Pictet group

| Banque Pictet & Cie SA | |

|---|---|

| Country |

|

| Seat | Geneva |

| legal form | Limited partnership |

| IID | 8755 |

| BIC | PICTCHGGXXX |

| founding | 1805 |

| Website | group.pictet |

| Business data | |

| insoles | 576 billion CHF (December 31, 2019) |

| Employee | 4600 (2019) |

| management | |

| Corporate management |

Partners College |

The Pictet Group is an asset management and private bank whose headquarters have been in Geneva , Switzerland , since 1805 . The group is one of the leading Swiss private banks and one of the first independent asset management companies in Europe. It offers private individuals and institutions worldwide the following services: asset advice , institutional asset management and a range of services related to the investment, management and administration of assets.

Pictet was founded in Geneva in 1805 and has operated as a partnership ever since. During the last 215 years there were only 43 partners with an average membership of over 21 years. Pictet has been organized as a limited partnership since 2013 . This is made up of seven partners who are responsible for all of the Group's business. Since 1805 the group has grown considerably without taking over other companies or going public.

The group employs more than 4,600 people, 900 of whom are asset managers. It has a global network made up of 28 offices in financial service centers. This also includes registered banks in Geneva , Luxembourg , Nassau , Hong Kong and Singapore .

According to the last annual report, the group manages assets worth CHF 576 billion. Pictet does not operate in investment banking and does not extend commercial loans. The group fulfills the strict requirements of Switzerland by far: its total capital ratio is 20.5%, which corresponds to a core capital ratio of Tier 1 Capital. The private bank Pictet & Cie SA is rated P-1 / Aa2 by Moody's and F1 + / AA- by Fitch .

history

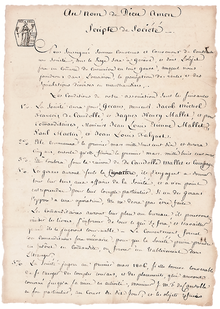

Pictet's origins go back to the establishment of Bank De Candolle Mallet & Cie in Geneva on July 23, 1805. On that day, Jacob-Michel-François de Candolle signed and Jacques-Henry Mallet along with three other limited partners, the founding charter of the partnership . At that time, trading in goods was the day-to-day business of all Geneva banks and Pictet was initially no exception. But soon advising clients on financial and business matters as well as asset management came to the fore. In the 1830s it was already offering its clients a wide range of securities to diversify their risks.

With the death of de Candolle in 1841, his wife's nephew, Edouard Pictet, joined the society. The name Pictet has been closely associated with the bank ever since. Between 1890 and 1929 the bank grew considerably; the number of employees rose from 12 to more than 80 over the course of 30 years. Although the Pictet family had been extremely committed to the bank since the mid-19th century, the company only changed its name to Pictet & Cie in 1926 .

After a relative stagnation marked by two world wars and the Great Depression of the 1930s , the bank expanded from the 1950s when a long phase began for the western world , which was characterized by prosperity and economic growth . In the late 1960s , the bank began institutional asset management, which was in its infancy. This now accounts for around half of their investment volume. The first of its currently 28 offices worldwide was opened in Montreal in 1974 . The workforce increased from 40 employees in 1950 to 300 in 1980.

Pictet has always focused on wealth management . The company offers three main services for private individuals, families and institutions worldwide: management of private assets, institutional asset management and services related to assets. Pictet is now the third largest asset management company in Switzerland and one of the largest European private banks.

In 2013, Pictet went from a partnership to a limited partnership that acts as the parent company for the Group's global operations. The aim of this change was to enable the group of companies to do business in an international environment. It also allows the seven partners who are shareholders in the group to maintain their succession arrangements, which have remained unchanged for 200 years. According to these regulations, the share of the respective partner cannot be bequeathed to their children: this is a temporary status that ends with retirement. Every partner surrenders shares in the group every five to ten years, so that the group of partners is always made up of people from three generations who are connected to the families. This is to avoid problems that the generation change brings with it. In 2015, the Pictet Group joined the Association les Hénokiens , an organization steeped in tradition, family businesses whose member companies have been majority-owned by the founding family for at least 200 years and are managed by a descendant of the founder.

Business areas

The company distributes responsibility for business activities and key areas, such as HR, risk control and legal affairs, among several partners. Small committees monitor the various activities of the company so that not one partner takes responsibility for an entire area. The senior partner of the group (the longest serving partner) oversees the areas related to auditing, risk management, HR and compliance.

Wealth management

Pictet Wealth Management offers expertise for private clients, solutions for the management of private assets and the family office for families of extraordinary wealth. The services include tailor-made institutional asset management, advice on strategy development and the choice of investments, settlement on global markets and the safeguarding and permanent monitoring of client assets. For hedge funds , private equity and real estate investments , the independent division Pictet Alternative Advisors selects third party asset managers to design alternative financial asset portfolios for investors.

