Technical analysis

The Technical Analysis (also Chartanalyse ) is a form of financial analysis . It tries to determine favorable buying and selling times from the price and sales history of the underlying , i.e. H. Predict the price development - or at least the probability of its occurrence.

Both the technical and the fundamental analysis contradict the market efficiency hypothesis , according to which neither of the two methods can systematically perform better than the respective market.

General

The technical analysis only takes into account the price history and, if applicable, the trading volume of the underlying assets. In contrast to fundamental analysis, the company's business data or the economic environment (e.g. economic indicators ) are not included.

The fundamental axiom of technical analysis is that all decision-relevant information about the past and future is already included in the course of the course and enables forecasts of likely course developments. This presupposes that the capital markets are not efficient, because otherwise it would not be possible to forecast and arbitrate by analyzing the price development. Therefore information diffusion must exist in the market, i. In other words, price-relevant information may only be priced in with a delay.

All chart technical analysis models have in common the assumption that there are recurring, observable events with similar, probable future courses. Depending on which discipline a chart analyst follows, certain geometric patterns or purely statistical, quantitative indicators can be used as "direction indicators".

The professional association of technical analysts in Germany is the association of technical analysts in Germany .

history

In the western world, the American Charles Dow (the developer of the Dow Jones Index named after him ) is considered the founder of technical analysis. He published his Dow Theory on chart analysis in a series of articles in the Wall Street Journal starting in 1884. Dow never claimed to have developed a scientific theory capable of predicting future prices of individual stocks. Rather, he viewed his findings as a tool for analysts to better define general market trends. Dow believes that financial markets are cyclical, with short, medium, and long-term waves.

The US mathematician Ralph Nelson Elliott built on the findings of Charles Dow in the 1930s and 40s and founded the theory of the Elliott waves . His model also describes trend cycles, but these are much more mathematically defined than in the Dow theory.

Richard W. Schabacker , one of the most influential financial journalists of his time, published in his book "Technical Analysis and Stock Market Profits: A Course in Forecasting", which was first published in 1932 , the still valid summary of the fundamentals of chart analysis based on geometric patterns.

However, the purely quantitative analysis models of chart technology only became possible with the widespread availability of computer technology. Since the 1980s, technical trading models have been calculable in real time and are used to trade huge sums of money on international financial markets.

criticism

Whether one can actually make statements about the further course of a security with the help of technical analysis has not been scientifically proven and is controversial. Representatives of the classic financial market theories ( market efficiency hypothesis , random walk ), for example, contradict this. Quantitative studies that have dealt with the informative value of different technical forecasting models since the 1980s (see web links: "To measure the success of technical trading approaches") are rare and (at least in 2005) do not provide a clear picture for or against the assumption that technical analysis models would provide a better way of anticipating market developments than chance would suggest.

One argument for including chart technology in price analysis is its widespread use and popularization via investor magazines. The fact that a lot of capital is moved out of the belief in chart analysis alone creates the phenomenon of self-fulfilling prophecy known from psychology , which makes a meaningful statistical validity study difficult. Based on the belief that the expected price movements will occur, actions (in this case corresponding limit orders , stop-buy and stop-loss orders ) are carried out, which can then themselves be the actual cause of these price movements actually taking place .

Ultimately, it is at least disputed whether, as the technical analysis implies, price movements are based on inherent recurring mechanisms from which future developments can be derived with sufficient certainty. For example, depending on the time of observation, certain chart progressions can be interpreted both as a sign of a trend confirmation and as a signal for a beginning trend reversal.

Charts

General

A chart is a diagram that shows the price development of an underlying asset. The time is typically plotted linearly on the abscissa and the price on the ordinate . In order to show price movements more proportionately, the price axis can be scaled logarithmically , especially for longer-term periods . The two time parameters of the chart are the observation period and the size of the individual time intervals. Usually the time intervals are chosen to be larger, the larger the total period considered - and vice versa.

As a rule, the following three or four display variants are used for charts.

Bar chart

In bar charts (also OHLC for open, high, low, close ), each interval is shown as a vertical line that extends from the lowest to the highest price within the interval. The opening price is represented as a horizontal line on the left and the closing price as a horizontal line on the right.

