Interbank trading

Interbank trading worldwide is trading with financial instruments (including cash , securities , foreign exchange , varieties , precious metals and derivatives ) between banks mentioned. The transactions of credit institutions with their central bank are not part of interbank trading .

content

In interbank trading, objects such as money, foreign exchange, sorts ( money market ) or securities ( capital market ) are exchanged at interbank prices on the interbank market. The interbank market, on the other hand, is the economic location (i.e. not a geographically delimitable location) where interbank supply and demand meet.

For money lending , internationally recognized reference rates such as EURIBOR, LIBOR or EONIA are used as the basis for calculating the interest:

- EURIBOR (European Interbank Offered Rate) is an international representative euro money market interest rate that is paid among banks for unsecured euro investments with a term of up to 12 months.

- LIBOR (London Interbank Offered Rate) is the reference interest rate for unsecured money market loans (1 day to a maximum of 12 months), first introduced in January 1986, between the most important international banks. Every bank working day they report to the Thomson Reuters news agency around 11:00 a.m. London time (GMT) the interest rate at which they would take out commercial unsecured money market loans on the London interbank market. The average interest rate is calculated by Thomson Reuters according to certain criteria, announced by the ICE Benchmark Administration (IBA), authorized by the Financial Conduct Authority (FCA), daily around 11:45 a.m. London time and by its partners (e.g. global-rates. com) published.

- EONIA (Euro Overnight Index Average) is a turnover-weighted average rate for unsecured overnight money in interbank business, which has been calculated daily by the ECB on the basis of actual turnover since April 1999.

The European Central Bank , for example, publishes reference rates on working days for the trading of foreign exchange between banks at the so-called interbank rate.

Legal bases

All trading at credit institutions can be assigned to one of the three following categories:

- Trading in someone else's name for someone else's account ( open representation ) is a financial service within the meaning of Section 1 (1a) 2 No. 2 of the KWG (contract brokerage ),

- trading in one's own name for third-party account (hidden representation) is banking within the meaning of Section 1 (2) No. 4 KWG ( finance commission business ),

- Trading in your own name for your own account is - if understood as a service for others - a financial service within the meaning of Section 1 (2) No. 4 KWG ( proprietary trading ). When trading on behalf of a customer as a proprietary trader, the bank does not act as a commission agent , but as a buyer or seller. Even if this is a pure sales contract under civil law, the business is a service in the sense of the EC Investment Services Directive.

purpose

The credit institutions participate in interbank trading for two reasons. They either close out ( open ) positions that were previously established in customer business or proprietary trading, or they conduct proprietary trading. The interbank market thus functions like an allocation mechanism with the aim of efficiently distributing bank risks.

Closeouts

All transactions in interbank trading in the European Union are subject to the provisions of the Capital Adequacy Ordinance (CRR) and other laws and are monitored by banking supervisory law because open positions must be backed with equity . It can therefore make sense not to keep risk positions acquired in the customer area in the portfolio, but to close them out congruently (congruent) in interbank trading . This also applies vice versa for existing positions that are sold to customers as required and are to be balanced again in interbank trading. In this way, bank risks can be reduced or even completely eliminated by closing out interbank trading. Smooth positions are only available if an exactly opposite transaction is effected to an open interbank position ( english closing transaction ). This neutralizes an open position and no longer has to be backed with equity.

Proprietary trading

Credit institutions conduct proprietary trading if their activities are not triggered by customer business but are carried out in their own name and for the credit institution's own account. (Open) positions can also be built up or closed in proprietary trading. If positions are built up, additional banking risks arise, which have to be backed with equity within the framework of the crediting regulations. This shows that proprietary trading and customer business are not always clearly distinguishable from one another. The motives for proprietary trading are either arbitrage or speculation .

In normal times, proprietary trading contributes between 20 and 50% to bank income, but it has been reduced considerably since 2007 as part of the financial crisis , also because higher capital requirements were to be expected. In volatile markets, the risk in proprietary trading also increases, especially with stocks and foreign exchange, so that banks tend to withdraw from proprietary trading, at least temporarily.

Shape and structure

As is customary, interbank trading takes place by telephone or online with a subsequent written confirmation of the transaction.

In a complete interbank market, all credit institutions interact with one another in a non-discriminatory manner, while an incomplete interbank market is characterized by the fact that some credit institutions are ignored as market participants. This has an impact on contagion effects , as these are theoretically lower in complete markets due to diversification than in incomplete interbank markets.

Risks

Interbank trading is not risk-free. If one abstracts from the typical trading risks ( market price risks ), which can be minimized or even eliminated through close-out transactions ( risk compensation or risk reduction ), the counterparty or counterparty default risk remains with all transactions in interbank trading . Behind this there is the risk that the other bank partner of the transaction ( counterparty ) can, in the worst case, no longer be able to fulfill its consideration from the interbank business because it has become insolvent.

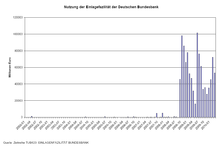

Since the Lehman Brothers insolvency on September 15, 2008, this performance or “settlement” risk has come back into the public and banking debate. Lehman Brothers was also no longer able to meet the obligations entered into in interbank trading due to insolvency, so that the other banking partners had to bear at least replacement losses, and possibly even had open positions again that were actually considered closed. The Lehman bankruptcy is the real reason for the wait- credit institutions on the interbank market. Statistically it can be shown that the credit institutions tend to invest their money with their central banks and largely ignore the interbank market.

scope

The interbank market continues to be an important source of refinancing for banks in order to control liquidity as well as market and banking risks. The interbank business therefore takes a considerable part in the euro market. According to the Bundesbank, the interbank market reaches 30% of the total assets of universal banks in normal times , some special banks (such as auto or partial payment banks ) are up to 90% dependent on the interbank market. Before the crisis, banks lent each other up to 450 billion euros a day. As a result of the financial crisis from 2007 onwards , this interbank trade almost completely came to a standstill because the banks' trust in one another was disrupted. This is why credit institutions tend to invest their excess liquidity with the ECB at lower interest rates than they would receive on the interbank market, since there is no settlement risk with the ECB.