As of December 31, 2019, Pictet Wealth Management, which has 22 offices around the world, managed assets worth CHF 234 billion and employed 1,029 full-time employees, including 352 private bankers.

On May 9, 2011, Irving Picard , trustee for the liquidation of Madoff Investment Securities, sued the bank in a class action lawsuit for $ 156 million in damages. According to Picard, there were irregularities in Bernard Madoff's investments and the banks should have known about them. Pictet denies ever selecting or recommending funds related to Madoff's businesses. Pictet only held a small scale Madoff Investments as a third party custodian .

On November 26, 2012, it was reported that the Wealth Management department, along with 11 other Swiss companies, had been targeted by the United States Department of Justice . The Justice Department examined banks suspected of aiding and abetting tax evasion. Unlike other firms, Pictet indicated that they would not post any provisions for 2015 and that their current capital reserves were well enough to cover any fine.

Asset management

Pictet Asset Management provides asset management for institutional investors and mutual funds; large pension funds, sovereign wealth funds and financial institutions are included. In addition, this department manages the investments of individual investors with the help of a range of mandates, products and services. She assists clients in managing stocks, bonds, and alternative and combined investment strategies.

Pictet Asset Management, represented by 17 Pictet offices worldwide, had assets under management of CHF 202 billion as of December 31, 2019 and employed 1,003 full-time employees, including 399 investment specialists.

Asset Services

Pictet Asset Services offers a range of services for asset managers, pension funds and banks. These include: fund services for institutional and private investors as well as for independent asset managers; Custody services in more than 80 countries; Transactions across all major asset classes are processed by Pictet Global Markets. The fund service includes the establishment of funds, their management and control. Pictet Asset Services operates nine booking centers, holds assets valued at CHF 509 billion and employs 1,402 full-time employees.

Prix Pictet

In 2008 Pictet launched the Pictet Prize , which honors photographic works that address social interactions and problems. Each year, appointed photographers are invited to submit a series of images on a specific topic, such as "Water" (2008) or "Space" (2017). The winner will be chosen by an independent jury chaired by Sir David King. Kofi Annan was the President of the Prix Pictet from its inception in 2008 until his death in 2018.

Individual evidence

- ↑ a b Entry in the bank master of Swiss Interbank Clearing

- ↑ a b c d e f Annual Report 2019 . Retrieved June 16, 2020.

- ↑ a b Pictet - About . Retrieved May 13, 2019.

- ↑ Les gérants de fortune augmentent en taille, sans être toutefois plus profitable . Retrieved July 12, 2016.

- ↑ Pictet Corporate Ratings . Retrieved January 8, 2020.

- ↑ Jean-Louis Mallet, Paul Martin and Jean-Louis Falquet.

- ^ "Pictet & Cie", 1805-1955, Atar, Genève, 1955.

- ^ Youssef Cassis, Les capitales du Capital: histoire des places financières internationales, 1780-2005, Geneva, Slatkine, 2005 ( ISBN 9782745317049 ), p. 48

- ^ Louis H. Mottet, Regards sur l'histoire des banques et banquiers genevois, Geneva, Tribune éditions, 1982 ( ISBN 978-2829700231 ), "Banques et banquiers genevois dans la première moitié du XIXe siècle", p. 139-155

- ^ Archives of the Pictet Group, ref. AHP 1.1.7.1

- ^ "200 years of History: one bank and the men who built it", Atar, Geneva, 2005.

- ↑ Pictet, deux siècles de vision ( Memento of the original of July 12, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved July 12, 2016

- ^ "Pictet & Cie, Genève: 1805-1980", Geneva, Atar, 1980.

- ↑ a b c cornerstones of a long company history . Retrieved July 12, 2016.

- ↑ Schisme chez les banquiers privés . Retrieved July 12, 2016.

- ^ Nicolas Pictet est le nouvel associé senior du groupe Pictet. Retrieved July 28, 2016

- ↑ You sur-mesure en banque privée . Retrieved July 12, 2016.

- ↑ Swiss banks compete on Asia's millionaires . Retrieved July 12, 2016.

- ↑ NZZ news item from April 12, 2011

- ^ Pictet targeted in widening US probe of Wealth Managers . Retrieved July 12, 2016.

- ↑ États-Unis: Pictet & Cie attend une réponse . Retrieved July 12, 2016.

- ^ Pictet Asset Services . Retrieved June 16, 2020.

- ^ Finalists for Prix Pictet Photography Award Announced . Retrieved July 12, 2016.

- ^ The inaugural Prix Pictet: Kofi Annan and the elemental power of the image . Retrieved July 12, 2016.

- ↑ Prix Pictet 2017: Richard Mosse wins prize with heat-map shots of refugees . Retrieved June 5, 2018.

- ^ Prix Pictet . Retrieved June 5, 2018.

Coordinates: 46 ° 11 '19.8 " N , 6 ° 7' 53.4" E ; CH1903: 499,084 / 116107