Lines chart

With line charts, only the closing prices of the respective intervals are displayed and connected by a line. Due to the lack of high and low prices, the price fluctuations within an interval are not visible; the diagram therefore contains less information than the other display types. Some charts can only be displayed as a line chart, e.g. B. Intraday charts showing each tick (i.e. each individual deal) as its own value. Tick charts have a non-linear time axis because there are different numbers of ticks per unit of time, depending on how often a security is traded.

Candlestick chart (candle chart)

Candlestick charts , often in the German candlestick charts are a variation of bar charts, where smaller trends are easily recognizable. The Japanese rice trader Munehisa Homma ("God of the Markets", born 1724) was the first to develop the form of the candle charts from a long-term record of prices on the Japanese rice exchange and to use the analysis of the candle charts to forecast the price development for rice . The range between the opening and closing price is shown as a small rectangle (solid). This is white (hollow) or green if the closing price is above the opening price or black or red if the closing price is below. Above this rectangle there is a line up to the top of the interval (the so-called wick or upper shadow ). A line is also drawn from the lower edge of the rectangle to the bottom (the so-called fuse or lower shadow ). As a result, this form of representation has a certain resemblance to a candle.

Point and figure charts

An alternative form of representation is the point and figure chart , which does not have a (linear) time axis, but only shows the price movement.

Kagi chart

Another form of representation originating from Japan is the Kagi chart , which consists of a series of vertical lines connected by short horizontal lines. Like the point and figure charts, Kagi charts are independent of time and are based exclusively on the closing prices of the underlying security. Depending on a predefined reversal amount, the line in the chart changes direction. For the analyst, the line width is also relevant, which can be either thick ( Yang line ) or thin ( Yin line ).

Comparison charts

In the case of comparison charts, the price developments of several underlyings are shown in one chart. This makes an (visual) comparison of the price developments easier.

Chart pattern

There are a number of patterns in chart analysis, the meanings of which sometimes contradict each other.

Gaps

A Gap (English; in German: gap ) is a gap in the chart that has been caused by a track jump between two successive time intervals. The low point of the following section is higher than the high of the previous one (upward gap) or the high of the current section is lower than the low of the previous one (downward gap). Gaps can be seen very clearly, especially in bar charts.

- Small price jumps within the movement are referred to as ordinary gaps or common gap .

- As breakaway or Breakaway Gap a greater price jump is referred to, which marks a new high or low.

- A runaway gap is one or more price jumps in a row in the direction of the trend.

- An exhaustion gap is a price gap that forms the end point after a price movement. At the beginning it cannot be differentiated from a runaway gap, but no new highs or lows subsequently develop.

Spike

A spike is a price formation in which, in contrast to the previous and following day, a clear high or a clear low has formed and the closing price is at the other end of the previous movement, and thus resembles a spearhead in a bar chart. It is assumed here that such a spike marks the peak of the current buying and selling pressure and that for this reason there is a trend reversal. This should be supported by a significantly increased volume. The probability that a spike is of great importance increases the more it stands out from the current chart development.

Trend lines and trend channels

In order to determine trends , so-called trend lines are drawn in at local extremes of a chart. An upward trend line is drawn on at least two local minima of an upward trend that are not too closely spaced. A downward trend line is drawn on at least two local maxima of a downward trend that are not too closely spaced.

Trend channels are obtained if two lines, which are as parallel as possible, are drawn in at different distances from one another in the chart. A narrow trend channel includes short-term price fluctuations, a broad trend channel includes longer price cycles.

Trends can be stable over long periods of time, but there are often short-term, even contrary trends within this trend channel. If one then finds a short-term downtrend in a stable, long-term upward trend, which reverses again at the lower limit, as expected, this results in a potentially well-suited entry point. A market participant can also interpret the approach to the upper trend channel limit as a possible exit point.

With trend lines and trend channels, however, it should be noted that they can more or less reliably be drawn only afterwards. Trend lines for current trends often need to be redrawn as it is possible that a movement could be misjudged. There are different opinions about how many highs or lows are needed to draw the most useful trend line possible.

There is also the procedure of the internal trend lines , in which the highest highs or the lowest lows are not to be connected, but as many points as possible where extreme price peaks are not taken into account.

More patterns

The following patterns are intended to signal a trend reversal:

- Double high or double low,

- Triple high or low,

- (inverted) saucer,

- Shoulder-head-shoulder,

- Triangle.

