Economies of scale

As economies of scale ( englisch economies of scale ) are in the production theory of economics cost advantages referred to, resulting from the company size of a company or its production yield.

General

As long as economies of scale exist, it generally makes sense for a company to produce more units of a good or service in order to achieve lower unit costs . The fixed costs are mostly allocated to a larger amount ( fixed cost degression ). The law of mass production works .

Under certain circumstances, an increase in the quantity produced can also lead to size disadvantages ( English diseconomies of scale ). As the company grows, the (not directly productive) coordination effort in a company typically increases, and administration can become more cumbersome.

definition

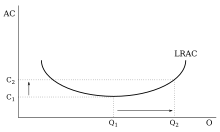

Economies of scale are also referred to as economies of scale , economies of scale or increasing returns to scale. Economies of scale exist if a proportional increase in all production factors (e.g. by 1%) results in a disproportionate increase in all output components (by more than 1%). So if the output of a unit of production increases, the company's average cost of producing that output may decrease to a certain point. In other words, to double a company's output, costs need to be increased less than double. This trend is known as the economies of scale.

Economies of scale are also defined as cost advantages resulting from company size and / or capacity size. The proportional fixed costs per production unit depend on the size of the company or the production volume; the larger the company, the lower the proportionate fixed costs.

With free competition, economies of scale lead to such a large expansion of company size that perfect competition in these economic sectors is no longer guaranteed and only a few companies are active in an industry - or even only a single one. In the one-product case, falling average costs due to high fixed costs lead to immediate incentives for mergers with the aim of increasing efficiency. Having economies of scale maximizes welfare for a given number of businesses. If the companies act under this economic assumption, then they use the (size) advantage in an industry. Thus, the companies have compared to the size of the industry (the market) a large farm size . As a result, they serve a large proportion of the customers and so only a few other companies can enter the market to serve the remaining proportion of the customers. Joe Bain defined this phenomenon in 1949 as the cause of the appearance of a barrier to entry into the market.

The economies of scale method is directly applicable to the analysis of intra- and inter-industrial trade. If a company serves the domestic market with a certain product, it can export this product to another country. In return for this, it could import another good that it does not manufacture itself, but there is a demand for this product on the domestic market. This could make the company more profitable.

Global view

The size advantage is primarily not to be seen in relation to other companies ( competitors ), but in the comparison of one's own input and output quantities. That is to say, which input enables the company to achieve the greatest possible output. This means that profit maximization (profitability principles with regard to the maximum principle ) is implemented as a corporate principle in which cost efficiency (keeping costs as low as possible) is implemented.

"To analyze the relationships between the size of the company and the company's costs, we have to recognize that the expansion path ( curve running through the tangential points of the isocost line and isoquant of a company) no longer forms a straight line when the input proportions are changed, and the concept of returns to scale (inputs are used in constant proportions when the output increases, in contrast to the economies of scale, where the input proportions are variable) no longer applies. Instead, we can say that the company enjoys economies of scale if it can double its output at less than double the cost. The term economies of scale includes increasing economies of scale as a special case, but is more general as it reflects changing input proportions when the company changes its production level. "

Occur

- In the media sector, there are economies of scale when a reduction in the unit costs is followed by an increase in the number of units. The main economies of scale for the media are due to the significant first copy costs. These costs consist of the costs of the entire creation of the editorial and advertising content as well as the costs of production. In this industry, the costs arise regardless of the number of subsequent users.

- In addition to corporate strategies (product differentiation, price differentiation, etc.), economies of scale in production play an important role in realizing effective competition.

- In sales and marketing, economies of scale are also important: large-scale advertising and market presence are the keys to success here.

- In operational sales, the specific sales expenditure plays an important role, as this decreases with a higher sales volume and thus the unit costs also fall.

- Economies of scale also occur in the procurement of resources because, for example, volume discounts are achieved for the procurement of larger quantities and so the costs per unit procured for the company are reduced.

- Even in the area of research and development, economies of scale can be used by placing a generated information advantage and the associated development costs on the highest possible number of pieces.

- However, economies of scale result not only from internal, but also from external contexts. Because a dominant market position of the company brings advantages for customers and market partners and thus leads to self-reinforcing effects.

calculation

To scale to achieve, they are often based on a cost-output elasticity E C measured. E C is the percentage change in production costs resulting from a one percent increase in output:

In order to examine how E C relates to the conventional measure of cost , the equation presented above is rewritten as follows:

- C = cost

- q = quantity

- GK = marginal costs

- DC = average cost

E C = 1 when the marginal cost is equal to the average cost . In this case, there are neither economies of scale nor disadvantages of size, since costs increase proportionally with output.

