Budget book

A household book is usually kept by private individuals. It compares all income with the expenditure items. All income and expenses should be arranged clearly and according to months and possibly according to categories (e.g. expenses for food, household items, cars or public transport - as required) in order to enable clear budgeting .

A budget book helps to precisely determine regular and irregular expenses, so that available income can be planned precisely for expenses and savings ( capital formation ) at the beginning of the month . The clear listing of income and expenses ensures cost transparency: the personal financial situation is shown at a glance.

After the budget book has been kept for a year, there is the option of drawing an annual balance sheet .

background

Household books are traditionally and primarily kept in order to record the continuity of income and expenditure within a household with several household members and to identify potential savings if necessary. In addition, a comparison can be made of how the price development has affected the budget of the household ( consumer behavior ).

Only in the second place do they offer a control function that makes it easier for an auditor to identify and remedy irregularities in the accounting of an individual and superfluous processes such as unnecessary payment obligations.

history

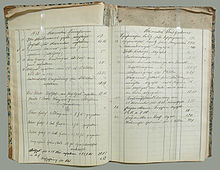

Household books have existed since antiquity : From ancient Greece , among other things, the economics of Hesiod , Xenophon and Aristotle are known. The earliest extant prose text dates from 150 BC. From the pen of Cato the Elder : De agri cultura . These early household books, like the Christian economics from the European Middle Ages , were not yet a pure comparison of income and expenditure. Nonetheless, these writings also served to improve housekeeping and thus to maintain and possibly enlarge the house.

Early household books describe the organization of all household-related things and offer, for example, an overview of harvests, stocks, number of employees, slaughtered animals, kitchen appliances and other household appliances, a list of other possessions - but often also detailed cooking recipes or descriptions of feasts. In addition, the household books also regulated the coexistence in the household and laid down the social roles and expectations of family members and employees. The idea of a preprinted household book with notes and recipes was a business idea of the entrepreneurial housewife Fini Pfannes in the 1920s .

Cultural-historical significance of the budget book

Household books are culturally and historically interesting writings, as they allow an insight into housekeeping and economic activity in earlier eras, which allows direct conclusions to be drawn about the living habits of the time. They also provide information about the social status of family members and employees or slaves.

Categories

A budget book is divided into different categories. As described, it is used to compare income and expenditure; the categories are therefore based on an income side and an expenditure side with monthly fixed costs and variable expenses.

- Income: The income includes all net wages and salaries as well as all other payments, such as pensions, social benefits, child benefit, etc., as well as income from rental and interest.

- Fixed costs: This category includes the fixed costs that are incurred each month. Sub-categories are, for example, rent, insurance premiums, costs for electricity and gas, etc. In the case of amounts that arise every six months or annually, it can make sense to calculate these down to the month in order to obtain an up-to-date financial overview.

The overviews for income and fixed costs are prepared in advance at the beginning of each month. The income - fixed costs calculation then results in the budget that is available for variable expenses.

- Variable expenses: Variable expenses are continuously updated. These include, for example, expenses for food, clothing, health, leisure, transport, luxury goods, etc. With proper household accounting , receipts ( receipts , receipts ) are collected for every issue, no matter how small , and the individual items are noted in the household book. Usually this means that consumers enter their variable expenses in the household book on a daily basis.

Based on the actual variable expenses, the balance can be determined at the end of the month and whether there is a surplus or a minus. To do this, the actual expenditure amount is deducted from the budget for variable expenditure. The exact list of changeable items shows where there is still potential for savings and which expenses can possibly be dispensed with.

- Special expenses: Costs for one-off major purchases, such as cars or real estate, vacations or family celebrations, can be entered in this category.

Differentiation between digital and paper-based household books

Since private financial management is also often handled digitally, a distinction has to be made between electronic and paper-based household books.

Paper-based household books

Household books are traditionally "books" or booklets. Many households created and created these themselves, z. B. by means of a DIN A5 square booklet from the stationery store. There are also preprinted household books from manufacturers of form booklets in the stationery store. Savings banks often offer household books free of charge, consumer advice centers and debt advice centers often at a low price. In this booklet, expenditure and income are compared on different pages in order to show an improvement or deterioration in the financial situation.

Digital household books

The majority of all households today have the option of keeping household books in electronic form using PCs , tablet computers , smartphones and similar devices. A distinction can be made here:

- Use of general software such as spreadsheet programs

- Use of software that was specially developed for keeping a household book

- Online solutions that do not run on the local machine, but a server and as a browser be used

- Mobile apps for smartphones and tablets

Digital household books have the advantage that the data only has to be entered and all calculations, evaluations, forecasts etc. are carried out automatically. For the use of a spreadsheet program such as OpenOffice or Microsoft Excel for housekeeping, there are a large number of free and paid templates on the Internet that enable the corresponding calculations.

Online household books offer the advantage that they can be maintained regardless of location. Household book apps, which are offered for all common smartphone and tablet platforms, also offer this advantage. Thanks to the mobile use of these devices, entries can be made very flexibly and promptly (for example, entering expenses directly when shopping). Some apps also offer the option of synchronizing the data with other devices and platforms. Bookings can be entered by different people or edited on different devices.

literature

- Irmintraut Richarz (ed.): Households in past and present. Contribution to an international interdisciplinary symposium at the University of Münster. Vandenhoeck and Ruprecht, Göttingen 1994, ISBN 3-525-13228-X

Web links

- PDF template from the Hamburg consumer advice center. In: vzhh.de

- Digital household book based on Excel for private use.

- Open source program for keeping an online budget book. In: html5-haushaltsbuch.de

Individual evidence

- ^ A b Zotter, Hans (2008): The Budget Book: A Success Story. In: uni-graz.at , lecture (PDF)

- ↑ Christiane Damos-Kienzel: From economics to political economy. Königshausen & Neumann, Würzburg 2003, p. 48 ff.

- ↑ How to Keep a Budget Book - Structure and Structure. In: primoco.me