Rate of assessment (tax law)

In municipal tax law , the assessment rate is the designation for a factor that is multiplied by the tax base to determine the tax liability . In Germany, a rate of assessment is provided for trade tax ( Section 16 GewStG ) and property tax ( Section 25 GrStG ). It is thus an instrument with which the municipalities in Germany can influence the amount of the municipal taxes due to them . This right is part of the constitutionally secured guarantee of self-government ( Art. 28, Paragraph 2, Clause 3 of the Basic Law ).

fixing

There are three rates of assessment:

- Assessment rate for property tax A (for agricultural and forestry companies)

- Assessment rate property tax B (for most other properties)

- Assessment rate of trade tax

The municipal council decides the amount of the respective assessment rate. The tax base value is having the force for the local council by the tax authorities determined. With a higher rate of assessment, the municipality receives more tax revenue, but runs the risk that it will be used for commercial operations (by levying the business tax); becomes less attractive for farmers (property tax A) or for building owners (property tax B) compared to other municipalities.

The assessment rates for property and trade tax are regularly set in the municipal budget statute for a budget year (= calendar year), so they can be changed every year. They are referred to as “percentages”, so they are to be understood as percentages . For example, if the assessment rate is 350%, the tax base is multiplied by 3.5.

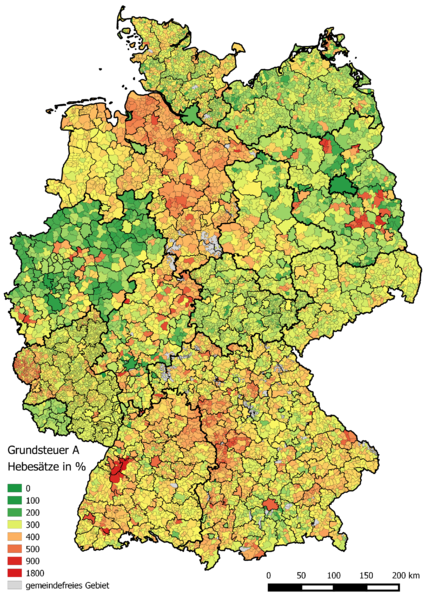

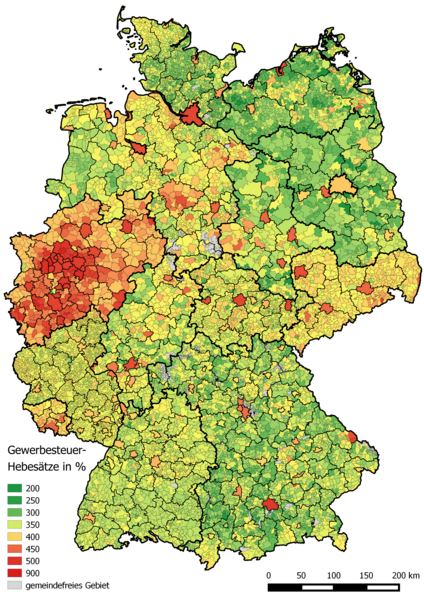

In 2009, the business tax rate in most municipalities was 250% to 400%. The lowest assessment rate was 200% (the legal minimum), a few hundred municipalities charge over 400%. The assessment rate for property tax A is usually between 250% and 350%; the assessment rate for property tax B is around 250% to 400%, with many municipalities charging lower rates and, on the other hand, the large cities in the Ruhr area consistently showing assessment rates from 500% upwards.

The municipality of Enzklösterle in the district of Calw, in Baden-Württemberg, currently has the highest property tax rate in Germany at 1800%. Peak values for large cities can be found in Offenbach , Berlin and Hagen with a rate of assessment for property tax B of 995% (Offenbach), 810% (Berlin) and 750% (Hagen). However, the financial crisis is now also forcing smaller municipalities to raise the tax rate. Currently, especially in structurally weak regions of Hesse, as an effect of the protective shield, the assessment rates are often raised to values between 500% and 800% and above. According to the DIHT have in 2013 from the 684 German towns with over 20,000 inhabitants, 165 the assessment rate for property tax B and 107 the assessment rate for the property tax A increased.

In the GDR , the business tax rate was uniformly 400%.

Minimum height

Since 2004, the municipalities have been obliged to apply a rate of at least 200% for trade tax ( Section 16 (4) sentence 2 GewStG). This is to prevent so-called trade tax oases (see Norderfriedrichskoog ). The regulation is covered by Article 105, Paragraph 2 of the Basic Law (priority of federal legislation for certain taxes) in conjunction with Article 72, Paragraph 2 of the Basic Law (priority of federal legislation, if the establishment of equivalent living conditions in the federal territory requires it). Most of the time, the rates of assessment in large cities are higher than those in the surrounding area. For example, Munich has a rate of assessment of 490%, the rates of assessment of the municipalities in the surrounding area are between 240% ( Grünwald ) and 350% (e.g. Olching ).

Maps of the height of the assessment rates in Germany

Web links

- Federal Statistical Office (DESTATIS): Publication - Public Finances & Taxes - Assessment Rates for Real Taxes. Federal and State Statistical Offices, accessed on January 6, 2013 .

Individual evidence

- ↑ Bund der Steuerpayers NRW , accessed on April 11, 2018

- ↑ Municipality of Enzklösterle: Determination of property tax and dog tax for the 2019 calendar year . Retrieved January 16, 2019.

- ↑ BVerfG, decision of January 27, 2010 , Az.BvR 2185/04 and 2 BvR 2189/04, full text.

- ↑ Assessment rates for real taxes, 2012 edition , Destatis.