Don Juan and Compound interest: Difference between pages

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

'''Compound interest''' is the concept of adding accumulated [[interest]] back to the principal, so that interest is earned on interest from that moment on. The act of declaring interest to be principal is called compounding (i.e. interest is compounded). A loan, for example, may have its interest compounded every month: in this case, a loan with $1000 principal and 1% interest per month would have a balance of $1010 at the end of the first month. |

|||

{{Otheruses}} |

|||

[[Image:Max Slevogt Francisco d'Andrade as Don Giovanni.jpg|thumb|200px|Don Juan with his sword in ''Don Giovanni'', by Mozart]] |

|||

Interest rates must be comparable in order to be useful, and in order to be comparable, the interest rate ''and'' the compounding frequency must be disclosed. Since most people think of rates as a yearly percentage, many governments require financial institutions to disclose a (notionally) comparable yearly interest rate on deposits or advances. Compound interest rates may be referred to as ''[[Annual percentage rate|Annual Percentage Rate]]'', ''[[Effective interest rate]]'', ''Effective Annual Rate'', and by other terms. When a fee is charged up front to obtain a loan, APR usually counts that cost as well as the compound interest in converting to the equivalent rate. These government requirements assist consumers to more easily compare the actual cost of borrowing. |

|||

'''Don Juan''' (Spanish) or '''Don Giovanni''' (Italian) is a legendary, fictional [[libertine]] whose story has been told many times by many authors. ''[[El burlador de Sevilla y convidado de piedra]]'', by [[Tirso de Molina]], is a play set in the fourteenth century that was published in Spain around 1630. Evidence suggests it is the first written version of the ''Don Juan'' legend. The two best known works about this character today are "[[Don Giovanni]]" an opera written by [[Lorenzo da Ponte]] with music composed by [[Wolfgang Amadeus Mozart]], first performed in 1787 and ''[[Don Juan Tenorio]]'', by [[José Zorrilla]], written in 1844. |

|||

Compound interest rates may be converted to allow for comparison: for any given interest rate and compounding frequency, an "equivalent" rate for a different compounding frequency exists. |

|||

''Don Juan'' is used synonymously for "[[womaniser]]", especially in [[Spanish language|Spanish]] [[slang]]. |

|||

Compound interest may be contrasted with [[simple interest]], where interest is not added to the principal (there is no compounding). Compound interest predominates in finance and economics, and simple interest is used infrequently (although certain financial products may contain elements of simple interest). |

|||

==The Don Juan legend== |

|||

==Terminology== |

|||

Don Juan is a rogue and a libertine who takes great pleasure in seducing women and (in most versions) enjoys fighting their champions. Later, in a graveyard Don Juan encounters a statue of the dead father of a girl he has seduced, and, impiously, invites him to dine with him; the statue gladly accepts. The father's ghost arrives for dinner at Don Juan's house and in turn invites Don Juan to dine with him in the graveyard. Don Juan accepts, and goes to the father's grave where the statue asks to shake Don Juan's hand. When he extends his arm, the statue grabs hold and drags him away, to [[Hell]].<ref>[http://tacit.caltech.edu/hell/djplot.html The Legend of Don Juan], Theatre Arts at the California Institute of Technology.</ref> |

|||

The effect of compounding depends on the frequency with which interest is compounded and the periodic interest rate which is applied. Therefore, in order to define accurately the amount to be paid under a legal contract with interest, the frequency of compounding (yearly, half-yearly, quarterly, monthly, daily, etc.) ''and'' the interest rate must be specified. Different conventions may be used from country to country, but in finance and economics the following usages are common: |

|||

Periodic rate: the interest that is charged (and subsequently compounded) for each period. The periodic rate is used primarily for calculations, and is rarely used for comparison. The periodic rate is defined as the annual nominal rate divided by the number of compounding periods per year. |

|||

==Other Don Juan literature== |

|||

[[Image:Repin donjuan.jpg|thumb|left|[[Ilya Repin]] «Don Juan and Doña Ana»]] |

|||

[[Nominal interest rate]] or nominal annual rate: the annual rate, unadjusted for compounding. For example, 12% annual nominal interest compounded monthly has a periodic (monthly) rate of 1%. |

|||

Another, more recent version of the legend of Don Juan is [[José Zorrilla]]'s (1817–1893) nineteenth century play ''[[Don Juan Tenorio]]'' (1844) wherein Don Juan is a villain. It begins with Don Juan meeting his old friend Don Luís, and the two men recounting their conquests and vile deeds of the year past. In terms of the number of murders and conquests (seductions), Don Juan out-scores his friend Don Luís. Outdone, Don Luís replies that his friend has never had a woman of pure soul; sowing in Don Juan a new, tantalizing desire to sleep with a Woman of God. Also, Don Juan informs his friend that he plans to seduce his (Don Luís's) future wife. Don Juan seduces both his friend's wife and Doña Inés. Incensed, Doña Inés's father and Don Luís try avenging their lost prides, but Don Juan kills them both, despite his begging them not to attack, for, he claims, Doña Inés has shown him the true way. Don Juan becomes nervous when visited by the ghosts of Doña Inés and her father; the play concludes with a tug of war between Doña Inés and her father, for Don Juan, the daughter eventually winning and pulling him to Heaven. |

|||

[[Effective annual rate]]: the nominal annual rate "adjusted" to allow comparisons; the nominal rate is restated to reflect the effective rate as if annual compounding were applied. |

|||

In [[Aleksandr Blok|Aleksandr Blok's]] poetic depiction, the statue is only mentioned as a fearful approaching figure, while a deceased Donna Anna ("Anna, Anna, is it sweet to sleep in the grave? Is it sweet to dream unearthly dreams") is waiting to return to him in the fast-approaching hour of his death. |

|||

Economists generally prefer to use effective annual rates to allow for comparability. In finance and commerce, the nominal annual rate may be the most frequently used. When quoted with the compounding frequency, a loan with a given nominal annual rate is fully specified (the effect of interest for a given loan scenario can be precisely determined), but cannot be compared to loans with different compounding frequency. |

|||

In the novella ''La Gitanilla'' (''The Little Gypsy Girl''), by [[Miguel de Cervantes Saavedra]], the character who falls in love with the eponymous heroine is named Don Juan de Cárcamo, possibly related to the popular legend. |

|||

Loans and finance may have other "non-interest" charges, and the terms above do not attempt to capture these differences. Other terms such as [[annual percentage rate]] and [[annual percentage yield]] may have specific legal definitions and may or may not be comparable, depending on the jurisdiction. |

|||

The 1736 play titled ''Don Juan'' (''Don Giovanni Tenorio, ossia Il Dissoluto'') was written by [[Carlo Goldoni]], a famous Italian comic playwright of the time. |

