Hubbert peak theory

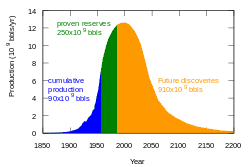

The Hubbert peak theory posits that for any given geographical area, from an individual oil-producing region to the planet as a whole, the rate of petroleum production tends to follow a bell-shaped curve. It is one of the primary theories on peak oil.

Choosing a particular curve determines a point of maximum production based on discovery rates, production rates and cumulative production. Early in the curve (pre-peak), the production rate increases due to the discovery rate and the addition of infrastructure. Late in the curve (post-peak), production declines due to resource depletion.

The Hubbert peak theory is based on the observation that the amount of oil under the ground in any region is finite, therefore the rate of discovery which initially increases quickly must reach a maximum and decline. Extraction roughly follows the discovery curve after a time lag (typically about 35 years[1][2]) for development. The theory is named after American geophysicist M. King Hubbert, who created a method of modeling the production curve given an assumed ultimate recovery volume.

Hubbert's peak

"Hubbert's peak" can refer to the peaking of production of a particular area, which has now been observed for many fields and regions.

Hubbert's Peak was achieved in the continental US in the early 1970s. Oil production peaked at 10.2 million barrels a day. Since then, it has been in a gradual decline.

Peak oil as a proper noun, or "Hubbert's peak" applied more generally, refers to a singular event in history: the peak of the entire planet's oil production. After Peak Oil, according to the Hubbert Peak Theory, the rate of oil production on Earth would enter a terminal decline. Based on his theory, in a paper[3] he presented to the American Petroleum Institute in 1956, Hubbert correctly predicted that production of oil from conventional sources would peak in the continental United States around 1965-1970. Hubbert further predicted a worldwide peak at "about half a century" from publication and approximately 12 gigabarrels (GB) a year in magnitude. In a 1976 TV interview[4] Hubbert added that the actions of OPEC might flatten the global production curve but this would only delay the peak for perhaps 10 years.

Hubbert's theory

Hubbert curve

In 1956, Hubbert proposed that fossil fuel production in a given region over time would follow a roughly bell-shaped curve without giving a precise formula; he later used the Hubbert curve, the derivative of the logistic curve, for estimating future production using past observed discoveries.

Hubbert assumed that after fossil fuel reserves (oil reserves, coal reserves, and natural gas reserves) are discovered, production at first increases approximately exponentially, as more extraction commences and more efficient facilities are installed. At some point, a peak output is reached, and production begins declining until it approximates an exponential decline.

The Hubbert curve satisfies these constraints. Furthermore, it is roughly symmetrical, with the peak of production reached when about half of the fossil fuel that will ultimately be produced has been produced. It also has a single peak.

Given past oil discovery and production data, a Hubbert curve may be constructed that attempts to approximate past discovery data, and used to provide estimates for future production. In particular, the date of peak oil production or the total amount of oil ultimately produced can be estimated that way. Cavallo[5] defines the Hubbert curve used to predict the U.S. peak as the derivative of:

where max is the total resource available (ultimate recovery of crude oil), the cumulative production, and and are constants. The year of maximum annual production (peak) is:

Use of multiple curves

This section needs expansion. You can help by adding to it. (June 2008) |

The sum of multiple Hubbert curves can be used in order to model more complicated real life scenarios. [6]

Definition of reserves

Almost all of Hubbert peaks must be put in the context of high ore grade. Except for fissionable materials, any resource, including oil, is theoretically recoverable from the environment with the right technology. A current example would be biofuel. However, a genetically engineered organism that produces crude oil would not invalidate Hubbert's peak for oil. His research was about the "easy" oil, "easy" metals, and so forth that can be recovered before a society considers greatly advanced mining efforts and how to time the necessity of such resource acquisition advancements or substitutions by knowing an "easy" resource's probable peak. Also, as reserves become more difficult to extract there is the possibility that mining or alternatives are too expensive for developing countries.

The "easy" oil constraint also applies to "abiotic oil", a theory believed by virtually no notable U.S. geologists, although it is believed by some Russian and Ukrainian geologists. This theory states that some oil is created through other methods than conventionally understood biogenic processes. However, in order to have any effect on Hubbert peak theory applied to oil, this other creation of oil would have to occur at a rate comparable to current oil depletion, something that has not been credibly observed.

