Reaganomics

The term Reaganomics ( suitcase word , composed of "Reagan" and "economics", English for economy ) describes the economic policy of the USA under President Ronald Reagan .

theory

Reagan's economic policy was based on economic theses or theories of the Chicago School (also called supply policy) and on the theory of the economist Arthur B. Laffer that after tax cuts, tax revenues would not decrease but even increase (see Laffer curve ).

Tax Policy and Government Revenue

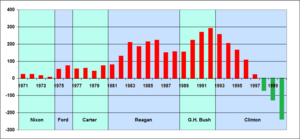

The Reagan administration dropped the Economic Recovery Tax Act of 1981 the top rate of income tax from 70% to 33%. The taxes on capital gains and corporate taxes have been reduced. This significantly reduced tax revenues. Moderate tax increases have been passed through various laws such as the Tax Equity and Fiscal Responsibility Act of 1982 , the Social Security Amendments of 1983 , the Deficit Reduction Act of 1984 , the Omnibus Budget Reconciliation Act of 1987 and the Tax Reform Act of 1986 .

Government revenues initially fell in 1983, then rose again, albeit more slowly than before. The effects of Reagan's tax policy showed that although the economy could be increased in the medium term with less tax revenue, there were massive budget deficits . It was only under Bill Clinton that tax rates were increased again and the budget was balanced.

confrontation

The Reagan administration's economic policy remains the subject of controversial debate to this day. Critical voices argue that it is a policy to the detriment of the poorer classes and in favor of the upper two percent of the population of the USA, since financial grants for social programs from the times of the Great Society were cut.

Gerard Radnitzky characterizes Reaganomics as "a free market economy in rhetoric and some privatizations, while in practice state spending and the tax share as a percentage of the gross national product have increased."

In Great Britain there was talk of Thatcherism , named after the British Prime Minister Margaret Thatcher , who was based on a similar policy. In New Zealand, based on Reaganomics, the term rogernomics developed for the policy of Finance Minister Roger Douglas .

The Atari Democrats and the term Third Way referred to social democratic and moderately left politicians as well as political currents who received individual aspects of Reaganomics on the political left.

The sociologist Colin Crouch sees the fundamental changes in the USA during the Reagan administration in the liquidation of welfare state institutions, the marginalization of the unions and a division between rich and poor on a level comparable to countries of the Third World .

Representatives of the Center for American Progress assume a counterproductive effect of the cut in the top tax rate. Accordingly, the financial resources that are freed up by tax cuts for the rich are not used by them for consumption or invested in means of production. Rather, they would be saved, used for capital investments or transferred to tax havens. This leads to higher inequality and a lack of financial resources in the middle and lower income groups. This financial shortage lowers demand and ultimately economic growth.

See also

literature

- Rudolf Hickel : Reagan's 'American Dream' - a nightmare for Europe. In: Blätter für German and international politics , edition 03/1981, pp. 286–300. ( PDF; 1.8 MB )

Web links

- Supply Tax Cuts and the Truth About the Reagan Economic Record Analysis of the Libertarian Cato Institute

Individual evidence

- ^ Office of Tax Analysis: Revenue Effects of Major Tax Bills. (PDF) United States Department of the Treasury , September 2006, accessed February 5, 2011 (Working Paper 81, Table 2).

- ↑ treasurydirect.gov - Historical Debt Outstanding - Annual 1950–1999

- ↑ cbpp.org - Richard Kogan: Will The Tax Cuts Ultimately Pay For Themselves?

- ↑ Ronald Reagan - Loved and Hated on YouTube , documentary by Eugene Jarecki

- ↑ Gerard Radnitzky: Hayek and Myrdal - The Irony of a Price Division ( Memento of August 13, 2011 in the Internet Archive ) (PDF; 46 kB) p. 2

- ^ Colin Crouch: Post Democracy . Suhrkamp, Frankfurt 2008, p. 19.

- ↑ The wealth that failed to trickle down: The rich do get richer while poor stay poor, report suggests. In: independent.co.uk. The Independent , January 19, 2015, accessed January 3, 2018 .