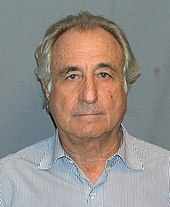

Bernard L. Madoff

Bernard Lawrence "Bernie" Madoff [meidɔf] (* 29. April 1938 in Brooklyn , New York City ; † 14. April 2021 in Butner , North Carolina ) was an American financial and stock brokers and investment fraudsters . Before his fraudulent activities were exposed, he was a well-respected securities trader and chairman of the NASDAQ technology exchange . A whistleblower discovered Madoff's investment fraud in 1999, but was approved by the US Securities and Exchange Commission SEC ignored for years.

End of 2008, Madoff was arrested for fraud, as it decades a mutual fund for a Ponzi scheme had operated. At the time of the trial of Madoff, the total amount of damage was estimated at at least 65 billion dollars (around 51 billion euros ) and the number of injured parties at 4800. According to lawyers, this is the "first truly global fraud case". In April 2009, the case directly or indirectly affected around three million people worldwide. Around 300 law firms and 45,000 lawyers are said to have dealt with the case at the time. Madoff was sentenced to 150 years in prison on June 29, 2009, and his case was brought up by the United States Attorney for the Southern District of New York , Preet Bharara .

The married couple Ruth and Bernard Madoff acted as donors to numerous charitable and cultural institutions and were members of the boards of many theaters, foundations and colleges. Because of this philanthropic appearance, several charitable foundations decided to entrust Madoff with their money, which ultimately resulted in high financial damage to them.

Life

Madoff was born in Brooklyn , New York, in 1938 , the second of three children to the married couple Sylvia Muntner and Zookan "Ralph" Madoff. His grandparents were Eastern European Jews who immigrated to the United States in the early 20th century. Madoff grew up in a modest family (his father's sports business had to file for bankruptcy) in Laurelton, a middle-class neighborhood of Queens that was then largely inhabited by Jewish immigrants , where he first attended public school and, from 1952, Far Rockaway High School. There he graduated from school in 1956.

From 1956 to 1957 he attended the University of Alabama , where he joined the Sigma Alpha Mu Jewish fraternity, which has existed since 1909. In 1960, after three years, he finished his political science studies at what was then Hofstra College on Long Island . From 1960 to 1961 he attended lectures at Brooklyn Law School and worked on the side.

As early as 1956, in Laurelton, he met Ruth Alpern, who was three years his junior and who was also the granddaughter of Jewish immigrants. She and Madoff married in 1959 and had two sons: Mark (1964-2010) and Andrew (1966-2014).

Business life

With a savings of 5,000 dollars from summer jobs as a lifeguard (in Silver Point Beach Club in Atlantic Beach , Long Iceland ) and installer for garden irrigation systems, he founded an investment company called in 1960. Investment Securities , focusing initially on so-called penny stocks specialized. She pointed ten years later a large number of customers who principally in country clubs of high society , such as the Palm Beach Country Club had won. His company initially lived on the so-called spread , the difference between the offer and demand price of a security . In addition, he offered computer trading in securities at an early stage and was thus often able to offer cheaper prices, which in turn offered advantages for funds .

In August 1963, the registration of Sylvia Madoff, the mother of Bernard Madoff, who worked as a broker dealer with her company Gibraltar Securities , was challenged by the United States Securities and Exchange Commission (SEC). In January 1964, the SEC waived further action in connection with its unclear financial situation, but in return Sylvia Madoff was forced to resign. It is unclear whether her husband Ralph ran the business, although she was registered for it. The extent to which this was related to the couple's tax debts is also unclear.

Madoff was a member of the National Association of Securities Dealers (NASD), which regulated the NASDAQ . His company was one of the driving forces behind its development, and he was non-executive chairman of the board of directors and a member of the board of governors from 1990, 1991 and 1993 .

The finance broker owned properties in the Upper East Side of Manhattan, the Hamptons , Palm Beach and Paris . Together with his wife Ruth he worked as a philanthropist and donor for colleges, theaters, educational institutions, Jewish charities and as a patron of the arts . From 1993 to 1994, Bernard Madoff had an affair with the publicist Sheryl Weinstein , who at the time was the chief financial officer of Hadassah , the Zionist women's organization in the USA.

Madoff's Bernard L. Madoff Investment Securities LLC , a limited liability company , had no general partner - it acted primarily as a broker on the stock exchange, but also as an investor . She was involved in the biggest fraud scandal the New York Stock Exchange has ever seen . The Wall Street Journal said it was what "could turn out to be the greatest financial fraud in history." The company operated as a so-called market maker . The brokerage house managed investment funds for high net worth clients and a number of hedge funds .

In 1970 Madoff's brother Peter B. Madoff entered the business. The brothers jointly ran Cohmad Securities , a company located in the same building as the Bernard Madoffs company. As it turned out later, Madoff stopped trading stocks as early as 1996.

In November 2008, Madoff transferred $ 164 million from Great Britain alone to his New York company.

Criminal Consequences

In December 2008, Madoff was arrested by the FBI . The US Securities and Exchange Commission (SEC) initially froze the remaining assets of around $ 70 million. Madoff was accused of having paid out promised profits from ever new customer deposits, a so-called Ponzi scheme . When one of his customers asked for billions in deposits back, the system collapsed. The SEC then filed charges on December 11, 2008. The case was therefore at the US District Court in Manhattan (US District Court for the Southern District of New York, Manhattan) under the name US versus Madoff, 08-MAG-02735 , pending. In a function similar to that of an investigative judge, more precisely as a US magistrate judge, Gabriel Gorenstein appeared.

Apparently Madoff was about to surrender when his system was on the verge of collapse. Problems had existed since December 2007 because customers withdrew their deposits in the wake of the financial crisis . It was also noticeable that the Madoff Family Foundation donated only $ 95,000 to charities in 2007, compared with $ 1,277,600 the year before.

The lawsuits indicate that Madoff had also cheated on his sons Andrew and Mark. After he revealed to them on the evening of December 10, 2008 that only $ 200 to 300 million of the billions of investors were left, the brothers called lawyers and turned on the authorities. Shortly before, Ruth Madoff had withdrawn $ 15.5 million from a company in which her husband was involved.

For testing the books, according to the New York investment advisory was Aksia the company Friehling & Horowitz responsible, a company with three employees.

Bernard Madoff was released on $ 10 million bail, but was not allowed to leave New York State . On December 16, 2008, prosecutors ordered a full-day curfew . Madoff agreed to wear an electronic ankle cuff and hand in his passport . His wife Ruth also had to surrender her passport, although she was not accused.

Attorney General Michael Mukasey withdrew from the case according to the Ministry of Justice because his son Marc Mukasey, Frank DiPascali, represented a senior employee in Madoff's company.

On January 13, 2009, the prosecution tried again to arrest Madoff, but District Judge Lawrence McKenna dismissed her because there was no risk of escape. This met with incomprehension from the public, especially since it had previously become known that Madoff had sent jewelry worth more than one million dollars to friends and relatives while under house arrest.

On March 12, 2009, Madoff was arrested after pleading guilty of theft , money laundering and forgery . He was taken away in the courtroom. On June 29, 2009, Madoff was sentenced to 150 years in prison, the highest possible for his offenses.

Forced liquidation of the company, privately owned

On the evening of December 15, 2008, a New York judge granted the application by the Securities Investor Protection Corporation (SIPC) to liquidate the Bernard Madoffs company in order to place it under a trustee . Stephen Harbeck, head of the SIPC, suspected even at that time that the company had only minor reserves. For its part, the SIPC has a reserve fund to support investors in financial companies with up to $ 500,000 per customer. The reserve fund is in turn approved by Congress. At the end of February 2009, its President Stephen Harbeck gave foreign investors hope that his institution could step in up to the aforementioned limit.

Authorities cordoned Madoff's headquarters on the 17th floor of the Lipstick Building on Third Avenue in Manhattan and examined the business records. The trustee in charge of SIPC Irving Picard was able to secure assets of approximately $ 830 million with Madoffs BMIS by January 21, 2009. Among other assets, the trustee tried to terminate the leasing contracts for six luxury cars.

Money that had been deposited but not yet invested shortly before Madoff's arrest was withheld by the bankruptcy administrator and was not included in the bankruptcy estate but was returned to investors. On January 1, 2009, attorney Howard Kleinhendler filed a lawsuit against trustee Irving Picard and JP Morgan Chase on behalf of Martin Rosenman. His $ 10 million investment had gone into a bank account on December 5, 2008, six days before Madoff was arrested. Kleinhendler also sued the bank on January 7, 2009 on behalf of Stanley Kriegler's company Hadleigh Holdings LLC for one million dollars, which had also gone to JP Morgan Chase on December 8, 2008.