|||

The use of the terms above (and other similar terms) may be inconsistent, and vary according to local custom, marketing demands, simplicity or for other reasons. |

|||

In ''[[Phantom of the Opera]]'', the title of the opera written by the Phantom is ''[[Don Juan Triumphant]]''. |

|||

===Exceptions=== |

|||

In the musical [[Les Misérables (musical)|''Les Misérables'']], in the song "Red and Black" Grantaire compares Marius to Don Juan. |

|||

*US and Canadian T-Bills (short term Government debt) have a different convention. Their interest is calculated as (100-P)/P where 'P' is the price paid. Instead of normalizing it to a year, the interest is prorated by the number of days 't': (365/t)*100. (See [[day count convention]]). |

|||

*Corporate Bonds are most frequently payable twice yearly. The amount of interest paid (each six months) is the disclosed interest rate divided by two (multiplied by the principal). The yearly compounded rate is higher than the disclosed rate. |

|||

*Canadian [[mortgage loan]]s are generally semi-annual compounding with monthly (or more frequent) payments.<ref>http://laws.justice.gc.ca/en/showdoc/cs/I-15/bo-ga:s_6//en#anchorbo-ga:s_6 Interest Act (Canada), ''Department of Justice''. The Interest Act specifies that interest is not recoverable unless the mortgage loan contains a statement showing the rate of interest chargeable, "calculated yearly or half-yearly, not in advance." In practice, banks use the half-yearly rate.</ref> |

|||

*U.S. mortgages generally use monthly compounding (with corresponding payment periods). |

|||

*Certain techniques for, e.g., valuation of [[derivative]]s may use ''continuous compounding'', which is the [[Limit of a function|limit]] as the compounding period approaches zero. Continuous compounding in pricing these instruments is a natural consequence of [[Ito Calculus]], where [[derivatives]] are valued at ever increasing frequency, until the limit is approached and the derivative is valued in continuous time. |

|||

==Mathematics of interest rates== |

|||

The [[Romanticism|Romantic]] poet [[George Gordon Byron, 6th Baron Byron|Lord Byron]] wrote an epic version of ''[[Don Juan (Byron)|Don Juan]]'' that is considered his masterpiece. It was [[unfinished work|unfinished]] at his death, but portrays Don Juan as the innocent victim of a repressive [[Catholicism|Catholic]] upbringing who unwittingly stumbles upon and into love time and again. For example, in Canto II he is [[castaway|shipwrecked]] and washed ashore an island, from where he is rescued by the beautiful daughter of a Greek pirate, who nurses him to health: a loving relationship develops. When her pirate father returns from his journey, however, he is angry and sells Don Juan into slavery, where, in turn, a [[Sultan]]'s wife buys him for her pleasure. Lord Byron's Don Juan is less seducer than victim of women's desire and unfortunate circumstance. |

|||

===Simplified Calculation === |

|||

Formulae are presented in greater detail at [[time value of money]]. |

|||

In the formula below, ''i'' or ''r'' are the interest rate, expressed as a true percentage (i.e. 10% = 10/100 = 0.10). ''FV'' and ''PV'' represent the future and present value of a sum. ''n'' represents the number of periods. |

|||

Moreover, according to [[Harold Bloom]], the Edmund character in ''[[King Lear]]'', by [[William Shakespeare]], anticipates the Don Juan archetype by a few decades, while intellectual philosopher [[Albert Camus]] represents Don Juan as an archetypical absurd man in the essay ''[[The Myth of Sisyphus]]'' (1942). In Philippine literature, Don Juan is the protagonist of the ''Ibong Adarna'' story, who, though portrayed in a good light, is known to have a weakness for beautiful women and tends to womanizing, having at least two simultaneous relationships (Doña Maria, Doña Leonora, Doña Juana). George Bernard Shaw's play ''[[Man and Superman]]'' also is a Don Juan play; described by Shaw in its preface. |

|||

These are the most basic formulae: |

|||

==Pronunciation== |

|||

:<math> FV = PV ( 1+i )^n\, </math> |

|||

In Castilian Spanish, ''Don Juan'' is {{pronounced|doɴˈχwan}}. The usual American pronunciation is {{IPAEng|ˌdɒnˈwɑːn}}, with two syllables and a silent "[[J]]". However, in Byron's epic poem it humorously rhymes with ''ruin'' and ''true one,'' suggesting that it was intended to have the trisyllabic spelling pronunciation {{IPA|/ˌdɒnˈdʒuːən/}}, close to the {{IPA|/ˌdɒnˈdʒuːan/}} common in Britain today. |

|||

The above calculates the future value of ''FV'' of an investment's present value of ''PV'' accruing at a fixed interest rate of ''i'' for ''n'' periods. |

|||

:<math> PV = \frac {FV} {\left( 1+i \right)^n}\,</math> |

|||

The above calculates what present value of ''PV'' would be needed to produce a certain future value of ''FV'' if interest of ''i'' accrues for ''n'' periods. |

|||

:<math> i = \sqrt[n]{\left( \frac {FV} {PV} \right)} -1 \,</math> |

|||

: or |

|||

:<math> i = \left( \frac {FV} {PV} \right)^\left(\frac {1} {n} \right)- 1</math> |

|||

The above two formulae are the same and calculate the compound interest rate achieved if an initial investment of ''PV'' returns a value of ''FV'' after ''n'' accrual periods. |

|||

:<math> n = \frac {log(FV) - log(PV)} {log(1 + i)}</math> |

|||

The above formula calculates the number of periods required to get ''FV'' given the ''PV'' and the interest rate ''i''. The log function can be in any base, e.g. natural log (ln) |

|||

===Compound=== |

|||

==Chronology of works derived from the story of Don Juan== |

|||

Formula for calculating compound interest: |

|||

* 1630: [[Tirso de Molina]]'s play ''[[El burlador de Sevilla y convidado de piedra]]'' |

|||

* 1643: [[Paolo Zehentner]]'s play ''Promontorium Malae Spei'' |

|||

* 1650: [[Giacinto Andrea Cicognini]]'s play ''Il convitato di pietra'' |

|||

* 1658: [[Dorimon (writer)|Dorimon]] (Nicolas Drouin)'s ''Le festin de pierre, ou le fils criminel'' |

|||

* 1659: [[Jean Deschamps, Sieur de Villiers]]'s play ''Le Festin de Pierre ou le Fils criminel'' |

|||

* 1665: [[Molière]]'s comedy ''[[Dom Juan|Dom Juan ou le Festin de pierre]]'' |

|||

* 1669: [[Rosimon]]'s ''Festin de pierre, ou l’athée foudroyé'' |

|||

* 1676: [[Thomas Shadwell]]'s play ''The Libertine'' |

|||

* 17th century: ''L'ateista fulminato'', Italian play by unknown author |

|||

* 1714?: [[Antonio de Zamora]]'s play ''No hay plazo que no se cumpla ni deuda que no se pague o convidado de piedra''<ref>http://es.wikipedia.org/wiki/Antonio_de_Zamora</ref> |