For heavy crude or deep water drilling attempts, such as Noxal oil field or tar sands or oil shale, the price of the oil extracted will have to include the extra effort required to mine these resources. According to the U.S. Minerals Management Service, areas such as the Outer Continental Shelf may also incur higher costs due to environmental concerns. So not all oil reserves are equal, and the more difficult reserves are predicted by Hubbert as being typical of the post-peak side of the Hubbert curve.

Reliability

Generally the only reliable way to identify the timing of any production peak, including the global peak, is in retrospect. United States oil production peaked in 1970, and this provides the greatest evidence to support the theory.

Hubbert, in his 1956 paper,[3] predicted that US conventional oil production (crude oil + condensate) would fall between higher and lower bounds:

- low-bound estimate: a logistic curve with a logistic growth rate equal to 6%, an ultimate resource equal to 150 Giga-barrels (Gb) and a peak in 1965.

- high-bound estimate: a logistic curve with a logistic growth rate equal to 6% and ultimate resource equal to 200 Giga-barrels and a peak in 1970.

Forty years later, the high-bound estimate has been proven to be very accurate in terms of cumulative production, less so in terms of annual production. For 2005, the upper boundary of the Hubbert model predicts 178.2 Gb cumulative and 1.17 Gb current production; actual US production was 176.4 Gb cumulative crude oil + condensate (1% lower than the upper boundary of the model), with annual production of 1.55 Gb (32% higher than the upper boundary of the model).

Economics

Energy return on energy investment

When oil production first began in the mid-nineteenth century, the largest oil fields recovered fifty barrels of oil for every barrel used in the extraction, transportation and refining. This ratio is often referred to as the Energy Return on Energy Investment (EROI or EROEI). Currently, between one and five barrels of oil are recovered for each barrel-equivalent of energy used in the recovery process. As the EROEI drops to one, or equivalently the Net energy gain falls to zero, the oil production is no longer a net energy source. This happens long before the resource is physically exhausted.

Note that it is important to understand the distinction between a barrel of oil, which is a measure of oil, and a barrel of oil equivalent (BOE), which is a measure of energy. Many sources of energy, such as fission, solar, wind, and coal, are not subject to the same near-term supply restrictions that oil is. Accordingly, even an oil source with an EROEI of 0.5 can be usefully exploited if the energy required to produce that oil comes from a cheap and plentiful energy source. Availability of cheap, but hard to transport, natural gas in some oil fields has led to using natural gas to fuel enhanced oil recovery. Similarly, natural gas in huge amounts is used to power most Athabasca Tar Sands plants. Cheap natural gas has also led to Ethanol fuel produced with a net EROEI of less than 1, although figures in this area are controversial because methods to measure EROEI are in debate.

Growth-based economic models

Insofar as economic growth is driven by oil consumption growth, post-peak societies must adapt. Hubbert believed [7]:

Our principal constraints are cultural. During the last two centuries we have known nothing but exponential growth and in parallel we have evolved what amounts to an exponential-growth culture, a culture so heavily dependent upon the continuance of exponential growth for its stability that it is incapable of reckoning with problems of nongrowth.

Some economists describe the problem as uneconomic growth or a false economy. At the political right, Fred Ikle has warned about "conservatives addicted to the Utopia of Perpetual Growth" [8]. Brief oil interruptions in 1973 and 1979 markedly slowed - but did not stop - the growth of world GDP [9].

Between 1950 and 1984, as the Green Revolution transformed agriculture around the globe, world grain production increased by 250%. The energy for the Green Revolution was provided by fossil fuels in the form of fertilizers (natural gas), pesticides (oil), and hydrocarbon fueled irrigation.[6]

David Pimentel, professor of ecology and agriculture at Cornell University, and Mario Giampietro, senior researcher at the National Research Institute on Food and Nutrition (INRAN), place in their study Food, Land, Population and the U.S. Economy the maximum U.S. population for a sustainable economy at 200 million. To achieve a sustainable economy world population will have to be reduced by two-thirds, says the study.[7] Without population reduction, this study predicts an agricultural crisis beginning in 2020, becoming critical c. 2050. The peaking of global oil along with the decline in regional natural gas production may precipitate this agricultural crisis sooner than generally expected. Dale Allen Pfeiffer claims that coming decades could see spiraling food prices without relief and massive starvation on a global level such as never experienced before.[8][9]

Hubbert peaks

Although Hubbert peak theory receives most attention in relation to peak oil production, it has also been applied to other natural resources.

Natural gas

While Hubbert correctly predicted peak oil timing in the United States (under his higher of two scenarios), the peak he predicted for natural gas was very far off. In 2000, U.S. natural gas production was 2.4 times higher than Hubbert had predicted in 1956 and has not produced in a fashion of the logistic curve Hubbert initially envisioned.