Picard has since managed to locate another $ 75 million in assets in Gibraltar , on top of the 946 million discovered worldwide, and a house in Cap d'Antibes that was valued at one million. This added up to the total value by March 23, 2009 to around one billion dollars. In the UK, the lawyers work with the local Serious Fraud Office and the Serious Organized Crime Agency .

A part of Madoff's company, the value of which he himself had estimated at $ 700 million, was sold for 15 million to the Boston company Castor Pollux Securities for the benefit of the aggrieved investors.

Networks

For years Madoff was one of the biggest donors to the Democratic Party . One of the closest friends is Alvin Ira Malnik , who was also a major donor to the Democratic Party.

Madoff operated the recruiting of new investors personally until the end, but some of the recruited by him has approached other investors. Among them is the hardest-hit Fairfield Greenwich Group . This group has managed $ 14.1 billion in investor funds since the early 1980s. It was headed by Walter Noel (78), whose four sons-in-law, who come from Colombia , Switzerland and Italy , recruited new customers in Europe and South America according to a contribution from the International Herald Tribune . The company said it had lost $ 7.5 billion, largely due to the Fairfield Sentry fund , which invested exclusively with Madoff. It required one percent of the investment from the investors, plus twenty percent of the profits. The Manhattan-based Fairfield-Greenwich Group worked in turn with Jeffrey Tucker, a former employee of the Securities and Exchange Commission , and Andrés Piedrahita, the husband of Corina Noel, one of Walter Noel's five daughters and his Swiss-Brazilian wife Monica. In Italy, Lisina Noel's husband, Yanko Della Schiava, recruited Alix Noel's husband, Philip Toub , in Lausanne, Switzerland .

Other "feeders", such as J. Ezra Merkin and his Ascot Partners fund or Gerald Breslauer from Los Angeles , who invested for Steven Spielberg and Jeffrey Katzenberg , received 1.5 percent of the investment sums. Charges were also brought against Merkin and Ascot. Mortimer Zuckerman sued Merkin in the New York State Supreme Court in Manhattan that he had informed him in a fax in December that he was working for Zuckerman's CRT Investments Ltd. I invested 25 million at Madoff. In addition, Merkin said through his Gabriel Capital Corp. approximately 30% of Zuckerman's personal wealth, approximately $ 15 million, is invested in Madoff. In total, Merkin is said to have invested 2.4 billion dollars in this way without the knowledge of investors. Merkin, the former chairman of General Motors' financial division GMAC and three of its funds - Ascot, Gabriel and Ariel - reportedly received a total of $ 470 million in commission, according to the indictment. Merkin had raised funds from charities, universities, and retail investors, including two New York universities that lost $ 20 million.

The merger arbitrage specialist Victor Teicher worked with Merkin, but he was imprisoned from 1994 to 1995 for insider trading, of which he was convicted in 1990. Only a professional ban by the securities regulator finally ended their business relationship in 2000 after more than 15 years, whereby Teicher Merkin had warned against Madoff, as Andrew Cuomo, the attorney general of New York, was able to determine. Merkin herself had only made a small investment in Madoff.

In close contact with Madoff was Robert Jaffe, a 64-year-old from Massachusetts who had good contacts with investors in Boston and Palm Beach. Jaffe is the son-in-law of Carl J. Shapiro, the founder of Kay Windsor . He was vice president of Cohmad Securities , a brokerage firm 20 percent owned by Madoff. Cohmad paid commissions to feeders who referred customers to Madoff. Jaffe also received one to two percent of each customer's first deposit, but claimed that he had no knowledge of Madoff's Ponzi scheme.

The Brazilian Banco Safra from São Paulo ran a fund called Zeus Partners Limited , which was part of Madoff's feeder system, for several years .

Poor SEC supervision

Christopher Cox , director of the Securities and Exchange Commission (SEC) since 2005, said on December 16, 2008 that he was very concerned that there had been "credible and targeted allegations" and evidence of fraudulent behavior by the former NASDAQ director for years had not been followed up. The first clues came from 1999. Harry Markopolos , who worked for the Rampart Investment Management hedge fund (a competing mutual fund) in Boston, had warned the authorities that Madoff was not really a successful asset manager, but ran a gigantic Ponzi scheme, he So finance the profits of the old investors with the deposits of the new ones. Markopolos reported the case to the supervisory authorities back in 2000. In 2005, Markopolos sent a major report to the SEC entitled "The World's Largest Hedge Fund Is A Scam".

Christopher Cox initiated an investigation into the matter. According to the Times report above, this also included the relationship between Madoff's niece, Shana Madoff, and SEC executive Eric Swanson, who married in 2007. Swanson worked for the SEC from 1996 to 2006.

The US President- elect Barack Obama , who was still- designate at the time, commented on the scandal with the words that the case "has reminded us again of how badly reform is needed" ("has reminded us yet again of how badly reform is needed") ).

On January 14, 2009, the Financial Times reported that the Financial Industry Regulatory Authority (Finra), which oversees more than 5,000 registered securities dealers, had investigated complaints against Madoff 19 times since 1999. However, the SEC only followed up these complaints half-heartedly and in a highly uncoordinated manner: Although several teams were assigned to Madoff, communication between the various groups rarely took place. In some cases it was even Madoff himself who informed the inspectors of the existence of other investigation teams.

Madoff had contacted the SEC early on, and Arthur Levitt , who headed it from 1993 to 2001, took occasional advice from him. However, the two had different opinions in many ways and the contact should not have had any special status.

Injured party

Directly injured party

As of December 25, 2008, directly injured parties included issuers of various types of investment funds , but also wealthy private individuals such as:

- Fairfield Sentry Ltd, a hedge fund of Walter Noel's Fairfield Greenwich Group. According to Bloomberg (see below) it is the biggest loss. It should be $ 7.3 billion, which is more than half of its total assets of $ 14.1 billion.

- Kingate Global Fund Ltd, a hedge fund of Kingate Management Ltd.

- The hedge fund Bramdean Alternatives by Nicola Horlick in London.

- The Maxam Capital Management LLC , founded by Sandra Manzke, lost around 280 million dollars. Ms. Manzke herself was one of the people who referred investors to Madoff.

- Tremont Group Holdings Inc., a hedge fund owned by Oppenheimer Funds Inc., had half of its assets, around $ 3.1 billion, invested in Bernard Madoff, as Bloomberg reported on December 16.

- The Robert I. Lappin Charitable Foundation , a charitable Jewish organization in Salem, Massachusetts that financed trips for Jewish children to Israel, for example, had to file for bankruptcy on December 12, 2008 as a result of the developments.

- The Picower Foundation in New York, which a.o. Funded medical research projects, and had Madoff Securities manage the entire foundation's assets of approximately $ 1 billion, had to cease operations on December 20, 2008.

On January 7, 2009, the Wall Street Journal published a much more extensive list of victims, which as of January 16, 2009 listed more than 110 victims. The damage has now totaled well over 30 billion US dollars, including 2.1 billion US dollars at the Austrian bank Medici and 2.87 billion US dollars at the Spanish Banco Santander .

The official list of victims, presented on February 5, 2009, is 162 pages long.

United States of America

In addition to the Shapiro couple, Steven Spielberg and his business partner and boss of DreamWorks Animation , Jeffrey Katzenberg, were among the prominent private investors . According to Herald Sun , its charitable foundation, the Wunderkinder Foundation, is also affected. Irwin Kellner, an economist at MarketWatch, sued Bernard Madoff on December 16, 2008 for $ 2.2 million in damages following the Herald Sun's contribution. Municipal employee organizations such as the employees board and the police and fire board , which represented 971 workers, had also invested $ 41.9 million.

In addition to the victims, who became known shortly after Madoff's arrest, there were also renowned scientists such as Gabriel Bitran from the Massachusetts Institute of Technology . He had suggested to investors that they could minimize price fluctuations, but had invested part of the money through a fund at Madoff.

The then 91-year-old actress Zsa Zsa Gabor and her husband Frederic Prinz von Anhalt were also affected with a loss of 4.5 million dollars.

Even executives from Merrill Lynch, at the time still an investment bank, such as the former CEOs Daniel Tully and David Komansky and the former head of the investment banking division Barry Friedberg had invested in funds that had been set up by in-house brokerage chief John Steffens.

The Elie Wiesel Foundation of Nobel Prize winner and Holocaust survivor Elie Wiesel lost almost all of its $ 15.2 million fortune in the wake of the Madoff scandal.

Luxembourg

The funds “Lux-Alpha” and “Lux-Invest” of the Swiss UBS and “Thema” of the English HSBC , which were involved in Madoff, were operated under Luxembourg law. Luxalpha , Luxinvest and Herald Fund Luxembourg had meanwhile suspended the redemption of units . According to the Luxembourg banking supervisory authority CSSF , a total of 16 funds had suspended the redemption of units as a result of an exposure to Madoff.

