Guaranteed minimum income

The Guaranteed Minimum Income ( MEK ) is a socio-political transfer concept in which every citizen receives a basic income from the state. In contrast to the citizen's allowance , not all state social benefits should be cut or abolished, but the MEK is not unconditional.

The idea of ( MEK ) in Germany was developed in the late 1970s at the Johann Wolfgang Goethe University in Frankfurt am Main by a group of young economists in the context of the student movement, who dealt with the failure of the Keynesian project of global control , the emerging neoconservative economic policy in the USA , the operaismo (Italian: operaismo) of Italian philosophers ( Antonio Negri , Mario Tronti ) and the Neoricardian School from Cambridge (UK) ( Joan Robinson , Piero Sraffa , Nicholas Kaldor ).

Methodologically and mathematically, it is similar to the negative income tax , which exists in the USA as Earned Income Tax Credit and in Great Britain (Working Families Tax Credit) and goes back to a proposal by Milton Friedman from 1962. The main differences lie in the poverty resistance, needs orientation, the recipient's obligation to explain and the sanction mechanisms. The models of a ( MEK ) discussed in Germany include B. the solidarity citizens 'money ( Althaus model), the Ulm model , the " Liberal citizens' money " or the basic income model by Götz Werner .

General concept

The ( MEK ) is a tax-financed income, which secures the existence and social participation. The means test, the practice of sanctions and the obligation to work are severely restricted or abolished compared to unemployment benefit II . Instead, positive incentives should enable socially meaningful activities without compulsory work, but not prescribe them. Nonetheless, the ideal of gainful employment remains, because gainful activities are decisive for the amount of the tax credit granted.

To finance the ( MEK ), a single tax flat tax and a reorganization of the tax system are conceivable, as well as much less effort and bureaucracy in social administration, as existing transfer payments would be replaced by the ( MEK ). Unemployment benefits , social assistance (Germany) , pensions , child benefits and similar social benefits can gradually disappear due to the guaranteed minimum income. In addition, there would be a flat-rate health and care premium for basic insurance, which differ in terms of amount and structure in the models.

functionality

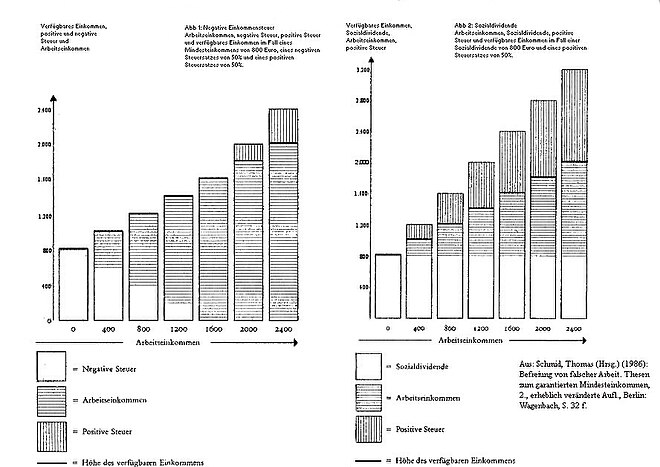

A distinction must be made between earned income, negative and positive taxes and disposable income. Negative tax means the state transfer payment and positive tax means a payment to the state in accordance with the previous wage and income tax. In the case of low incomes, the disposable income will consist of labor income plus negative tax; in the case of higher incomes, it will consist of the seven types of income minus positive tax. Analogous to a proportional negative income tax, with the guaranteed minimum income from the transfer limit positive income is taxed as a percentage. Up to the transfer limit, Fig. 1 shows a negative income tax : The person is a beneficiary. Above the transfer limit, the person becomes a net payer, with the payments being used to finance the benefits to recipients. The percentages (after the transfer limit) are either the same as for the negative income tax or lower as is the case with the Ulm model . The social dividend (SD), on the other hand, is paid to every citizen, regardless of their own earnings (Fig. 2). This initially makes the SD more expensive; the volume that has to be redistributed is very large. In principle, it is conceivable that income is taxed at 50 percent. Then the social dividend, labor income, positive tax and disposable income can be displayed graphically as in the figure for single taxpayers. The overall result is obviously the same as in the case of negative income tax.

financing

From an economic point of view, the ( MEK ) is not an additional income, but an advance that is offset against tax based on performance. In the gross calculation in Germany, with a basic income of € 800 per month for 80.5 million citizens, this would result in a financial volume of € 768 billion per year. There are two model approaches to financing these amounts: taxation of consumption and income taxation.

- Consumption taxation: gross income is paid out 1: 1 as net income. Goods and services serve as a source of financing for the basic income (Werner model). Not only would the tax system have to be changed significantly, but high consumption taxes would also apply. A value added tax of 50% will be necessary, which could fuel the black market and tax evasion. Undeclared work can be avoided if income from work is not taxed. Problems of income distribution remain unsolved.