The North American peak happened in 2001, according to Western Gas Resources Inc; according to Doug Reynolds, the peak will have occurred in 2007 [10]; according to Bentley, production will peak anywhere from 2010 to 2020.[10]

Since compressed natural gas powered cars are already available in North America, peak oil and peak gas are related for transportation usage.

Because gas transport is a complicated operation, the global peak of gas is currently less important than the peak per continent. Due to higher gas prices LNG transportation has become economic. This leads to high investments in LNG production and transportation, which will lead to a more global gas market.

Natural gas production may have peaked on the North American continent in 2003, with the possible exception of Alaskan gas supplies which cannot be developed until a pipeline is constructed. Natural gas production in the North Sea has also peaked. UK production was at its highest point in 2000, and declining production and increased prices are now a sensitive political issue. Even if new extraction techniques yield additional sources of natural gas, like coalbed methane, the energy returned on energy invested will be much lower than traditional gas sources, which inevitably leads to higher costs to consumers of natural gas.

The United States accounts for 24% of world natural gas consumption [11]. Since natural gas is the single largest feedstock used to produce ammonia for fertilizers, an increase in natural gas prices could provide upward pressure on food costs, in addition to the increase in the transportation component of food prices. Note however, that the essential element of fertilizers is nitrogen and not carbon, while the energetically-limiting ingredient is hydrogen. This implies that ammonia can be synthesized using electricity, and electricity can come from many forms of renewable energy (not necessarily biomass). Renewable ammonia will likely have a higher price, depending on the future cost of electricity from renewable sources.

If a hydrogen economy based on renewable energy ever becomes a reality, diverting some of the hydrogen to ammonia production for fertilizers would be straightforward.

Also note that while natural gas is difficult to ship between continents, shipping ammonia is much more economical. When natural gas is a feedstock for fertilizer, it is often cheaper to locate the ammonia plants near the gas wellheads, and then ship the ammonia product rather than the natural gas. However, this may threaten food security if the gas wells and the ammonia plants are both in politically unstable countries.

Coal

Peak coal is significantly further out than peak oil, but we can observe the example of anthracite in the USA, a high grade coal whose production peaked in the 1920s. Anthracite was studied by Hubbert, and matches a curve closely.[11] Pennsylvania's coal production also matches Hubbert's curve closely, but this does not mean that coal in Pennsylvania is exhausted--far from it. If production in Pennsylvania returned at its all time high, there are reserves for 190 years. Hubbert had recoverable coal reserves worldwide at 2500 × 109 metric tons and peaking around 2150 (depending on usage).

More recent estimates suggest an earlier peak. Coal: Resources and Future Production (PDF 630KB[12]), published on April 5 2007 by the Energy Watch Group (EWG), which reports to the German Parliament, found that global coal production could peak in as few as 15 years [13]. Reporting on this Richard Heinberg also notes that the date of peak annual energetic extraction from coal will likely come earlier than the date of peak in quantity of coal (tons per year) extracted as the most energy-dense types of coal have been mined most extensively [14]. A second study, The Future of Coal by B. Kavalov and S. D. Peteves of the Institute for Energy (IFE), prepared for European Commission Joint Research Centre, reaches similar conclusions and states that ""coal might not be so abundant, widely available and reliable as an energy source in the future".[15].

Work by David Rutledge of Caltech predicts that the total of world coal production will amount to only about 450 gigatonnes.[12] This implies that coal is running out faster than usually assumed, or than what is assumed in calculations of global warming.

Finally, insofar as global peak oil and peak in natural gas are expected anywhere from imminently to within decades at most, any increase in coal production (mining) per annum to compensate for declines in oil or NG production would necessarily translate to an earlier date of peak as compared with peak coal under a scenario in which annual production remains constant.

Fissionable materials

In a paper in 1956 [16], after a review of US fissionable reserves, Hubbert notes of nuclear power:

There is promise, however, provided mankind can solve its international problems and not destroy itself with nuclear weapons, and provided world population (which is now expanding at such a rate as to double in less than a century) can somehow be brought under control, that we may at last have found an energy supply adequate for our needs for at least the next few centuries of the "foreseeable future."

Technologies such as thorium, reprocessing and fast breeders can, in theory, considerably extend the life of uranium reserves. Roscoe Bartlett claims [17]

Our current throwaway nuclear cycle uses up the world reserve of low-cost uranium in about 20 years.