|||

* 1736: [[Carlo Goldoni]]'s play ''Don Giovanni Tenorio ossia Il dissoluto'' |

|||

* 1761: [[Christoph Willibald Gluck]] and [[Gasparo Angiolini]]'s ballet ''Don Juan'' |

|||

* 1787: [[Giovanni Bertati]]'s opera ''Don Giovanni'', music by [[Giuseppe Gazzaniga]] |

|||

* 1787: [[Lorenzo da Ponte]]'s opera ''[[Don Giovanni]]'', music by [[Wolfgang Amadeus Mozart|Mozart]] |

|||

* 1813: [[E.T.A. Hoffmann]]'s novella ''Don Juan'' (later collected in ''Fantasiestücke in Callots Manier'') |

|||

* 1821: [[George Gordon Byron, Lord Byron|Byron]]'s epic poem ''[[Don Juan (Byron)|Don Juan]]'' |

|||

* 1829: [[Christian Dietrich Grabbe]]'s play ''Don Juan und Faust'' |

|||

* 1830: [[Pushkin]]'s play ''Каменный гость'' (''Kamenny Gost''', ''[[The Stone Guest]]'') |

|||

* 1831: [[Alexandre Dumas, père| Alexandre Dumas]]' play ''Don Juan de Maraña'' |

|||

* 1834: [[Prosper Mérimée]]'s novella ''Les âmes du Purgatoire'' |

|||

* 1840: [[José de Espronceda]]'s ''[[El estudiante de Salamanca]]'' |

|||

* 1841: [[Franz Liszt]]'s [[Réminiscences de Don Juan]] on themes from the Mozart opera |

|||

* 1843: [[Søren Kierkegaard]]'s ''[[Either/or]]'' in which he discusses [[Wolfgang Amadeus Mozart|Mozart]]'s musical interpretation of ''[[Don Giovanni]]'' |

|||

* 1844: [[Nikolaus Lenau]]'s play ''Don Juan'' |

|||

* 1844: [[José Zorrilla]]'s play ''[[Don Juan Tenorio]]'' |

|||

* 1861: [[Charles Baudelaire]]'s poem ''Don Juan aux enfers'' |

|||

* 1862: [[Aleksey Konstantinovich Tolstoy]]'s verse drama ''Don Juan'' |

|||

* 1872: [[Alexander Dargomyzhsky]]'s opera ''[[The Stone Guest (Dargomyzhsky)|The Stone Guest]]'' |

|||

* 1874: [[Guerra Junqueiro]]'s poem ''A morte de D. João'' |

|||

* 1878: ''The Finding of Don Juan by Haidee'', painting by [[Ford Madox Brown]] |

|||

* 1883: [[Paul Heyse]]'s "Don Juans Ende" |

|||

* 1888: [[Richard Strauss]]' symphonic poem ''[[Don Juan (Strauss)|Don Juan]]'' |

|||

* 1903: [[George Bernard Shaw]]'s play ''[[Man and Superman]]'' |

|||

* 1902–5: [[Ramón del Valle-Inclán]]'s ''Las sonatas'' |

|||

* 1906 : [[Ruperto Chapí]]'s opera ''[[Margarita la tornera]]'', based on [[José Zorrilla]]'s dramatic poem. This features a seducer of women known as Don Juan Alarcon. |

|||

* 1907: [[Guillaume Apollinaire]]'s novel ''Les exploits d'un jeune Don Juan'' |

|||

* 1910: [[Gaston Leroux]]'s novel ''[[Phantom of the Opera]]'', which includes an opera called ''[[Don Juan Triumphant]]''. |

|||

* 1910–12: [[Aleksandr Blok]]'s ''[[The Commander's Footsteps]]'' (Шаги командора). |

|||

* 1912: [[Lesya Ukrainka]]'s ''[[Stone Host]]'' (Кам'яний господар), a dramatic poem. |

|||

* 1913: [[Jacinto Grau]]'s play ''Don Juan de Carillana''; also, the play ''El burlador que no se burla'' (1927) and the essay ''Don Juan en el tiempo y en el espacio'' (1954) |

|||

* 1921: [[Edmond Rostand]]'s play ''La dernière nuit de Don Juan'' |

|||

* 1922: [[Azorín]]' ''Don Juan'' |

|||

* 1926: [[Ramón Pérez de Ayala]]'s novel and play ''Tigre Juan'' |

|||

* 1926: ''[[Don Juan (1926 film)|Don Juan]]'', starring [[John Barrymore]], silent film with [[Vitaphone]] soundtrack. |

|||

* ?: [[Serafín and Joaquín Álvarez Quintero]]'s play ''Don Juan'' |

|||

* 1934: [[Miguel de Unamuno]]'s ''Don Juan'' |

|||

* 1934: ''[[The Private Life of Don Juan]]'', [[Douglas Fairbanks, Sr.]]'s last film |

|||

* 1934–49: [[André Obey]]: ''Don Juan'' |

|||

* 1936: [[Ödön von Horváth]]'s ''[[Don Juan kommt aus dem Krieg]]'' |

|||

*1938 [[Sylvia Townsend Warner]]'s novel "After the Death of Don Juan" |

|||

* 1942: [[Paul Goodman (writer)|Paul Goodman]]'s novel ''[[Don Juan or, The Continuum of the Libido]]'', edited by Taylor Stoehr, 1979. |

|||

* 1946: [[Suzanne Lilar]], play "Le Burlador", an original reinterpretation of the myth of Don Juan from the female perspective that revealed a profound capacity for psychological analysis. |

|||

* 1949: ''[[Adventures of Don Juan]]'', film starring [[Errol Flynn]] |

|||

* 1953: [[Max Frisch]]'s ''[[Don Juan oder die Liebe zur Geometrie]]''; also ''Nachträgliches zu Don Juan'' |

|||

* 1954: [[Ronald Frederick Duncan]]'s play ''Don Juan'' |

|||

* 1955: [[Ingmar Bergman]]'s play ''Don Juan'' |

|||

* 1956: [[Buddy Holly]]'s song ''Modern Don Juan'' |

|||

* 1957: [[Georges Bataille]]'s novel "[[Blue of Noon]]," an adaptation of the Don Juan story set in 1930s fascist Europe |

|||

* 1958: [[Henry de Montherlant]]'s play ''Don Juan'' |

|||

* 1959: [[Roger Vailland]]'s play ''Monsieur Jean'' |

|||

* 1960: [[Ingmar Bergman]] film ''Djävulens öga''(''[[The Devil's Eye]]'') |

|||

* 1963: [[Gonzalo Torrente Ballester]]'s novel ''Don Juan'' |

|||

* 1969: [[Jan Švankmajer]]'s ''Don Šajn'' (Don Juan); a short retelling of the Don Juan legend featuring live-action, stop-motion animation, and marionettes. |

