reserve currency

A key currency (or anchor currency ) is a currency that is used in the global economy and in international payments across currency areas to a significant extent as a transaction and reserve currency , although payment in the domestic currency would be possible.

General

In a narrower sense, the currency of a state, with which other countries, with which it is economically closely linked, keep their own currencies in a stable exchange relationship through a common currency policy , is to be called the reserve currency. For example, the British pound is the key currency of the countries of the Commonwealth of Nations (except Canada).

An anchor currency is usually the currency of the state that dominates trade within an economic area : in North America ( USA , Canada , Mexico ) the US dollar , in Europe the euro , in the Asia-Pacific region the yen . During the Bretton Woods system (from 1945 to 1973), the US dollar, pegged to the gold standard , was the global anchor currency. The Deutsche Mark functioned de facto - not de jure - in the European Monetary System until the introduction of the euro in January 1999.

Historic key currencies

Historical examples of key currencies are

- the Chinese Liang ,

- the Greek drachma (5th century BC),

- Indian silver coins ( English "punch marked coins" ; 4th century),

- the Roman denarius ,

- the Byzantine solidus ,

- the Islamic Dinar (Middle Ages),

- the Rhenish Gulden (Middle Ages),

- the Venetian ducat (or ducat - Renaissance),

- the Dutch guilder and

- more recently the British pound .

Currently (as of 2015) the US dollar is the world's most important reserve currency; some economists also refer to it as the world currency ( world reserve currency ).

Before the introduction of the euro (as the book currency in 1999; cash since January 2002), in addition to the US dollar, the British pound and the yen were key currencies of global importance. The euro became the second reserve currency behind the US dollar; The British pound and the yen compete for "third place". After the Chinese government enabled free trade in the renminbi (yuan), it has been part of the IMF's currency basket since October 1, 2016.

meaning

If a country's currency is used extensively outside its borders for store of value and transaction purposes, this has great advantages for the country:

- Seigniorage income,

- reduced exchange rate uncertainty and

- reduced transaction costs .

The economist Barry Eichengreen of the Berkeley University pointed out in 2011 that the United States to date an annual basis of the reserve currency status of the dollar current account deficit could pile up of about 500 billion dollars. That corresponded to an annual economic benefit of three percent of the American national income .

Reserve currency

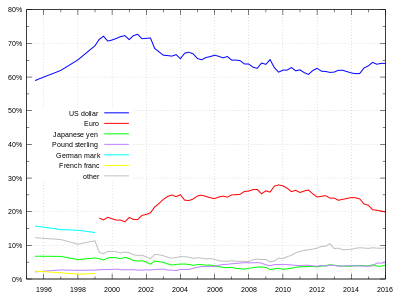

A reserve currency is usually a currency used by the central banks for currency reserves . Most studies show a decline in the importance of the US dollar as a reserve currency and a simultaneous increase in the euro since its introduction in 1999.

|

|

| 1970 | 1980 | 1990 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD | 77.2 | 67.2 | 62.8 | 70.5 | 70.7 | 66.5 | 65.8 | 65.9 | 66.4 | 65.5 | 64.1 | 64.1 | 62.1 | 61.8 | 62.2 | 61.2 | 61.0 | 63.3 | 64.1 | 63.9 | 62.7 | 61.7 | 60.9 | |||||||

| EUR | - | - | - | - | 17.9 | 24.2 | 25.3 | 24.9 | 24.3 | 25.1 | 26.3 | 26.4 | 27.6 | 26.0 | 25.0 | 24.2 | 24.4 | 21.9 | 19.7 | 19.7 | 20.2 | 20.7 | 20.6 | |||||||

| DEM | 1.9 | 14.8 | 19.8 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| JPY | - | 0.1 | 4.6 | 9.4 | 5.2 | 4.5 | 4.1 | 3.9 | 3.7 | 3.1 | 2.9 | 3.1 | 2.9 | 3.7 | 3.5 | 4.0 | 3.8 | 3.9 | 4.0 | 4.2 | 4.9 | 5.2 | 5.7 | |||||||

| GBP | 10.4 | 2.9 | 2.4 | 2.8 | 2.7 | 2.9 | 2.6 | 3.3 | 3.6 | 4.4 | 4.7 | 4.0 | 4.3 | 3.9 | 3.8 | 4.0 | 4.0 | 3.8 | 4.9 | 4.4 | 4.5 | 4.4 | 4.6 | |||||||

| FRF | 1.1 | 1.7 | 2.7 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||

| CHF | 0.7 | 3.2 | 0.8 | 0.3 | 0.3 | 0.4 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 0.2 | |||||||

| other | 8.7 | 5.9 | 4.9 | 1.4 | 1.2 | 1.4 | 1.9 | 1.8 | 1.9 | 1.8 | 1.8 | 2.2 | 3.1 | 4.4 | 5.3 | 5.8 | 6.5 | 6.8 | 6.7 | 7.6 | 7.6 | 7.8 | 8.0 | |||||||

|

Sources: |

||||||||||||||||||||||||||||||

Transaction currency

A transaction currency is a currency that is used to a considerable extent for international goods and capital transactions (e.g. more than its share in world trade). If an actor with a business partner uses his domestic currency as the transaction currency, this can represent a competitive advantage over other actors in other currency areas.

In 2010, according to the Bank for International Settlements (BIS), the US dollar was the currency in which around 85 percent of all foreign exchange market transactions were made.

Financial transactions

The increased importance of the euro is also evident in financial transactions. In 2003, the share of euro transactions in the foreign exchange markets was already 25% compared to 50% in US dollars and 10% each in sterling and Japanese yen.

