Ellsberg paradox

The Ellsberg paradox is a paradox from decision theory in which decisions violate the postulates of the subjective expected utility theory ( SEU ), which in large parts of the economy is not only seen as a normative basis for decisions but also serves as the basis for descriptive models. Such voting behavior cannot generally be understood as an underlying individual probability distribution and therefore cannot be explained in particular by risk attitudes ( risk aversion , neutrality or affinity ). Daniel Ellsberg therefore makes the additional distinction between risk and uncertainty (in the original ambiguity ). An important result of the experiment is that people often prefer a risk - the probability distribution of which is known - to a situation of uncertainty, even if the perceived probabilities are kept constant.

Historical background

Both John Maynard Keynes and Frank Knight grappled with the concept of uncertainty as early as the 1920s.

FH Knight writes:

“Uncertainty must be understood as something radically different from the familiar meaning of risk, from which it has never been properly separated […] The crucial fact is: risk in some cases means a measurable quantity, while in other cases it means something has a completely different character; and there are far-reaching and decisive differences with regard to the behavior of phenomena depending on which of these [meanings] actually exist. [...] It seems that measurable uncertainty - called "risk proper" - differs from non-measurable [uncertainty] in one The extent to which it [at first] is ultimately not an uncertainty at all. "

In addition, it is often said that the concepts that Keynes developed in his A Treatise on Probability in 1921 are very closely related to the criticism of the SEU model that Ellsberg formulated. Among other things, he introduces a concept of uncertainty, which he describes as non-comparable probabilities .

Differentiation between risk, uncertainty and uncertainty

In (1) and (2), possible results and probabilities are known, while in (4) only the possible results are known, but no probabilities. In (3) the urn contains an extremely momentous result, which can either be extremely good ('diamond') or extremely bad ('bomb'). In (5) neither possible realizations nor probabilities are known. Where (4) and (5) represent decisions under ambiguity.

In the real world, people have to make decisions in very different situations. Knight already distinguishes between

(i) a priori probabilities that can be logically derived in random games;

(ii) Statistical probabilities derived from empirical data; and

(iii) predicting situations where there is no basis for any sort of classification.

Based on this, various scenarios of security / risk / uncertainty (ambiguity) can be distinguished.

The Ellsberg experiment includes both risk (the urn or colors whose distribution is known) as well as uncertainty / ambiguity (“Knightian uncertainty” - the urn or the colors whose distribution is not known).

Subjective expectation-utility theory

It often seems plausible that agents' (subjective) probability distributions can be derived directly from bets made by agents regarding different lotteries , but one automatically assumes that they act rationally within the framework of a (subjective) expected utility theory (subjective expected utility - SEU). This means in particular that one assumes that there is at least a “qualitative probability relationship” between events.

In order for a relationship ![]() between events to have the properties of a "qualitative probability relationship ", the following conditions must be met in particular: ( and denote the complements to α and β)

between events to have the properties of a "qualitative probability relationship ", the following conditions must be met in particular: ( and denote the complements to α and β)

-

arranges all events; for two events α and β the following applies: Either α is “not less likely” than β or β is “not less likely than” α; and if α ≥ β and β ≥ γ ⇒ α ≥ γ

arranges all events; for two events α and β the following applies: Either α is “not less likely” than β or β is “not less likely than” α; and if α ≥ β and β ≥ γ ⇒ α ≥ γ - If α is more likely than β ⇒ is less likely than ; if α is equally probable and β is equally probable as ⇒ α is equally probable as β

- If α and γ are mutually exclusive and β and γ also (α ∩ γ = β ∩ γ = 0), and at the same time α is more likely than β ⇒ the union (α ∪ γ) is more likely than (β ∪ γ)

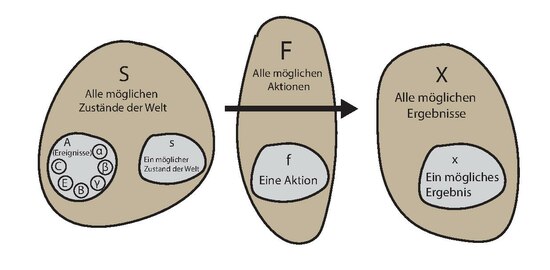

In order to be able to infer an underlying “qualitative probability relationship” with respect to the events from the decisions of the agents (actions), the relationship ≿ between the actions must be subject to some axiomatic restrictions. One such system are the Savage Postulates, the most important of which are:

- P1 (Ordering): The relation ≿ is complete, reflexive and transitive .