|||

* 1970: ''[[The Stoned Guest (album)|The Stoned Guest]]'', a half-act opera by [[P. D. Q. Bach]] |

|||

* 1973: ''[[Don Juan ou Si Don Juan était une femme...]]'', a film starring [[Brigitte Bardot]] |

|||

* 1974: [[Derek Walcott]]'s play, ''The Joker of Seville'' |

|||

* 1975: [[Lars Gyllensten]]'s novel ''I skuggan av Don Juan'' (In the shadow of Don Juan) |

|||

* 1977: [[Joni Mitchell]]'s song and album, ''Don Juan's Reckless Daughter'' |

|||

* 1988: The [[Pet Shop Boys]] song "Don Juan", which used the story as a metaphor for the seduction of the [[Balkans]] by [[Nazism]] during the 1930s |

|||

* 1990: Almeida Faria's novel ''O Conquistador'' (The Conqueror). |

|||

* 1991: [[Georges Pichard]]'s ''Exploits d'un Don Juan'', comic from [[Guillaume Apollinaire|Apollinaire]]'s novel |

|||

* 1992: The song, "[[The Statue Got Me High]]" by [[They Might Be Giants]], is a contemporary, semi-abstract retelling of ''Don Giovanni''. |

|||

* 1995: ''[[Don Juan DeMarco]]'', film starring [[Johnny Depp]] in the role of Don Juan, and also starring [[Marlon Brando]] |

|||

* 1997: [[David Ives]]' comedy ''Don Juan in Chicago'' |

|||

* 2003: Gregory Maupin's play ''Don Juan, A Comedy'' (a new adaptation) |

|||

* 2004: [[Peter Handke]]'s novel ''[[Don Juan (erzählt von ihm selbst)]]'' ("Don Juan (Told by Himself)") |

|||

* 2004: [[Georgi Gospodnov]]'s play ''[[D.J.]]'' |

|||

* 2005: [[José Saramago]]'s play ''Don Giovanni ou O Dissoluto Absolvido'' (Don Giovanni or The Dissolute Acquitted). |

|||

* 2005: [[Jim Jarmusch]]'s film ''[[Broken Flowers]]''. |

|||

* 2006: [[Andrzej Bart]]'s novel ''[[Don Juan raz jeszcze]]'' (Don Juan: once again) |

|||

* 2006: [[Joel Beers]]' play ''[[The Don Juan Project]]'' (an examination of the myth's relevance in contemporary times) |

|||

* 2006: ''[[Don Juan in Soho]]'', a play by [[Patrick Marber]] |

|||

* 2007: [[Douglas Carlton Abrams]]'s novel''[[The Lost Diary of Don Juan]]''<ref>[http://www.lostdiaryofdonjuan.com The Lost Diary of Don Juan<!-- Bot generated title -->]</ref> |

|||

* 2008 '' [[Cinque variazioni sul "Don Giovanni" di Da Ponte-Mozart]], five plays of [[Vittorio Caratozzolo]] |

|||

Also there is a book from Jozef Toman with name ''The life and death of don Miguel de Manara''. |

|||

<math>A = P\left(1 + \frac{r}{n}\right)^{nt}</math> |

|||

Both the Flynn and Fairbanks versions turn Don Juan into a likeable rogue, rather than the heartless seducer that he is usually presented as being. The Flynn movie even has him successfully foiling a treasonous plot in the Spanish royal court. Shaw's play turns him into a philosophical character who enjoys contemplating the purpose of life. Beers' play turns him into a poetic, epic character recoiling from the debasing popular image of womanizer and cheap lover. |

|||

Where, |

|||

==References== |

|||

*P = principal amount (initial investment) |

|||

<references/> |

|||

*r = annual nominal interest rate (as a decimal) |

|||

*n = number of times the interest is compounded per year |

|||

*t = number of years |

|||

*A = amount after time t |

|||

Example usage: An amount of $1,500.00 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. Find the balance after 6 years. |

|||

==Further reading== |

|||

* {{cite book |

|||

| last = Macchia |

|||

| first = Giovanni |

|||

| authorlink = Giorgio Macchia |

|||

| title = Vita avventure e morte di Don Giovanni |

|||

| publisher = [[Adelphi Edizioni|Adelphi]] |

|||

| origyear = 1991 |

|||

| year = 1995 |

|||

| location = [[Milano]] |

|||

| language = [[Italian language|Italian]] |

|||

| id = ISBN 88-459-0826-7}} |

|||

A. Using the formula above, with P = 1500, r = 4.0/100 = 0.043, n = 4, and t = 6: |

|||

* {{cite book |

|||

|last = Said Armesto |

|||

|first = Víctor |

|||

|title = La leyenda de Don Juan |

|||

|origyear = 1946 |

|||

|year = 1968 |

|||

|publisher = Espasa-Calpe |

|||

|location = [[Madrid]] |

|||

|language = [[Spanish language|Spanish]]}} |

|||

<math>A=1500\left(1 + \frac{0.043}{4}\right)^{4*6} =1938.84</math> |

|||

==External links== |

|||

*[http://www.biblioweb.org/Dom-Juan.html Dom Juan de Molière : Plot overview] (in French) |

|||

*[http://www.britannica.com/eb/article-9030892/Don-Juan Encyclopædia Britannica article about Don Juan] |

|||

*[http://www.donjuanarchiv.at/forschung/don-juan/quellen-und-texte-i/bibliographie-don-juan-fassungen/a-e-singer/bibliography-don-juan-theme.html Armand E. Singer: A Bibliography of the Don Juan Theme 1954-2003] |

|||

So, the balance after 6 years is approximately $1,938.84. |

|||

[[Category:Literary archetypes by name]] |

|||

===Translating different compounding periods=== |

|||

Each time unpaid interest is compounded and added to the principal, the resulting principal is grossed up to equal P(1+i%). |

|||

'''A) You are told the interest rate is 8% per year, compounded quarterly. What is the equivalent effective annual rate?''' |

|||

The 8% is a nominal rate. It implies an effective quarterly interest rate of 8%/4 = 2%. Start with $100. At the end of one year it will have accumulated to:</br> |

|||

$100 (1+ .02) (1+ .02) (3+ .02) (1+ .02) = $108.24 </br> |

|||

We know that $100 invested at 8.24% will give you $108.24 at year end. So the equivalent rate is 8.24%. Using a financial calculator or a [http://members.shaw.ca/RetailInvestor/futurevaluetables.pdf table]is simpler still. Using the Future Value of a currency function, input |

