U.S. dollar

| U.S. dollar | |

|---|---|

| Country: |

|

| Subdivision: | 10 Dime 100 Cent (¢) 1000 Mill (₥, obsolete) |

| ISO 4217 code : | USD |

| Abbreviation: | USD, US $, $ |

|

Exchange rate : (August 24, 2020) |

1 EUR = 1.185 USD 1 CHF = 1.101 USD |

| Issuer : | Fed |

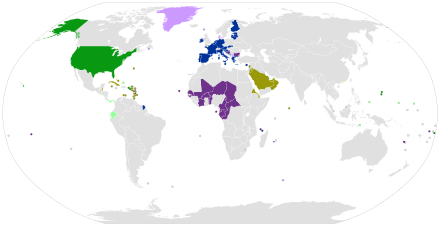

The US dollar [ ˈdɑlɚ ] ( United States Dollar; abbreviation: USD; symbol: $ ) is the official currency unit of the United States . The US dollar is also used as official and legal tender in several other countries and regions. These include Bonaire , the British Virgin Islands , Ecuador , El Salvador , Cambodia , Liberia , the Marshall Islands , Micronesia , East Timor , Palau , Panama , Saba , Sint Eustatius and the Turks and Caicos Islands .

A dollar is officially divided into 10 Dime , 100 Cent (Symbol: ¢ or c ) or 1000 Mill (Symbol: ₥). Due to the green color scheme of the back of the banknotes, the dollar is also known colloquially as the "greenback". The term "buck" is also common. The Bureau of Engraving and Printing is responsible for printing the banknotes . The United States Mint is responsible for minting coins . The US dollar is freely convertible .

Origin of the "$" character

The origin of the well-known $ symbol , which also stands for the US dollar, cannot be clearly determined. It is possible that the character from the abbreviation for the Spanish florin ( guilder ) widespread in the New World and in particular the abbreviation "Ps.", Which arose for peso ; in North America at the time also known as the "Spanish dollar". The explanation is based on the fact that when writing the "S" over time the "P" was written and thus a new character was created. The rounding of the "P" gradually fell away and the "$" remained. According to another theory, this symbol is a stylization of the pillars of Heracles as they are used as the Spanish state symbol .

The Spanish dollar was a widely used currency in the United States until it was replaced by the US dollar in 1785. The "$" symbol by no means exclusively stands for the US currency, but is still used today as a common peso symbol in many Spanish-speaking countries in Latin America .

history

The origin of the United States' single currency dates back to 1690 when several British colonies existed on the east coast of North America. At that time, the colonies were very valuable as suppliers of raw materials, including tobacco and cotton . The 13 colonies levied customs duties on their borders, which made trade very difficult. In addition, the English currency was not accepted, the British pound was banned. There were different currencies for trading within the American colonies. One of the colonies, the " Massachusetts Bay Colony " (today the American state of Massachusetts with its capital Boston ) was the first colony to use its own paper money to finance the military. The other colonies followed suit. (see also history of the US Army )

The British tried to impose restrictions on the development of an industry and finance economy that was independent of the motherland. In 1704 the minting of coins was banned in all colonies. In order to continue trading, the colonists mostly used Spanish or Dutch currency (Netherlands: guilder ; Spain: real ). In this context, the term dollar was created , derived from the European name " Taler ". Silver coins of Spanish origin were known as "Spanish dollars".

In 1775 the American War of Independence broke out. The Continental Congress , which represented the government of the colonies, had its own banknotes, the so-called continental dollars , printed as the new official currency of the colonies . However, due to the weak financial system and the high rate of forgery, the newly introduced currency did not stay in circulation for long or quickly lost value.

In 1781, the Continental Congress asked what was then the first national bank, the Bank of North America in Philadelphia , for help. The aim was to strengthen the financial system . In 1785 the dollar was introduced as the new currency of the USA; The first coins were issued in 1787. In 1792 the monetary system was laid down in law in the Coinage Act (coining laws).

The US dollar has been a decimal currency right from the start . The USA was the first state to permanently introduce this system. The dollar was divided into 10 dimes, 100 cents and 1000 mills. $ 10 equals one eagle. The term 'dime' is still used today for the 10-cent piece; however, the dime is not an invoice currency . The mill was never used on coins, but was used in certain cases well into the 1960s. The cent served as a model for the hundredths of almost all currencies existing around the world. The new coins were minted from gold, silver and copper.

On March 3, 1849, the US Congress passed a law ("Mint Act", also "Gold Coinage Act") that allowed the United States Mint to mint two gold coins. This created the “Gold Dollar” and the “Double Eagle” with a face value of 20 dollars.

The first dollar banknotes made of paper were put into circulation in 1861/1862 to finance the Civil War . The notes were called "greenbacks" because of their color and featured portraits of famous Americans on the front. The new bills were more difficult to forge and bore the Treasury's seal .

In 1913 the central bank (" Federal Reserve Bank ") was founded (legal basis: Federal Reserve Act ). The aim was to structure the financial system in such a way that it could adapt to the changing needs of the country. The first note of the newly established central bank was issued in 1914. Later, the bank's board of directors decided to reduce the size of the notes by 30 percent to reduce manufacturing costs.

Over the years the US dollar gained more and more international importance. At the meeting in Bretton Woods ( New Hampshire , USA) in 1944, where the Bretton Woods system was created, the US dollar was chosen as the reserve currency. This system is a monetary system that was developed by representatives of a total of 44 countries and the International Monetary Fund . The aim of the new system was to create smooth global and international trade through the establishment of fixed exchange rates. It was not until August 1971 that this system was seriously disrupted when Richard Nixon removed the gold backing of the US dollar. In the spring of 1973, 29 years after its inception, the Bretton Woods system collapsed.

