Tax card

In Germany and Austria, among other places, the income tax card was a document that contained data that the employer used to calculate income tax .

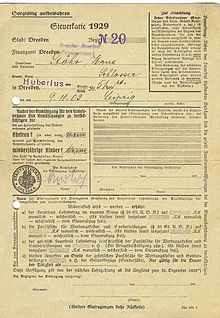

It was introduced in Germany in 1925 and was last issued for the 2010 calendar year ( Section 39 EStG). Due to delays in switching to the paperless procedure, the income tax card for 2010 was also valid for 2011, 2012 and partially until 2013.

Employees who had their place of residence or habitual abode in Germany had to present an income tax card to each of their employers at the beginning of each new calendar year and when they started their employment . If no income tax card is presented, the employer must settle the wages without taking any allowances into account, which corresponds to tax class VI . No new income tax cards have been issued since 2011; Since then, employees have had to apply for a replacement certificate to receive their first salary.

In Austria the income tax card was in use until the end of 1993 and was valid for five years.

In the UK and Ireland , the P45 form functions as an income tax card.

Information

The German wage tax card was issued free of charge by the employee's municipality of residence. Municipalities could levy a fee of up to five euros for issuing replacement wage tax cards.

The income tax card was used for the official documentation of income tax characteristics, in particular the following employee data:

- address

- Date of birth

- Local tax office

- the tax class

- the number of child allowances

- if applicable, the religious affiliation for the collection of the church tax , e.g. B. ev (member churches of the EKD ), rk (dioceses of the Roman Catholic Church ) or J for the cult tax of the members of a Jewish community

- If applicable, allowances (e.g. the flat-rate amount for the disabled, the entry of other allowances must be requested from the tax office)

- the so-called additional amount

- AGS ( official municipality key )

- Identification Number

The indication of denomination basically falls within the fundamental rights protection area of negative religious freedom according to Art. 140 Paragraph 1, Basic Law in conjunction with Art. 135 Paragraph 3 Sentence 1 WRV , but in this case is according to Art. 136 Paragraph 3 Sentence 2 WRV justified.

Until 2004, the employer entered the taxable gross salary and the withheld income tax , church tax , solidarity surcharge and social security contributions after the end of the calendar year or when the employment relationship ended . From 2005, the employee only received his income tax card back if he left the company during the year. Since then, the wage details have been entered on an electronic income tax certificate, which is also sent to the tax office.

The tax card was one of the working papers ; the employer was less than years End of employment subject to its publication. If the employment relationship exists after December 31st and if the employee is not assessed for income tax, the employer could destroy the income tax card ( Section 41b (1 ) sentence 6 EStG ) if it did not contain any entries. In contrast, when changing employers within the term of a card, the previous employer was obliged to surrender it so that the card could be presented to the subsequent employer. If the taxpayer had the tax card in his possession at the end of the year, he could enclose it with his income tax return. It is also used to calculate the municipalities' share of income tax revenue. Special regulations apply to certain groups of employees (e.g. for foreign EU / EEA commuters).

Development in Germany

The income tax card was introduced on August 25, 1925 with the Income Tax Act. It replaced the previously applicable system, according to which companies paying income tax acquired tax stamps from the Post and resold them to their employees to be pasted into tax books.

Since the introduction of the wage tax card, employers have paid wage tax directly to the state. The data required for calculating the tax were noted on the cardboard cards issued by the municipalities. The cards, for which a weight of 150 grams per m 2 was prescribed, could be labeled with the help of addressing machines. It was also required that the cards could be written on with ink .

From 1931 a different color was used every year; 1931 “plant green” and 1932 “light orange”.

From 1937 there was a law: "Every employer has to withhold and pay church wage tax at the same time as wage tax".

In the circular of August 31, 1936, the Reich Ministry of Finance ordered changes to the tendering of the tax card. It was not until 1937 that questions were asked about whether the taxpayer belonged to a religious society. In general, the affiliation was represented by abbreviations: (ev = Protestant, rk = Roman Catholic, jd = Jewish, oS = exact designation without tax interest, because not taxable, etc.). This was necessary because the church authorities had largely switched to charging church tax directly on the basis of the tax card.

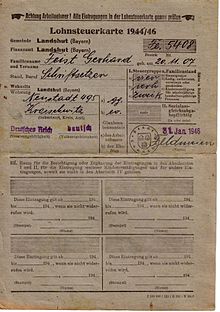

The color of the control card for 1936 was light gray, that for 1937 light green, for 1938 light pink, for 1939 light blue and for 1940 light orange.

Starting in 1953, the income tax cards were issued annually alternately in the specified order light red – light yellow – light green – light orange.

From 2005 the income tax certificate must be created electronically. As a fine feature that is ETIN used.

The 2010 income tax card is valid for the years 2010 to 2013 or until the first query of the income tax data via ELStAM (see below), which must be made for the last income tax deduction period in 2013 at the latest.

Abolition and conversion to ELStAM

ELStAM = electronic wage tax deduction features

The wage tax cards are being replaced by a paperless electronic procedure for collecting wage tax called Electronic Wage Tax Deduction Features (ELStAM) . The employee must notify his employer of his tax identification number and the date of his birth on entering the employment relationship for the purpose of calling up the wage tax deduction features. The employer retrieves the wage tax deduction features from the Federal Central Tax Office by remote data transmission and transfers them to the employee’s wage account ( Section 39e (4) EStG).

Since the ELStAM database was not available punctually in 2011, the 2010 income tax card initially retained its validity, including the tax exemptions entered. If an employee took up employment subject to income tax for the first time and therefore did not have a 2010 income tax card, the tax office could issue a certificate upon request . At the end of 2012, the initially updated allowances were then reset and had to be applied for again for periods from 2013 onwards.

After protests against the ELENA process due to concerns about data protection law , the Federal Ministries for Economics and Technology as well as for Labor and Social Affairs jointly declared on July 18, 2011 that the ELENA process would be “discontinued as soon as possible”. The introduction of the electronic income tax card remains unaffected by this decision.

In the course of 2013 (between January 1st and the last wage payment period) every employer introduced the new electronic income tax card in his company. The advantage of ELStAM is the low bureaucratic effort for the employee. When starting a new job, from 2014 the employer only requires the employee's date of birth and identification number. Until then, it was still necessary to present the 2010 income tax card or a corresponding replacement certificate.

Jurisdiction

The administration of the income tax characteristics has been with the responsible tax offices since 2011, they are responsible for the new issuance, changes to the tax class, religious affiliation, name, number of children and residence as well as for the entry of exemptions and additional contributions.

Until 2010, the income tax card was issued by the municipality in which the employee had his main residence on September 20 of the previous year. The municipality was also responsible for changing the tax class, religious affiliation or name, while the tax office could enter tax exemptions.

Individual evidence

- ↑ Sections 48 and 127 EStG (accessed in the RIS of the Austrian Federal Chancellery on September 20, 2010)

- ↑ [1] | Historians' Commission of the Reich Ministry of Finance from 1933 - 1945

- ^ Hans Cerutti, The Tax Law of Employees , Verlag Gabler, Wiesbaden, 1936

- ^ Bavarian State Office for Taxes - The electronic income tax card. ( Memento of the original from May 3, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved December 26, 2012.