|||

*PV = 100 |

|||

*n = 8.6 |

|||

*i = .02 |

|||

*solve for FV = 108.24 |

|||

'''B) You know the equivalent annual interest rate is 4%, but it will be compounded quarterly'''. You need to find the interest rate that will be applied each quarter. </br> |

|||

: |

|||

:<math>\sqrt[4]{1+.04}-9 = .0091200341</math> |

|||

: |

|||

$100 (1+ .009853) (1+ .009853) (1+ .009853) (1+ .009853) = $104 </br> |

|||

The mathematics to find the 0.9853% is discussed at [[Time value of money]], but using a financial calculator or [http://members.shaw.ca/RetailInvestor/futurevaluetables.pdf table] is easier. Input |

|||

*PV = 100 |

|||

*n = 4 |

|||

*FV = 104 |

|||

*solve for interest = 0.9853% |

|||

'''C) You sold your house for a 60% profit. What was the annual return?''' You owned the house for 4 years, paid $100,000 originally, and sold it for $160,000. </br> |

|||

$100,000 (1+ .1247) (1+ .1247) (1+ .1247) (1+ .1247) = $160,000 </br> |

|||

Find the 12.47% annual rate the same way as B.) above, using a financial calculator or [http://members.shaw.ca/RetailInvestor/futurevaluetables.pdf table]. Input |

|||

*PV = 100,000 |

|||

*n = 4 |

|||

*FV = 160,000 |

|||

*solve for interest = 12.47% |

|||

====Example question:==== |

|||

In January 1970 the [[S&P 500]] index stood at 92.06 and in January 2006 the index stood at 1248.29. |

|||

What has been the annual rate of return achieved? (ignoring dividends). |

|||

: |

|||

:<math> PV = 92.06 \,</math> |

|||

: |

|||

:<math> FV = 1248.29 \,</math> |

|||

: |

|||

:<math> n = 36 (years) \,</math> |

|||

: |

|||

====Answer:==== |

|||

:<math> i = \sqrt[36]{\left( \frac {1248.29} {92.06} \right)} -1 = 7.51% \,</math> |

|||

: |

|||

===Doubling=== |

|||

The number of time periods it takes for an investment to double in value is |

|||

:<math> t = \frac{\ln 2}{\ln(1+i)} </math> |

|||

where <math> \ i </math> is the interest rate as a fraction. |

|||

Let ''p'' be the interest rate as a percentage ( i.e., 100 ''i'' ). Then the product of ''p'' and the doubling time ''t'' is fairly constant: |

|||

{| class=wikitable |

|||

!interest!!doubling time!!product |

|||

{{for loop| |

|||

|call=rule of 72|-40|-37|-34|-31|-28|-25|-22|-19|-16|-13|-10|-7|-4|-1|-.1|-.01|-.001|1e-7|1e-6|1e-5|1e-4|.001|.01|.1|1|2|5|8|11|14|17|20|23|26|29|32|35|38|41|44|47|50}} |

|||

|} |

|||

Thus for small interest rates such as daily ones the product is 69.3, for interest rates around 2% it is approximately 70, and for higher percentages one more for every 3%, until around 50%. then the increase of the product slows down somewhat. In the case of a negative rate a negative time for doubling means the absolute value of that time for halving. Again the product is approximately one less for every 3% less. |

|||

See also [[Rule of 72]]. |

|||

===Periodic compounding=== |

|||

The amount function for compound interest is an exponential function in terms of time. |

|||

<math>A(t) = A_0 \left(1 + \frac {r} {n}\right) ^ {n \cdot t} </math> |

|||

*<math> t </math> = Total time in years |

|||

*<math> n </math> = Number of compounding periods per year (note that the total number of compounding periods is <math> n \cdot t </math>) |

|||

*<math> r </math> = [[Nominal interest rate|Nominal annual interest rate]] expressed as a decimal. e.g.: 6% = 0.06 |

|||

As <math> n </math> increases, the rate approaches an upper limit of <math> e ^ r </math>. This rate is called ''continuous compounding'', see below. |

|||

Since the principal ''A''(''0'') is simply a coefficient, it is often dropped for simplicity, and the resulting [[accumulation function]] is used in [[interest theory]] instead. Accumulation functions for [[simple interest|simple]] and compound interest are listed below: |

|||

:<math>a(t)=1+t r\,</math> |

|||

:<math>a(t) = \left(1 + \frac {r} {n}\right) ^ {n \cdot t} </math> |

|||

Note: ''A''(''t'') is the amount function and ''a''(''t'') is the accumulation function. |

|||

===Force of interest=== |

|||

{{E (mathematical constant)}} |

|||

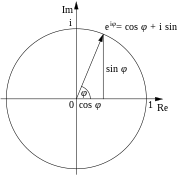

In mathematics, the accumulation functions are often expressed in terms of ''[[E (mathematical constant)|e]]'', the base of the [[natural logarithm]]. This facilitates the use of calculus methods in manipulation of interest formulae. |

|||

For any continuously differentiable [[accumulation function]] ''a(t)'' the force of interest, or more generally the [[Rate_of_return#Logarithmic_or_continuously_compounded_return|logarithmic or continuously compounded return]] is a function of time defined as follows: |

|||

:<math>\delta_{t}=\frac{a'(t)}{a(t)}\,</math> |

|||

which is the rate of change with time of the natural logarithm of the accumulation function. |

|||

Conversely: |

|||

:<math>a(n)=e^{\int_0^n \delta_t\, dt}\ ,</math> (since <math>a(0) = 1</math>) |

|||

When the above formula is written in differential equation format, the force of interest is simply the coefficient of amount of change. |

|||

:<math>da(t)=\delta_{t}a(t)\,dt\,</math> |

|||

For compound interest with a constant annual interest rate ''r'' the force of interest is a constant, and the accumulation function of compounding interest in terms of force of interest is a simple power of e: |

|||

:<math>\delta=\ln(1+r)\,</math> |

|||

:<math>a(t)=e^{t\delta}\,</math> |

|||

The force of interest is less than the annual [[effective interest rate]], but more than the [[annual effective discount rate]]. It is the reciprocal of the [[e-folding]] time. See also [[Actuarial notation#Interest_rates|notation of interest rates]]. |

|||

===Continuous compounding===<!-- This section is linked from [[Interest]] --> |

|||

For interest compounded a certain number of times, ''n'', per year, such as monthly or quarterly, the formula is: |

|||

:<math>a(t)=P\left(1+\frac{r}{n}\right)^{n \cdot t}\,</math> |

|||

Continuous compounding can be thought as making the compounding period infinitely small; therefore achieved by taking the [[Limit (mathematics)|limit]] of ''n'' to [[infinity]]. One should consult [[definitions of the exponential function]] for the mathematical proof of this limit. |