If E C <1, there are economies of scale because the costs increase less than the output and the marginal costs are lower than the average costs.

If E C > 1, there are size penalties because the marginal cost is higher than the average cost.

Measurement

The SCI index of economies of scale shows whether economies of scale exist or not. This key figure is defined as follows:

- If E C = 1, then SCI = 0 and there are neither size advantages nor size disadvantages.

- If E C > 1, SCI is negative and there are size disadvantages.

- If E C <1, then SCI is positive and there are economies of scale.

Examples

The following examples are intended to illustrate that relevant economies of scale always lose importance when fixed costs are reduced and flexibility is increased. In order to achieve a dominant or at least competitive size, companies therefore often go beyond purely internal, organic growth. By merging with other companies, you are trying to reach a size where you can achieve cost advantages over the competition. Examples include a .:

- the aviation industry: Airbus and Boeing achieve economies of scale in research and development, purchasing, production, sales and service because they share the corresponding market for large aircraft.

- The steel and computer industry: the computer manufacturer Dell has consistently established a direct sales model via telephone and internet and at the same time optimized the logistics so that a customized computer can reach the client within a very short time. By sourcing its monitors directly from the manufacturer, Dell reduces its capital, inventory and production costs.

- the automotive industry: since many small and medium-sized automakers do not have the volume to bear the enormous development costs of new models, these have been taken over by their big competitors over the years.

Another example is the car manufacturer Toyota . In the 1980s the group reduced its fixed costs and a. through an innovative reduction of the inventory within the production process, the shortening of the set-up times of the systems as well as the series production so far that the economies of scale prevailing in this branch played an increasingly minor role.

forestry

A forestry company cuts 600 trees on its land every year. The cost per tree cut is 200 monetary units (MU). The work is carried out by 20 employees with 20 axes and 10 hand saws. If the company doubles its output to 1200, it would need 40 employees, 40 axes and 20 hand saws. The input increases proportionally to the output, so the economies of scale remain constant. For a company with such an output volume, however, there is the possibility of some input factors through machines, B. chainsaws to replace. The machine replaces some workers because it is faster and easier for the employees to operate. The cost of 200 MU per tree cut goes back to 150 MU. The resulting cost reduction results in a lower input with the same output; thus an advantage of size has arisen. The diagram clearly shows the difference and thus the economies of scale on the various levels - output costs, costs per unit.

A forestry company cuts 600 trees on its land every year. The cost per tree cut is 200 monetary units (MU). The work is carried out by 20 employees with 20 axes and 10 hand saws. If the company doubles its output to 1200, it would need 40 employees, 40 axes and 20 hand saws. The input increases proportionally to the output, so the economies of scale remain constant. For a company with such an output volume, however, there is the possibility of some input factors through machines, B. chainsaws to replace. The machine replaces some workers because it is faster and easier for the employees to operate. The cost of 200 MU per tree cut goes back to 150 MU. The resulting cost reduction results in a lower input with the same output; thus an advantage of size has arisen. The diagram clearly shows the difference and thus the economies of scale on the various levels - output costs, costs per unit.

The economies of scale can be seen most clearly in the column on the right, “costs / piece”. Here, the cost per unit of production with economies of scale is much lower than the cost per unit of production with no economies of scale (normal).

Delimitation of size disadvantages

Disadvantages of size exist if more than double the costs are necessary to double the output. They arise when unit costs rise with increasing output, for example when machines are operated beyond their operating optimum (internal size disadvantages) or a spatial concentration leads to excessive stress on the infrastructure (external size disadvantages). Disadvantages in size mostly arise from the fact that the transaction costs rise disproportionately with the growth of a company. Transaction costs include all costs for the coordination of economic activities and arise both within a company and in business activities between market partners.

Disadvantages of size can be differentiated in terms of cultural, technical and administrative nature.

It is important to compensate for cultural size disadvantages, because the larger the company, the more difficult it is to formulate a uniform company structure with which the employees can identify. In complex companies it becomes clear that it is not easy to ensure smooth communication. This calls for committed employees who counteract these processes.

Technical size disadvantages can be counteracted relatively easily. An excessively loaded machine results in higher maintenance costs and energy consumption in the short term, which are easy to measure. This can be avoided, for example, by purchasing new systems with higher capacities.

The risk of administrative size disadvantages is that in large companies the internal bureaucracies grow faster than the company as a whole, and customer relationships can suffer as a result.

