Lohmann-Ruchti effect

With the Lohmann-Ruchti effect circumscribing business administration , the effect of the consumption-related depreciation as exclusive Reinvestitionsquelle for new investments in the fixed assets of companies . Since this can increase the operational capacities under certain premises , one also speaks of the capacity expansion effect .

history

In August 1867, Karl Marx and Friedrich Engels described this effect in three correspondence (of August 24, 26 and 27, 1867) almost 100 years before the namesake Lohmann / Ruchti. In 1926 a work by Nico Jacob Polak based on the example of a shipping company followed . Polak is widely cited as the first author to deal with the issue of capacity expansion through reinvestment of depreciation. Hans Ruchti quoted Polak's considerations in his habilitation thesis in 1942 before Martin Lohmann published an article on depreciation in 1949. It was not until Hans Ruchti described this process again in 1953 that it entered the specialist literature as the Lohmann-Ruchti effect .

Renowned business economists such as Helmut Neubert (1951), Heinz Langen (1953), Erich Schäfer (1955), Karl Hax (1955), or Erich Gutenberg (1955) took part in the lively discussion that arose, which was mainly held in the journal for commercial research ( ZfhF). Schäfer and Hax, in particular, opposed the term “effect”.

requirements

The Lohmann-Ruchti effect only works if certain premises are met. These premises are summarized as conditions in the model and in their totality result in the Lohmann-Ruchti effect:

- The production costs, including depreciation, must be earned through sales on the market.

- The manufactured products are completely accepted by the market .

- The depreciation corresponds exactly to the impairment .

- The depreciation returns in the cash flow are immediately and completely invested in new, similar machines .

- The acquisition costs of the machines must remain constant over the long term.

Components

If these requirements are met, the Lohmann-Ruchti effect consists of two components, the capital release effect and the capacity expansion effect .

Capital release effect

The impairment of operational goods is recorded in the balance sheet through regular depreciation. Since they are included in the calculation of the sales prices as prime costs , they are also reflected in the income statement , so that the depreciation counter values flow back to the company .

The decisive effect is that depreciation not only increases the return flow of the equivalent value, but is also recorded as an expense in the income statement , thereby reducing the distributions to the company's shareholders . The result is that the depreciation is available to the company as money and can therefore be used for purposes other than distributing profits.

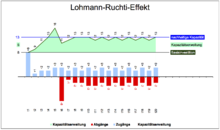

Capacity expansion effect

Since the depreciation equivalent is available to the company before a replacement investment is required, they can also be used for new or expansion investments in the meantime . In order for this process to function smoothly, the company must draw up a precise depreciation and reinvestment plan so that the capital required is available when a replacement investment is due .

The capacity expansion factor indicates the number of machines on which the capacity expansion effect levels off. For very long useful lives , straight-line depreciation and continuous return flows, the capacity expansion factor is counterbalanced, but this is only possible if the machines are absolutely divisible and therefore only a theoretical value.

Example :: 8 machines are purchased as basic equipment, each with a useful life of 5 years.

The capacity expansion effect is particularly evident in table form.

For this purpose it is assumed that 8 machines with a useful life of 5 years are purchased in year 1 for € 15,000 each. Each machine has a capacity of 1,000 pieces per period. It is depreciated using the straight-line method. The imputed depreciation corresponds to the balance sheet depreciation .

| year | Number of machines | invested capital in € | Depreciation in € | Capital in € | Entrance exit | Reinvestment in € | Remaining capital in € |

|---|---|---|---|---|---|---|---|

| 1 | 8th | 120,000 | 24,000 | 24,000 | 1/0 | 15,000 | 9,000 |

| 2 | 9 | 135,000 | 27,000 | 36,000 | 2/0 | 30,000 | 6,000 |

| 3 | 11 | 165,000 | 33,000 | 39,000 | 2/0 | 30,000 | 9,000 |

| 4th | 13 | 195,000 | 39,000 | 48,000 | 3/0 | 45,000 | 3,000 |

| 5 | 16 | 240,000 | 48,000 | 51,000 | 3/8 | 45,000 | 6,000 |

| 6th | 11 | 165,000 | 33,000 | 39,000 | 2/1 | 30,000 | 9,000 |

criticism

The practical significance of this theorem is small. The effect only works as a capacity expansion if all conditions are fully met. If even one premise is missing or not fully met, the effect cannot be ideally achieved. Some of these conditions are impractical, so that the effect does not fully develop in reality. This is because there must be a larger number of tangible assets with a sufficiently long service life in infinitesimally small units, whereby the acquisition costs must remain unchanged (there must therefore be no inflation in the long term ). The reinvestment of the depreciation equivalent in assets of the same type must take place immediately. Since the capacity expansion effect leads to a higher production volume , the capital requirement increases and must be able to be fully covered.

Because of the complexity of the investment and depreciation problem, according to Ruchti, the companies are not primarily interested in a computationally precise determination of the depreciation amounts that will finally become available from the given capacity. The companies did not try to determine the possible expansion of capacity with a given capital investment (Neubert), but rather concentrate on the usable depreciation volume.

- The constant prices for the replacement of the machines cannot be met due to inflationary developments.

- The constantly growing stocks lead to permanently increasing total depreciation and must be generated through (increasing) revenues (i.e. increasing sales prices or increasing sales figures).

- The calculated depreciation must correspond to the actual depreciation. There must be no premature replacement requirement.

- The process takes up a lot of space because there are sometimes many machines in the company at the same time.

- It is questionable whether all machines can be fully utilized.

See also

Individual evidence

- ^ Karl Hax, The exchange of letters between Friedrich Engels and Karl Marx 1844 to 1883 , in: ZfhF 1958, pp. 222–226

- ^ Nico Jacob Polak, Fundamentals of Financing with Consideration for the Loan Duration , 1926, pp. 92–94

- ↑ Hans Ruchti, The importance of depreciation for business , 1942, p. 40, FN 44

- ↑ Martin Lohmann, Depreciation, what they are and what they are not , in: Der Wirtschaftsprüfer, 1949, p. 353 ff.

- ↑ Hans Ruchti, The Depreciation , 1953, p. 91 ff.

- ↑ Helmut Neubert, Plant Financing from Depreciation , in: ZfhF 1951, pp. 367–383 and pp. 415–423

- ↑ Heinz Langen, The expansion of capacity through reinvestment of liquid funds from depreciation , in: ZfhF 1953, pp. 49–70

- ^ Erich Schäfer, Depreciation and Financing: On the financing function of depreciation , in: ZfhF 1955, p. 137 ff.

- ^ Karl Hax, Depreciation and Financing: Further comments on the "Lohmann-Ruchti Effect" , in: ZfhF 1955, pp. 141 ff.

- ↑ Erich Gutenberg, review of Ruchti: The write-off. Their fundamental importance as an expense, income and financing factor , in: ZfhF 1955, p. 348 ff.

- ↑ Horst-Tilo Beyer, Finanzlexikon , 1971, p. 190