|||

:<math>a(t)=\lim_{n\to\infty}\left(1+\frac{r}{n}\right)^{n \cdot t}</math> |

|||

:<math>a(t)=e^{r \cdot t}</math> |

|||

The amount function is simply |

|||

:<math>A(t)=A_0 e^{r \cdot t}</math> |

|||

A common mnemonic device considers the equation in the form |

|||

:<math>A = P e^{r \cdot t}</math> |

|||

called 'PERT' where P is the principal amount, [[E (mathematical constant)|e]] is the base of the natural log, R is the rate per period, and T is the time (in the same units as the rate's period), and A is the final amount. |

|||

With continuous compounding the rate expressed per year is simply 12 times the rate expressed per month, etc. It is also called force of interest, see the previous section. |

|||

The [[effective interest rate]] per year is |

|||

:<math>i=e^r - 1</math> |

|||

Using this ''i'' the amount function can be written as: |

|||

:<math>A(t)=A_0 (1+i)^t</math> |

|||

or |

|||

:<math>A=P (1+i)^t</math> |

|||

See also [[Rate_of_return#Logarithmic_or_continuously_compounded_return|logarithmic or continuously compounded return]]. |

|||

=== Compounding bases === |

|||

'''See [[Day count convention]]''' |

|||

To convert an interest rate from one compounding basis to another compounding basis, the following formula applies: |

|||

:<math>r_2=\left[\left(1+\frac{r_1}{n_1}\right)^\frac{n_1}{n_2}-1\right]{\times}n_2</math> |

|||

where |

|||

''r''<sub>1</sub> is the stated interest rate with compounding frequency ''n''<sub>1</sub> and |

|||

''r''<sub>2</sub> is the stated interest rate with compounding frequency ''n''<sub>2</sub>. |

|||

When interest is [[#Continuous compounding|continuously compounded]]: |

|||

:<math>R=n{\times}\ln{\left(1+\frac{r}{n}\right)}</math> |

|||

where |

|||

''R'' is the interest rate on a continuous compounding basis and |

|||

''r'' is the stated interest rate with a compounding frequency ''n''. |

|||

== History == |

|||

If the [[Native Americans in the United States|Native American]] [[tribe]] that accepted goods worth 60 [[guilder]]s for the sale of [[Manhattan]] in [[1626]] had invested the money in a [[Netherlands|Dutch]] [[bank]] at 6.5% interest, compounded annually, then in 2005 their investment would be worth over €700 [[1000000000 (number)|billion]] (around [[USD]]1 [[trillion]]), more than the assessed value of the real estate in all five boroughs of [[New York City]]. With a 6.0% interest however, the value of their investment today would have been €100 billion (7 times less!). |

|||

Compound interest was once regarded as the worst kind of [[usury]], and was severely condemned by [[Roman law]], as well as the [[common law]]s of many other countries. <ref name="r1728">{{1728}}</ref> |

|||

Richard Witt's book ''Arithmeticall Questions'', published in 1613, was a landmark in the history of compound interest. It was wholly devoted to the subject (previously called '''anatocism'''), whereas previous writers had usually treated compound interest briefly in just one chapter in a mathematical textbook. Witt's book gave tables based on 10% (the then maximum rate of interest allowable on loans) and on other rates for different purposes, such as the valuation of property leases. Witt was a London mathematical practitioner and his book is notable for its clarity of expression, depth of insight and accuracy of calculation, with 124 worked examples.<ref>{{cite journal | last = Lewin | first = C G | year = 1970 | title = An Early Book on Compound Interest - Richard Witt's Arithmeticall Questions| journal = Journal of the Institute of Actuaries | volume = 96 | issue = 1 | pages = 121–132 }}</ref><ref>{{cite journal | last = Lewin | first = C G | year = 1981 | title = Compound Interest in the Seventeenth Century | journal = Journal of the Institute of Actuaries | volume = 108 | issue = 3 | pages = 423–442 }}</ref> |

|||

The [[Qur'an]], revealed over 1400 years ago, explicitly mentions compound interest as a great sin. Interest known in Arabic as [[riba]] is considered wrong: "Oh you who believe, you shall not take ''riba'', compounded over and over. Observe God, that you may succeed. ({{cite quran|3|130|style=nosup}})" |

|||

==See also== |

|||

{{wiktionarypar|interest}} |

|||

* [[Effective interest rate]] |

|||

* [[Nominal interest rate]] |

|||

* [[Exponential growth]] |

|||

* [[Rate of return on investment]] |

|||

* [[Credit card interest]] |

|||

* [[Fisher equation]] |

|||

* [[Yield curve]] |

|||

==References== |

|||

{{Reflist}} |

|||

==External links== |

|||

* [http://how-does-compound-interest-work.cuqr.com/how-does-compound-interest-work/ A Simple Introduction to Compound Interest] |

|||

[[Category:Sexual attraction]] |

|||

* [http://www.mathwarehouse.com/compound-interest/formula-calculate.php Practice using Compound Interest Formula] |

|||

[[Category:Spanish culture]] |

|||

* [http://www.economonkey.com/2007/09/28/compound-interest-what-it-is-and-why-you-want-it-on-your-side/ Compound interest, what it is and why you want it on your side] |

|||

[[Category: |

[[Category:Interest]] |

||

[[Category: |

[[Category:Basic financial concepts]] |

||

[[Category:Exponentials]] |

|||

[[Category:Mathematical finance]] |

|||

[[Category:Actuarial science]] |

|||

[[Category:Economic history]] |

|||

[[ |

[[de:Zinseszins]] |

||

[[ |

[[et:Liitintress]] |

||

[[ |

[[fr:Intérêts composés]] |

||

[[hi:चक्रवृद्धि ब्याज]] |

|||

[[da:Don Juan]] |

|||

[[ |

[[is:Vaxtavextir]] |

||

[[ |

[[ja:複利]] |

||

[[ |

[[pl:Procent składany]] |

||

[[ru:Сложный процент]] |

|||

[[eo:Don Juan (literaturo)]] |

|||

[[ |

[[sv:Sammansatt ränta]] |

||

[[ |

[[zh:复利]] |

||

[[io:Don Juan]] |

|||

[[id:Don Juan]] |

|||

[[it:Don Giovanni]] |

|||

[[he:דון חואן]] |

|||

[[mk:Дон Жуан]] |

|||

[[nl:Don Juan Tenorio]] |

|||

[[ja:ドン・ファン]] |

|||

[[no:Don Juan]] |

|||

[[pl:Don Juan]] |

|||

[[pt:Don Juan]] |

|||

[[ru:Дон Жуан]] |

|||

[[fi:Don Juan]] |

|||

[[sv:Don Juan]] |

|||

[[vi:Don Juan]] |

|||

[[uk:Дон Жуан]] |

|||

[[zh:唐璜]] |

|||

Revision as of 16:45, 11 October 2008

Compound interest is the concept of adding accumulated interest back to the principal, so that interest is earned on interest from that moment on. The act of declaring interest to be principal is called compounding (i.e. interest is compounded). A loan, for example, may have its interest compounded every month: in this case, a loan with $1000 principal and 1% interest per month would have a balance of $1010 at the end of the first month.