The following patterns are intended to signal a continuation of the trend:

- Rectangle,

- Triangle and wedge,

- Flag and pennant .

Technical indicators

A technical indicator is used to provide an alternative representation of the price trend of an underlying asset . It is used to quantify price developments and to reduce them to the relevant information with regard to certain properties.

Technical indicators are basically timing indicators because they should determine the point in time of a buying or selling decision or at least provide information about the state of a value (e.g. whether there is a trend). In contrast to economic indicators , technical indicators are not based on external data, but exclusively price and possibly volume data.

In general, a distinction is made between so-called trend-following indicators and oscillators.

Trend following indicators

Trend-following indicators are intended to show whether a security is currently in an upward or downward trend. As the name suggests, these indicators follow a trend; In other words, they always react with a delay to the price development. Often a trend is only displayed when it has already progressed a bit and the end or the trend reversal is signaled with a delay. Furthermore, they do not provide a forecast for the future price development.

One of the most popular trend following indicators is the so-called MACD . It shows whether there is an upward or downward trend and provides signals when a trend has become established. The trend-oriented formation of ever new extreme values in the courses that are no longer reflected in the indicator (called divergence) should indicate the weakening of a trend.

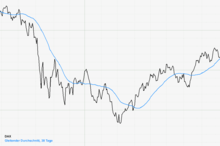

Another popular trend-following indicator is the moving average ( GD or MA for short). The GD-38 consists for example of the average of the last 38 courses. If a stock is now in an upward trend, the moving average will also rise. Stock prices are subject to certain fluctuations, which can make it difficult to see the current trend. The moving average smooths the price trend so far and makes it easier to read the prevailing trend.

In phases in which there is no clearly dominant trend (e.g. in a sideways movement), trend-following indicators often give false signals.

In addition to trend following indicators, there are trend strength indicators. The ADX is one of the best known. It only shows whether there is a trend or not. The trend direction must be determined otherwise.

Oscillators

Oscillators are intended to anticipate or merely confirm possible turning points in the course of the price, so they represent the counterpart to the trend-following indicators.

When it comes to oscillators, one speaks of overbought and oversold . This means that the indicator is in the upper (overbought) or lower (oversold) range.

List of technical indicators

Price based:

- MACD (Moving Average Convergence / Divergence Indicator)

- Moving average

- Average Directional Movement Index (ADX)

- Advance Decline Line

- Momentum

- Parabolic Stop and Reversal System, also Parabolic SAR

- Relative Strength Index (RSI)

- Keltner Canal

- Williams% R

- Stochastics

- DSS Bressert

Volume based:

Overlays: Overlays (English; in German overlays ) called indicators in the price window of the chart (eg in the form of lines.) About the prices are set.

- Bollinger bands

- The Ichimoku-Kinko-Hyo is a combination of several technical indicators and basically already represents a trading system.

- Donchian Canal

See also

literature

- Richard W. Schabacker: Technical Analysis and Stock Market Profits . 2nd Edition. Harriman House Ltd., Petersfield 2005, ISBN 1-897597-56-8 (English, first edition: USA 1937).

- Robert D. Edwards, John Magee, WHC Bassetti: Technical Analysis of Stock Trends . 10th edition. Taylor & Francis Inc., Boca Raton (Florida, USA) 2013, ISBN 978-1-4398-9818-5 (English).

- John J. Murphy: Technical Analysis of Financial Markets. Basics, strategies, methods, applications . Incl. Technical Analysis Workbook . 11th edition. FinanzBook Verlag, Munich 2014, ISBN 978-3-89879-062-8 (English: Technical Analysis of the Financial Markets. A Comprehensive Guide to Trading Methods and Applications . 1999.).

- Jack D. Schwager: Brother-in-law on technical analysis. Introduction, application, consolidation . FinanzBook Verlag, Munich 2003, ISBN 3-89879-034-7 ( limited preview in the Google book search - English: Getting Started with Technical Analysis .).

Individual evidence

- ↑ See Schwager (2003), pp. 56–59 ( section “Internal trend lines” in the Google book search).

- ↑ See Murphy (2014), pp. 102-103.

- ^ FAZ Börsenlexikon: MACD

- ↑ FAZ Börsenlexikon: Moving average line