- P2 ( Sure-Thing Principle ): The order of preference between two actions f and f * depends only on the values of f and f * in which they differ. This means that for two actions f and f * that only differ in a special event E and are otherwise the same, it is irrelevant for the comparison which values they assume outside of E.

- P3 (Eventwise Monotonicity): Let there be an action that always achieves the result x in the case of (the non-empty ) event E. If this action is changed in such a way that in the case of E it always achieves the result y, then the preference between the two actions should correspond exactly to the preference between the results x and y (or more precisely: the order of the constant functions that x or y).

- P4 (Weak Comparative Probability): P4 is used to establish a ( qualitative ) ranking of events. Given the results x * ≻x and y * ≻y, then applies to all events A and B: ( and denote the complements of A and B)

The Ellsberg experiment

The Ellsberg Paradox goes back to Daniel Ellsberg's 1961 work "Risk, ambiguity and the Savage axioms". There he presents two versions of an urn experiment , both of which come to the conclusion that people show uncertainty aversion in most situations.

The Ellsberg Experiment: The 2-color version

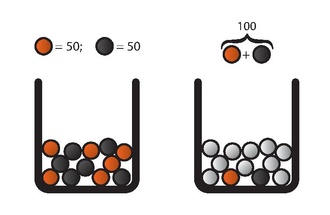

The structure is as follows: There are two urns , each containing exactly 100 balls. In urn 1 there are - verifiable by the agent - exactly 50 red and 50 black balls. In urn 2 there are also 100 balls, but the distribution between black and red is unknown; so it can contain any combination from (100 Red 2 & 0 Black 2 ) to. (0 Red 2 & 100 Black 2 ) including all distributions in between. The following actions are offered to the agent (one after the other):

- Bet on red 1 or black 1 or indifferent?

- Bet on red 2 or black 2 or indifferent?

- Bet on red 1 or red 2 or indifferent?

- Bet on black 1 or black 2 or indifferent?

Where red 1 corresponds to a (randomly drawn) red ball from urn 1 and black 2 to a (randomly drawn) black ball from urn 2 .

The typical response pattern that results is (set 1 ): In cases 1 and 2 indifference. In case 3: red 1 is preferred over red 2 and in case 4: black 1 is preferred over black 2 .

There is also the (much rarer) pattern in which case 3 and case 4 are answered exactly the other way around as in set 1 (set 2 ). In case 3: red 2 is preferred over red 1 and in case 4: black 2 is preferred over black 1 .

In addition, there is a third pattern in which there is indifference about all possible answers (set 3 ). Other response patterns are possible, but even more rarely. The latter (Set 3 ) is also the only - if the case 1 & 2 indifference - that consistent with the Savage axioms or SEU is common. Both Set 1 and Set 2 violate axioms that are necessary to derive an SEU from the answers, with Set 1 representing the (typical) case of uncertainty aversion and Set 2 the (much rarer) case of uncertainty affinity. In order to understand the contradiction, we assume that we are in Set 2 : An observer using the Savage axioms would conclude from the choice in Case 3: Red 1 ≺ Red 2 that we are Red 2 as more likely consider red 1 . At the same time, however, we also prefer Black 2 over Black 1 , which would mean that we consider Black 2 to be more likely than Black 1 . But since black 1 corresponds exactly ( complement red 1 ) and black 2 corresponds exactly ( complement red 2 ) in our experiment , this would mean that we consider red 2 to be more likely than red 1 and at the same time to be more likely than . But this is an obvious contradiction.

The Ellsberg Experiment: The 3-color version

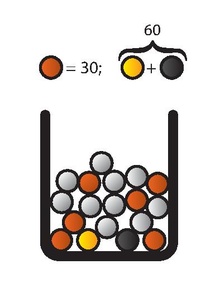

Another version of the Ellsberg experiment is as follows:

In an urn there are 30 red and 60 black and yellow balls, but the distribution between black and yellow is unknown. A ball is drawn at random from the urn. Now you have to choose between the following actions in pairs: First

| 30th | 60 | ||

|---|---|---|---|

| red | black | yellow | |

| Action I. | 100 € | 0 € | 0 € |

| Action II | 0 € | 100 € | 0 € |

The agent can choose between Action I (bet on red) or Action II (bet on black).