Disadvantages in terms of size can, however, be avoided by taking countermeasures in good time. The greatest difficulty lies in recognizing these disadvantages and counteracting them with clear responsibilities or comprehensible reporting systems.

literature

- Elben, glove: manual cost reduction. Methods, case studies, concepts and success factors. 1st edition, Wiley-VCH, Weinheim 2004, ISBN 3-527-50039-1 .

- Günter Knieps: Competition Economics: Regulation Theory, Industrial Economics, Competition Policy. 3rd edition, Springer Verlag, Berlin 2008, ISBN 978-3-540-78349-7 .

- Hal R. Varian: Fundamentals of Microeconomics . 7th edition, Oldenbourg Verlag, Munich 2007, ISBN 3-486-58322-0 .

- PA Samuelson, WD Nordhaus: Economics. The international standard work on macro and microeconomics. 3rd edition, mi-Fachverlag, Landsberg am Lech 2005, ISBN 3-636-03033-7 .

- Robert S. Pindyck, Daniel L. Rubinfeld: Microeconomics . 5th edition, Pearson Studium, Munich 2003, ISBN 3-8273-7025-6 .

Web links

- Huan Zhao: Scale Economies, Unemployment, and Industry Agglomeration (Eng.) Jinhe Center for Economic Research, Xi'an Jiaotong University 2005 (PDF file)

- Rabah Amir: Market Structure, Scale Economies, and Industry performance (engl.) Discussion Paper FS IV 00-08, Science Center Berlin, 2000 (PDF, 541 kB)

- Overcome the limits of growth. Using economies of scale, avoiding disadvantages in size , Roland Berger Strategy Consultants Munich 2005 (PDF file; 143 kB)

- Relief of the environment and traffic through regional economic cycles , research report, Federal Environment Agency, Institute for Economic Research, Berlin 2003, pp. 60–64 (PDF file; 2.27 MB)

Individual evidence

- ↑ a b c d See Robert S. Pindyck, David L. Rubinfeld. Microeconomics . Munich 2003, 6th edition, Pearson Studium, pp. 324 ff., 330, 343, ISBN 3-8273-7164-3 .

- ↑ See Gabler: Wirtschaftslexikon. Economies of scale. 16th edition. Gabler Verlag, Wiesbaden 2005, p. 1296, ISBN 3-409-10386-4 .

- ↑ a b c d Cf. Günter Knieps: Competition Economics : Regulation Theory, Industrial Economics, Competition Policy. 3rd edition, Berlin 2008, Springer Verlag, pp. 5, 13, 58, 68, 74, 223, ISBN 3-540-78348-2 .

- ↑ See Charles van Marrewijk: International Economics . 1st edition. Oxford University Press, New York 2007, p. 211, ISBN 0-19-928098-3 .

- ↑ Rabah Amir: See Market Structure, Scale Economies, and Industry Performance ( PDF; 554 kB) Discussion Paper FS IV 00-08, Wissenschaftszentrum Berlin, 2000, p. 3.

- ↑ Cf. Hans G. Nutzinger , Walter Elberfeld: Regulation, competition and market economy: economies of scale, potential competition and entry barriers. Göttingen 2003, Vandenhoeck and Ruprecht, p. 151, ISBN 3-525-13236-0 .

- ↑ See Roehlano M. Briones. Market Size, Differentiated Scale Economies and Inter Industry Trade (engl.) ( Page no longer available , searching web archives ) Info: The link is automatically marked as defective. Please check the link according to the instructions and then remove this notice. Ateneo de Manila University 2004, pp. 2, 23.

- ↑ Expansion path in mikrooekonomie.de ( Memento of the original from May 1, 2008 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ See Hermann Richter: Press Concentration and New Media . Göttingen 1988, pp. 80 f., ISBN 3-525-12276-4 .

- ↑ a b c d e Cf. Helmut Elben, Martin Handschuh: Handbook of cost reduction. Methods, case studies, concepts and success factors , Weinheim 2004, p. 36 f., ISBN 3-527-50039-1 .

- ↑ See Elben / Glove: Handbook of cost reduction. Methods, case studies, concepts and success factors . Weinheim 2004, p. 37 ff., ISBN 3-527-50039-1 .

- ↑ a b c d e cf. Burkhard Schwenker, Stefan Bötzel: Overcoming the limits of growth. Use economies of scale, avoid size disadvantages (PDF; 146 kB) pp. 5, 8, 14–16.