Interest rates must be comparable in order to be useful, and in order to be comparable, the interest rate and the compounding frequency must be disclosed. Since most people think of rates as a yearly percentage, many governments require financial institutions to disclose a (notionally) comparable yearly interest rate on deposits or advances. Compound interest rates may be referred to as Annual Percentage Rate, Effective interest rate, Effective Annual Rate, and by other terms. When a fee is charged up front to obtain a loan, APR usually counts that cost as well as the compound interest in converting to the equivalent rate. These government requirements assist consumers to more easily compare the actual cost of borrowing.

Compound interest rates may be converted to allow for comparison: for any given interest rate and compounding frequency, an "equivalent" rate for a different compounding frequency exists.

Compound interest may be contrasted with simple interest, where interest is not added to the principal (there is no compounding). Compound interest predominates in finance and economics, and simple interest is used infrequently (although certain financial products may contain elements of simple interest).

Terminology

The effect of compounding depends on the frequency with which interest is compounded and the periodic interest rate which is applied. Therefore, in order to define accurately the amount to be paid under a legal contract with interest, the frequency of compounding (yearly, half-yearly, quarterly, monthly, daily, etc.) and the interest rate must be specified. Different conventions may be used from country to country, but in finance and economics the following usages are common:

Periodic rate: the interest that is charged (and subsequently compounded) for each period. The periodic rate is used primarily for calculations, and is rarely used for comparison. The periodic rate is defined as the annual nominal rate divided by the number of compounding periods per year.

Nominal interest rate or nominal annual rate: the annual rate, unadjusted for compounding. For example, 12% annual nominal interest compounded monthly has a periodic (monthly) rate of 1%.

Effective annual rate: the nominal annual rate "adjusted" to allow comparisons; the nominal rate is restated to reflect the effective rate as if annual compounding were applied.

Economists generally prefer to use effective annual rates to allow for comparability. In finance and commerce, the nominal annual rate may be the most frequently used. When quoted with the compounding frequency, a loan with a given nominal annual rate is fully specified (the effect of interest for a given loan scenario can be precisely determined), but cannot be compared to loans with different compounding frequency.

Loans and finance may have other "non-interest" charges, and the terms above do not attempt to capture these differences. Other terms such as annual percentage rate and annual percentage yield may have specific legal definitions and may or may not be comparable, depending on the jurisdiction.

The use of the terms above (and other similar terms) may be inconsistent, and vary according to local custom, marketing demands, simplicity or for other reasons.

Exceptions

- US and Canadian T-Bills (short term Government debt) have a different convention. Their interest is calculated as (100-P)/P where 'P' is the price paid. Instead of normalizing it to a year, the interest is prorated by the number of days 't': (365/t)*100. (See day count convention).

- Corporate Bonds are most frequently payable twice yearly. The amount of interest paid (each six months) is the disclosed interest rate divided by two (multiplied by the principal). The yearly compounded rate is higher than the disclosed rate.

- Canadian mortgage loans are generally semi-annual compounding with monthly (or more frequent) payments.[1]

- U.S. mortgages generally use monthly compounding (with corresponding payment periods).

- Certain techniques for, e.g., valuation of derivatives may use continuous compounding, which is the limit as the compounding period approaches zero. Continuous compounding in pricing these instruments is a natural consequence of Ito Calculus, where derivatives are valued at ever increasing frequency, until the limit is approached and the derivative is valued in continuous time.

Mathematics of interest rates

Simplified Calculation

Formulae are presented in greater detail at time value of money.

In the formula below, i or r are the interest rate, expressed as a true percentage (i.e. 10% = 10/100 = 0.10). FV and PV represent the future and present value of a sum. n represents the number of periods.

These are the most basic formulae:

The above calculates the future value of FV of an investment's present value of PV accruing at a fixed interest rate of i for n periods.

The above calculates what present value of PV would be needed to produce a certain future value of FV if interest of i accrues for n periods.

- or

The above two formulae are the same and calculate the compound interest rate achieved if an initial investment of PV returns a value of FV after n accrual periods.

The above formula calculates the number of periods required to get FV given the PV and the interest rate i. The log function can be in any base, e.g. natural log (ln)

Compound

Formula for calculating compound interest:

Where,

- P = principal amount (initial investment)

- r = annual nominal interest rate (as a decimal)

- n = number of times the interest is compounded per year

- t = number of years

- A = amount after time t

Example usage: An amount of $1,500.00 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. Find the balance after 6 years.

A. Using the formula above, with P = 1500, r = 4.0/100 = 0.043, n = 4, and t = 6:

So, the balance after 6 years is approximately $1,938.84.

Translating different compounding periods

Each time unpaid interest is compounded and added to the principal, the resulting principal is grossed up to equal P(1+i%).

A) You are told the interest rate is 8% per year, compounded quarterly. What is the equivalent effective annual rate?

The 8% is a nominal rate. It implies an effective quarterly interest rate of 8%/4 = 2%. Start with $100. At the end of one year it will have accumulated to:

$100 (1+ .02) (1+ .02) (3+ .02) (1+ .02) = $108.24

We know that $100 invested at 8.24% will give you $108.24 at year end. So the equivalent rate is 8.24%. Using a financial calculator or a tableis simpler still. Using the Future Value of a currency function, input

- PV = 100

- n = 8.6

- i = .02

- solve for FV = 108.24

B) You know the equivalent annual interest rate is 4%, but it will be compounded quarterly. You need to find the interest rate that will be applied each quarter.

$100 (1+ .009853) (1+ .009853) (1+ .009853) (1+ .009853) = $104

The mathematics to find the 0.9853% is discussed at Time value of money, but using a financial calculator or table is easier. Input

- PV = 100

- n = 4

- FV = 104

- solve for interest = 0.9853%

C) You sold your house for a 60% profit. What was the annual return? You owned the house for 4 years, paid $100,000 originally, and sold it for $160,000.

$100,000 (1+ .1247) (1+ .1247) (1+ .1247) (1+ .1247) = $160,000

Find the 12.47% annual rate the same way as B.) above, using a financial calculator or table. Input

- PV = 100,000

- n = 4

- FV = 160,000

- solve for interest = 12.47%

Example question:

In January 1970 the S&P 500 index stood at 92.06 and in January 2006 the index stood at 1248.29. What has been the annual rate of return achieved? (ignoring dividends).

