund an annual fee for this, the calculation of which is regulated in the investment conditions. It is usually calculated as a percentage of the fund assets per thousand.

Finally, the investment conditions may stipulate that certain costs that arise for the fund may be paid separately by the investment company from the fund's assets. This can be, for. B. the fee of the auditor who audits the annual report of the fund.

All shifts in fund assets also cause transaction costs. In the case of equity funds, an average annual turnover ratio (PTR) of 1.5 is assumed. Since the bank that carries out the transactions and receives fees for them is often part of the investment company's group, conflicts of interest can arise if too many reallocations take place or the agreed fee rates are excessive.

In the case of index funds , reallocations are only necessary if the composition of the underlying index changes or if the fund management has to react to inflows or outflows of funds. In the case of index funds, an average annual switching rate of only 0.2 is therefore assumed.

The key measure for assessing the fees the fund company as a whole (excluding sales charge) is the total expense ratio (English total expense ratio , abbreviated TER).

Cost transparency

The maximum amount of the management fee and the custodian fee are already set out in the contractual conditions, as is a list of the costs that may be paid out of the fund's assets. The actual amount of the remuneration and costs actually incurred is shown in detail in the annual reports. In contrast, the costs of certificates for an investor are not visible because they are retained by the issuer as the difference between the issue price and a fair market value when the certificates are issued and are not published anywhere. Even with life insurance contracts, there is a lack of even halfway comparable transparency.

Acquisition of fund shares

The following options are available for purchase:

Banks or financial distributors

The provider usually processes the order through an investment company, so that a (sometimes reduced) sales charge is due here.

Free fund brokers

The fund broker usually works with a custodian bank. This accepts the orders and stores the securities. The intermediary is an intermediary between the customer and the bank. As a rule, he can offer more favorable conditions.

Stock exchange trading

If a fund is admitted to trading on the stock exchange or has been included in the so-called "open market" of a stock exchange, the fund units can be bought on the stock exchange without an issue surcharge. In addition to the usual order fee (comparable to a stock order) of the commissioned bank, there is also a fee from the stock exchange or the executing stockbroker (brokerage fee).

In August 2002, the Hamburg Stock Exchange was the first stock exchange in Germany to begin trading in open funds under the name of Fondsbörse Deutschland . Since then, fund shares can be traded like stocks. In this way, the brokers provide continuously tradable prices for all funds listed on the stock exchange during the entire trading period ; In addition, the investor can submit limits and stop-loss orders .

In 2006 also have Frankfurt Stock Exchange , Munich Stock Exchange and the Stuttgart Stock Exchange recorded on-exchange trade funds.

Investment company

When buying directly from an investment company, the customer enters into a contract with the same and no intermediaries are used. There is usually a front-end load for purchases.

Benefits of an open-ended mutual fund

Small investors can also use mutual funds to invest in assets and markets that would otherwise be closed to them. Investments in investment funds are possible with savings plans starting at around € 25 per month, as well as with one-off investments. Due to the bundling of many u. U. very small investment amounts in the fund, this can appear as a major customer in the financial markets . The investment company can then negotiate more favorable terms and invest more economically or more cheaply than would be possible for individual (small) investors. In addition, the investment companies professionally select assets, monitor markets etc. and the investor benefits from this without having to acquire the relevant specialist knowledge themselves.

Since investment funds must observe the principle of risk diversification, the investment risk is lower than with a direct investment in a single asset.

Fund units can usually be returned to the investment company every trading day at the unit value (if applicable, less a return fee, see costs ). This means that the investor can "exit" quickly and without great effort if he needs money or thinks he has found a better form of investment.

Since the investor's money belongs to a special fund and is not part of the assets of the investment company , the investors' money is safe in the event of bankruptcy of the investment company or the custodian bank. In the event of the insolvency of the investment company, the custodian takes care of the liquidation of the funds and the immediate payment to the shareholders. In Germany, funds are subject to government approval and supervision by BaFin. Hardly any other type of investment is so safe and well monitored in this regard.

Disadvantages of an open mutual fund

Contrary to the expectations aroused by capital investment companies, only less than a quarter of all actively managed equity funds outperform their respective benchmarks. The practice of cosmetic accounting leads to disadvantages for investors. These disadvantages do not apply to the index funds .

Pursuant to Section 32 (1) InvG, the investment company exercises voting rights on shares in the fund. Fund investors therefore have no opportunity to participate in general meetings of the stock corporations and to exercise voting rights, although they are co-owners of the shares. However, Section 32 (1) InvG should not only be seen as a disadvantage. Because with a fund with many thousands of investors who do not know each other and who also do not need to be known to the investment company, it should hardly be possible in practice to agree on how to vote before each general meeting.

However, the focus is on the risk associated with the fund's investment in certain assets, or the specific risk potential of the respective sector in which the fund invests. If a fund, in accordance with its investment conditions and its sales prospectus, B. investing primarily in European stocks, investors are exposed to the corresponding market risk. If the prices for European stocks fall, the value of your fund units will also decrease.