The appearance and size of dollar bills did not change until 1996 when new security features were introduced to protect against counterfeiting. Since then, changes have taken place at regular intervals.

Gold standard and gold ban

As part of the official gold standard currency , gold dollars have existed as curant coins since the "Currency Act" in 1900 . Since around 1900, all minted silver dollars and their sub-units down to the 1 cent piece were divisional coins .

In 1900 the gold parity per dollar was set at 1.504632 grams.

When the Great Depression began in 1929, the value of an ounce of gold was only US $ 20.67, which means that an increase in the supply of money to counter the crisis would not have been covered by the gold reserves. The crisis spread around the world and many countries suspended the gold standard, which led to a devaluation of money.

On April 5, 1933, the prohibition on private gold ownership, in accordance with the so-called " Gold Ban Decree" by Franklin Roosevelt , after a change in the draft of March 9, 1933, finally became legally binding. This included private ownership of all gold coins, gold bars and gold certificates. The owners have been asked to surrender their gold for a value of $ 20.67 an ounce. It was no longer possible to exchange coins and banknotes for gold. On January 31, 1934, the gold parity per dollar was set at 0.888671 grams, which corresponds to a value of $ 35 per troy ounce. According to the agreement, an exchange of dollars for gold (US $ 35 per ounce ) was only possible in commercial, international trade.

The US produced dollars beyond the real value of its gold reserves. The US dollar reserves in Europe and Japan exceeded the American gold reserves as early as 1960.

Thus, on August 15, 1971 , the Nixon government announced that extraordinary measures would be required to protect the American economy. These measures involved the abolition of the right to convert the dollar into gold.

Then the dollar, measured against gold, lost so much of its value within three years that it was only a fifth of its original gold value.

It was not until 1974, over 40 years after its enactment, that the ban on private gold ownership was lifted again.

Nowadays, like most of the world's currencies, the US dollar is no longer linked to a specific standard, but is mainly correlated with the economic performance and the total national wealth of the country, but also depends on the respective political stability and military supremacy of the state system.

Exchange rate development

Since World War II, the US dollar has become the world's dominant reserve and trade currency. Despite the end of gold convertibility in 1971 by US President Richard Nixon and many political upheavals, the USA retained this supremacy for many years.

Between 2002 and 2004 the dollar lost around 15 percent of its weighted average value against all currencies of US trading partners due to an enormous deficit in the US trade balance. After a brief "recovery phase", the loss in value continued since 2006 and was further exacerbated by the mortgage crisis in mid-2007. By spring 2009, the US dollar had risen again by around 13 percent. Since then, however, the currency has lost again by around 13 percent (as of November 2009).

German mark

For the dollar rate in German marks from 1948 to 1998 see the external value of the German mark .

Euro

After the euro was introduced as book money on January 1, 1999, it could be exchanged for US dollars just four days later at a rate of 1.1789 euros. The euro fell sharply against the US dollar over the next two years. The highest level of the US dollar was recorded on October 26, 2000 at 0.8252 dollars for one euro. The US dollar lost more than 50 percent of its value against the euro between 2002 and 2004. The subprime crisis that began in the USA in 2007 led to a further devaluation of the US dollar. Interest rates were lowered and funds from investors and speculators began to flow out. The dollar reached its all-time low on July 15, 2008 at a rate of $ 1.5990 for one euro. After a continuous increase since March 2014, the dollar exchange rate rose again to a price of 1.16 dollars per euro (July 2020).

Swiss franc

From 1945 to 1971 the franc was pegged to the US dollar through the Bretton Woods system , a dollar cost 4.30521 francs from 1945 to 1949, and from 1949 until the collapse of the Bretton Woods system, 4.375 francs. Since then, the US dollar has depreciated against the Swiss franc. The US dollar achieved its first equivalence to the Swiss franc on March 14, 2008. The previous low was on August 9, 2011 at 0.7215 francs per dollar.

Japanese yen

The Japanese yen is the third most widely traded currency in the world after the US dollar and the euro. The currency lost much of its value at the end of World War II and was pegged to the US dollar in 1949 as part of the Bretton Woods system. At that time, one dollar was worth 360 yen. The yen has been freely trading since 1973. The Japanese currency has a much weaker international weighting than the euro and the dollar. By 1971 the yen was undervalued, prompting the US to act and move away from the gold standard. In 1971 a new exchange rate of 308 yen against the dollar was set, but it was difficult to maintain, and in 1973 the world's major currencies were made free.

| year | 1 JPY | year | 1 JPY | year | 1 JPY |

|---|---|---|---|---|---|

| 1995 | $ 0.0106 | 2000 | $ 0.0093 | 2005 | $ 0.0091 |

| 1996 | $ 0.0092 | 2001 | $ 0.0082 | 2006 | $ 0.0086 |

| 1997 | $ 0.0083 | 2002 | $ 0.0080 | 2007 | $ 0.0085 |

| 1998 | $ 0.0076 | 2003 | $ 0.0086 | 2008 | $ 0.0096 |

| 1999 | $ 0.0088 | 2004 | $ 0.0092 | 2009 |

Pound Sterling

| year | 1 GBP | year | 1 GBP | year | 1 GBP |

|---|---|---|---|---|---|

| 1995 | $ 1.5781 | 2000 | $ 1.5130 | 2005 | $ 1.8182 |

| 1996 | $ 1.5602 | 2001 | $ 1.4369 | 2006 | $ 1.8400 |

| 1997 | 1.6371 USD | 2002 | 1.4987 USD | 2007 | 2,0009 USD |

| 1998 | 1.1211 USD | 2003 | 1.1312 USD | 2008 | |

| 1999 | $ 1.0658 | 2004 | 1.2439 USD | 2009 |

International significance of the US dollar

Since the Bretton Woods system, the US dollar has been used as the world's leading, transaction and reserve currency . It is the world's most traded currency.