The Lux-Alpha SICAV was liquidated by order of the Luxembourg financial supervisory authority CSSF. The “Herald (Lux) SICAV” was liquidated by order of the CSSF. Another Luxembourg fund, the Luxembourg Investment Fund-US Equity Plus , a subsidiary of the Swiss UBS , was sanctioned by the CSSF because the fund had suffered heavy losses as a result of Madoff investments. The legal closure of the fund was planned. After Luxalpha and Herald, UBS's Luxembourg Investment Fund was also liquidated in May 2009.

The Luxembourg public prosecutor's office has started investigations against the UBS branch in Luxembourg regarding the two funds LuxAlpha and LuxInvest . Among other things, forgery of documents is said to have been committed. UBS Luxembourg had already known in 2005 of Madoff's dual role as fund manager and fund sub-depositor , which would have been prohibited in the Grand Duchy of Luxembourg due to the conflict of interests .

In July 2014, a criminal complaint was filed against the board of directors of the Luxembourg financial regulator CSSF .

Switzerland

The Swiss Banque Benedict Hentsch Fairfield Partners SA , based in Geneva , announced that it had invested 56 million Swiss francs (47.5 million US dollars) of its customers in Madoff. According to this report, Carl and Ruth Shapiro, important donors for the Museum of Fine Arts , but also Brandeis University and the Beth Israel Deaconess Medical Center, are also affected. The Shapiros alone have then lost half of their assets, around $ 220 million. Avram and Carol Goldberg, the former owners of Stop and Shop , a supermarket chain, and Stephen Fine, president of Biltrite Corp., were also harmed. As reported by Reuters , Swiss banks alone had lost $ 4.22 billion.

Union Bancaire Privée , which specializes in hedge funds and managed 127 billion Swiss francs in June 2008, reported a total exposure of 700 million US dollars or 800 million Swiss francs at Madoff. This represented less than 1 percent of total assets under management. The Dinvest Total Return fund was particularly affected, and its return fell by 3 percent as a result. The bank itself had no funds of its own invested in Madoff. In January 2009, she denied ignoring warnings. In May 2009, US investors filed a lawsuit. You are demanding the reimbursement of the commissions collected and the interest.

The bank Benedict Hentsch was only merged in August 2008 with Fairfield Greenwich Group , which had invested 7.5 billion dollars in Madoff. The EIM Group , which invested 2% of its capital, or $ 220 million, in Madoff, was also among the victims. Notz, Stucki & Cie and Benbassat & Cie were also affected. According to its own statements, Credit Suisse is not affected .

In terms of the damage, it was initially impossible to determine the extent to which the banks themselves or their customers were affected. It was clear that several hundred customers of Hyposwiss Private Bank Geneva were affected. However, these were customers who consciously, and on their own initiative, had invested in Madoff. The fraud cost these customers 175 million francs. Hyposwiss Private Bank Geneva, which was called Anglo Irish Bank (Suisse) SA until February 2008, had been active in the hedge fund business for years as a subsidiary of the Irish Anglo Irish Bank . The Zurich parent company of Hyposwiss, on the other hand, was only marginally affected indirectly via third-party products. Hyposwiss, which is owned by St.Galler Kantonalbank , looks after wealthy investors with portfolios of between three and ten million francs.

Syz & Co and Pictet & Cie said they were not affected, as were Lombard Odier Darier Hentsch , Mirabaud and GAM (Julius Baer). The Bank Julius Baer told the news agency Reuters with, there was no damage.

The UBS announced that the damage would be meaningless. The French asset manager Oddo, however, who had sold the shares of his clients, which were in the Luxembourg fund Lux Alpha, whose depositary was UBS, and who on November 4, 2008, sued UBS. He never received the money, said a company spokeswoman for the French news agency AFP . That is why Oddo initiated proceedings against UBS in Luxembourg . On January 15, UBS Luxembourg was sentenced to 30 million euros in damages.

Basically, the legal dispute revolves around the responsibilities of the custodian banks of funds. "According to Bloomberg, the big banks UBS and HSBC could be sued for up to 3.2 billion dollars," reported the Neue Zürcher Zeitung on January 15, 2009 .

UBS had to disclose documents that could prove a breach of its duty of care, ruled a Luxembourg district court, before which two individual plaintiffs and the shareholders' association Deminor had sued. It concerned possible contracts between UBS and the investment company Madoffs as well as a secret report from the auditor. The Luxembourg banking supervisory authority CSSF asked the Swiss to be accountable for business conduct. A month later, the Herald-Lux-Fonds had a similar experience.

Austria

In Austria , private investors in particular were harmed, according to an initial estimate by the National Bank of around 350 million euros. You had invested in Primeo funds from Pioneer Alternative Investment Management, which belong to UniCredit , originally Bank Austria Group, in Milan , and in Herald Fonds, Herald USA and Herald Luxemburg . The investment advisor to Primeo funds was Bank Austria Worldwide Fund Management, which was 100% owned by the Bank Austria Group. Ursula Fano-Leszczynski acted as managing director and front woman.

The Primeo Fund showed a return of 6.5% for 2008. The Herald funds were invested by the Austrian private bank Medici , which was based in Vienna . At the end of March 2009, the share of the amounts transferred from Austria to New York was estimated at 3.2 billion euros.

Bank Medici

Bank Medici belonged to a quarter of Uni Credit , the rest belonged to Sonja Kohn , who had advised the government on economic affairs and was the chairwoman of the bank.

On December 31, 2008, the Medici private bank was put under government supervision and a government commissioner was appointed. The funds managed by the bank and the funds invested at Madoff LLC are said to be worth $ 3.6 billion. The bank itself, which had 15 employees, put the sum at 2.1 billion. In November 2008, the Viennese banker took first place in “Germany's Hedgefund Award”. According to an article in the Frankfurter Allgemeine Sonntagszeitung on January 11, 2009, Kohn had known Bernard Madoff personally since the 1980s. She had met him in Monsey , a town near New York mainly inhabited by Orthodox Jews. In 1990 she founded the company Eurovaleur and, after she returned to Vienna, Medici Finanzservice GmbH - taking over the unprotected name “Medici” without having any contact with the Florentine banking house. From 1996 to 2000 she advised the Austrian Finance Minister Johann Farnleitner and in 1999 received the Great Decoration of Honor for Services to the Republic of Austria . According to the Frankfurter Allgemeine Sonntagszeitung, Kohn could have largely driven out Madoff's holdings. Kohn claims he was unaware of Madoff's fraudulent intent.

The Oesterreichische Nationalbank carried out an audit against the Bank Medici . Kohn is said to have earned 50 million euros a year with Madoff's fraud system. She is said to have raised funds in Ireland and Luxembourg and transferred it to Madoff via the Cayman Islands . Of this, only 8 million euros are said to have flowed to Vienna annually, the rest to Switzerland, possibly to the private bank Genevalor, Benbassat & Cie.

On December 18, 2008, the former head of the stock exchange, Stefan Zapotocky, gave up his seat on the supervisory board of Banken-Österreichische Industrie-Holding AG Fimbag . He had sat on the board of the Madoff-managed fund Alpha-Prime , which was co-developed by Sonia Kohn. Kohn had received $ 526,000 from Madoff's Cohmad Securities Group, according to the ad published by William Galvin, the State Secretary of State for Massachusetts. Cohmad (composed of Maurice Cohn and Madoff), in turn, had received over $ 67 million from Madoff for brokerage services. On January 22nd, the bank countered rumors that it was about to close.

Kohn, who wanted to remain head of the Medici Bank on February 12, 2009, could not prevent the sale of the bank, which was announced two days later. The lawyer Gabriel Lansky reported Kohn and other board members of the bank on suspicion of fraud and embezzlement, the public prosecutor started their investigation on February 25, 2009.

In March 2009, only a statement appeared on the company's website that the bank had become a victim of Madoff and that they wanted to take care of the injured party.

On March 19, 2009, the Supervisory Board decided to close the bank, although the return of the banking license had been "not an issue" a week earlier . The return of the banking license, however, "does not necessarily mean the liquidation of the company", which still had 20 employees.

On December 10, 2010, Bank Medici, Sonja Kohn and other people of minor importance to the bank were sued in New York for damages in the amount of 19.6 billion dollars (around 15 billion euros).

Primeo Fund of Unicredit Bank Austria

As part of the liquidation of the Primeo Select fund, which was estimated at EUR 650 million, the first investors' meeting was to take place on March 24, 2009 in London. However, investors who had bought fund units from Bank Austria will not be taken into account in the liquidation at this time, as they have not been granted the status of shareholders in the fund. The liquidator is Kroll Limited in the Cayman Islands . The fund register may only contain the few investors who have acquired their units through the HSBC custodian bank. Primeo liquidator Richard Fogerty suspected, however, that UniCredit Bank Austria, which had offered the fund alongside Erste Bank, the Raiffeisen Group and Bank Medici in Austria, acted as the investor for the unrepresented.

