Project evaluation

The project evaluation is a branch of the Corporate Finance and includes methods of calculating the value of a project in the company. The resulting comparison of several alternative projects guarantees an optimal preparation of business decisions with regard to an efficient and risk-based distribution of scarce resources in the company.

A distinction can be made between a capital market-oriented and a risk-based project evaluation. In the capital market-oriented project valuation, the valuation is carried out with the aid of the capital goods price model (CAPM) based on the company's historical capital market data. In the risk-based project evaluation, all relevant project risks are identified as part of a risk analysis and described quantitatively using probability distributions . This makes it possible to determine the risk-appropriate value of a project with the help of a model.

A project evaluation can also be used for a project rating. It enables external investors to quantify the expected losses.

Basics

The project evaluation and selection takes place against the background of the benefit of the project on the one hand and the limited resources on the other. Every company only has a limited number of capacities (machines and personnel), time and capital. It is therefore necessary for companies to carry out an analysis of the project benefits, the project requirements for resources and the resources available in the company. As a result, a ranking list that prioritizes the projects can be drawn up. Based on this list, the investment decision can now be made as to whether a project will be implemented or not.

The mutual influence of different projects on one another should not be neglected in order to identify any synergy effects or possible bottlenecks. For this reason, various projects are considered bundled in project portfolios . It is also essential to implement different types of projects, for example projects with different risk classes, in order to achieve a balanced mix within the project portfolio. Softer factors, such as the integration of the project into the strategic direction of the company, must also be taken into account when selecting a project. The project portfolio management deals more intensively with the latter topics. It is subordinate to the multi-project management .

Ultimately, correct project selection lays the foundation for the success of the project for the company, even before successful project management .

The rest of the article deals less with the limited resources of companies and more with determining the economic attractiveness of a project. This can be calculated with different methods to determine the profitability. Depending on the method, the result for evaluating the projects may vary. In practice, a capital market-oriented valuation is often used, which neglects different project risks, but takes into account the different points in time at which costs and profits are incurred via the net present value.

Capital market oriented project evaluation

Action

Companies can raise funds on the capital market to carry out an investment project . This has the advantage that relatively short-term, large sums are freely available which, as a rule, cannot be derived from the company's operating cash flows . On the other hand, the return on equity can be leveraged through the financial leverage effect , provided that the debt can be raised on more favorable terms than the company achieves in terms of total return on capital.

The financing conditions are directly related to the assessment of the debt service capability that the company achieves with the implementation of the investment project. Since, according to the definition, a project takes place once and is novelty, the capital market has no assessment-relevant and objective information about the project and the associated risks. In order to still be able to carry out a project evaluation and make an investment decision, the decision-makers in the company often fall back on the Capital Asset Pricing Model (CAPM). The CAPM was originally intended for calculating stock returns, but its range of use has been expanded due to its simplicity of use.

When evaluating projects using CAPM, the project risk is summarized in the beta factor, which represents the standard deviation of the expected return as a risk measure . Since in reality there is no perfect capital market , all risks of the project are estimated by the capital market. The quantification of the project value is carried out on the application of discounted cash flow method, which the net present value is determined (net present value, NPV). It is calculated by discounting the expected cash flow of the project with the help of the discount rate calculated using CAPM. The expected return is therefore calculated on the basis of the company's share return fluctuations.

For the subsequent decision-making, typical project finance key figures such as the Loan Life Cover Ratio (LLCR) are calculated, which sets the net present value of the project in relation to the borrowed capital. In contrast to the debt service coverage ratio , however, not only the respective period result is considered, but also the cash flows during the entire project period.

criticism

The capital market-oriented project valuation using CAPM is now the common practice for determining the net present value of a project. It offers a quick and easy way for decision-makers to evaluate a project. However, the application of the CAPM leads to weaknesses in applicability due to the narrow premises. Overall, there are various strengths and weaknesses of the approach:

Strengthen:

- Even if not all information on a project is (yet) available, a project value can be determined and compared with alternatives.

- A sensitivity analysis can be carried out quickly by varying the beta factor .

- Simple and understandable to use.

Weaknesses:

- A perfect capital market is assumed when calculating the beta factor (risk measure). However, this does not exist in reality.