And then under the same conditions:

| 30th | 60 | ||

|---|---|---|---|

| red | black | yellow | |

| Action III | 100 € | 0 € | 100 € |

| Action IV | 0 € | 100 € | 100 € |

The agent can choose between Action III (bet on red or yellow) or Action IV (bet on black or yellow)

Here, too, the typical response pattern (set 1 ) is:

Action I is preferred to Action II and

Action IV is preferred to Action III

The opposite pattern (set 2 ) is much less common :

Action II is preferred to Action I and

Action III is preferred to Action IV.

Both sets represent a direct violation of the sure-thing principle , according to which the order of the first pair (actions I and II) would also have to be maintained in the second pair (actions III and IV), since action III is nothing more than action I and action IV is nothing other than Action II. The only difference is that the last column has been increased by a constant amount. Again, there is no combination of yellow and black that would correspond to this choice within an SEU .

Probabilistic Sophistication

Mark J. Machina and David Schmeidler introduce a more general version of the SEU model, in which preferences do not necessarily have to conform to the expected utility hypothesis, but can still be described with a probability distribution. The main difference is that expected utility functions combine (subjective) probabilities linearly, while “probabilistic sophistication” does not require this. “Probabilistic sophistication” is therefore a weaker requirement than those required to construct an SEU: Violations of the sure-thing principle or the expected utility theory in general do not generally imply a violation of “probabilistic sophistication”.

But these weaker demands are also violated in the Ellsberg Paradox. The decisions made there do not allow any conclusions to be drawn about an underlying probability distribution (linear or otherwise).

Normative and descriptive perspective

In economics, SEU assumptions often form the basis of descriptive rational-agent models. For such an interpretation, the Ellsberg paradox is a direct contradiction and cannot be integrated without changing the model basis or explicitly restricting the area of application. The possibly weaker claim that the Savage axioms have at least a normative role is easier to defend, although a problem arises here too, since individuals in certain situations, even after reflection, deliberately violate the axioms and thus do not recognize their normativity. Ellsberg argues that there are at least three characteristics commonly associated with irrational behavior that are absent from this behavior, namely:

- a) That this behavior is unpredictable (i.e. no formal decision rules can be found).

- b) That it Intransitivität has.

- c) That it rejects utility by e.g. B. chooses strictly dominated strategies .

The last point (c) is, however, questionable: As long as we are in the situation of the initial example of the three-color version and use a choice according to Laplace's rule (1/3; 1/3; 1/3) as a benchmark , There is actually no disadvantage to choosing Bet I and Bet IV as any other choice will generate the same expected payout. However, if you pay a premium for the "felt safe choice" (i.e. a premium for bet I versus bet II and at the same time a premium for bet IV versus bet III), this has to be subtracted from the expected profit, and this strategy loses versus the Laplace reference strategy. or any other SEU strategy that pays no such bonuses, as it is not possible that there are more red balls than black balls, but at the same time more black balls than red balls (after all, it's the same urn). This applies regardless of the underlying utility function and, in particular, regardless of risk aversion .

Criticism of the normative validity of such a choice comes from Howard Raiffa , among others :

He suggests randomization as a thought experiment: Assuming an individual has the (typical) order of preferences I≻II and IV≻III. He is now offered two bets:

Option A: A fair coin is tossed and in the case of heads bet I is played and in the case of tails bet IV

Option B: A fair coin is tossed and in the case of heads bet II is played and in the case of tails bet III

| head | number | |

|---|---|---|

| Option a | Action I. | Action IV |

| Option B. | Action II | Action III |

Due to strict dominance, an individual who has the above preferences should now strictly prefer option A over option B as well. However, if we now analyze the situation - from the position in which a certain color was drawn - it looks like this:

From this perspective, option A and option B appear to be objectively identical and thus paying a premium for A seems irrational. With this structure it is ensured at the same time that distortions by the hostile environment scenario cannot occur, since the experimenter cannot know whether heads or tails will fall and thus cannot manipulate the urns.

Explanations

Hostile environment

If it is not clear that all questions refer to the same urn, the offer of the bets could be interpreted as a signal in a game with a "hostile authority", the aim of which is to minimize the player's profit, as e.g. B. the execution of the experiment would then be "cheaper" for them. In such a case, the player could assume that the uncertain options would work to his disadvantage: when choosing between red and black, he would assume that there are probably fewer black balls than red balls, while in the situation where he is between (red and Yellow) vs. (Black and yellow), assumes that there are fewer yellow than red balls ( 3-color version ).