In some countries around the world, the US dollar is an unofficial minor or second currency. In some states it is possible to pay in US dollars without having to convert it into the actual local currency. Some raw materials are traded in this currency unit on the world market. This includes crude oil , for example , with the money flowing into the seller countries being returned to the international markets under the term petrodollar .

The role of the US dollar as a reserve currency

While the euro share of global currency reserves increased significantly, the share of the US dollar has only fallen insignificantly in recent years. It is generally assumed that the euro will steadily gain in importance as a global reserve currency, while the US dollar will lose importance. Worldwide, the US dollar can account for more than 60% of total investment reserves, which corresponds to several trillions. The FED can dispose of this value and offer it in the form of loans on the world market. The interest that has to be paid on these loans represents the seigniorage income of the FED.

| 1970 | 1980 | 1990 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 77.2 | 67.2 | 62.8 | 70.5 | 70.7 | 66.5 | 65.8 | 65.9 | 66.4 | 65.5 | 64.1 | 64.1 | 62.1 | 61.8 | 62.2 | 61.2 | 61.0 | 63.3 | 64.1 | 63.9 | 62.7 | 61.7 | 60.9 | |||||||

| EUR | - | - | - | - | 17.9 | 24.2 | 25.3 | 24.9 | 24.3 | 25.1 | 26.3 | 26.4 | 27.6 | 26.0 | 25.0 | 24.2 | 24.4 | 21.9 | 19.7 | 19.7 | 20.2 | 20.7 | 20.6 | |||||||

| DEM | 1.9 | 14.8 | 19.8 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| JPY | - | 0.1 | 4.6 | 9.4 | 5.2 | 4.5 | 4.1 | 3.9 | 3.7 | 3.1 | 2.9 | 3.1 | 2.9 | 3.7 | 3.5 | 4.0 | 3.8 | 3.9 | 4.0 | 4.2 | 4.9 | 5.2 | 5.7 | |||||||

| GBP | 10.4 | 2.9 | 2.4 | 2.8 | 2.7 | 2.9 | 2.6 | 3.3 | 3.6 | 4.4 | 4.7 | 4.0 | 4.3 | 3.9 | 3.8 | 4.0 | 4.0 | 3.8 | 4.9 | 4.4 | 4.5 | 4.4 | 4.6 | |||||||

| FRF | 1.1 | 1.7 | 2.7 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| CHF | 0.7 | 3.2 | 0.8 | 0.3 | 0.3 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 | |||||||

| other | 8.7 | 5.9 | 4.9 | 1.4 | 1.2 | 1.4 | 1.9 | 1.8 | 1.9 | 1.8 | 1.8 | 2.2 | 3.1 | 4.4 | 5.3 | 5.8 | 6.5 | 6.8 | 6.7 | 7.6 | 7.6 | 7.8 | 8.0 | |||||||

|

Sources: |

||||||||||||||||||||||||||||||

Role as transaction currency

The US dollar accounts for over 50% of international financial transactions, making it the most widely traded currency in the world. After the Second World War, the British pound , the reserve currency at the time, was largely replaced by the US dollar on the ( financial ) markets. US dollar transactions in 2003 were 50% versus 25% in euros and 10% each in pounds sterling and Japanese yen .

Legal tender role

In some states and regions outside of the United States and its suburbs , the US dollar is used as an official or legal tender despite its status as a foreign currency in these areas. These include:

- Bonaire , Special Municipality of the Netherlands , since 2011

- British Virgin Islands , British Overseas Territory

- Ecuador , since September 2000, has also minted its own coins

- El Salvador , the former national currency Colón since 2001, is still officially valid, but is no longer in circulation

- Liberia , as a second currency parallel to the national currency, the Liberian dollar

- Marshall Islands (traditional)

- Micronesia (traditional)

- East Timor , since 2000, has also minted its own coins

- Palau (traditional)

- Panama , managed as a second currency parallel to the national currency Balboa (Balboa banknotes do not exist)

- Saba , Special Municipality of the Netherlands , since 2011

- Zimbabwe , as a transition currency (also euro and rand )

- Sint Eustatius , Special Congregation of the Netherlands , since 2011

- Turks and Caicos Islands , British Overseas Territory

In addition, the following states and territories are passive users of the US dollar, some of which is the de facto currency:

- Bahamas

- Bermuda , British overseas territory

- British Indian Ocean Territory

- Cayman Islands , British overseas territory

- Guatemala

- Cambodia

- Maldives

Current currencies pegged to the US dollar with a fixed exchange rate:

| currency | Exchange rate | countries |

|---|---|---|

| Antilles guilder | 1: 1.79 |

Curacao Sint Maarten |

| Aruba florin | 1: 1.79 | Aruba |

| Bahamian dollars | 1: 1 | Bahamas |

| Bahraini dinar | 1: 0.376 | Bahrain |

| Barbados dollars | 1: 2 | Barbados |

| Belize dollars | 1: 1.97 (de facto 1: 2) |

Belize |

| Bermuda dollars | 1: 1 | Bermuda |

| Eritrean Nakfa | 1: 15 | Eritrea |

| Jordanian dinar | 1: 0.709 | Jordan |

| Cayman Dollars | 1: 1.227 (de facto 1: 1.25) |

Cayman Islands |

| Qatari riyal | 1: 3.64 | Qatar |

| Convertible peso | 1: 1 (de facto plus 10% commission) |

Cuba |

| Cuban peso | 1:24 (CUC to CUP) 1:25 (CUP to CUC) (de facto coupled via CUC) |

Cuba |

| Lebanese pound | 1: 1,507.5 | Lebanon |

| Omani rial | 1: 0.3845 | Oman |

| East Caribbean dollar | 1: 2.7 |

Anguilla Antigua and Barbuda Dominica Grenada Montserrat St. Kitts and Nevis St. Lucia St. Vincent and the Grenadines |

| Panamanian balboa | 1: 1 | Panama |

| Saudi riyal | 1: 3.75 | Saudi Arabia |

| Turkmenistan manat | 1: 3.50 | Turkmenistan |

| UAE dirham | 1: 3.6725 | United Arab Emirates |

Dollar indices

US dollar index

After the collapse of the Bretton Woods system , the geometrically weighted US dollar index (USDX) was introduced in March 1973 and set to a value of 100. Usually only one currency is weighted against another. With USDX, the US dollar is set in relation to six other currencies. This comparison is intended to show the value of the US dollar in a meaningful way.

The index represents a basket of the following currencies: the euro (57.6%), the Japanese yen (13.6%), the British pound (11.9%), the Canadian dollar (9.1%), the Swedish krona (4.2%) and the Swiss franc (3.6%). A US dollar index of 120 means that the US dollar is worth 20% more than the same basket of currencies in 1973 ( benchmark ).

The USDX has been listed on ICE Futures US , formerly the "New York Board of Trade" (NYBOT), since 1985 .

Trade Weighted US Dollar Index

The trade-weighted Trade Weighted US Dollar Index is comparable to the geometrically weighted US Dollar Index . The US Federal Reserve (FED) has been calculating the effective exchange rates in the index since 1998 with a broad group (The Broad Index) of trading partners. This is split into a main group (The Major Currencies Index) and a subsidiary group (OITP - Other important trading partners).

Compared to the US Dollar Index, the FED's index measures the value of the US dollar much more accurately, as the weighting of the FED represents the competitiveness of US goods compared to other countries and trading partners.

The Major Currencies Index has fallen sharply in recent years and is currently at an average value of 76.1018 points (as of September 2010). Compared to 1985, when the index reached a high of an average of 140 index points, it has stagnated since 2007 at a value between 70 and 80 index points. Conversely, this means that the US dollar has depreciated significantly in relation to the other currencies in recent years.

| year | Points |

|---|---|

| 1973 | 100.2277 |

| 1982 | 115.7585 |

| 1991 | 88.5180 |

| 2000 | 101.5737 |

| 2009 | 78.1149 |

| 2010 | 76.1018 |

Coins

description

| Face value | front | back | portrait | motive | Weight | diameter | thickness | material | edge |

|---|---|---|---|---|---|---|---|---|---|

|

1 cent "penny" |

|

|

Abraham Lincoln | until 2008 Lincoln Memorial 2009 changing motifs from 2010 heraldic shield |

2.50 g | 19.05 mm | 1.55 mm | 97.5% Zn 2.5% Cu |

smooth |

|

5 cents "nickel" |

|

|

Thomas Jefferson |

Monticello 2004/05 changing motifs |

5.00 g | 21.21 mm | 1.95 mm | 75% Cu 25% Ni |

smooth |

|

10 cents "Dime" |

|

|

Franklin D. Roosevelt | Olive branch, torch, oak branch | 2.27 g | 17.91 mm | 1.35 mm | 91.67% Cu 8.33% Ni |

118 corrugation |

|

25 cents "quarter" |

|

|

George Washington | until 1998 bald eagle from 1999 changing motifs |

5.67 g | 24.26 mm | 1.75 mm | 91.67% Cu 8.33% Ni |

119 corrugation |

|

50 cents "half dollar" |

|

|

John F. Kennedy | Seal of the President | 11.34 g | 30.61 mm | 2.15 mm | 91.67% Cu 8.33% Ni |

150 corrugations |

|

1 dollar "Buck" |

|

Sacajawea | Bald eagle flying until 2008, changing motifs from 2009 |

8.10 g | 26.50 mm | 2.00 mm | 88.5% Cu 6% Zn 3.5% Mn 2% Ni |

smooth from 2009 inscription |

|

|

1 dollar "Buck" |

|

|

President of the United States (series of motifs) |

statue of Liberty | 8.10 g | 26.50 mm | 2.00 mm | 88.5% Cu 6% Zn 3.5% Mn 2% Ni |

inscription |

Over time, more coins with different denominations were minted:

- Half cent , ½ cent (1793-1857)

- Two cents (1864–1873)

- Three cents, 3 cents (1851-1889)

- Twenty cents, 20 cents (1875–1878)

- Quarter Eagle, $ 2½ (1796-1929)

- Three dollars , three dollars (1854–1889)

- Half Eagle, $ 5 (1795-1929)

- Eagle , $ 10 (1795-1933)

- Double Eagle, $ 20 (1849-1933)

The $ 10 gold coin, known as the Eagle because of its eagle motif, as well as the quarter, half, and double eagle coins, and also the $ 1 and $ 3 gold coins that were in circulation, became withdrawn from the Federal Reserve Bank in the wake of the gold ban. The " Double Eagle ", which was still minted with the year 1933 and valued at 20 gold dollars, was no longer issued due to the gold prohibition decree. One of the 20 or so unmelted copies was sold at an auction on July 30, 2002 at the Sotheby’s auction house in New York for the record price of a total of 6.6 million US dollars, which is probably the highest collector price paid for a coin to date.

