Complete competition

Under perfect competition (engl. Perfect competition ) refers to a theoretical model or a market form of economics , particularly the Mikroökonomik . The term can sometimes be found in the literature under perfect competition, perfect competition, polypol on the perfect market or homogeneous polypol.

The model

Characteristics

The model is essentially based on the following assumptions:

- In relation to the market size, there are many small suppliers who face many customers (atomistic market structure, polypol)

- There are homogenous goods offered.

Additional assumptions or characteristics are often mentioned:

- There are no barriers to entry in the market .

- All actors have complete information .

- All market participants react infinitely quickly to changes.

history

The model of complete competition has its origin in the price theory of the classical period . However, it did not develop until the neoclassical period , largely under Léon Walras and Alfred Marshall . Special significance took it with Walter Eucken in Ordoliberalismus and coined the mid-20th century, the competition policy .

Pricing and Market Equilibrium

In order to find the equilibrium price for a fully competitive market, all market participants must have complete information. Since this is seldom the case in reality, this process can be imagined with the help of an auctioneer (or an exchange) who collects the price signals from the individual market participants and combines them into an equilibrium price.

The homogeneity condition means that the goods that are traded on the market are identical. Accordingly, there are no preferences whatsoever to prefer the goods of one market participant to those of the other and there is no possibility of the product being offered e.g. B. particularly emphasize by quality differences in order to set different prices. Due to the atomistic market structure, it is not possible for any market participant to influence the market price through their own actions, since they are insignificantly small compared to the size of the market. Because of these assumptions, the players in the fully competitive market are called price takers . They have to accept the price determined by the market and can only influence the quantity of their offered goods as a quantity adjustor .

The price-response function of the providers on the market is therefore completely elastic . The amount an individual company offers depends on its individual marginal costs (price per additional unit of measure). So it offers the maximum profitable amount at which the price corresponds to the marginal cost. In the long run, companies cannot make a profit in a fully competitive market ( zero profit ). Due to the lack of market entry barriers, new companies enter the market as soon as there is a profit to be made.

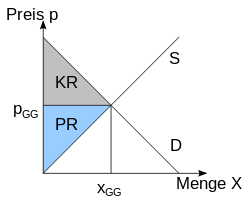

The market equilibrium is reached when the supply and demand curves intersect in a price-quantity diagram . Since the consumer and producer surplus is maximum in the model of complete competition, it represents an ideal market and therefore also serves as a reference for the static efficiency of a market.

Demarcation

monopoly

A monopoly market is the extreme opposite of a fully competitive market. This market is characterized by one supplier (the monopoly), unique goods and high barriers to entry.

Incomplete competition

These types of market are to be positioned between a monopoly and a market with complete competition.

- In an oligopoly , both homogeneous and heterogeneous goods can be offered by a small number of providers who have limited market power. There are barriers to entry in this market, but not as high as in a monopoly market.

- In a market of monopoly competition , heterogeneous goods (imperfect substitutes) are offered by many providers with market power. As with full competition, there are no barriers to entry.

criticism

A market with full competition is seldom to be found in reality due to the restrictive model assumptions. In this respect, it is questionable how practicable the model is, since a deviation from the assumptions would imply allocative market failure . The biggest point of criticism is therefore the static view of the model, i.e. the strong focus on market equilibrium and the neglect of dynamic processes in competition . A few points of criticism are listed below:

- Due to the complete information and the speed of reaction, there are no pioneering profits and therefore no incentives for innovations.

- In reality there are many barriers to market entry e.g. B. in the form of technological advances.

- Transaction costs are not taken into account.

- Economies of scale are not possible due to the large number of market participants.

- Consumers prefer a certain variety of products and not homogeneous products.

Taxes and their effects under full competition

In a simplified analysis, taxes are designed as a unit tax, i.e. a tax in the amount of a certain amount of money per unit sold . This is in contrast to value tax, a proportional tax, an example of this would be sales tax, but the analysis falls roughly the same. The unit tax can now be imposed on the producer or the consumer. Who ultimately bears the burden of the tax depends on the respective supply and demand curves and in particular on the relative elasticities of supply and demand. In complete competition, the same elasticities are assumed. In this case, the tax is partly due to the consumer and partly to the producer.

A tax , for example euros , is now levied on a certain good. The equilibrium price paid by the buyer increases , the supply curve shifts , the new intersection with the demand curve also increases. The new intersection is characterized by a higher price and a lower quantity. As a result of the higher price, demand falls, and consumers lose consumer surplus ( ). Due to lower demand producers must produce cheaper this results in a lower producer surplus , . Consumers and producers lose the same amount of rent and therefore contribute the same tax burden. In return, tax revenues arise for the state , but these cannot compensate for the accumulated losses of the respective pensions. This creates a so-called deadweight loss .

literature

- Ulrich Baßeler, Jürgen Heinrich, Burkhard Utecht: Basics and problems of economics. 19th edition. Schäffer-Poeschel Verlag, Stuttgart 2010, ISBN 978-3-7910-2928-3 .

- Michael Fritsch: Market Failure and Economic Policy. 9th edition. Vahlen Verlag, Munich 2014, ISBN 978-3-8006-4771-2 .

