Revolut

| Revolut Ltd. | |

|---|---|

|

|

| Country |

|

| Seat | Level 39, One Canada Square, E14 5AB London |

| legal form | Limited |

| BIC | REVOGB21XXX |

| founding | July 1, 2015 |

| Website | www.revolut.com |

| management | |

| Corporate management |

Nikolay Storonsky |

The Revolution Ltd. is a London- based fintech start-up . The company was founded in 2014 and is based at Level39, a financial technology incubator in Canary Wharf .

history

Revolut was founded by Nikolay Storonsky (previously a dealer at Credit Suisse and Lehman Brothers ), Vlad Yatsenko (previously software developer at Credit Suisse and Deutsche Bank ) and Tom Reay (previously software developer at Expedia and Ocado). In addition, the founders obtained start-up funding of around $ 3.5 million. Revolut was launched to the public in July 2015 with the aim of "creating a fair and smooth platform for the global use and management of money" by removing hidden fees and offering major bank currency rates.

In February 2017, Revolut launched UK checking accounts, which should enable customers to receive a personal IBAN . In July 2017, users received a personal EUR -IBAN.

From March to October 2019, the number of customers rose from four to more than eight million.

According to the company, around 20,000 new accounts are opened every day, in August 2019 it should have been more than 40,000 in one day. According to Revolut, these customers have made over 250 million transactions to date in mid-2019. In Switzerland , Revolut has set up a correspondence account with Credit Suisse since December 2018 , as customers were often charged fees for international transfers. According to its own information, Revolut has almost a quarter of a million Swiss customers (as of October 2019).

In December 2018, Revolut received a “specialized banking license” from the Lithuanian Banking Authority , which allows the company to accept deposits and extend loans . Revolut is not allowed to offer its own investment products with this license. Revolut had sales of £ 55 million in fiscal 2018. The loss was £ 33 million.

In January 2019, the company was valued at 1.5 billion euros. A company spokesman pointed out in August 2019 that the company was growing “faster than N26 , Monzo , Monese, Starling and other competitors combined”.

In a funding round in early 2020, the company was valued at $ 5.5 billion. Revolut has also been offering its service in the USA since March 2020.

criticism

Revolut has been criticized for poor working conditions in the media based on statements from former employees. Questionable recruitment criteria, unusually long working days, unpaid work and high fluctuation in the workforce were cited in detail .

Products

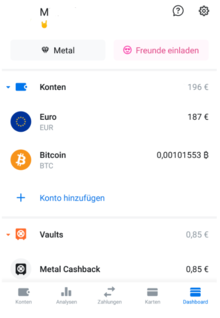

Revolut currently supports ATM issues and withdrawals in 120 currencies, including 26 currencies directly from the mobile app. This is the product of the same name, Revolut , a digital banking alternative that offers a prepaid credit card (MasterCard or VISA), currency exchange, crypto currency exchange from and to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and peer to peer payments. As part of a market penetration strategy, Revolut did not charge any fees for the majority of its services in the basic account model until August 2020. From August 2020, fees will be due for payments in foreign currencies.

The Revolut app enables immediate access to Bitcoin, Litecoin and Ether by exchanging 26 cash currencies.

Apple Pay

Revolut has been offering payments via Apple Pay for customers from numerous European countries since May 2019 .

Google Pay

Since 2017, it has been possible to use Mastercard credit cards with Google Pay on Android smartphones in countries where Google Pay is available, including Germany (since 2018) and Switzerland.

Revolut for Business

Revolut for Business is a product for companies and the self-employed and has significantly more functions than the standard product. Among other things, the account here also has a web interface and a programmable API, while private customers can only use a mobile app.

Individual evidence

- ↑ Entry in the BIC directory at SWIFT

- ↑ No more credit card fees abroad. In: observer.ch . August 16, 2019, accessed February 2, 2019 .

- ↑ Romain Dillet: Revolution launches current accounts and a chatbot . In: TechCrunch . ( techcrunch.com [accessed February 10, 2018]).

- ↑ David Torcasso: Revolut founder: "We have 50,000 customers in Switzerland". In: handelszeitung.ch . September 24, 2018. Retrieved September 25, 2018 .

- ↑ About Us | Revolut. Retrieved March 12, 2019 .

- ↑ Revolut: “Growing faster than N26 and Monzo together”. August 9, 2019, accessed September 7, 2019 .

- ↑ Investors wanted: Neo-Bank Revolut is aiming for a ten billion valuation. In: t3n.de. October 20, 2019, accessed October 23, 2019 .

- ↑ Peter Hody: Banking: The price becomes a battlefield. In: finews.ch. Finews , October 16, 2018, accessed October 21, 2018 .

- ↑ About Us | Revolut. Retrieved March 12, 2019 .

- ↑ Michael Heim: Revolut is becoming a little more Swiss. In: handelszeitung.ch . December 25, 2018, accessed December 27, 2018 .

- ↑ 250,000 customers: The Swiss run into Revolut's booth. Retrieved May 18, 2020 .

- ↑ British banking scare: Fintech Revolut secures banking license - and wants to become the Amazon for banking. Retrieved February 8, 2019 .

- ↑ a b Philip Plickert: Revolut digital bank becomes Europe's most expensive fintech. In: Frankfurter Allgemeine Zeitung. February 25, 2020, accessed March 13, 2020 .

- ↑ N26 collects 260 million euros - and becomes a unicorn. January 10, 2019, accessed June 24, 2019 .

- ↑ Revolut: “Growing faster than N26 and Monzo together”. August 9, 2019, accessed September 7, 2019 .

- ↑ Jay Peters: Popular European banking app Revolut is launching in the US today. In: The Verge. March 24, 2020, accessed on April 16, 2020 .

- ^ Mathias Möller: The ugly sides of the banking revolution. In: Tages-Anzeiger from March 1, 2019.

- ↑ Revolut insiders reveal the human cost of a fintech unicorn's wild rise (en-UK) . In: Wired , March 1, 2019.

- ↑ FAQ - Revolut. Retrieved February 10, 2018 (UK English).

- ↑ Banking app for travelers - Revolut changes money without fees! Retrieved February 10, 2018 .

- ↑ Romain Dillet: Revolution Raises $ 2.3 Million For Its Mobile Foreign Exchange Service . In: TechCrunch . ( techcrunch.com [accessed February 10, 2018]).

- ↑ Pricing - Revolut. Retrieved February 10, 2018 (UK English).

- ↑ Michael Schäfer: The miracle of Revolut is over. In: Neue Zürcher Zeitung. June 24, 2020, accessed on June 26, 2020 (German).

- ↑ Revolut: Bank app now also supports Apple Pay in Austria. In: Trending Topics. June 11, 2019, accessed on June 23, 2019 (German).

- ↑ Google Pay is now available in Switzerland. In: Techgarage. April 30, 2019, accessed on May 29, 2019 (Swiss Standard German).

- ↑ The Business Bank Account Alternative | Revolut. Retrieved September 7, 2019 .