History of coins

"Penny"

From 1793 to 1857, the 1 cent piece was a 27 to 29 mm large copper coin, known as the "Large Cent". From 1856 to 1858 the front motif was a flying eagle and from 1859 to 1909 a portrait of Liberty with an Indian headdress. Since 1909 the obverse has shown a portrait of Abraham Lincoln designed by Victor D. Brenner . Between 1959 and 2008 the Lincoln Memorial was on the back . In 2009, four special motifs were embossed in honor of Lincoln and a coat of arms has been on the back since 2010.

"Nickel"

A portrait of Thomas Jefferson has been featured on the obverse of the 5-cent nickel coin since 2006 . The portrait shows Jefferson in his position as Vice President at the age of 57. This painting was the basis for most of the paintings made by Jefferson during his lifetime. The inscription “Liberty” was modeled from his own handwriting. This inscription first appeared on the nickel coin in 2005. The design of the back of the nickel in 2006 was sharper and more detailed than ever. This is due to the fact that the engravers of the United States Mint provided their original with more details (such as balconies, windows, doors).

"Dime"

On January 30, 1946, the so-called dime (ten cent coin) in the version with the image of President Franklin D. Roosevelt , in memory of his death on April 12, 1945, was introduced. This coin is still in circulation today. One reason for the introduction was that shortly after Roosevelt's death in 1945, many citizens turned to the Federal Ministry of Finance in writing with the request that the portrait of Franklin D. Roosevelt be struck on a coin, as the latter applied during his lifetime participated in a research program called the March of Dimes for cures for the polio virus at the age of 39 . On the other side of the coin is a torch that stands for freedom, an olive branch that symbolizes peace and the branch of an oak tree, which symbolizes strength and independence. Of all the coins, the dime is the smallest and thinnest that is still in use today. The sound of the name "Dime" was the same back then as it is today, but the spelling has been changed. At that time, the dime still wrote “disme”. This is based on the old Latin term "decimus", which means something like tenth.

"Quarter Dollar"

The quarter dollar, which has been produced since 1796, is worth 25 cents or a quarter of a US dollar. The first coins in circulation featured Lady Liberty on the obverse and the bald eagle on the reverse. In 1932, for the 200th birthday of George Washington, a new quarter was introduced with its image.

In 1999, the 50 State Quarters Series was started. Since then, five US states have been awarded a quarter annually. In 2009 the series was supplemented with editions for the District of Columbia and five suburbs . Starting in 2010, the America the Beautiful Quarters program will feature five national parks or other sites of national importance annually .

"Half dollar"

The obverse of this 50 cent coin features a portrait of John Fitzgerald Kennedy , who was the youngest president ever elected. The presidential elections formed the basis for the portrait on the coin. The sculptor Roberts created this design immediately after Kennedy's assassination. The design on the back was based on the presidential seal. It consists of the image of a heraldic eagle with a shield on its chest, which holds a symbolic olive branch in one claw and a bundle of 13 arrows in the other. This eagle is surrounded by a wreath of 50 stars, these stars symbolizing the 50 states.

"Dollar"

The 1 dollar coins made of silver have been minted since 1794, with some longer interruptions. The first coins were the so-called Flowing Hair Silver Dollars , they showed the profile of Miss Liberty with flowing hair (1794–1803). In 2013 such a coin was auctioned for 10 million US dollars, the highest amount ever paid for a coin. The second minting period for 1 US dollar coins made of silver lasted from 1840 to 1873, the third from 1878 to 1904 or 1921. In the third minting period, the Morgan dollar was minted. In 1921 the fourth minting period (until 1935) began, in which peace dollars were minted.

Two different 1 dollar coin series are currently in production. On the one hand, there is the Sacagawea dollar , which was issued for the first time in 2000 and since 2009 has had special, annually changing motifs in honor of the Native Americans ("Native American $ 1 Coin"); on the other hand, there is the presidential dollar series (“Presidential $ 1 Coin Program”), which was implemented in 2007. Both series of 1 dollar coins are gold-colored. This is due to a special mixture of different metals, although it does not contain gold. These coins have the same "electromagnetic signature" as the previous Susan B. Anthony dollar (SBA dollar), which was silver in color. This coin was very similar to the Quarter in terms of color and size, which often led to confusion. Since this coin was rather unpopular, the 1 dollar bill remained the more common means of payment. The minting of this coin was discontinued in 1980, but special mintings followed in 1981 and 1999. Although this coin is rarely in circulation these days, it is still considered a means of payment. They are most likely to be found as change at vending machines.

Ironically, the popularity of the "Presidential Dollars" was partly undoing, as they are very popular with collectors and have been withdrawn too often from payment transactions. Originally, the introduction of the new series of motifs was aimed at making the dollar coin a more common means of payment compared to the dollar bill, as bills wear out faster and therefore have to be replaced earlier. In the meantime, however, this approach has been abandoned and it has been decided to consciously continue the series for collectors - with a significantly reduced number of issues.