Nürnberger Versicherung AG Austria joined a lawsuit against Bank Medici and Bank Austria, in particular against Primeo Fund, Pioneer Alternative Investment and HSBC Holding in the USA at the end of March 2009, and wants to appear there as the main plaintiff. As in many other cases, this also involves the violation of supervisory and fiduciary duties. It is about 763,000 euros in damage. Other injured parties are also organizing and want to sue, including the former Bank Austria General René Alfons Haiden, as well as the former National Bank President Adolf Wala and GiroCredit boss Hans Haumer. An out-of-court settlement with 740 affected customers had already failed.

A Viennese doctor sued the Kärntner Sparkasse in May 2009 because it allegedly caused damage of 500,000 euros due to inadequate advice, which resulted from the complete worthlessness of his Primeo fund shares.

Overall, Bank Austria is facing numerous lawsuits, and personal consequences have already been drawn. The board of directors for private and business customers changes to AWD ; the Markets and Investments division had to be evacuated.

Alpha-Prime Fund of the Erste Bank Group

In August 2009, investors want to bring a lawsuit against Erste Bank in the "Madoff" case. The institute is accused of violating the Investment Fund Act. Erste Bank rejects this for the time being.

Netherlands

Fortis Nederland, an offshoot of the Dutch-Belgian Fortis AG taken over by the Dutch government , recorded indirect losses on customers and funds that borrowed money to purchase fund shares, which in turn have invested in Madoffs Investment Securities LLS. The losses amounted to 922 million euros. Added to this are losses from pension funds amounting to 166 euros, from private investors by 200 and from insurers amounting to around one million euros.

Germany

According to Reuters, no German banks were affected, but according to information from the Financial Times Deutschland, around 20 freely distributed funds of funds and certificates and thus private customers.

Thereafter, their investments were made "apparently via the detour of two funds distributed from Austria with the names 'Thema US Equity' and 'Herald US Absolute Return'". The distributor was the Viennese private bank Medici. It also said: “The ... companies - Frankfurt-Trust, AmpegaGerling, Carat, Alceda and Universal-Investment - had to write off the value of the two funds in their portfolios to a value of 10 cents. The price of the fund of funds also fell accordingly. ”This was an indication of further damage that customers had suffered as a result of changes in over-the-counter and on-exchange valuations. The article also stated, “The custodian, an Irish subsidiary of the major bank HSBC, is responsible for the safekeeping of the assets in the fund. It is also liable to investors if it has not complied with the safekeeping and inspection obligations. The auditor is PricewaterhouseCoopers . "

Well-known sales source in Germany was UBS, which invested in Thema and Herald for particularly wealthy clients through funds of funds of the UBS Sauerborn Trust .

On February 20, 2009, the Ministry of Finance announced that “153 million euros had been invested via German investment funds in Madoff funds that may have been directly affected”. These are "69 investment funds", including 35 special funds, whereby the number of those affected cannot be determined.

At the end of April 2009 it became clear that the total damage incurred in Germany totaled over one billion euros. Among the victims was the German-Swiss industrial dynasty Thyssen-Bornemisza, descendants of August Thyssen . The family had invested in Madoff through the company TBG in Monaco.

Italy

In Italy , the Pioneer Alternative Investments fund of the UniCredito bank , which is based in Dublin , was affected . According to the bank, it was 75 million euros, with private customers practically unaffected. The indirect involvement in Bernard L. Madoff Investment Securities was therefore around EUR 805 million. Their money flowed mainly into the Herald USA Fund of the Viennese bank Medici .

Mediobanca denied any investment in Madoff, but admitted on December 16, 2008 that it had invested 671,000 dollars through Compagnie Monegasque de Banque .

France

In France , BNP Paribas reported losses of 350 million euros. It should not have been affected directly, but through trade and credit. The financial service provider Natixis had until then had losses of around 450 million euros. The Societe Generale was invested by its own account with less than 10 million euros. She had put Madoff on her internal blacklist after a visit to New York and warned her clients not to invest.

According to media reports on December 24, 2008, René-Thierry Magon de la Villehuchet , founder and fund manager of the mutual fund Access International Advisors , committed suicide in his Paris office as a result of losses of $ 1.4 billion . The fund manager came from an aristocratic French family. The will in 2002 Prince Charles of Prince Michael of Yugoslavia an investment in Access International Advisors have been suggested, but the prince decided against it. Prince Michael, a distant relative of the Yugoslav Crown Prince Alexander , worked as a partner at Thierry Magon de La Villehuchet, who had invested around 3/4 of the funds he managed there when Bernard Madoff's funds collapsed.

Spain and Portugal

The Spanish Banco Santander , which had a so-called "exposure" of up to 3 billion dollars, was hit much harder . The investments were made by the subsidiary Optimal , which managed a total of around 10.5 billion euros. Santander had only invested 17 million on its own account. The Spanish anti-corruption agency investigated Santander's relationship with the mutual fund Fairfield Greenwich Group and the funds of the US wealth manager Madoff. Santander offered its injured customers 1.38 billion euros in paper, probably preferred shares of its own company. However, this option was only available to private customers who were asked to explain that they did not want to sue Santander. Cremades & Calvo-Sotelo, who represented 1,800 victims, also demanded compensation from institutional investors. At the end of May, Santander agreed to pay $ 235 million to compensate the victims.

The second largest bank in Spain after Santander, Banco Bilbao Vizcaya Argentaria SA, denied having invested in Madoff.

According to the Bank of Portugal, the damage there amounted to at least 67 million euros, with 18 million euros to be borne by banks. The Portuguese regulator, however, assumed at least 76 million.

Great Britain

In the UK , Bramdean Alternatives , which had put over 9% of its equity in Madoff, was at risk of heavy losses. The Royal Bank of Scotland also feared losses of 400 million euros, as AP reported. The HSBC (Hongkong and Shanghai Banking Corporation), as on 15 December 2008, the Financial Times reported, particularly affected because they had invested around one billion dollars. According to the bank, only a "small number" of institutional investors and custodian customers were affected.

Damaged people were also found among the hedge funds in so-called tax havens , such as the British Virgin Islands in the Caribbean . There Auriga International Advisers were hit with losses of 350 million dollars (here the official currency). This hedge fund was mainly invested in Fairfield Sentry , as the majority owner Jacques Rauber explained, who in turn was invested exclusively in Madoff. According to the Zurich resident, the Auriga Alternative Strategies fund was much less affected.

Australia

None of the five major Australian banks were directly involved in the Madoff case, but the Commonwealth Bank and National Australia Bank were investigating whether they were indirectly involved. These investigations were triggered by lawsuits brought by mutual funds against UBS and HSBC. In mid-January 2009, Westpac was the only bank in Australia to be considered unaffected.

Other countries

The Japanese Nomura reported losses of around 225 million euros, and Aozora was also invested in Madoff with at least 137 million dollars.

According to a list of various media, the following losses occurred as of December 25, 2008:

| Surname | country | Loss in US $ millions |

|---|---|---|

| Fairfield Greenwich | United States | 7,300 |

| Banco Santander | Spain | 3,600 |

| Kingate management | United States | 2,800 |

| Bank Medici | Austria | 2,000 |

| HSBC | Great Britain | 1,200 |

| Picower Foundation | United States | 1,000 |

| Benbassat & Cie | Switzerland | 935 |

| Union Bancaire Privée | Switzerland | 850 |

| Natixis | France | 450 |

| Fix asset management | Cayman Islands | 400 |

| Reichmuth Matterhorn | Switzerland | 330 |

| Maxam Capital | United States | 280 |

| EIM Group | Switzerland | 230 |

| Shapiro Foundation | United States | 145 |

| Banque Bénédict Hentsch | Switzerland | 48 |

| Madoff Family Foundation | United States | 18th |

| Elie Wiesel Foundation | United States | 15.2 |

On December 16, 2008, Fortis announced that it had lost up to one billion euros through indirect investments.

According to media reports, a Shell pension fund was also affected, which claims to have suffered losses of around 29 million euros.

Indirect damage

Damage to charities and nonprofits

The Justice, Equality, Human dignity, and Tolerance (JEHT) foundation had to forego donations from Madoff due to the scandal. She was forced to give up, as her head Robert Crane explained on Democracy Now .