Info gap decision theory

This approach assumes that the agent cannot maximize expected utility because it does not know exact probabilities. Instead of subjective probabilities, he now internally formulates an info-gap model for the part for which he does not know any probabilities and thus tries to maximize the robustness of the decision against the uncertainty in this part.

Comparative Ignorance Hypothesis

Craig R. Fox and Amos Tversky argue that the aversion to ambiguity only results from comparing options with different degrees of ambiguity. In particular, this means that such an aversion disappears or decreases sharply in the absence of comparable options (i.e. with an isolated choice).

Economic decision-making models under ambiguity

Since its popularization by D. Ellsberg 1961, the Ellsberg Paradox has, or experienced the whole field of decision theory under uncertainty / ambiguity, a considerable increase in research and significant theoretical and experimental advances. This has resulted in a large number of models that model and explain uncertainty in different ways. These models are generally more powerful than a pure SEU model because they already contain this as a special case. Provide an overview of the development (Etner et al., 2012) and (Camerer & Weber, 1992). The most important models are the Choquet expected utility developed by David Schmeidler in 1989 and the Maxmin expected utility developed by Itzhak Gilboa & Schmeidler in 1989 . However, the increased descriptive validity obtained in this way - compared to SEU modeling - is accompanied by an increased complexity due to the increase in the number of parameters. This is expressed, for example, in the fact that in a dynamic situation an additional distinction must be made between agents who do not behave consequently and those who do not behave dynamically consistent.

See also

literature

- D. Ellsberg : Risk, ambiguity, and decision. Taylor & Francis , 2001.

- J. Etner et al .: Decision Theory under Ambiguity In: Journal of Economic Surveys. Vol. 26, No. 2, 2012, pp. 234-270. doi: 10.1111 / j.1467-6419.2010.00641.x

- C. Camerer and M. Weber: Recent Developments in Modeling Preferences: Uncertainty and Ambiguity. In: Journal of Risk and Uncertainty. No. 5, 1992, pp. 325-370. doi: 10.1007 / BF00122575

- Bruno de Finetti : Foresight: its logical laws, its subjective sources (1937), in HE Kyburg and HE Smokler (eds.), Studies in Subjective Probability, New York: Wiley, 1964, 93–159.

Web links

Individual evidence

- ↑ a b See Homo oeconomicus

- ↑ a b Economist - IRRATIONALITY Rethinking thinking Dec 16th 1999

- ↑ a b Economist , Behaviorists at the gates ; May 8th 2003

- ↑ J. Eichberger et al .: Ambiguity and social interaction. In: Oxford Economic Papers. No. 61, 2009, pp. 355-379.

- ^ A b D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, pp. 643-669.

- ^ C. Camerer and M. Weber: Recent Developments in Modeling Preferences: Uncertainty and Ambiguity. In: Journal of Risk and Uncertainty. No. 5, 1992, pp. 325,360.

- ^ FH Knight , Risk, Uncertainty, and Profit. , Boston, MA: Hart, Schaffner & Marx; Houghton Mifflin Company, 1921

- ↑ A. Feduzi: On the relationship between Keynes's conception of evidential weight and the Ellsberg paradox. In: Journal of Economic Psychology. No. 28, 2007, pp. 545-565.

- ↑ a b B. Meder et al .: Decision making in uncertain times: what can cognitive and decision sciences say about or learn from economic crises? In: Trends in Cognitive Sciences. Vol. 17, No. 6, 2013, pp. 257-260.

- ^ D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, p. 648.

- ↑ MJ Machina and D. Schmeidler: A More Robust Definition of Subjective Probability. In: Econometrica. Vol. 60, No. 4, 1992, pp. 749 f.

- ^ I. Gilboa et al .: Theory of Decision under Uncertainty. Cambridge: Cambridge university press. , 2009, p. 97 ff.

- ↑ D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, pp. 650 ff.

- ^ D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, pp. 654 f.

- ↑ MJ Machina and D. Schmeidler: A More Robust Definition of Subjective Probability. In: Econometrica. Vol. 60, No. 4, 1992, pp. 753 f.

- ↑ J. Etner et al .: Decision Theory under Ambiguity In: Journal of Economic Surveys. Vol. 26, No. 2, 2012, p. 253. doi: 10.1111 / j.1467-6419.2010.00641.x

- ^ D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, p. 656.