Caltech physics professor David Goodstein has stated [18] that

... you would have to build 10,000 of the largest power plants that are feasible by engineering standards in order to replace the 10 terawatts of fossil fuel we're burning today ... that's a staggering amount and if you did that, the known reserves of uranium would last for 10 to 20 years at that burn rate. So, it's at best a bridging technology ... You can use the rest of the uranium to breed plutonium 239 then we'd have at least 100 times as much fuel to use. But that means you're making plutonium, which is an extremely dangerous thing to do in the dangerous world that we live in.

Metals

Hubbert applied his theory to "rock containing an abnormally high concentration of a given metal" [19] and reasoned that the peak production for metals such as copper, tin, lead, zinc and others would occur in the time frame of decades and iron in the time frame of two centuries like coal. The recent jump in the price [20] of copper [21] has become known among traders as peak copper. Lithium availability is a concern for a fleet of Li-ion battery using cars but a paper published in 1996 estimated that world reserves are adequate for at least 50 years [22]. A similar prediction [23] for platinum use in fuel cells notes that the metal could be easily recycled.

Phosphorus

Phosphorus supplies are essential to farming and depletion of reserves is estimated at somewhere from 60 to 130 years [24]. Individual countries supplies vary widely; without a recycling initiative America's supply [25] is estimated around 30 years [26]. Phosphorus supplies affect total agricultural output which in turn limits alternative fuels such as biodiesel and ethanol.

Renewable resources

Despite the fact that, in theory, Hubbert's analysis does not apply to renewable resources, over-exploitation often results in a Hubbert peak nonetheless. The Hubbert curve seems to be applicable to any resource that can be harvested faster than it can be replaced:[citation needed]

- Water: For example, a reserve such as the Ogallala Aquifer can be mined at a rate that far exceeds replenishment. This turns much of the world's underground water [27] and lakes [28] into finite resources with peak usage debates similar to oil. These debates usually center around agriculture and suburban water usage but generation of electricity [29] from nuclear energy or coal and tar sands mining mentioned above is also water resource intensive. The term fossil water is sometimes used to describe older aquifers that are not considered renewables anymore.

- Fisheries: At least one researcher has attempted to perform Hubbert linearization on the whaling industry, as well as charting the transparently dependent price of caviar on sturgeon depletion. [30] Another example is the cod of the North Sea [31].

Criticism

Economist Michael Lynch [32] argues that the theory behind the Hubbert curve is overly simplistic. [33] Lynch claims that Campbell's predictions for world oil production are strongly biased towards underestimates, and that Campbell has repeatedly pushed the date back. [34] [13]

Leonardo Maugeri, vice president for the Italian energy company ENI, argues that nearly all of peak estimates do not take into account non-conventional oil even though the availability of these resources is significant and the costs of extraction and processing, while still very high, are falling due to improved technology. He also notes that the recovery rate from existing world oil fields has increased from about 22% in 1980 to 35% today due to new technology and predicts this trend will continue. The ratio between proven oil reserves and current production has constantly improved, passing from 20 years in 1948 to 35 years in 1972 and reaching about 40 years in 2003.[14] These improvements occurred even with low investment in new exploration and upgrading technology due to the low oil prices during the last 20 years. However, Maugeri feels that encouraging more exploration will require relatively high oil prices [35].

Edward Luttwak, an economist and historian, claims that unrest in countries such as Russia, Iran and Iraq has led to a massive underestimate of oil reserves.[15] The Association for the Study of Peak Oil and Gas, or ASPO responds by claiming neither Russia nor Iran are troubled by unrest currently, but Iraq is [36].

Cambridge Energy Research Associates authored a report [37] that is critical of Hubbert influenced predictions:

Despite his valuable contribution, M. King Hubbert's methodology falls down because it does not consider likely resource growth, application of new technology, basic commercial factors, or the impact of geopolitics on production. His approach does not work in all cases-including on the United States itself-and cannot reliably model a global production outlook. Put more simply, the case for the imminent peak is flawed. As it is, production in 2005 in the Lower 48 in the United States was 66 percent higher than Hubbert projected.

CERA does not believe there will be an endless abundance of oil, but instead believes that global production will eventually follow an “undulating plateau” for one or more decades before declining slowly.[16]

While ASPO and CERA agree on the current available data on future energy needs, ASPOs reply is that CERA is overly optimistic about future supplies, and that we can not count[17].

