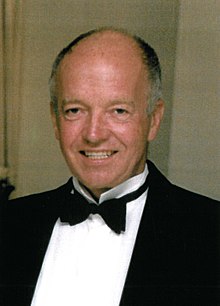

Renatus Rüger

Renatus Rüger (born January 18, 1933 in Dresden ) is an entrepreneur in the real estate fund sector. He is the managing partner of Dr. Rüger Immobilien Holding GmbH & Co. KG , Cologne .

Career

Rüger comes from a middle-class family. After graduating from high school in 1954, he studied economics and sociology at the Johann Wolfgang Goethe University in Frankfurt am Main with Theodor W. Adorno and Max Horkheimer , co-founders of the Frankfurt School and Critical Theories .

At the end of 1956, Rüger took over the management of a student refugee camp in Styria , Austria . At the same time he switched to the political science faculty of the Karl-Franzens-University in Graz / Austria. There he received his doctorate as Dr. rer. pole. summa cum laude with the international law dissertation "The division of the German Empire and the international legal status of its sub-areas".

In 1960 a student accommodation agency was founded in Cologne with the aim of financing the habilitation as an international lawyer offered in Graz. A real estate brokerage quickly developed from the room agency activity. In 1963 the first own construction measures with up to 1,000 residential units were carried out in the Cologne, Bonn and Düsseldorf area.

Renatus Rüger has three children.

Fund area

At the end of 1969, the first tax-privileged fund was launched with the Berlin student residence on Potsdamer Platz an der Mauer . This was followed by another forty funds (WITAG funds, Westdeutsche Immobilien Treuhand) with a volume of around two billion DM . At that time, the Dr. Rüger from around 60 companies with 300 employees.

From 1975 to 1982 around 2,000 units were built in the so-called builder model . In the 1970s, the Rüger Group was the industry leader in the tax-privileged real estate and fund sector (including shipping, industrial holdings such as the Israel Corporation )

The most striking investments include:

- Ostseebad Damp (5,000 beds)

- Hotels in Gran Canaria (2,200 beds)

- Herkules high-rise in Cologne

- Berlin-Tegel shopping center

Rüger attracted national attention through his temporary involvement with IG Farbenindustrie AG i. L. emerged. His group of companies was considered to be the largest cadre forge for committed young managers in the sector of tax-privileged investments, which at the time was called the " gray capital market ". Back then, high tax advantages helped overcome market difficulties. “Converting taxes into assets” was the catchphrase and, for good reason, always controversial. Since the forecast returns could not always be achieved over a longer period of time due to entrepreneurial risks in the investment industry and the tax authorities threatened the tax concepts with administrative decrees more and more frequently, the risk of class actions by investors increased. These risks prompted the pioneer of the “gray capital market” at the beginning of the 1980s to withdraw from the fund business.

Since 1983, Dr. Rüger Holding is responsible for the development, construction and management of its own real estate in Germany and the USA. Today Rüger runs the company group together with his children Diana Gerdom and René Gerdom.

social commitment

- Cambodia / Doctors Without Borders

- Warmbronn children's home

Web links

| personal data | |

|---|---|

| SURNAME | Rüger, Renatus |

| BRIEF DESCRIPTION | German entrepreneur |

| DATE OF BIRTH | January 18, 1933 |

| PLACE OF BIRTH | Dresden |