Interactions with non-bank lending

Since interbank markets represent an important refinancing basis for lending to non-banks in normal times , it can be assumed that if this source ceases to exist, lending to non-banks will also suffer if the situation remains the same. Conversely, the BIS found in a study that reducing interbank positions can lead to higher lending to non-banks. Both effects are currently coming together because, despite a reduction in interbank positions, there is no higher lending to non-banks. This is because the currently perceived credit crunch can also be attributed to a non-functioning interbank market, because a major source of refinancing for loans to non-banks has largely disappeared.

organization

The MaRisk demand in Germany (similar in most Western nations) firstly a strict separation between trading ( market side , English front office ) and administration ( back office side , English back office ). Commercially itself of customer business differentiates between execution ( english execution trading advice to institutional investors (), English sales trading ) and " traders " who are responsible for proprietary trading. Institution- specific trading limits are in place to limit the risks, i.e. limits on the amount of trading volume per trading day, per trading product and per trader.

Current situation

After the insolvency of Lehman Brothers, the interbank market worldwide and especially in Germany practically came to a standstill from October 2008. In all transactions with typical creditor risks (such as unsecured interbank financial investments), noticeable attentiveness has resulted in credit institutions lending only a small amount of money to one another, because the insolvency of the counterparty could jeopardize repayment. Instead, credit institutions deposit excess liquidity with the central bank, they make extensive use of the deposit facility , so that the refinancing function of the interbank market is practically eliminated. In October 2008, against the background of the Financial Market Stabilization Act , the ECB was still of the opinion “that the granting of state guarantees to cover interbank deposits should be avoided”.

Today , credit institutions no longer have to deal with the counterparty default risk of a large number of financial services institutions, credit institutions or investment firms , but only with a few clearing houses . Their counterparty default risk is either very low (some central banks are incapable of insolvency such as the Deutsche Bundesbank ; or clearing houses with pure payment processing such as the CLS-Bank ) or standard banking (such as TCC ). This reduces the risk of counterparty default, which increases the security of the transactions and the market participants who carry them out .

Contagion effects

There are permanent interdependencies between the credit institutions through interbank relationships, other relationships between financial institutions and the connections within the framework of payment transaction and securities settlement systems , which in the event of disruptions can lead to far-reaching systemic and financial crises. In a weekly report, DIW Berlin sees a problem in the fact that banks increasingly mistrusted each other and lending in interbank transactions has stalled, so that individual banks could run into liquidity problems. Despite major regulatory concerns, support measures are therefore required - also with state participation - for those institutions whose decline would have considerable negative effects on the entire financial sector in Germany.

May Interbank trading offers the banks the world the opportunity to be so strong network with each other to self-crosslinking to be too in order to set, present ( english too interconnected to fail ). This can lead governments to shy away from bankruptcy of a highly connected bank for fear of the effects of contagion . This disincentive means a moral risk . Because by entering into low net but high gross positions, particularly in the case of derivatives , banks that are not already considered “ too big to fail ” due to their size can construct themselves an implicit guarantee of existence. In March 2008, for example, the small and rather insignificant investment bank Bear Stearns was bailed out because it was viewed as too connected. The more credit derivatives (especially credit default swaps ) a bank sells as protection seller, the higher the probability that the institution will be rescued by the state in an emergency .

See also

Web links

- Bundesbank statistics ( memo from November 26, 2006 in the Internet Archive )

- European Central Bank statistics

Individual evidence

- ↑ SNB glossary ( Memento of the original dated February 17, 2015 in the Internet Archive ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (a collection of terms that need to be explained). Retrieved February 4, 2015

- ↑ a b LIBOR, information about the London InterBank Offered Rate . Retrieved February 7, 2015.

- ^ Analogous: Gerhard Maier, The domestic effective money supply in an interdependent world , 1987, p. 80, with further references.

- ^ "Proprietary trading of banks buried" , Handelsblatt dated January 28, 2009.

- ^ "Deutsche Bank ends proprietary trading" , Spiegel Online from January 17, 2009.

- ↑ "Interest rate cuts are particularly important now". In: Handelsblatt. December 10, 2008, accessed July 2, 2017 .

- ↑ ECB concerned about interbank market. In: Handelsblatt. December 11, 2008, accessed July 2, 2017 .

- ↑ Gerhard Maier: The domestic effective money supply in an interdependent world , 1987, p. 80

- ^ Deutsche Bundesbank: Banking Statistics December 2008 , p. 9.

- ↑ "The banks don't dare" , Hannoversche Allgemeine dated December 13, 2008.

- ^ "Money market without trading" , Börsen-Zeitung of December 19, 2008.

- ↑ BIS: International Banking Business and International Financial Markets , Quarterly Report March 2004, p. 15 ff.

- ^ Opinion of the European Central Bank on the German Financial Market Stabilization Act of October 21, 2008, p. 4.

- ↑ Marcel V. Lähn, Hedge Funds, Banks and Financial Crises , 2004, p. 48.

- ↑ DIW Berlin, weekly report 21/2008 , 2008, p. 616.