The Museum of Jewish Heritage had to lay off 12% of its employees because sponsorship payments collapsed. Given that, according to Bloomberg, 25% of donations for higher education institutions come from Jews, this disaster is likely to hit a number of other organizations. Brandeis University and Boston's Museum of Fine Arts, for example, and foundations that had invested in Madoff, such as the Frank Lautenberg Foundation, also suffered losses and are therefore doubly affected. Founded by New Jersey Democrat Lautenberg , the foundation invested 12.8 of its $ 13.8 million in deposits with Madoff. That foundation alone gave $ 352,500 to the United Jewish Appeal of MetroWest NJ in Whippany, New Jersey (both in 2006). The Jewish Federation of Greater Los Angeles lost $ 6.4 million, 11% of its wealth, according to the same report. She supports the impoverished members of the community. The Yeshiva University probably lost 110 million. Ramaz, a school on New York's Upper East Side, has lost around 6 million; Maimonides School, an Orthodox day school in Brookline, Massachusetts, lost around 5 million. The UJA Federation, which supports around 100 health, educational and community institutions, was only able to collect $ 18.8 million in donations instead of $ 21.6 million at the Wall Street Dinner in 2008, as in 2007.

Another foundation, which was only established in 2007, had to be closed around the turn of the year from 2008 to 2009, the Fair Food Foundation of Ann Arbor . Their activities were based on the deposits of an unknown, wealthy person with Madoff. She had inter alia target the food supply of impoverished areas in Detroit .

There were also renowned research institutes such as the Feinberg School of Medicine and the Massachusetts Institute of Technology (MIT). Some of their main sponsors, such as the couple Barbara and Jeffrey Picower, who had entrusted Madoff with their money, now fell out as donors. For example, her foundation, the Picower Foundation , supported a facility called the Nurse-Family Partnership in Denver , whose nurses visit poor people who have no health insurance. They were missing a million dollars now.

Tax losses and repayments

The Seattle Times speculated about how the asset losses could affect US tax revenues. It resulted in tax losses of up to $ 17 billion.

Investor losses are likely to be treated in the same way as losses due to theft. This means that they can be deducted for tax purposes, which can lead to significant repayments.

Damage to reinsurers

The fund operators have taken out special liability insurance against the damage caused by lawsuits against brokers and fund managers who had invested customer money in Madoff and who breached their duties of care and disclosure.

According to estimates by the reinsurance broker Aon Benfield, the insurers must reckon with a loss burden of 1.8 billion dollars. Overall, maximum insurance coverage of over six billion dollars can be expected. The insured damage amounts to 760 million to 3.8 billion dollars.

Legal reactions from the injured party

Lawsuits against intermediate bodies

Since only very few of the injured parties were directly involved with Madoff, the asset managers concerned prepared themselves for complaints from customers, because it had to be determined in each individual case whether the administrators had fulfilled their obligations. For example, the Schutzgemeinschaft der Kapitalanleger eV had set up an information service “for Madoff victims”. The starting point was then the US Equity and Herald US Absolute Return funds , in which investments were made via funds of funds and certificates . According to an estimate by the SdK, they last had a volume of 1.5 billion euros. As a precaution, the investment companies Alceda, Ampega-Gerling, Carat, Frankfurt-Trust and Universal-Investment have set the value of the two funds in their portfolios to EUR 0.10 . The damage was estimated on December 19, 2016 at a high double-digit million amount. Dozens of lawsuits totaling approximately $ 50 billion were filed on December 10th.

Lawsuits against banks in Luxembourg

In this context, the French government criticized that the Luxembourg financial supervision and the implementation of the corresponding EU directive in Luxembourg law were not sufficient. Luxembourg defended itself, however, with the argument that Luxembourg had adopted the wording of the corresponding EU directive practically unchanged. The "Madoff Task Force" of the association of investment banks ALFI delivered its final report in September 2009.

Since 2005, UBS Luxembourg has known the roles that Madoff played in the Luxembourg SICAV LuxInvest. This is at least clear from an internal procedural document (OPMEM) of this bank, which was handed over to the Luxembourg judiciary. On page 18 of the OPMEM should read: Madoff "is at the same time acting as investment trader, broker and sub-custodian". This corresponds neither to the official prospectus of the fund nor to the legal regulations in this area. It is currently highly controversial to what extent the bank, investors and / or banking supervisors were aware of this situation.

In its communiqué of November 18, 2009, the CSSF made it clear that in the case of Madoff fraud it had taken the necessary steps to investigate and that the Luxembourg custodian banks concerned were ultimately requested to adapt their internal procedures to the existing regulations. Only the official prospectus is legally valid and comes to the knowledge of the CSSF; The CSSF never became aware of any deviations from this, for example in internal procedural documents. For the question of the liability of the custodian banks, however, the ordinary courts are responsible, where the corresponding lawsuits by the investors are pending.

The Luxembourg Court of Appeal (Cour d'appel) then obliged UBS Luxembourg to issue the fund management agreements for a Spanish company with regard to LuxInvest. The request to force the surrender of the contracts between UBS and Madoff was rejected by the court because it was unlikely that such a thing would exist; the handing over of other papers was refused with reference to the bank's professional secrecy. LuxInvest investors ($ 460 million) have been briefed by the two liquidators of their work since the end of April 2009. At this public meeting you made very clear statements about the role of Madoff and his company BMIS, which UBS denies.

On December 16, 2009, the Luxembourg judge Brigitte Konz dismissed the claim of a Luxinvest investor for damages as unfounded, although the CSSF circular 2002/77 basically obliges a custodian bank to pay damages in the event of errors. However, the request of a Luxembourg investigating judge (le parquet) was granted to hand over the internal procedural document of UBS Luxembourg. A criminal investigation can therefore be expected.

On December 17, 2009, the liquidators of the Luxalpha Fund filed a claim for damages amounting to 1.5 billion euros with the Tribunal d'arrondissement . UBS Luxembourg, as custodian, is accused of having entrusted Madoff with the incompatible functions of both a custodian and manager. In addition to the CSSF, which is to be called in in order to speed up the process, the auditor Ernst & Young , who worked here as an extended arm of the CSSF , is also in the sights. At the end of January, a second claim for damages against LuxInvest was expected, involving assets amounting to 400 million euros. The commercial court has dismissed individual claims by investors against UBS; this is the sole responsibility of the insolvency administrator of the funds.

Lawsuits against the Luxembourg Financial Market Authority CSSF

In December 2009, several class actions for damages were filed against UBS, the fund manager Access International and the Luxembourg financial market regulator CSSF .

The allegations include the fact that the regulations on the fund market of the Grand Duchy of Luxembourg are not sufficient to exercise a comprehensive control function and that the funds concerned should not have been approved at all in the Grand Duchy of Luxembourg and thus in the European internal market due to the lack of incomplete documents and that the control mechanisms in the Grand Duchy of Luxembourg only in legal texts but not in practice.

In July 2014, a criminal complaint was filed against the board of directors of the Luxembourg financial regulator CSSF .

The legal situation at fund companies

Some funds of funds with an absolute return approach saw the investment forms, which were not yet recognized as Madoff funds at the time, as a suitable instrument for their portfolio. That was the case for the fund of funds manager Bernd Greisinger, in whose five funds the Madoff shares averaged 40 percent. He had also acquired Herald funds in the second half of 2008. Funds of funds such as BG Global Dynamic or Carat Global One with their high proportion of Herald and Thema funds have suspended their price determination because the custodian bank HSBC stopped trading. Other funds of funds wrote off the losses and suffered a significant price decline on December 16. The UBS Sauerborn Asset Strategy I with a volume of over 500 million euros was affected .

At the beginning of December there were still buy orders amounting to perhaps 100 million euros, for example with the financial services provider Carat, where 1.2 million euros were waiting for the investment deadline in mid-December. This delay, in turn, was due to the fact that, as is usual with this type of investment, the funds were only traded twice a month. At that time, the money was still with the custodian bank in Luxembourg, a subsidiary of HSBC. HSBC immediately canceled all orders when Madoff was arrested, but the whereabouts of the deposited money is unclear. Christine Lagarde , the French finance minister, urged EU finance ministers to change the rules in this regard. This concerns the regulations known as undertakings in collective investment in transferrable securities or UCITS, which differ from country to country. Luxembourg's Prime Minister Jean-Claude Juncker protested against this , because the money that had already been paid in but not yet invested was deposited everywhere and paid out again when required. However, this did not apply to companies and banks commissioned by deposit banks. The chain of the respective intermediate owners must be monitored more closely.

Ultimately, courts have to decide who has to pay what damage. For example, it is unclear whether hedge funds, which withdrew their money and profits before the collapse of the Madoff system, will be induced to surrender their profits. This in turn would result in complaints from investors to the funds concerned.

Repex Ventures SA , a company based in the British Virgin Islands , sued Medici Bank in the United States on January 12th . It had invested $ 700,000 in Bank Medici's Herald (LUX) US Absolute Return Fund . The lawsuit is also directed against Sonja Kohn and the former CEO Peter Scheithauer. According to Bloomberg, class or group status will be sought for the lawsuit. The allegation is investor fraud, as the connection to Madoff was not mentioned anywhere.

In Austria, Advofin, a litigation financier who represents around 200 investors, is seeking a class action lawsuit against Bank Austria, which owns 25% of Medici Bank. The same applies to Zwerling, Schachter & Zwerling, who are based in New York and Seattle.