- Income taxation: offsetting against one's own income could be achieved relatively easily in the existing system according to the transfer limit model ( Ulm model , solidarity citizens' money ).

- In the net bill, the transparent triangle in the graphic would have to be financed, i.e. an amount that would be significantly below the gross bill.

Differences to Hartz IV and the unconditional basic income

The ( MEK ) differs from a state-administered basic security or unemployment benefit II or Hartz IV, which usually requires the willingness to accept a job and is only granted as a substitute if no own income or assets can be used. The goal set for unemployment benefit II itself, namely to dissolve entrenched unemployment by putting pressure on the unemployed, has not been achieved. Rather, the length of stay in unemployment has increased. A quarter of the long-term unemployed have been unemployed for more than four years and the sanctions regime has worsened participation in society. Therefore four demands are appropriate: the increase in the standard rate, the simplification of the transfer system, the incentive system and an actual livelihood security.

The guaranteed minimum income ( MEK ) is therefore a form of citizen benefit with a social face and can be understood as the entry level of the unconditional basic income .

criticism

Pro-arguments for a ( MEK ) are:

- It is a possible answer to the crisis of the Bismarckian welfare state ( social legislation under Bismarck ).

- Due to technical change ( automated processes ), the working society is running out of work. Wage subsidies can stop work and income from drifting apart.

- Social utopian concepts in the context of the crisis in the working society Initiative freedom instead of full employment (Sascha Liebermann).

- Ecological aspects of quantitative growth ( environmental protection - wages for non-work , society for culture and ecology).

Cons: A basic or minimum income is criticized primarily for these reasons:

- The system change is not financially viable.

- The system change is not conducive to job supply and work ethic.

- The basic income is a new combined wage and the number of top-ups is increasing because employers, with reference to the state wage subsidy, set a wage spiral downwards ( wage dumping ), which put an additional burden on taxpayers ( Christoph Butterwegge ).

- (Wage) work is identity-creating. In contrast, wages for non-work destabilize the social cohesion of society.

Against this criticism, especially from a trade union perspective, it is argued that a minimum living wage would curb the low-wage sector - especially in combination with an adequate statutory minimum wage. Low wages and precarious working conditions would thus be replaced by better paid and more attractively designed work, because the recipients could reject bad or badly paid jobs ( Götz Werner ). In contrast to low-wage work, good work would also generate additional tax revenue. Incidentally, social experiments in the USA did not reveal any noticeable reduction in the number of jobs when various models of the negative income tax were granted .

Web links

- Archive Basic Income , extensive collection of links on the subject

- Michael Borchard (ed.): The solidarity citizen money. Analysis of a reform idea. Lucius & Lucius, Stuttgart 2008, ISBN 978-3-8282-0393-8 ( contributions by Dieter Althaus and Michael Opielka / Wolfgang Strengmann-Kuhn as PDF; 806 kB ; further PDFs on the KAS website )

- Guaranteed minimum income , further development from Hartz IV to a basic income

- Klaus-Uwe Gerhardt : Hartz plus. Wage subsidies and minimum income in the low wage sector , VS-Verlag, Wiesbaden 2006, pp. 201–216, ISBN 978-3-531-14842-7

- ders./ Arnd Weber: Guaranteed minimum income, Alemantschen . Materials for radical ecology, ecological professional practice , ed. from the Society for Culture and Ecology ; Volume 3, Maintal, pp. 69–99, 1983 [1]

- Max Neufeind: "Land of milk and honey or realized civil society? An interview on the unconditional basic income with Sascha Liebermann and Theo Wehner." In: "Zurich Contributions to the Psychology of Work." 1/2012. (PDF)

- Michael Opielka : Basic Income instead of Hartz IV. On the political sociology of social reforms. In: Sheets for German and international politics . 9/2004, pp. 1081-1090 ( PDF )

- Thomas Schmid (Ed.): Liberation from wrong work. Theses on the guaranteed minimum income . Second, significantly changed edition, Verlag Klaus Wagenbach, Berlin 1986, ISBN 3-8031-2109-4 , Universitätsverlag Karlsruhe, Karlsruhe 2007, ISBN 978-3-86644-109-5 ( PDF; 6.3 MB )

- Thomas Straubhaar (Hrsg.): Unconditional basic income and solidarity citizens' money - more than socially utopian concepts. Hamburg University Press, Hamburg 2008, ISBN 978-3-937816-47-0 ( PURL )

- Wolfgang Strengmann-Kuhn : Financing a basic income through a "Basic Income Flat Tax". ( PDF ) In: Götz W. Werner & André Presse (ed.): Basic income and consumption tax.