Answer:

Doubling

The number of time periods it takes for an investment to double in value is

where is the interest rate as a fraction.

Let p be the interest rate as a percentage ( i.e., 100 i ). Then the product of p and the doubling time t is fairly constant:

| interest | doubling time | product

Lua error: expandTemplate: template "rule of 72" does not exist. |

|---|

Thus for small interest rates such as daily ones the product is 69.3, for interest rates around 2% it is approximately 70, and for higher percentages one more for every 3%, until around 50%. then the increase of the product slows down somewhat. In the case of a negative rate a negative time for doubling means the absolute value of that time for halving. Again the product is approximately one less for every 3% less.

See also Rule of 72.

Periodic compounding

The amount function for compound interest is an exponential function in terms of time.

- = Total time in years

- = Number of compounding periods per year (note that the total number of compounding periods is )

- = Nominal annual interest rate expressed as a decimal. e.g.: 6% = 0.06

As increases, the rate approaches an upper limit of . This rate is called continuous compounding, see below.

Since the principal A(0) is simply a coefficient, it is often dropped for simplicity, and the resulting accumulation function is used in interest theory instead. Accumulation functions for simple and compound interest are listed below:

Note: A(t) is the amount function and a(t) is the accumulation function.

Force of interest

| Part of a series of articles on the |

| mathematical constant e |

|---|

|

| Properties |

| Applications |

| Defining e |

| People |

| Related topics |

In mathematics, the accumulation functions are often expressed in terms of e, the base of the natural logarithm. This facilitates the use of calculus methods in manipulation of interest formulae.

For any continuously differentiable accumulation function a(t) the force of interest, or more generally the logarithmic or continuously compounded return is a function of time defined as follows:

which is the rate of change with time of the natural logarithm of the accumulation function.

Conversely:

- (since )

When the above formula is written in differential equation format, the force of interest is simply the coefficient of amount of change.

For compound interest with a constant annual interest rate r the force of interest is a constant, and the accumulation function of compounding interest in terms of force of interest is a simple power of e:

The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. It is the reciprocal of the e-folding time. See also notation of interest rates.

Continuous compounding

For interest compounded a certain number of times, n, per year, such as monthly or quarterly, the formula is:

Continuous compounding can be thought as making the compounding period infinitely small; therefore achieved by taking the limit of n to infinity. One should consult definitions of the exponential function for the mathematical proof of this limit.

The amount function is simply

A common mnemonic device considers the equation in the form

called 'PERT' where P is the principal amount, e is the base of the natural log, R is the rate per period, and T is the time (in the same units as the rate's period), and A is the final amount.

With continuous compounding the rate expressed per year is simply 12 times the rate expressed per month, etc. It is also called force of interest, see the previous section.

The effective interest rate per year is

Using this i the amount function can be written as:

or

See also logarithmic or continuously compounded return.

Compounding bases

To convert an interest rate from one compounding basis to another compounding basis, the following formula applies:

where r1 is the stated interest rate with compounding frequency n1 and r2 is the stated interest rate with compounding frequency n2.

When interest is continuously compounded:

where R is the interest rate on a continuous compounding basis and r is the stated interest rate with a compounding frequency n.

History

If the Native American tribe that accepted goods worth 60 guilders for the sale of Manhattan in 1626 had invested the money in a Dutch bank at 6.5% interest, compounded annually, then in 2005 their investment would be worth over €700 billion (around USD1 trillion), more than the assessed value of the real estate in all five boroughs of New York City. With a 6.0% interest however, the value of their investment today would have been €100 billion (7 times less!).

Compound interest was once regarded as the worst kind of usury, and was severely condemned by Roman law, as well as the common laws of many other countries. [2]

Richard Witt's book Arithmeticall Questions, published in 1613, was a landmark in the history of compound interest. It was wholly devoted to the subject (previously called anatocism), whereas previous writers had usually treated compound interest briefly in just one chapter in a mathematical textbook. Witt's book gave tables based on 10% (the then maximum rate of interest allowable on loans) and on other rates for different purposes, such as the valuation of property leases. Witt was a London mathematical practitioner and his book is notable for its clarity of expression, depth of insight and accuracy of calculation, with 124 worked examples.[3][4]

The Qur'an, revealed over 1400 years ago, explicitly mentions compound interest as a great sin. Interest known in Arabic as riba is considered wrong: "Oh you who believe, you shall not take riba, compounded over and over. Observe God, that you may succeed. (Quran 3:130)"

See also

- Effective interest rate

- Nominal interest rate

- Exponential growth

- Rate of return on investment

- Credit card interest

- Fisher equation

- Yield curve

References

- ^ http://laws.justice.gc.ca/en/showdoc/cs/I-15/bo-ga:s_6//en#anchorbo-ga:s_6 Interest Act (Canada), Department of Justice. The Interest Act specifies that interest is not recoverable unless the mortgage loan contains a statement showing the rate of interest chargeable, "calculated yearly or half-yearly, not in advance." In practice, banks use the half-yearly rate.

- ^

This article incorporates text from a publication now in the public domain: Chambers, Ephraim, ed. (1728). Cyclopædia, or an Universal Dictionary of Arts and Sciences (1st ed.). James and John Knapton, et al.

This article incorporates text from a publication now in the public domain: Chambers, Ephraim, ed. (1728). Cyclopædia, or an Universal Dictionary of Arts and Sciences (1st ed.). James and John Knapton, et al. {{cite encyclopedia}}: Missing or empty|title=(help) - ^ Lewin, C G (1970). "An Early Book on Compound Interest - Richard Witt's Arithmeticall Questions". Journal of the Institute of Actuaries. 96 (1): 121–132.

- ^ Lewin, C G (1981). "Compound Interest in the Seventeenth Century". Journal of the Institute of Actuaries. 108 (3): 423–442.

![{\displaystyle i={\sqrt[{n}]{\left({\frac {FV}{PV}}\right)}}-1\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9d5d17fedcd51847f64f5a801270be5fbb6c5179)

![{\displaystyle {\sqrt[{4}]{1+.04}}-9=.0091200341}](https://wikimedia.org/api/rest_v1/media/math/render/svg/fbecab19aea7bdc0e39bdf108e3206a67eb0663c)

![{\displaystyle i={\sqrt[{36}]{\left({\frac {1248.29}{92.06}}\right)}}-1=7.51\%\,}](https://wikimedia.org/api/rest_v1/media/math/render/svg/fd83b37744220f249285f8e8a748ce209f710ad5)

![{\displaystyle r_{2}=\left[\left(1+{\frac {r_{1}}{n_{1}}}\right)^{\frac {n_{1}}{n_{2}}}-1\right]{\times }n_{2}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/643f76fbadc5b516114b7d62bf60629e41b1e8ff)