Banknotes

description

The dimensions of the notes in circulation do not differ (in spite of their different value) in terms of their paper cut (e.g. with the euro) and are uniformly 155.81 mm by 66.42 mm. The thickness is not specified and is given as 0.1 mm to 0.6 mm; However, most of the surrounding notes have a thickness of 0.11 mm. There have been many different types of dollar bills in the past. Nowadays only so-called Federal Reserve Notes are issued. Nonetheless, the 1965 law governing the status of dollar bills as legal tender refers to the United States Dollar Notes, then considered the primary currency . They are referred to as “Legal Tenders” or, because of the red seal, “Red Seal”. This law states that these same United States Dollars, along with Federal Reserve Notes and notes issued by National Banks and Federal Reserve Banks, are legal tender. The old gold certificates and silver certificates are therefore not legal tender . Only Federal Reserve Notes are produced and issued today, and there are no others in circulation either. The manufacturing and paper costs per dollar are 3.6 cents per dollar bill. The main component of the dollar is denim , a particularly tightly woven cotton fabric.

| Face value | front | back | portrait | Backside motif |

|---|---|---|---|---|

| 1 dollar |

|

|

George Washington | Lettering "ONE" and both sides of the state seal |

| 2 dollars |

|

|

Thomas Jefferson | Signing the Declaration of Independence (painting by John Trumbull ) |

| 5 dollars |

|

|

Abraham Lincoln | Lincoln Memorial |

| 10 dollars |

|

|

Alexander Hamilton | US Treasury Department |

| 20 dollars |

|

|

Andrew Jackson | White House |

| 50 dollars |

|

|

Ulysses S. Grant | Capitol |

| 100 dollars |

|

|

Benjamin Franklin | Independence Hall |

| Last printed in 1945; Withdrawn in 1969; still legal means of payment: | ||||

| $ 500 |

|

|

William McKinley | (written representation of the face value) |

| $ 1,000 |

|

|

Grover Cleveland | (written representation of the face value) |

| $ 5,000 |

|

|

James Madison | (written representation of the face value) |

| $ 10,000 |

|

|

Salmon P. Chase | (written representation of the face value) |

| Not in circulation, but still legal tender: | ||||

| $ 100,000 |

|

|

Woodrow Wilson | (written representation of the face value) |

Remarks

- Banknotes with a value of over 100 US dollars are no longer issued these days, but are still considered legal tender, although their collector 's value far exceeds their face value today. Most of the specimens that are still in circulation are owned by collectors and museums.

- The highest denomination note ever printed by the Bureau of Engraving and Printing was a 1934 gold certificate for $ 100,000. This was only issued against gold of the same value. This note was only used for transactions between central banks.

Special features of the banknotes

Serial numbers of the banknotes

The serial number of a dollar bill is based on a uniform scheme for all bills: It consists of two capital letters, followed by eight digits, and finally another capital letter.

Example: DL82674476A

Explanations based on the example:

- D: The first letter indicates the series or edition of the note, e.g. B. the "D" indicates that this ticket belongs to a series from 2003. If the design of a banknote changes, a new series is issued, regardless of the extent of the change. For example, a new series can be printed due to the change in the signature on the slip. A new series is put out about every one to two years.

- L: The second letter shows the bank from which the note was issued. There are central banks at twelve locations, which are assigned the following letters:

- A: Boston

- B: New York

- C: Philadelphia

- D: Cleveland

- E: Richmond, Virginia

- Q: Atlanta

- G: Chicago

- H: Saint Louis

- I: Minneapolis

- J: Kansas City (Missouri)

- K: Dallas

- L: San Francisco

- 82674476: The series of numbers is a consecutive number.

- A: This letter always counts up by one letter as soon as the consecutive number has reached its end and has to start again at 00000001. The letters O and Z are omitted, making 24 combinations.

In addition, there are the “star notes”, also known as replacement banknotes, which are issued for faulty notes. In the American monetary system, the serial numbers are preceded by an asterisk or star , in German: asterisk "*".

The green of the "greenbacks"

There is no precise explanation as to why the backs of US banknotes were printed with green ink. It is known that in 1929 the green dye was present in large quantities and that it was relatively resistant to chemical and physical changes in the manufacturing process. Furthermore, the color green is intended to express the strength and stability of the government and to create trust in the currency.

Security features

Since July 5, 1865, there has been a cooperation between the United States Secret Service , the Federal Reserve System and the Bureau of Engraving and Printing to develop measures to keep the occurrence of forgeries as low as possible. In 1966 the government began printing security features on banknotes. In order to continue to ensure the security of the currency, the design of the notes is changed every seven to ten years (except for 1 and 2 dollars):

- Security thread : The security thread is a thin strip that runs through the banknote. This cannot be reproduced by printing. All series printed after 1990 (except the $ 1 and $ 2 notes) contain this feature. The nominal value of the note is printed on this strip.

- Microscripts: These imprints appear as a line when viewed normally, but with the aid of a magnifying glass, the respective nominal value of the grade becomes visible. Most copiers do not have enough resolution to recognize these fonts.

The following security features have also been used since 1996.

- Watermark: This mark is created by different degrees of density of the paper. If the banknote is held up to the light, the portrait of the person depicted on the banknote becomes visible.

- Optically variable ink : The color of the inscription changes when you look at it from different angles.

- Fine line structures: line patterns are printed on the front behind the portrait and on the back around the historic building. These lines are visible to the eye but are difficult to see by scanners and printers.