- ^ D. Ellsberg : Risk, ambiguity and the Savage axioms In: Quarterly Journal of Economics Vol. 75, No. 4, 1961, p. 663.

- ^ A b H. Raiffa : Risk, Ambiguity, and the Savage Axioms: Comment. In: The Quarterly Journal of Economics. Vol. 75, No. 4, 1961, pp. 690-694.

- ↑ a b R. Lima Filho: Rationality Intertwined: Classical vs Institutional View. In: SSRN 2389751. 2009, pp. 5-6.

- ^ Y. Ben-Haim: Info-Gap Decision Theory. GB, Academic Press, 2006

- ^ CR Fox & A. Tversky: Ambiguity aversion and comparative ignorance. In: The quarterly journal of economics. 1995, pp. 585-603.

- ↑ a b J. Etner et al .: Decision Theory under Ambiguity In: Journal of Economic Surveys. Vol. 26, No. 2, 2012, pp. 234-270. doi: 10.1111 / j.1467-6419.2010.00641.x

- ^ C. Camerer and M. Weber: Recent Developments in Modeling Preferences: Uncertainty and Ambiguity. In: Journal of Risk and Uncertainty. No. 5, 1992, pp. 325-370. doi: 10.1007 / BF00122575

- ↑ D. Schmeidler: Subjective probability and expected utility without additivity. In: Econometrica: Journal of the Econometric Society. 1989, pp. 571-587. doi: 10.2307 / 1911053

- ^ I. Gilboa & D. Schmeidler: Maxmin expected utility with non-unique prior. In: Journal of mathematical economics. Vol. 18, No. 2, 1989, pp. 141-153. doi: 10.1016 / 0304-4068 (89) 90018-9

- ^ A. Dominiak, P. Dürsch & JP Lefort: A dynamic Ellsberg urn experiment. In: Games and Economic Behavior. Vol. 75 No. 2, 2012, pp. 625-638. doi: 10.1016 / j.geb.2012.01.002

![{\ displaystyle \ left [{\ begin {array} {ll} f ^ {*} (s) & {\ mbox {if}} s \ in E \\ g (s) & {\ mbox {if}} s \ notin E \ end {array}} \ right] \ succsim \ left [{\ begin {array} {ll} f (s) & {\ mbox {if}} s \ in E \\ g (s) & { \ mbox {if}} s \ notin E \ end {array}} \ right] \ Rightarrow \ left [{\ begin {array} {ll} f ^ {*} (s) & {\ mbox {if}} s \ in E \\ h (s) & {\ mbox {if}} s \ notin E \ end {array}} \ right] \ succsim \ left [{\ begin {array} {ll} f (s) & { \ mbox {if}} s \ in E \\ h (s) & {\ mbox {if}} s \ notin E \ end {array}} \ right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/0b2792e4c87527cca6fc8ca3290c05465c0f534b)

![{\ displaystyle \ left [{\ begin {array} {ll} x & {\ mbox {if}} s \ in E \\ g (s) & {\ mbox {if}} s \ notin E \ end {array} } \ right] \ succsim \ left [{\ begin {array} {ll} y & {\ mbox {if}} s \ in E \\ g (s) & {\ mbox {if}} s \ notin E \ end {array}} \ right] \ Leftrightarrow x \ succsim y}](https://wikimedia.org/api/rest_v1/media/math/render/svg/84461945b593326c0547e0551395dfa541a5bd97)

![{\ displaystyle \ left [{\ begin {array} {ll} x ^ {*} & {\ mbox {if}} A \\ x & {\ mbox {if}} {\ overline {A}} \ end {array }} \ right] \ succsim \ left [{\ begin {array} {ll} x ^ {*} & {\ mbox {if}} B \\ x & {\ mbox {if}} {\ overline {B}} \ end {array}} \ right] \ Leftrightarrow \ left [{\ begin {array} {ll} y ^ {*} & {\ mbox {if}} A \\ y & {\ mbox {if}} {\ overline {A}} \ end {array}} \ right] \ succsim \ left [{\ begin {array} {ll} y ^ {*} & {\ mbox {if}} B \\ y & {\ mbox {if} } {\ overline {B}} \ end {array}} \ right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/6b5d4688730c63b27213174b34b63c13777fee75)