Theory of optimal currency areas

The theory of optimal currency areas (often referred to as OCA because of its English name, optimal currency area theory ) is a sub-area of economics . It deals with the economically sensible size of currency areas . The theory was named after a work by Robert Mundell from 1961 , which was awarded the Alfred Nobel Memorial Prize for Economics in 1999 .

Historical development

All work on the topic examines whether it is advantageous for certain countries to form a common currency area. In other words, they use certain variables to clarify whether the costs outweigh the benefits of a monetary union or vice versa.

Mundell examined the different effects of asymmetric shocks in a two-country model. In a monetary union, a shock cannot be offset by the exchange rate mechanism , but only by internal devaluation . According to Mundell's observation of the economic history of Canada and the United States, there was insufficient internal devaluation in these monetary unions; macroeconomic shocks were more likely to be offset by the migration of workers and capital. He therefore came to the conclusion that a currency area is optimal if there is sufficient factor mobility , i.e. H. There is sufficient qualification, sectoral and, above all, geographical mobility of employees and capital.

As an alternative to labor mobility, James C. Ingram examined the extent to which flexible capital flows can offset asymmetrical shocks. He came to the conclusion that financial market integration is an essential prerequisite for an optimal currency area. In this case, the balance of payments adjustment through exchange rates ( exchange rate mechanism ) is no longer necessary, since small changes in interest rates are sufficient to induce sufficient capital flows.

Another important piece of work was done by McKinnon in 1963 . He examined the benefits of monetary unions based on the degree of openness of their (potential) members: the more trade there is between two countries, the more damaging the effects of a change in the exchange rate between the two currencies. From this McKinnon deduced that two countries are more likely to form an optimal currency area the more they trade.

Peter Kenen developed another approach . It aimed at shocks that occur across the industry, not nationwide. Such an industry shock is all the less significant for the development of an economy , the lower the industry's share of national value added. Kenen concludes from this that countries with highly diversified foreign trade and production structures can do without the exchange rate.

According to Roland Vaubel , it also makes sense for countries to enter into a currency union if exchange rates have remained stable over a long period and similar preference structures can be found in the countries.

De Grauwe considers institutional and political framework conditions in his study. These may also be useful as shock absorbers. Examples to be mentioned here are the convergence of national economic policies, the way in which government expenditure is financed, the structure of national financial markets or the similarity of labor market institutions.

Since all of the approaches mentioned have important arguments for assessing the optimality of a currency area, today's studies mostly work with metamodels which, in addition to those mentioned, take into account other costs and benefits of a common currency area and thus arrive at a comprehensive judgment.

meaning

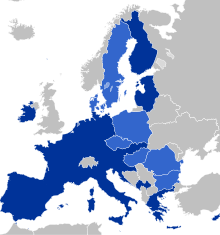

The theory of optimal currency areas is often used by euro critics as a justification against a common currency, since the euro area in fact only partially fulfills most of the criteria. As a rule, this is also seen by many supporters of the euro. However, the supporters of the monetary union believe that the euro can still work despite its weaknesses. Optimal currency areas can be defined abstractly, but in the end compromises have to be found, the advantages and disadvantages balanced and which fit the historical, cultural and political circumstances. They also point out that a currency area is not static, but can be optimized through further integration and cohesion measures. From the currently non-existent optimality of the Eurozone, they do not conclude that it should be dissolved, but instead that it should be further integrated and, in particular, that factor mobility should be further increased.

The objectives established in the euro introduction euro convergence criteria are to be seen as criteria to verify the optimality of the currency area - countries which meet the convergence criteria, asymmetric shocks need only limited to fear, so that the loss of national monetary and currency policy does not weigh heavily for them. However, the convergence criteria only partially coincide with the criteria for measuring optimal currency areas discussed in scientific theory. The British government set five criteria of its own against which it wants to check the degree of integration of the country with the other EU countries. Only when these criteria are met will there be a referendum in Great Britain on the euro. In view of the euro crisis and the vote that has now taken place on Great Britain's exit from the EU (" Brexit "), joining the euro zone has been ruled out since 2009 at the latest.

In view of the EU enlargement to the east and the introduction of the euro in the affected countries, which appeared at the time, there was renewed discussion about the optimality of the euro area. Critics of the rapid introduction of the euro in the Central and Eastern European countries (CEEC) referred in particular to the Balassa-Samuelson effect , which suggests that higher inflation rates will also be expected in these countries in the future .

Others

From 1971 to March 1973 the Bretton Woods system (to which over 40 countries belonged) collapsed ; From 1973 onwards, exchange rates came about through supply and demand on foreign exchange exchanges .

Exchange rates fluctuated faster and more than macroeconomists Robert Mundell and Marcus Fleming had predicted. In 1976, Rudi Dornbusch (1942–2002) succeeded in uniting purchasing power parity theory with interest parity theory to form monetary exchange rate theory .

literature

- FP Mongelli: "New" views on the optimum currency area theory: what is EMU telling us? , European Central Bank, Frankfurt am Main 2002 (= Working paper series / European Central Bank, No. 138), European Central Bank (PDF, 544 kB; accessed June 8, 2008)

- FP Mongelli: European Economic and Monetary Integration, and the Optimum Currency Area Theory , Directorate-General for Economic and Financial Affairs of the European Commission, Brussels 2008, ISBN 978-92-79-08227-6 (= European economy. Economic papers, № 302), doi : 10.2765 / 3306 , European Commission (PDF, 953 kB; accessed June 10, 2008)

- K. Rose, K. Sauernheimer: Theory of foreign trade , 13th edition, Munich 1999

Individual evidence

- ^ R. Mundell: A Theory of Optimum Currency Areas , in: The American Economic Review , Vol. 51, № 4, 1961, ISSN 0002-8282 , pp. 657-665

- ↑ Jörg Bibow, The euro debt crisis and Germany's euro trilemma , Working Papers, Levy Economics Institute of Bard College, 2012, p. 14

- ^ J. Ingram: Comment: The Currency Area Problem . In: R. Mundell, A. Swoboda (eds.): Monetary Problems of the International Economy , Chicago / London 1969, pp. 95-100

- ↑ Ohr, Renate. Fit for the exam: European integration: textbook. Vol. 3952. UTB, 2013. p. 153

- ^ R. McKinnon: Optimum Currency Areas . In: The American Economic Review , Vol. 53 (1963), ISSN 0002-8282 , pp. 717-724

- ^ P. Kenen: The Theory of Optimum Currency Areas: An Eclectic View . In: R. Mundell, A. Swoboda (Eds.), Monetary Problems of the International Economy , Chicago / London 1969, pp. 41-59

- ↑ P. De Grauwe: Economics of Monetary Union , 4th ed., New York 2000

- ↑ Is the euro zone an "optimal currency area" after all? - macronomer . In: Makronom . January 30, 2017 ( makronom.de [accessed January 31, 2017]).

- ↑ FAZ.net April 12, 2014: Why are the currencies going crazy?