Another disadvantage of open funds is the fact that the individual investor - at least in the case of mutual funds - has no right to individual information or information from the investment company about the fund. Jurisprudence and literature assume that individual investors cannot demand to find out more about the fund than the investment company is required to disclose by law in the contractual conditions, sales prospectuses and reports. The idea behind this is that all investors in a fund should be treated equally, and that the Investment Act stipulates an “information package” that all investors are entitled to. Therefore, it is particularly impossible for an investor to find out the transaction costs incurred in a fund over a certain period of time, no matter how justified they may have an interest in them. German court practice shows that u. a. the wording of § 41 InvG is interpreted as an argument against the investor's right to information, also supported by the commentary literature. Accordingly, there is no known case in which an investor was able to successfully obtain this information. This means that an investor hardly has the opportunity to check whether a disappointing performance of his fund units is due to excessively high transaction costs.

Another disadvantage is that it makes exiting an investment fund more difficult or leads to disadvantages if too many other investors also want to return their shares. These return requests can only ever be contested from the liquid assets of an investment fund. If the liquidity quota falls below a certain level due to too many return requests, the investment company is usually entitled and obliged to suspend the return and liquidate other assets. However, this can mean losses for the fund and thus for all shareholders, especially if there is time pressure or in the case of assets that cannot be traded on a daily basis such as real estate. In the case of real estate assets in particular, there is the additional fact that these were often not only financed from fund assets, but also with the help of bank loans in order to leverage the return. In such a case, an early sale often leads to interest compensation obligations to the bank and thus additional losses for the investors. In such a case, it is also possible that investment units cannot be returned regularly for years and can only be sold on the open market, often with considerable discounts.

Sales Material

Open-ended investment funds must prepare an annual report once a year and a semi-annual report every six months. A sales prospectus must be available for each retail fund, which provides information on the investment principles and costs, among other things. Some funds even have to have two prospectuses: a “simplified” and a “detailed” one. The current annual report, the sales prospectus and the semi-annual report (if it is more recent than the annual report) must be offered to a potential buyer. In the case of funds that prepare a simplified prospectus, only this has to be offered. However, if the (potential) investor so requests, the other documents must also be made available to him free of charge.

Rating of funds

The historical performance of individual funds is assessed by rating agencies .

Legal basis

Germany

The legal basis has been in the Capital Investment Code (KAGB) since July 22, 2013 (previously in the Investment Act ) and in the Investment Tax Act . The previous capital investment companies (KAGs) became capital management companies (KVGs) after the KAGB came into force. These differ according to the type of investment assets managed in public and special funds as well as in UCITS -KVG and AIF-KVG. In all cases, the fund assets of open funds are separated from the assets of the capital management company. It remains with investors even if the KVG becomes insolvent. The funds launched in Germany and the public distribution of foreign investment funds in Germany are subject to the supervision of the Federal Financial Supervisory Authority (BaFin).

State Incentives

capital accumulation benefits

The state helps workers build a fund account with financial incentives. Those who invest their capital-forming benefits (VL) in funds approved for VL-Sparen can receive a savings bonus of a maximum of € 80 per year (= 20% of € 400). Under certain conditions (e.g. at least 60% shares), funds of funds and mixed securities and real estate special funds can also benefit from the promotion. The income limits are € 20,000 for singles and € 40,000 for people who are assessed together. If the taxable income is below these limits, you will receive the allowance. (As of April 2009)

Riester pension

With the Riester pension , certain products offered by investment companies, credit institutions and insurance companies are funded, from which a lifelong monthly income flows from the age of 62 or from the beginning of an old-age pension for the investor.

When investing in investment funds, a payment plan with fixed and variable payments can be agreed. Up to 30% of the saved capital can be paid out at the beginning of the payout phase. For all subsidized systems, a promise must be made that at least the amounts paid in will be paid out again. Before the start of the offer, the Federal Financial Supervisory Authority must confirm whether the pension products offered meet the required funding criteria .

Investment funds are used both directly and indirectly (via unit-linked products) as part of the Riester pension. The offers of the investment companies combine the high-yield investment in equity funds with the short-term stable investment, for example in bond funds. The share (fund) portion of a Riester fund offer can be determined by the age of the investor. In this case, the rule of thumb applies: “The younger the investor, the higher the equity component”. Managed fund savings plans can also provide that the equity component varies depending on the current market situation. In this case, the age of the investor does not matter.

There is a choice of concepts in which the actual fund selection is made exclusively by the investment company, as well as offers in which the investor can influence the specific fund selection. This takes into account the different needs of investors. The specific selection of a Riester fund product should be made in a discussion with an investment advisor.

