BTA bank

| BTA bank

|

|

|---|---|

| legal form | Corporation |

| founding | March 4th 1991 |

| Seat | Almaty , Kazakhstan |

| management |

|

| Branch | Finances |

| Website | www.bta.kz |

| Status: 2020 | |

The BTA Bank ( Kazakh БТА Банкі , Russian БТА Банк ) is a former Kazakh credit institution and today's financial company headquartered in Almaty . In the course of the financial crisis , the bank ran into considerable economic difficulties and had to be rescued by the Kazakh state in February 2009. In 2014 it was sold to Kazkommertsbank and the businessman Kenges Raqyschew . In June 2015, she voluntarily returned her banking license and the company's debt management activities have continued since then the former bank.

activities

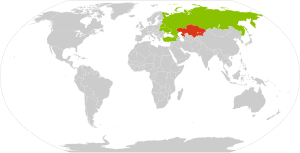

The bank works in corporate and retail banking and other areas of the financial industry. Russian АМТ Bank and Kazakh Temirbank are owned by the bank. BTA Bank has subsidiaries in Georgia , Belarus , Armenia , Ukraine and Turkey . The BTA Bank also owns several other financial companies.

history

Beginnings of the bank

The history of BTA Bank goes back to 1925 when the Russian Prombank opened a department in Kazakhstan. On June 7, 1932, by decree of the government of the Kazakh SSR, it was decided to open a regional bank branch in Almaty on the basis of the assets of Prombank. Above all, this should finance the development of the construction and electricity industries.

On July 24, 1991, the Turanbank was founded as a joint-stock company by resolution of the leadership of the Kazakh Socialist Soviet Republic . The chairman of the new bank with a total of 66 branches was Oraz Beysenov. In August 1992, Vnesheconombank was renamed the Bank of Foreign Economic Activities of the Republic of Kazakhstan Alem Bank Kazakhstan by the Kazakh government. Over the years, Alem Bank has acted as a government dealer in collecting foreign bonds under state guarantees.

The government of Kazakhstan decided on January 15, 1997 to restructure the two credit institutions Turanbank and AlemBank Kazakhstan. The two banks were merged to form the TuranAlem bank and placed under the Kazakh Ministry of Finance as a closed joint-stock company. On October 1, 1998, the company was privatized by converting it into an open joint stock company.

The Kazakh manager and businessman Muchtar Äbljasow (2005–2009) was elected as the new chairman of the board in May 2005 . Under him, BTA Bank began aggressively pursuing its plans to achieve financial success in the markets of the Commonwealth of Independent States . In 2006 he managed to acquire majority stakes in Temirbank and in the insurance company Insurance company London-Almaty.

In February 2008 the bank changed its name to BTA Bank. It was the largest bank in Kazakhstan in terms of total assets, capital and profit.

Financial crisis

In the course of the global financial crisis, BTA Bank ran into considerable difficulties. In early 2008, the bank had accumulated around $ 17 billion in debt and was de facto insolvent. To save the bank from bankruptcy, the Kazakh state holding company Samruk-Kazyna bought old shares in BTA Bank and issued new shares. In 2009, Samruk-Kazyna acquired 75.1 percent of the shares and gave her 251.3 billion tenge of additional capital. On April 20, 2009, the bank finally stopped all debt repayments, whereupon the rating agency Standard & Poor’s lowered the creditworthiness to the lowest level D. On September 25, the ordinary shares on the Kazakh Stock Exchange were suspended from trading.

In the years 2009 to 2010 attempts were made to restructure the ailing institute. The debt was reduced to 4.2 billion US dollars, the stake of Samruk-Kazyna was increased to 81.48. In 2011, the financial position and liquidity deteriorated to such an extent that a second restructuring process was initiated. After Lehman Brothers and Dubai World, the restructuring was one of the largest restructuring of a financial institution during the financial crisis. At the end of 2012, a total of 97.3 of the bank shares were owned by Samruk-Kazyna.

In February 2014 it was announced that BTA Bank and Kazkommertsbank will merge to become the largest bank in Central Asia by the end of the year. Kazkommertsbank will take over 46.5 percent of the BTA shares from the Kazakh state holding Samruk-Kasyna, and the current chairman of the supervisory board, Kenges Raqyshev , one of the largest private investors in Kazakhstan, will buy another 46.5 percent . Kazkommertsbank and Raqyshev will each acquire their shares for 72 billion tenge (around 465 million US dollars).

BTA Group

The BTA Group had the following subsidiaries in Asia and Europe (as of April 2014):

- BTA-Kazan OJSC ( Kazan , Russia )

- BTA Bank PJSC ( Kiev , Ukraine )

- BTA Bank CJSC ( Minsk , Belarus )

- BTA Bank JSC ( Tbilisi , Georgia )

- BTA Bank CJSC ( Yerevan , Armenia )

- Şekerbank TAŞ. ( Istanbul , Turkey )

- BTA Ipoteka JSC ( Almaty , Kazakhstan )

- SPF UlarUmit JSC (Almaty, Kazakhstan)

- Zhetysu Pension Assets Investment Management Organization JSC (Almaty, Kazakhstan)

- BTA Securities JSC (Almaty, Kazakhstan)

- SLIC BTA Bank BTA Zhizn JSC (Almaty, Kazakhstan)

- BTA Insurance SC of the BTA Bank JSC (Almaty, Kazakhstan)

- Insurance company London-Almaty (Almaty, Kazakhstan)

- JSC National Joint-Stock Insurance Company Oranta (Kiev, Ukraine)

- Titan-Inkassatsia LLP (Almaty, Kazakhstan)

- AlemCard LLP (Almaty, Kazakhstan)

Web links

- Official website of BTA Bank (English, Kazakh and Russian)

Individual evidence

- ↑ About Turan Bank (1991-1997). BTA Bank, accessed April 27, 2014 .

- ↑ About BTA Bank JSC (since 2008). BTA Bank, accessed April 27, 2014 .

- ↑ Deutsche Allgemeine Zeitung: BTA-Bank: The big sigh of relief ( memento of the original from June 7, 2015 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ About BTA Bank JSC (since 2008). BTA Bank, accessed April 25, 2014 .

- ↑ Handelszeitung: Kazakhstan: The sudden end of golden times

- ↑ Kazkommerzbank and BTA-Bank will merge by the end of 2014. (No longer available online.) Delegation of German business for Central Asia, archived from the original on April 25, 2014 ; Retrieved April 25, 2014 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ BTA Group. (No longer available online.) BTA Bank, archived from the original on April 25, 2014 ; accessed on April 27, 2014 (English). Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.