In the United States, lawsuits against Madoff, his middlemen and business partners are based on violations of New York Debtors and Creditors Act, New York Commercial Law, the Racketeer Influenced and Corrupt Organizations Act, and on enrichment and complicity in breach of fiduciary duty.

In the meantime, legal efforts are increasingly bundled. On February 17th, representatives of law firms from 21 countries gathered at the Spanish and South American law firm Cremades & Calvo Sotelo formed an alliance. Behind it are 34 law firms with over 5,000 lawyers. Head is Dr. Javier Cremades, chairman of the venue's law firm, and vice-president is Gaytri Kachroo, partner at McCarter & English and attorney for US financial market detective Harry Makropolos, who warned the SEC about Madoff's business conduct back in 2000. In addition to a US class action lawsuit, the victims' options for action in Luxembourg are being examined.

Fairfield , Connecticut, was the first municipality to file a lawsuit on February 25 - more precisely at the Bridgeport Superior Court - but not against Madoff or his numerous feeders, but against consultants and auditors. It's about the loss of $ 42 million from the pension fund. The companies NEPC from Cambridge and KPMG from Montvale are said to have performed their duties inadequately.

Lawsuits against winners of the Madoff system

The situation for private investors who had made profits from Madoff's system was initially unclear. You could be forced to repay, it was said back in January. However, this has conditions: “While the actual fraudulent actions (fraudulent transfers) presuppose intent or knowledge, which can only be proven in very few cases, this proof is not necessary with the so-called constructive fraud if (1) the dispositions before opening bankruptcy occurred, (2) they were incongruent (ie for less than a reasonable equivalent value) and (3) the debtor was already insolvent at the time of payment. "

In April, trustee Irving Picard sent letters to 223 investors who had drawn profits from Madoff's system, asking them to repay those profits. Their lawyers, in turn, announced that they would question the legality of the claim.

Out of court negotiations

Over 100 Spanish and South American investors who lost a total of 120 million euros got in touch with various banks. They had invested between 150,000 and 10,000,000 euros and wanted to negotiate with Barclays Bank and Banco Santander. Santander owns Abbey National , Alliance & Leicester, and Bradford & Bingley . Talks are also planned with Fortis and the Portuguese bank Espirito Santo.

Other reactions

Numerous investors were harmed by Madoff's fraud system, some so badly that they saw no way out. The first to kill himself - apart from those who were part of the system, like Magon de la Villehuchet - was 65-year-old British war veteran William Foxton from Southampton , who shot himself to death in a park. The major , who had also been in the French Foreign Legion, had worked for the European Commission Monitoring Mission after his injury-related early retirement in the Yugoslavia conflict and had been spokesman for the Organization for Security and Cooperation in Europe . Most recently he worked for the UN in Afghanistan . He also raised funds for the Workers' Samaritan Association . For his service in Yugoslavia, he was made Officer of the Order of the British Empire in 1999 . He had invested his savings in the Herald USA and Herald Luxemburg funds, which had been marketed by the Viennese bank Medici.

Family consequences

In the course of the investigation and as a result of the collapse of the Madoff system, Bernard Madoff's family also fell apart. He and his wife are said to have tried to commit suicide together with sleeping pills on Christmas Eve 2008, shortly after the house arrest was ordered against him. In December 2010, Madoff's son Mark was found dead in his apartment. He committed suicide on the second anniversary of his father's arrest, according to his lawyer motivated by "the relentless pressure from false accusations and allegations that has persisted for two years." Mark Madoff is said to have not exchanged a word with his father since the fraud became known and also struggled with difficulties in finding work. After the death of her son, Ruth Madoff also broke off contact with her imprisoned husband.

His second son Andrew died of cancer in 2014. Since then, Bernard Madoff has no living offspring.

First compensations

As the Securities Investor Protection Corp. announced, the first checks were sent to aggrieved investors on March 6, 2009. On March 13, 2009, the Chilean bank Celfin Capital SA announced that it would compensate around one hundred customers with a total amount equivalent to $ 11 million.

Dispute over the Madoff family's fortune

Bernard Madoff's wife, Ruth Madoff, is the owner of a penthouse that is being debated in court. Part of the property has already flowed back to them as its acquisition is not related to the fraud system. It is unclear whether Ruth Madoff's real estate can be sealed in the event of a conviction. In addition to the $ 7 million penthouse on Manhattan's Upper East Side, Ms. Madoff holds an approximately $ 45 million municipal bond in an account with Cohmad Securities Group Corp., a brokerage firm her husband's jointly owned. On the Wachovia Bank are another 17 million dollars, and they claimed ownership of the 62-million-dollar apartment in which the Madoff currently reside.

On Friday, March 13, 2009, the court in which Madoff had admitted guilt the day before released the list of assets Madoff had to turn over to the SEC in December. It shows the Madoff-run company worth $ 700 million.

Ruth Madoff owns many of the assets, including the apartment where her husband was under house arrest until the trial began. Its value is estimated at seven million dollars. There are also properties valued at $ 19 million on Long Island as well as in Florida and the south of France, furniture and art objects valued at $ 9.9 million. Ruth Madoff had stated in court that she owned assets totaling $ 69 million, but also included securities of $ 45 million, so the total must be higher.

Overall, the Madoffs have private assets of at least $ 823 million. In mid-March 2009, after Bernard Madoff's assets were frozen, those of his wife were also to be frozen.

In the United States, parts of Madoff's property were confiscated in early April 2009, including the mansion in Palm Beach , Florida, his 17-meter yacht and a motorboat.

In order to force the surrender of assets that were not obtained through fraud, on April 13, 2009 the injured party filed a demand for Madoff's personal bankruptcy against the opposition of the Ministry of Justice and the SEC, who argued that proceedings were to be extended submitted. The plaintiffs also hope that money invested through financial intermediaries and funds that has been invested with Madoff without express consent can thus be recovered.

In late April 2009, bankruptcy judge Burton Lifland found that prosecutors, the SEC, court-appointed trustee Irving Picard and some investor groups had attempted "incoherently and uncoordinated" to seize property in homes, cars and boats. Judge Denny Chin imposed a transfer ban on Madoff and his wife's private assets because they could be confiscated. In addition, a coordinator should be appointed.

Trial and detention

The trial was scheduled for March 12, 2009. A week earlier, it was announced that Madoff was seeking a plead guilty deal to secure a portion of the fortune - $ 60 million - for his family. According to the Massachusetts government, Madoff sent his wife $ 10 million the day before his arrest, up from $ 5.5 million 15 days earlier.

Madoff was already in the Manhattan Correctional Center (MCC) in southern Manhattan the day before the trial began. The judge in charge refused a $ 10 million bail on the grounds that there was a risk of escape.

The actual trial began on March 13, 2009 in Room 11A of the New York District Court and lasted 75 minutes. In it, Madoff confessed to having operated a Ponzi scheme for many years, as well as being guilty of the ten other charges of securities fraud, money laundering and false statements.

Only then did Madoff read out his five-page confession of guilt, which contained the oft-quoted sentences “I confess guilty. I am very sorry. I am ashamed ”contained. Madoff admitted “guilty” each time on the 11 counts brought forward. The whole process took five minutes, with Madoff saying he hadn't invested the funds since the early 1990s.

Yet Madoff only pleaded guilty to those points where he had already been blamed. Joel Cohen , former chief prosecutor, said Madoff was "light years away from being cooperative," while Lev Dassin, the chief prosecutor in Manhattan, also disagreed with Madoff's statements, but now found his guilt proven.

Madoff was handcuffed and led away in the courtroom, which was greeted with applause by the audience.

On March 20, 2009 , the competent appellate court rejected his request that he be released until the sentence was pronounced .

Shortly before the start of the trial, it became known that the immediate damage amounts to a total of 65 billion dollars, the number of victims to 4800.

Madoff was sentenced to 150 years imprisonment on June 29, 2009 and immediately after the sentencing was pronounced a prisoner at the Metropolitan Correctional Center (MCC) in New York City (reg. No. 61727-054). On July 14, 2009, he was transferred to the Federal Correctional Complex Medium , a security unit in the US Federal Prison in Butner, North Carolina .

Madoff's attorney stated on July 9, 2009 that his client would not appeal the verdict. Madoff made $ 40 a month in prison. In 2010 he was said to have been a popular prisoner and fellow prisoners asked him for investment tips.

After trying unsuccessfully to be released from prison for health reasons in 2020, Madoff died on April 14, 2021 in the US Federal Prison Detention Center in Butner, North Carolina. According to his own statement, he suffered from an incurable kidney disease.

Investigations and charges in the corporate environment

Madoff also claimed to have acted alone during his trial, but authorities continued to investigate members of his family and employees, as well as accountants. Investigator Irving Picard is demanding a total of $ 735 million from this inner circle.