A guarantee of a lifelong annuity is always a prerequisite for state funding. Since the biometric risk of longevity cannot be borne by investment funds, BaFin obliges providers to take out an additional pension insurance contract for every saver. The contributions to this are taken from the saved capital at the start of retirement. As a rule, the amount of the contribution is only known when you retire. The pension payments from the insurance contract usually begin at the age of 85.

Tax aspects

The taxation of investment funds is based on the Investment Tax Act:

Regulation until December 31, 2008

As far as mutual funds the requirements of § 5 InvStG meet (disclosure requirements, so-called full transparency), distributions and reinvested income of the investment fund for tax purposes basically treated as if they would have generated the Shareholder directly themselves. The following applies in detail:

- Ongoing investment income, particularly interest income and dividends are attributed to the investor at year end and are taxable for him, even if they are not distributed.

- Extraordinary profits, in particular price gains that are achieved at the level of the fund, are always tax-free for private sales transactions, even if they are sold within the one-year period ; this applies to private investors both in the case of a distribution and in the case of the retention of capital gains.

- The return or sale of investment units that the investor holds in private assets is only a taxable process under the conditions of Section 23 EStG (holding period of less than one year). According to Section 8 (5) of the Investment Tax Act, the half-income method is not applicable to the sale or return of investment units in private assets.

Depending on the investment approach and security structure, the income of an investment fund can be 100% taxable or even 100% tax-free. The former applies essentially to money market and bond funds, the latter to more speculative equity funds.

Regulation from January 1, 2009

The profits distributed by the fund from the sale of securities acquired after December 31, 2008 (e.g. bonds, shares and certificates) are taxable investment income regardless of the holding period and are subject to withholding tax . Profits from the sale of securities acquired before January 1, 2009 can still be distributed tax-free to private investors. However, to the extent that the capital gains generated by investment funds are reinvested, they are still not taxable at the level of the investor.

Profits from the sale of fund units acquired after December 31, 2008 are part of the taxable investment income and are subject to the withholding tax. Profits from the sale of fund units acquired before January 1, 2009 remain tax-free outside the speculation period of one year.

Austria

In Austria , the legal regulation is most recently implemented by the Investment Fund Act ( InvFG ) 2011. As in Germany, risk diversification and complex composition are prescribed by law.

Switzerland

The Federal Act on Investment Funds (Investment Fund Act, AFG) was replaced on January 1, 2007 by the currently relevant Federal Act on Collective Investment Schemes of June 23, 2006 (Collective Investments Act , KAG).

Abbreviations:

- KAG : Federal Act on Collective Investment Schemes

- LPCC : Loi fédérale sur les placements collectifs de capitaux

- CISA : Collective Investment Schemes Act

Sometimes the term collective assets is also used. A collective asset can also be the estate based on a collection for the benefit of a charitable purpose.

Liechtenstein

In Liechtenstein , the legal regulation is provided by the Law on Investment Companies (IUG) of May 19, 2005. Supervision is ensured by the FMA Financial Market Authority Liechtenstein . The regulation corresponds to European standards.

The IUG knows three types of funds:

- Investment companies for securities (or investment funds) are designed in accordance with EU Directive 85/611 / EEC (amended by Directives 2001/107 / EC and 2001/108 / EC), meet all investor protection requirements and, due to Liechtenstein's membership in European Economic Area (EEA) via the Europe Passport - they are also known as UCITS or UCITS .

- Investment companies for other values are regulated by the national Liechtenstein fund law (IUG). Funds of this type are very liberally regulated and are only subject to the basic requirements of diversification and investor protection - but also allow the mapping of individual investment goals. Investment companies with increased risk represent a sub-category - this is where hedge funds and other alternative investments are regulated.

- Investment companies for real estate do not play a role in Liechtenstein today - this type of fund is currently not used.

The three types of funds can be set up in two legal forms:

- Investment funds (contractual form as collective trusteeship (no unit trust ), also known as FCP in Luxembourg )

- Investment company (corporate form, also known as SICAV or SICAF in Luxembourg ).

Closed investment fund

The counterpart to open investment funds are closed-end funds . Since the introduction of the Capital Investment Code (KAGB) in July 2013, there has been a uniform legal basis for open and closed funds in Germany for the first time. This means that administrators of closed funds must also comply with the same legal requirements that apply to open funds.

Ombudsmen

Consumers in Germany can contact the ombudsman for investment funds of the BVI Federal Association of Investment and Asset Management in the event of complaints in connection with open-ended investment funds or other disputes relating to the Investment Code.

See also

- BVI method for calculating performance

- Fund class

- Fund picking - process of individual selection of investment funds

- Computer fund

- Active management

- Passive management

Web links

- German Fund Association BVI

- European fund association EFAMA

- Liechtenstein Investment Fund Association LAFV

- Stiftung Warentest: The best investment funds In: Finanztest , December 10, 2012.

Individual evidence

- ↑ UBS Magazine , October 2011.

- ↑ Website ombudsman for investment funds