- Austan Goolsbee, Steven Levitt, Chad Syverson: Microeconomics. Translated from American English by Ulrike Berger-Kögler, Reiner Flik, Oliver Letzgus and Gerhard Pfister. Schäffer-Poeschel Verlag, Stuttgart 2014, ISBN 978-3-7910-3246-7 .

- Ricarda Kampmann, Johann Walter: Microeconomics - Market, Economic System, Competition. Oldenbourg Verlag, Munich 2010, ISBN 978-3-486-59157-6 .

- N. Gregory Mankiw, Mark P. Taylor: Fundamentals of Economics. Translated from American English by Adolf Wagner and Marco Herrmann. 5th edition. Schäffer-Poeschel Verlag, Stuttgart 2012, ISBN 978-3-7910-3098-2 .

- Jochen Schumann: The pioneers of modern price and cost theory. In: Otmar Issing (Hrsg.): History of the national economy. 4th edition. Vahlen Verlag, Munich 2014, ISBN 978-3-8006-4357-8 .

- Jochen Schumann, Ulrich Meyer, Wolfgang Ströbele: Basics of the microeconomic theory. 8th edition. Springer Verlag, Berlin Heidelberg New York 2007, ISBN 978-3-540-70925-1 .

Individual evidence

- ↑ a b Ulrich Baßeler, Jürgen Heinrich, Burkhard Utecht: Fundamentals and problems of economics. 19th edition. Schäffer-Poeschel Verlag, Stuttgart 2010, p. 169

- ↑ N. Gregory Mankiw, Mark P. Taylor: Grundzüge der Volkswirtschaftslehre. Translated from American English by Adolf Wagner and Marco Herrmann. 5th edition. Schäffer-Poeschel Verlag, Stuttgart 2012, p. 78

- ^ A b Ricarda Kampmann, Johann Walter: Microeconomics - Market, Economic Order, Competition. Oldenbourg Verlag, Munich 2010, p. 124

- ↑ a b N. Gregory Mankiw, Mark P. Taylor: Grundzüge der Volkswirtschaftslehre. Translated from American English by Adolf Wagner and Marco Herrmann. 5th edition. Schäffer-Poeschel Verlag, Stuttgart 2012, pp. 350, 351

- ↑ Michael Fritsch: Market failure and economic policy. 9th edition. Vahlen Verlag, Munich 2014, pp. 25,26

- ↑ Ulrich Baßeler, Jürgen Heinrich, Burkhard Utecht: Fundamentals and problems of economics. 19th edition. Schäffer-Poeschel Verlag, Stuttgart 2010, pp. 201, 202

- ^ Jochen Schumann: The pioneers of modern price and cost theory. In: Otmar Issing (Hrsg.): History of the national economy. 4th edition. Vahlen Verlag, Munich 2014, pp. 180–182

- ↑ Ulrich Baßeler, Jürgen Heinrich, Burkhard Utecht: Fundamentals and problems of economics. 19th edition. Schäffer-Poeschel Verlag, Stuttgart 2010, pp. 169–171

- ^ Jochen Schumann: The pioneers of modern price and cost theory. In: Otmar Issing (Hrsg.): History of the national economy. 4th edition. Vahlen Verlag, Munich 2014, p. 182

- ↑ Jochen Schumann, Ulrich Meyer, Wolfgang Ströbele: Fundamentals of the microeconomic theory. 8th edition. Springer Verlag, Berlin Heidelberg New York 2007, pp. 215, 216

- ↑ Austan Goolsbee, Steven Levitt, Chad Syverson: Microeconomics. Translated from American English by Ulrike Berger-Kögler, Reiner Flik, Oliver Letzgus and Gerhard Pfister. Schäffer-Poeschel Verlag, Stuttgart 2014, pp. 391–396

- ↑ Austan Goolsbee, Steven Levitt, Chad Syverson: Microeconomics. Translated from American English by Ulrike Berger-Kögler, Reiner Flik, Oliver Letzgus and Gerhard Pfister. Schäffer-Poeschel Verlag, Stuttgart 2014, p. 436

- ↑ Austan Goolsbee, Steven Levitt, Chad Syverson: Microeconomics. Translated from American English by Ulrike Berger-Kögler, Reiner Flik, Oliver Letzgus and Gerhard Pfister. Schäffer-Poeschel Verlag, Stuttgart 2014, p. 390

- ↑ Austan Goolsbee, Steven Levitt, Chad Syverson: Microeconomics. Translated from American English by Ulrike Berger-Kögler, Reiner Flik, Oliver Letzgus and Gerhard Pfister. Schäffer-Poeschel Verlag, Stuttgart 2014, pp. 388, 441, 559, 602

- ^ A b Michael Fritsch: Market failure and economic policy. 9th edition. Vahlen Verlag, Munich 2014, pp. 57–60

- ^ Ricarda Kampmann, Johann Walter: Microeconomics - Market, Economic Order, Competition. Oldenbourg Verlag, Munich 2010, p. 180

- ↑ Robert Pindyck, Daniel Rubinfeld: Mikroökonmie . Translated from the English by Anke Kruppa, Peggy Lötz-Steger. 7th edition. Peorson Deutschland GmbH, Munich, 2009. ISBN 978-3-8273-7282-6 , pp. 438-442.