Charges against Madoff's accountant David Friehling

On March 18, 2009, the prosecution brought charges against Madoff's long-time accountant, David Friehling, of aiding and abetting investment fraud and of preparing four false audit reports. He has therefore not carried out any checks for 17 years, but faked it to the authorities. The 49-year-old surrendered and was released on bail of $ 2,500,000. He faces a prison sentence of up to 105 years. Friehling received $ 12,000 to $ 14,500 a month from Madoff at least from 2004 to 2007.

Confiscated property from Madoff's sons

Shortly after the trial of Bernard Madoff, the prosecutor announced that they would confiscate $ 31.55 million from the sons' property, as this was a loan from the convict. Both sons were employed in the father's company, but are said not to have known about his fraud system.

Madoff's brother

Peter Madoff was the Chief Compliance Officer of Bernard L. Madoff Investment Securities. A portion of Peter Madoff's assets have been frozen for violating his fiduciary duties and allegedly investing the assets of Andrew Ross Samuels, a Brooklyn Law School student , with Bernard Madoff. This is 478,000 dollars that Peter Madoff invested in the opinion of the plaintiff with full knowledge of Bernard Madoff's fraud system. Peter Madoff's assets were initially, except for a monthly credit limit i. H. of $ 10,000, frozen. Peter Madoff owns a house in Old Westbury, Long Island, valued at $ 3 million. A court ruled that he had to surrender his 1964 Aston Martin DB2 / 4 , for which he had withdrawn the equivalent of more than 150,000 euros from Madoff Securities International's account in March and May 2008.

In June 2012, Peter Madoff was arrested by the FBI in his attorney's office. He confessed in court that he had helped cover up the true extent of his brother Bernard's fraud. He confessed to helping continue his brother's organized fraud. He forged documents, lied to the stock exchange supervisory authority and structured payments in such a way that they did not have to be taxed. At the end of December 2012, Peter Madoff was sentenced to 10 years in prison.

Further compensations

On April 22, 2009, the asset manager Notz Stucki announced that it would pay compensation to those who had been damaged by around 870 million Swiss francs. This should amount to around 120 million Swiss francs and concerned cases in which investment managers had made the decision to invest with Madoff. Only customers who had invested with Madoff at their own request should not receive any compensation.

Reception of the "Falls Madoff"

Woody Allen published a story in the New Yorker March 30, 2009 in the humor section relating to the fraud case.

Raymond De Felitta filmed the material under the title Madoff as a two-parter with Richard Dreyfuss as Bernie Madoff for the television station ABC , which aired it on February 3rd and 4th, 2016. Another film adaptation was made by Barry Levinson with Robert De Niro in the lead role under the title The Wizard of Lies for the commercial broadcaster HBO , which began broadcasting in May 2017.

Web links

- Last version of Madoff's website dated October 19, 2007, stored at archives.org ( October 19, 2007 memento in the Internet Archive )

- Panel discussion on TPM TV with Madoff, December 17, 2007

- Extensive collection of articles, dossiers and documents on the case (English)

- List of injured parties and their detailed list ( PDF ; approx. 1.38 MB)

- Indictment in criminal proceedings (US v. Madoff; 08-MAG-02735) (PDF file)

- Indictment in civil proceedings (SEC v. Madoff, BMIS LLC; 08-CIV-10791) (PDF file; 816 kB)

- Paul Krugman: The Madoff Economy , in: The New York Times, December 19, 2008.

- Madoff: A Riot of Red Flags , January 2009 (PDF file; 1.4 MB)

- Robert Kilian: On the criminal liability of Ponzi schemes - The Madoff case under German competition and capital market law , in: HRRS 2009, pp. 285–290.

- Steve Fishman: “Everyone was greedy. I just took part ” in: Welt Online from March 13, 2011.

supporting documents

- ^ A b c Diana B. Henriques: Bernie Madoff, the Wizard of Lies - Inside the Infamous $ 65 Billion Swindle . Oneworld, New York 2011, ISBN 978-1-78074-043-0 . P. 44 ff.

- ↑ Laurence Arnold: Bernard Madoff, Mastermind of Giant Ponzi Scheme, Dies at 82.Bloomberg, April 14, 2021, accessed April 14, 2021 .

- ↑ Richard J. Tofel: Shadowing a Swindler . In: Wall Street Journal . March 9, 2010, ISSN 0099-9660 ( wsj.com [accessed April 17, 2020]).

- ↑ Jessica Pressler: Charities, Old People, Jews Hit Hardest by Madoff Fraud UPDATED . On December 15, 2008 on nymag.com

- ↑ a b Billing day in room 11A , Spiegel Online, March 12, 2009

- ^ A b Madoff scandal: Global alliance of law firms from 21 countries founded , in: Property Magazine , February 23, 2009

- ↑ Madoff - a stroke of luck for Swiss lawyers , in: Tagesanzeiger, April 8, 2009

- ^ "Judgment in the Madoff trial: 150 years imprisonment for the 'greatest fraudster of all time'", tagesschau.de ( memento of July 2, 2009 in the Internet Archive ). As of June 29, 2009 5:38 p.m.

- ↑ ksta.de , March 12, 2017: Federal prosecutor dismissed: US government fires New York prosecutor Preet Bharara (March 13, 2017)

- ↑ P. Sherwell, "Bernie Madoff: Profile of a Wall Street star," Telegraph, accessed December 17, 2008

- ^ Binyamin Appelbaum, David S. Hilzenrath and Amit R. Paley: 'All Just One Big Lie' . In: The Washington Post , December 13, 2008. Retrieved March 17, 2009.

- ↑ a b c d Erin Arvedlund: Too Good to Be True: The Rise and Fall of Bernie Madoff . Penguin, New York 2009, ISBN 978-1-101-13778-9 . Pp. 14–15 ( excerpt . From books.google.de, accessed on June 12, 2016)

- ↑ Thomas Schulz: Wealth - Hate with all my heart. spiegel.de, December 12, 2011, accessed May 7, 2015 .

- ↑ a b c The talented Mr. Madoff, in: International Herald Tribune, January 25, 2009

- ^ Candidates for Graduation - June 1956 . In: One-hundred-Fourteenth Commencement of the Far Rockaway Highschool . Board of Education of the City of New York, June 26, 1956. p. 4, accessed June 12, 2016 (The reference to the document is from: The Education of Bernie Madoff: The High School Years . In: Clusterstock . 22 December 2008 ( Memento from July 11, 2012 in the web archive archive.today ))

- ↑ Allen Salkin: Bernie Madoff, Frat Brother . January 16, 2009 on nytimes.com

- ↑ Marc Pitzke: Son commits suicide: Madoff's curse. spiegel.de, December 12, 2010, accessed May 7, 2015 .

- ↑ Bernie Madoff's Surviving Son, Andrew, Dies of Lymphoma. nbcnews.com, September 3, 2014, accessed May 7, 2015 .

- ↑ Madoff's mother tangled with the feds. The late Sylvia Madoff was registered as a broker-dealer in the 1960s but left the business after being cited for failing to file reports, in: CNN Money, January 16, 2009

- ^ Website of the Madoff Society on Company History ( Memento from February 11, 2007 in the Internet Archive )

- ^ Profile of a Wall Street star , Telegraph , December 14, 2008

- ↑ Nikolaus Piper: The monster as a cavalier. The New York publicist Sheryl Weinstein makes her affair with Bernard Madoff public, in: Süddeutsche Zeitung of August 20, 2009

- ↑ Literally: "What could prove to be history's largest financial scam" ( Robert Frank, Peter Lattman, Dionne Searcey and Aaron Luccetti: Fund Fraud Hits Big Names , in: The Wall Street Journal, December 13, 2008 )

- ↑ Prominent Trader Accused of Defrauding Clients, New York Times, December 11, 2008

- ↑ 'Falsified' records hamper Madoff inquiry, in: Financial Times 17 December, 2008

- ↑ Madoff has not bought shares for 13 years , in: Fonds Online, February 23, 2009

- ↑ Madoff transferred $ 164 million to US from UK , in: Times Online, February 27, 2009

- ↑ Madoff Charged in $ 50 Billion Fraud at Investment Advisory Firm. (No longer available online.) Bloomberg.com, December 11, 2008, archived from the original on October 24, 2012 ; Retrieved June 12, 2016 .

- ^ "Charity Caught Up in Wall Street Ponzi Scandal" at foxnews.com (accessed January 12, 2009)

- ↑ Madoff scandal: wife Ruth Madoff is targeted , in: ManagerMagazin, February 11, 2009

- ^ Message from the New York investment advisory service Aksia (in English; PDF; 41 kB)

- ↑ Billion fraudster Madoff. Total curfew, in: Süddeutsche Zeitung, December 20, 2008 ( Memento from January 25, 2009 in the Internet Archive )

- ↑ US justice boss leaves fraud case, in: BBC News, December 17, 2008

- ↑ Madoff Scandal Plot Thickens, in: thestreet.com, December 17, 2008

- ↑ US tries again to jail Madoff , Reuters, January 13, 2009

- ^ Judge allows Madoff to remain free, in: Times Online, Jan. 14, 2009

- ↑ Madoff is spared custody, in: Der Standard, January 15, 2009

- ↑ a b c Bernard Madoff's wife - "We wanted to kill ourselves". faz.net, October 27, 2011, accessed May 7, 2015 .