In terms of bonds , the euro replaced the dollar as the most important currency in 2004. As of September 2004, there were over $ 12,000 billion in international fixed and floating rate bonds outstanding worldwide. Of this, 5,400 billion euros, 4,800 US dollars, 880 billion British pounds , 500 billion Japanese yen and 200 billion Swiss francs . Since the introduction of the European single currency, the share of international debt securities denominated in euros has increased from 19% (1999) to 32% (2006), while the share of the US dollar fell from 49.83% to around 43.12% and that of the Yen halved to 6%. In 2006, 46% of new issues were in the euro and only 39% in the dollar. In 2008, 32.2% of international debt securities were denominated in the euro.

In addition, the share of dollar deposits in total foreign account balances in OPEC countries fell from 75% in summer 2001 to 61.5% in summer 2004. The share of euro deposits rose from twelve to twenty percent over the same period.

raw materials

Most raw materials are now billed in US dollars - including the economically very important trade in oil . Two meanings can be derived from the dollar billing of oil:

Firstly, the great and constant dependence of the world economy on crude oil means that each country's exchange rate against the US dollar is a decisive economic variable - after all, it has a major impact on a country's raw material prices.

Second, the almost exclusive dollar invoicing causes the US central bank Federal Reserve to have an enormous amount of liabilities vis-à-vis the oil-exporting countries, since these countries receive large stocks of dollars through oil exports, the so-called petrodollars .

Future development

While various analysts expect the US dollar to become less important in the future, they anticipate an increase in the importance of the euro and other currencies.

In 2007, Deutsche Bank predicted an increase in the euro share to 30 to 40 percent of global currency reserves by 2010, but this did not come true. She justified this with the great exchange rate uncertainties to which the US dollar is exposed (among other things due to the enormous current account deficit of the USA). The bank suspected that the uncertainty could lead central banks seeking stability to diversify their reserves more strongly . In addition, a gradual change in currency policy (moving away from a pure dollar peg to a peg to a currency basket ) can be observed in several countries . A third reason can be seen in the rise in currency reserves themselves; Central banks are under political pressure to invest the reserves at interest rates. For this reason, too, a diversification strategy seems worthwhile.

The former chairman of the US Federal Reserve, Alan Greenspan , believed in 2007 that the euro could replace the US dollar as the reserve currency. According to an econometric analysis by Jeffery Frankel and Menzie Chinn, this could happen before 2020 if (1) the remaining EU member states (including Great Britain) also introduce the euro by 2020 or (2) the decline in the value of the US dollar continues. On the other hand, history shows that such a process can take several decades, as in the case of the replacement of the pound by the US dollar. According to economist Barry Eichengreen , the main reason for the last replacement is the continual economic depreciation of the pound, combined with high inflation compared to the dollar. Over the first 75 years of the 20th century, this in Great Britain was around three times as high as in the USA.

Whether and how quickly the euro can actually rise to the new key currency depends on long-term political and economic developments, such as the success of the Lisbon strategy . It aims to make the EU the “most competitive and dynamic economic area in the world”. Another important factor is the future economic development of populous countries such as India and China.

In 2011 the World Bank assumed that the dominance of the dollar would end around the year 2025 and could be replaced by a monetary system "in which the dollar, the euro and the yuan are regarded as equal currencies".

Web links

Individual evidence

- ↑ Carsten Weerth: Definition: key currency . In: Gabler Wirtschaftslexikon . Gabler Publishing House. Retrieved November 10, 2010.

- ↑ Verlag Dr. Th. Gabler, Gabler's Economic Lexicon , Volume 4, 1984, Col. 93 f.

- ↑ Helmut Reisen: Shifting wealth: Is the US dollar Empire falling? . voxeu.org. Retrieved July 3, 2011.

- ^ Nathaniel Taplin, Ben Blanchard: China's yuan joins elite club of IMF reserve currencies . Reuters. Retrieved July 12, 2017.

- ↑ Barry Eichengreen On Timing The Inevitable Decline Of The US Dollar (en) , Businessinsider.com. January 7, 2011. Retrieved July 3, 2011.

- ↑ Former central bank chief: Greenspan sees the euro as the future reserve currency . In: Spiegel Online , September 17, 2007. Retrieved November 10, 2010.

- ↑ Christian Geinitz: China and Japan are moving closer together . FAZ . December 27, 2011. Retrieved December 28, 2011.

- ↑ a b Deutsche Bank Research : "International reserve currency, the euro, on the rise", EU Monitor 46, April 24, 2007

- ↑ The International Role of the Euro ( en , PDF; 2.0 MB) European Central Bank . July 8, 2009. Retrieved November 10, 2010.

- ↑ The euro competes with the dollar . Wiener Zeitung . December 31, 2004. Retrieved April 15, 2015.

- ↑ Euro could replace dollar as top currency - Greenspan (en) , Reuters. September 17, 2007. Retrieved November 10, 2010.

- ↑ Chinn Menzie, Jeffery Frankel: Will the Euro Eventually Surpass The Dollar As Leading International Reserve Currency? Archived from the original on August 25, 2013. Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF) In: NBER . January 2006. Retrieved October 11, 2007.

- ↑ Barry Eichengreen: Sterling's Past, Dollar's Future: Historical Perspectives on Reserve Currency Competition. (PDF; 179 kB) In: Tawney Lecture, delivered to the Economic History Society. April 2005, p. 20 , accessed on July 3, 2011 (English).

- ↑ Why the euro is unlikely to eclipse the dollar. New York Times, April 2, 2008, accessed July 3, 2011 .

- ↑ World Bank predicts the end of dollar rule. Spiegel Online, June 5, 2011, accessed June 21, 2011 .