- The CAPM is based on historical data, with the help of historical data forecasts for the future are made.

- The capital market also has less information on the risks of a project than corporate management (information asymmetry)

- As soon as no capital market data is available (e.g. B. in the case of non-listed companies) there are ambiguities in the valuation.

- The CAPM only takes into account the systematic risks determined in the beta factor (e.g. B. Business cycle). The individual project risks are not taken into account.

- The approach allows room for assessment and manipulation.

Overall, it can be said that the capital market-oriented project evaluation using the CAPM only incorporates the individual project risks to a small extent. Empirical studies have shown that the achieved returns could not be explained with the help of the CAPM. Consequently, the CAPM approach does not provide a reliable approach for assessing the benefits of a project. For a more qualified project appraisal, a risk-based project appraisal that takes into account all the risks of a project is necessary.

Risk-based project evaluation

Action

The basic idea of a risk-based project evaluation is not to determine the project value on the basis of historical capital market data, but rather to derive it from the aggregated income risk.

A project decision is always a decision made under uncertainty. This is due, on the one hand, to the uniqueness of projects and, on the other hand, to the fact that decision-relevant project sizes (e.g. B. amount, time and occurrence of payments) cannot be predicted with one hundred percent certainty. In order to be able to make a qualified project decision, all available information and all relevant risks must be taken into account when evaluating the project. Basically, the risk is the possibility of deviating from a planned value. This is the decisive difference to the capital market oriented project valuation. In the risk-based project assessment, the risk measures are derived from the project itself and its expected payments.

First of all, all relevant risks for the project must be identified, both positive (opportunities) and negative (dangers). Since these risks are often related to one another and affect the same target value (the project income), a calculation model is set up as part of a risk aggregation that records all risks as input parameters. This model is then evaluated using a Monte Carlo simulation .

After all input parameters have been identified, they must be evaluated. The starting point of each input parameter is its expected value. However, since this value is not necessarily certain, bandwidths are specified to avoid imprecise accuracy. For this purpose, information is first collected about the distribution of the input parameters, e.g. B. through expert assessments or an analysis of the capital market. With the help of this information, suitable probability distributions are assigned to the input parameters (e.g. B. normal distribution , triangular distribution, equal distribution), which enables a mapping of asymmetrical risks, z. B. with significantly more and more serious dangers compared to the opportunities.

With the help of the Monte Carlo simulation, any number of future scenarios can be mapped for the established model and the overall risk position can be calculated. The input parameters vary in each individual simulation, so that the project value (e.g. B. Yield as target value) is constantly recalculated. After a sufficiently high number of runs, a frequency distribution results for the target variable. This distribution can then be analyzed with regard to various criteria (e.g. B. Expected value , standard deviation , loss probability).

criticism

Overall, the risk-based project evaluation can be viewed as more advantageous and more precise than the capital market-oriented project evaluation. However, in addition to its strengths, there are some criticisms of this method:

Strengthen:

- Risks are included so that managers or decision-makers can better assess the usefulness of the project.

- In addition, the risks and sensitivity analysis can be used to identify critical bottlenecks inside or outside the project.

Weaknesses:

- One difficulty arises from considering and calculating the risks of the project. The problem arises that the risks should be quantified as precisely as possible. However, this is problematic because the probability of occurrence of the events is always subject to a certain uncertainty. It is therefore difficult to define exact values or ranges of values for the probabilities. The result of the evaluation of the project is ultimately determined by the probabilities defined at the beginning, which are determined under assumptions. Thus, the forecast quality of the project evaluation can only be improved to the extent that the probabilities can be correctly determined.

- The same applies to the type of probability distribution (e.g. B. normal distribution, triangular distribution etc.). It must also be determined and has an impact on the result.

- The first two points result in the risk of manipulation by the creator. He can strongly influence the project evaluation by adjusting assumptions and probabilities.

- Another point of criticism is the interpretation and evaluation of the results. In the risk-based project evaluation, the Monte Carlo simulation does not output an exact value, but a wide range of values with different probabilities. This could make a decision as to whether a project should be implemented or a decision between different projects more difficult. Projects could have a high chance of profit but also a high chance of loss. Managers could now tend to do more high-risk or low-risk projects. The reason is that many decision-makers are either risk averse or willing to take risks, and one project is not always rated clearly better than others.