- Enlarged, offset portraits: The larger images are more detailed and thus make counterfeiting the banknote more difficult. The respective portraits have been shifted slightly to the side to make room for the watermark and the security thread. The enlarged images make it easier for visually impaired people to identify the grade value.

In February 2011, a variant of the 100 dollar bill equipped with additional security features was to be brought into circulation in order to counteract the high rate of forgery. A 3D security tape, an additional watermark, a gold-colored printed “100” and a 3D image that changes between a bell and the “100” depending on the angle of view should bring the notes up to date in terms of security and make counterfeiting more difficult. On October 1, 2010, it was announced that the delivery of the new notes would be delayed because the planned quantities could not be produced on time due to problems in the manufacturing process. According to press reports, up to 30% of the produced notes are faulty, so that production has been stopped for the time being and "old" notes will continue to be printed for current needs. The new $ 100 bill was issued on October 8, 2013.

Other names for the US dollar

A common name for the dollar is buck . The term is possibly the short form of the term buckskin (suede), which was considered a means of payment in the early American years. 100 dollars are also called large , 1000 dollars are often called grand (or G). The $ 10 and $ 20 notes are also known as the sawbuck and double sawbuck . Like the banknotes, individual coins also have corresponding nicknames. 1 dollar is also referred to as "single", 2 dollars as "deuce" and 5 dollars as "fin" or "fiver".

Sometimes the names of the people depicted on the front of the notes, such as "George", "Tom" or "Frank", are used as nicknames. Dead presidents is also an occasional paraphrase, regardless of the fact that Alexander Hamilton , who is depicted on the $ 10 bill, and Benjamin Franklin , whose portrait is on the $ 100 bill, are not presidents were.

Inscriptions

The word LIBERTY ("freedom") can be found on all dollar coins minted since 1793 . The motto E pluribus unum (“One out of many”) initially only carried a few gold and silver coins. It is now part of all US coins. With the Coinage Act of 1864 , the 2-cent piece was introduced. It was the first coin with the inscription In God we trust (" In God we trust "). The saying was gradually adopted on the other coins and has been minted on all coins since 1938. The banknotes only bear the inscription In God We Trust . This first appeared in 1957 on a silver certificate for one dollar after the saying was declared a national motto in 1956.

Hawaiian dollars

In order to prevent larger dollar stocks from falling into enemy hands in the event of a possible conquest of Hawaii, Hawaii's own banknotes were issued from June 1942. These had the same motif as the normal dollar bills, but the seal of the treasury and the serial number were printed in brown instead of red or blue and the imprint HAWAII was added, twice small on the front and once large on the back. The series included $ 1, $ 5, $ 10, and $ 20 notes.

See also

literature

- Anton Zischka : The dollar - splendor and misery of a currency. Munich 1986, ISBN 3-7844-7172-2 .

- European Central Bank: Review of the International Role of the Euro. (PDF; 900 KB) , Frankfurt 2005.

- Günther Schön: World coin catalog 20th century. Battenberg Verlag, Augsburg 1993, ISBN 3-89441-096-5 .

- Hans Harlandt: The money. Schäuble Verlag Rheinfelden, Berlin 1994, ISBN 3-87718-542-8 .

- Krumnow, Gramlich (Ed.): Gabler-Bank-Lexikon: Bank - Stock Exchange - Financing. 12th edition. Gabler, Wiesbaden 1999, ISBN 3-409-46112-4 .

- Oettermann, Stephan: Strong money. What the dollar has to do with Hercules. In: Diagonal. Journal of the University-Comprehensive University-Siegen on the topic: Money. Siegen 1991, pp. 133-134.

Web links

- www.moneyfactory.gov: The “Bureau of Engraving and Printing” of the US Treasury Department

- Coin Specifications of the US Mint www.usmint.gov

- Current and historical banknotes of the USA

Individual evidence

- ↑ cf. Letter from AE Perez to the Austrian Chancellor Metternich from 1820 (also about the costs of a consulate in Havana), reproduced in Rudolf Agstner : "... which would be a convenable colony for Austria ..." - Kk consulates in the Caribbean or Puerto Rico as an kk colony? In: ders .: From emperors, consuls and merchants: The k. (U.) K. Consulates in Arabia, Latin America, Latvia, London and Serbia , Volume 2 (= research on the history of the Austrian Foreign Service , Volume 7), LIT Verlag, Münster 2012, ISBN 978-3-643-50459-3 , in particular p. 101 ( limited preview in Google Book search).

- ↑ The name of the (Dutch) guilder can still be found in the Aruba "florin" , the other Caribbean islands have alternating currencies called "dollars" or "pesos".

- ↑ "$ sign" ( Memento from September 28, 2007 in the Internet Archive ), accessed on June 19, 2010

- ↑ Kross Samuelson: Documentary History of Banking and Currency in the United States. Volume 1, New York 1969, pp. 19, pp. 95-100

- ↑ History US-Dollar. Retrieved November 27, 2009

- ↑ Kross Samuelson: Documentary History of Banking and Currency in the United States. Volume 3, New York 1969, p. 1754.

- ^ John Mathew Culbertson: Money and Banking. 2nd edition, New York 1977, ISBN 0-07-014886-4 , p. 508.

- ↑ coinlibrary.com: Legal text of March 3, 1849 (English) ( Memento of the original of May 14, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , accessed on March 2, 2010

- ^ History of the US dollar. Retrieved November 29, 2009

- ^ Nathan Lewis: GOLD - The Once and future money. 2007, ISBN 978-0-470-04766-8 , pp. 153-174, p. 197.