Alfred J. Cavallo, while predicting a conventional oil supply shortage by no later than 2015, [38] does not think Hubbert's peak is the correct theory to apply to world production.[5]

See also

- Category:Peak oil

- Limits to Growth

- Hubbert curve

- Olduvai theory

- Gross domestic product per barrel

- Kuznets curve

- Low-carbon economy

- Oil crisis

- OPEC

- World energy resources and consumption

- Hirsch report on peak oil

Notes

- ^ Jean Laherrere, "Forecasting production from discovery", ASPO Lisbon May 19-20, 2005 [1]

- ^ J.R. Wood, Michigan Technical University Geology Department Oil Seminar 2003 [2]

- ^ a b Nuclear Energy and the Fossil Fuels,M.K. Hubbert, Presented before the Spring Meeting of the Southern District, American Petroleum Institute, Plaza Hotel, San Antonio, Texas, March 7-8-9, 1956[3]

- ^ YouTube - 1976 Hubbert Clip

- ^ a b Hubbert’s Petroleum Production Model: An Evaluation and Implications for World Oil Production Forecasts, Alfred J. Cavallo, Natural Resources Research,Vol. 13,No. 4, December 2004 [4]

- ^ How peak oil could lead to starvation

- ^ Eating Fossil Fuels | EnergyBulletin.net

- ^ Peak Oil: the threat to our food security

- ^ Agriculture Meets Peak Oil

- ^ Global oil & gas depletion: an overview, R.W. Bentley, Energy Policy, 30, 189–205, 2002 [5]

- ^ GEO 3005: Earth Resources

- ^ "Coal: Bleak outlook for the black stuff", by David Strahan, New Scientist, Jan. 19, 2008, pp. 38-41.

- ^ Campbell, CJ (2005). Oil Crisis. p. 90. ISBN 0906522390.

- ^ Maugeri, L. (2004). Oil: Never Cry Wolf--Why the Petroleum Age Is Far from over. Science 304, 1114-1115

- ^ The truth about global oil supply

- ^ CERA says peak oil theory is faulty Energy Bulletin Nov 14, 2006

- ^ http://www.energybulletin.net/node/19120

References

- "Feature on United States oil production." (November, 2002) ASPO Newsletter #23.

- Greene, D.L. & J.L. Hopson. (2003). Running Out of and Into Oil: Analyzing Global Depletion and Transition Through 2050 ORNL/TM-2003/259, Oak Ridge National Laboratory, Oak Ridge, Tennessee, October

- Economists Challenge Causal Link Between Oil Shocks And Recessions (August 30, 2004). Middle East Economic Survey VOL. XLVII No 35

- Hubbert, M.K. (1982). Techniques of Prediction as Applied to Production of Oil and Gas, US Department of Commerce, NBS Special Publication 631, May 1982

External links

Sites

- U.S. Energy Information Agency Petroleum Data * U.S. Energy Information Agency Petroleum Data

- Association for the Study of Peak Oil

- PeakOil.com

- Oil Depletion Analysis Centre in the United Kingdom

- PowerSwitch in the United Kingdom

- Energy Bulletin Peak Oil related articles

- Peak Oil in the News Daily round-up of Peak Oil news

- The Oil Drum Discussions about Energy and our Future

- TrendLines current Peak Oil Depletion Scenarios Graph A monthly tracking of 23 recognized estimates of URR, Peak Year & Peak Rate.

- Carbon War

- Global Oil Watch - Extensive peak oil library

Documentaries

- The Oilcrash, 2006

Online videos

Articles

- M. King Hubbert on the Nature of Growth. 1974

- El mundo ante el cenit del petróleo Fernando Bullón Miró

- M. King Hubbert, "Energy from Fossil Fuels", Science, vol. 109, pp. 103-109, February 4, 1949

- Technocracy, Hubbert and peak oil Article from The North American Technocrat

- David Hughes on Canadian Oil and Gas Transcribed interview of a Geologist with the Geological Survey of Canada. 30 December 2006.

- Aviation & Peak Oil Airways Magazine article by Analyst / Economist (July 2006)

Reports, essays and lectures

- Doctoral thesis about Peak Oil

- Review: Oil-based technology and economy - prospects for the future The Danish Board of Technology (Teknologirådet)

- Peakoil conference 19-20 October 2004

- Graph showing oil production in lower 48 US states following Hubbert's predictions

- Trends in Oil Supply and Demand, Potential for Peaking of Conventional Oil Production, and Possible Mitigation Options: A Summary Report of the Workshop (2006), National Research Council

- The End of Oil, essay 1.pdf, Very concise peak-oil study by Bob Lloyd, July 2005

- Peak Oil Theory – “World Running Out of Oil Soon” – Is Faulty; Could Distort Policy & Energy Debate