- ↑ a b From luxury penthouse to prison, in: ARD Wirtschaft, March 12, 2009 (tagesschau.de archive) queried on March 16, 2009

- ↑ Madoff ruling expects a $ 170 billion fine, 150 years imprisonment? . In: FAZ , June 27, 2009. ISSN 0174-4909 . Retrieved June 5, 2012.

- ↑ Madoff Is Sentenced to 150 Years for Ponzi Scheme . In: New York Times , June 30, 2009. Retrieved December 11, 2018.

- ↑ a b c Madoff's investment company dissolved , in: Süddeutsche Zeitung, December 16, 2008 ( Memento from December 17, 2008 in the Internet Archive )

- ↑ Hope for Madoff victims , in: Tagesanzeiger, March 2, 2009

- ↑ a b Madoff associate skips court hearing, in: Times Online, January 21, 2009

- ↑ a b Zsa Zsa Gabor loses millions, in: Süddeutsche Zeitung, January 24, 2009 ( Memento from January 29, 2009 in the Internet Archive )

- ↑ Two businessmen win a round in Madoff lawsuits, Reuters, January 23, 2009

- ↑ UPDATE: Madoff Trustee Has Located More Than $ 1 Billion In Assets, in: Morningstar, March 23, 2009

- ↑ Part of Madoff's empire is being sold, in: Financial Times Deutschland, March 28, 2009 ( Memento of March 29, 2009 in the Internet Archive )

- ↑ Bill Richardson and Corruption on www.opednews.com by Michael Cavlan on January 16, 2006 (English)

- ↑ Madoff's biggest victim also helped sell the fund to others, in: International Herald Tribune, December 17, 2008

- ^ News, Morning Star, April 6, 2009

- ↑ "Hasty and poorly thought out" in: Süddeutsche Zeitung, April 7, 2009

- ↑ Hedge fund manager Merkin charged. Madoff investment fraud: Warning from prison brother , in: Handelsblatt, April 7, 2009

- ^ Madoff victims emerge at Safra, in: Financial Times, February 17, 2009

- ↑ Times Online, December 17, 2008 . There it says: “credible and specific allegations”.

- ↑ Mass. investor saw inside Madoff scam , AP, December 19, 2008 ( Memento from January 1, 2009 in the Internet Archive )

- ↑ http://www.t-online.de/wirtschaft/zinsen/id_76937562/ermittler-spuert-betruegerisches-schneeballsystem-auf-groesser-als-fall-madoff.html

- ↑ The World's Largest Hedge Fund is a Fraud (PDF; 1.6 MB) static.reuters.com. Retrieved June 5, 2012.

- ↑ The stock exchange supervisory authority admits errors in the Madoff scandal, in: NZZ online, December 17, 2008

- ↑ Obama: Madoff Reminds us Reform is Needed , in: New York Post, December 18, 2008 ( Memento of December 20, 2008 in the Internet Archive )

- ↑ Finra probed 19 Madoff complaints, in: Financial Times, January 14, 2009

- ↑ SEC report reveals embarrassing mishaps, in: Financial Times Deutschland, September 5, 2009 ( Memento of September 8, 2009 in the Internet Archive )

- ↑ The talented Mr. Madoff, in: International Herald Tribune, January 25, 2009

- ↑ published in January 2009 Morningstar a List Of Entities Announcing Exposure To Madoff Investments (list of units that are affected by Madoff's investments) .

- ↑ a b Madoff's alleged $ 50 billion fraud hits other investors ( memento of January 9, 2009 in the Internet Archive ), retrieved on December 13, 2008

- ^ Nicola Horlick is a possible victim of the Bernard Madoff scandal

- ^ For Investors, Trust Lost, and Money Too

- ↑ Robert Frank, Peter Lattman, Dionne Searcey and Aaron Luccetti: Fund Fraud Hits Big Names , in: The Wall Street Journal, December 13, 2008

- ^ Tremont Invested More Than Half Its Assets With Bernard Madoff, in: Bloomberg.com December 16, 2008

- ^ Website of the Robert I. Lappin Charitable Foundation

- ↑ New York Times consulted on December 13, 2008

- ↑ The Picower Foundation, a charity that supports programs ranging from medical research to education, said it was shutting down because of losses from investments with Bernard Madoff. in: Reuters December 20, 2008

- ↑ Madoff's Victims, in: Wall Street Journal, Jan. 7, 2009

- ↑ The complete list is available here (PDF; 2 MB).

- ^ Paralysis sets in after Madoff's touch, in: Herald Sun, December 17, 2008

- ↑ a b Unicredit customers had 800 million euros in Madoff funds. MIT professor had to close down hedge funds , in: BoerseExpress, January 13, 2009 ( Memento from January 22, 2009 in the Internet Archive )

- ↑ Former Merrill execs invested in Madoff funds: report, Reuters March 5, 2009

- ↑ Elie Wiesel Foundation

- ^ Controversy over Luxembourg as a financial location. Handelsblatt, January 14, 2009.

- ↑ CSSF press release of January 23, 2009, (PDF; 48 kB)

- ↑ http://www.wiwo.de/finanzen/vorsorge/investmentfonds-das-risk-bei-luxemburg-fonds-seite-all/6021552-all.html

- ^ Communiqué Commission de Surveillance du Secteur Financier.

- ↑ Withdrawal of the Sicav Herald (lux) from the Official List (PDF; 77 kB) cssf.lu. Retrieved June 5, 2012.

- ↑ Madoff-Causa brings down new Luxembourg fund - lawyer in sight. Fonds Online, March 5, 2009.

- ↑ Luxembourg regulator liquidates Madoff fund. financial news, May 13, 2009.

- ^ Luxembourg public prosecutor is investigating UBS . wort.lu. June 10, 2010. Retrieved June 5, 2012.

- ↑ Archive link ( Memento from March 1, 2014 in the Internet Archive )

- ↑ http://www.oe24.at/wirtschaft/Madoff-Skandal-Finanzaufsicht-kritisiert-UBS/480933 Madoff scandal - financial supervision criticizes UBS. The Luxembourg financial market supervisory authority CSSF has accused the major Swiss bank UBS of deficiencies in internal controls.

- ↑ Archived copy ( memento of July 14, 2014 in the Internet Archive ) Investor takes CSSF management to court

- ^ As reported by The Seattle Times, December 13, 2008

- ↑ Geneva banks lost more than $ 4 billon to Madoff: report

- ↑ Thomson Reuters, December 18, 2008

- ↑ Madoff: UBP has invested CHF 800 million. (No longer available online.) Cash.ch, December 18, 2008, archived from the original on December 21, 2008 ; Retrieved June 12, 2016 .

- ↑ Bank denies fraud warning, in: Financial Times Deutschland, January 15, 2009 ( Memento of January 21, 2009 in the Internet Archive )

- ^ Union Bancaire Privée defends itself against Madoff lawsuit. (No longer available online.) Cash.ch, May 13, 2009, archived from the original on May 31, 2009 ; Retrieved June 12, 2016 .

- ↑ Tages-Anzeiger, February 12, 2009

- ↑ Press release: Information Fraud Case Madoff; Hyposwiss, December 22, 2008

- ↑ Madoff fraud: Hundreds of Hyposwiss customers affected. (No longer available online.) Cash.ch, December 18, 2008, archived from the original on December 21, 2008 ; Retrieved June 12, 2016 .

- ↑ Asset manager initiates proceedings against UBS, in: News.ch, January 13, 2009

- ↑ UBS sentenced to pay in the Madoff case. Fund custodian banks face billions in lawsuits, in: NZZ Online, January 15, 2009

- ↑ UBS has to give out Madoff data , in: Financial Times Deutschland, March 6, 2009 ( Memento from September 7, 2012 in the web archive archive.today )

- ↑ This website has been established by the court appointed liquidators of Herald LUX Fund. boerse-online.de, April 7, 2009, accessed June 12, 2016 .

- ↑ Madoff fraud makes waves: Spielberg is one of the prominent victims, in: news.at, December 16, 2008

- ^ A b Madoff affair: Nürnberger Versicherung participates in US class action lawsuit , in: news.at, March 26, 2009

- ↑ Supervisory Board ( memo of December 19, 2008 in the Internet Archive ) website of the Bank Medici

- ^ Medici-Bank comes under Staatskuratel, Der Standard, December 31, 2008