- ^ Bretton Woods System. Retrieved November 28, 2009

- ↑ Gerald M. Meier: Problems of a World Monetary Order. Hoboken, New Jersey 1974, ISBN 0-19-501801-X , p. 27.

- ^ William Hauptman, Corinne Currat, Dominique Hoeltschi, préface de Sylvie Wuhrmann: Peindre l'Amerique - Les artistes du Nouveau Monde 1830-1900 . In: La Bibliothèque des Arts . Fondation de l'Hermitage , Lausanne 2014, ISBN 978-2-88453-186-3 , p. 90 ff., 165 .

- ↑ a b Lessons from history: From bond crash to gold ban . Wirtschaftswoche, February 3, 2009. Retrieved November 28, 2009

- ↑ Timeline . In: usmint.gov. Retrieved November 30, 2009.

- ↑ Money, gold and the gold standard. Retrieved November 28, 2009

- ↑ International policy analysis by Jörn Griesse and Christian Kellermann. Accessed December 2, 2009 (PDF; 511 kB)

- ↑ There is precarious calm in the currency markets. Article by Robert Mayer, accessed December 2, 2009

- ↑ comdirect Bank AG: 20-year price chart US dollar - euro

- ^ Philipp Hartmann: Currency competition and foreign exchange markets: the dollar, the yen and the euro. 1998, pp. 77-131.

- ↑ Currency: Japanese yen. ( Memento of the original from November 26th, 2009 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved December 1, 2009

- ↑ Source: IFS database

- ^ Source: Pacific Exchange Rate Service.

- ^ Krumnow / Gramlich: Gabler-Bank-Lexikon: Bank - Stock Exchange - Financing. 12th edition, 1999, p. 880.

- ↑ US currency. ( Memento of the original from September 16, 2011 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved November 28, 2009

- ↑ Bernd Johann: Financial market: The dollar myth is fading. In: Focus Online. July 19, 2013, accessed December 11, 2014 .

- ↑ Wall Street gambled away the dollar. In: tagesspiegel.de. Retrieved December 11, 2014 .

- ↑ Foreign Office on Cuba

- ↑ Forex Seminar: US Index. Retrieved December 1, 2009

- ^ Federal Reserve: Dollar Index. Retrieved October 6, 2010

- ↑ Coin Facts. Retrieved November 29, 2009

- ↑ Burlington.eu. Retrieved on November 28, 2009 ( Memento of the original from January 18, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Nickel. Retrieved November 26, 2009

- ↑ Dime. Retrieved November 26, 2009

- ↑ Quarter ( Memento of the original from July 17, 2009 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . In: dtn-info.com. Retrieved November 26, 2009.

- ↑ United States Mint / 25 cent coin . In: usmint.gov. Retrieved November 26, 2009.

- ↑ Half a dollar . In: usmint.gov. Retrieved November 26, 2009.

- ↑ Unique silver coin brings in ten million dollars. In: Spiegel Online. January 25, 2013, accessed December 11, 2014 .

- ^ Tyll Kroha (1977) Lexicon article "Dollar" in Lexikon der Numismatik, Bertelsmann Lexikon-Verlag, pp. 117f

- ↑ hypertextbook.com

- ↑ Legal tender status of currency . In: treasury.gov.

- ↑ The largest money factory in the USA A podcast broadcast by Anja Steinbuch and Michael Marek on Bayern 2 from May 16, 2019 - manuscript of the series p. 5 (PDF file) accessed on August 18, 2019

- ↑ The largest money factory in the USA A podcast broadcast by Anja Steinbuch and Michael Marek on Bayern 2 from May 16, 2019 - manuscript of the series p. 7 (PDF file) accessed on August 18, 2019

- ↑ a b c Bureau of Engraving and Printing ( Memento of the original from June 25, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. . In: moneyfactory.gov. Retrieved November 27, 2009.

- ↑ Green Ink ( Memento of the original from November 18, 2009 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . In: moneyfactory.gov. Retrieved November 25, 2009.

- ↑ The USSS and Counterfeiting ( Memento of the original from May 13, 2008 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . In: moneyfactory.gov. Retrieved November 28, 2009.

- ↑ a b c d e f Security Features ( Memento of the original from September 28, 2007 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . In: moneyfactory.gov. Retrieved November 28, 2009.

- ↑ New 100 dollar bill to protect against counterfeiting. In: Spiegel Online. April 21, 2010, accessed December 11, 2014 .

- ↑ Federal Reserve Announces Delay in the Issue Date of Redesigned $ 100 Note ( Memento of the original from December 29, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . In: newmoney.gov. October 1, 2010 (accessed February 20, 2011)

- ↑ Eamon Javers: The Fed Has a $ 110 Billion Problem with New Benjamin . In: www.cnbc.com . December 7, 2010 ( online [accessed February 20, 2011]).

- ^ Origin of the word buck. Retrieved November 30, 2009

- ↑ Nicknames. Retrieved November 29, 2009

- ↑ United States Department of the Treasury, In God We Trust. Retrieved April 26, 2015

- ↑ Timothy B. Benford: History Behind $ 1 Bills with 'HAWAII' Printed in Large Letters Across the Backside. (No longer available online.) July 6, 2007, archived from the original on October 10, 2012 ; accessed on July 31, 2012 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Hawaiian dollar banknotes. Bank Note Museum, accessed October 10, 2017 .