- Furthermore, the creation of a risk-based project assessment is associated with greater effort than the creation of a project assessment suitable for the capital market.

example

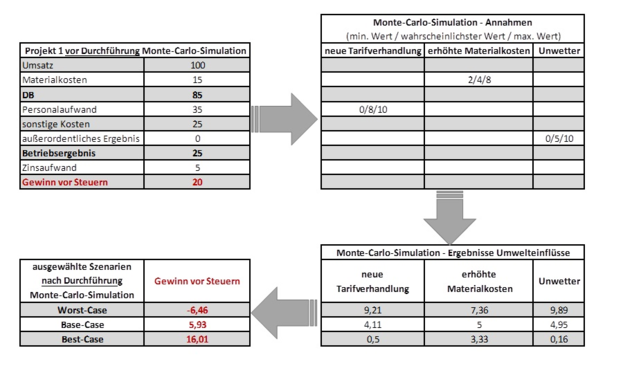

The P AG has applied for several environmental projects in the Dresden area. The AG was awarded a contract for two projects. In order to assess the profitability, PM AG analyzes the projects using risk aggregation . 10,000 scenarios are created using the Monte Carlo simulation . A triangular distribution was assumed for environmental influences . (n = 10,000)

An income statement is shown in the sample images. The assumptions and environmental influences represent the parameters for the Monte Carlo simulation and allow the profit before tax to vary depending on the scenario. In the second half of the images, three scenarios (worst case, base case and best case) were selected and presented with their respective effects on profit.

The following frequency charts were obtained with Crystall Ball:

Results analysis

Project 1 is the more sensible project for reasons of economy, because considering all risks, the profit before taxes is greater than or equal to 0 with a certainty of 91.29%. For project 2, a profit greater than or equal to 0 could be achieved in only 53.83% of the runs. The maximum loss for project 1 is 6.46 MU and is thus lower than for project 2 with 13.31 MU. In the runs in project 1, a maximum of 16.01 MU could be achieved in project 2 but only 15.75 MU. Project 1 is therefore preferable to Project 2.

The Y-axis represents the three risk factors that have a significant influence (sorted in descending order) on profit before tax. The variable with the broadest dispersion, which also has the greatest impact on the outcome, is the variable “new collective bargaining”. The numbers next to the individual bars indicate the minimum and maximum value apart from the base case of the respective variable. Since all three variables represent cost items, they have a negative impact on the result. The result of project 1 is mainly driven by the two parameters storms and the new collective bargaining. If there are significant changes or increased costs, the pre-tax profit will be more unfavorably influenced by Project 1 than would be the case with a maximum fluctuation in material costs. The company should therefore keep an eye on the first two parameters and, if necessary, take countermeasures to contain worst-case scenarios into account. A similar analysis can be made with the help of a sensitivity analysis.

Project rating

The result of the project evaluation cannot be used for investment decisions within a company, but also for determining the debt servicing capability of the project company and the expected losses from external investors. Debt serviceability describes the future ability of the project company to repay capital in full and on time to the external creditors who provided the financing for the project.

The project rating represents the project company's 1-year probability of default, i.e. the probability that the project company will become illiquid within a year and cannot make the loan payments due. It expresses the expected losses for (potential) lenders. A project evaluation can therefore be made from two different perspectives:

- from the owner's perspective

- from the lender's perspective

The project rating itself is based on the probability of default ( debtor default ) of the project company and the realization rate . The project company can default if, due to an unexpected lack of cash flows, overindebtedness occurs and insufficient equity is available to compensate. With the help of the probability and the realization rate, the expected loss for lenders can now be calculated:

See also

literature

- Richard Guserl, Helmut Pernsteiner: Handbook Financial Management in Practice . 2004.

- Victor Platon, Andreea Constantinescu: Monte Carlo Method in Risk Analysis for Investment Projects. Ed .: Procedia Economics and Finance, No. 15, 2014, pp. 393–400.

Individual evidence

- ^ Norbert Kauba, Gerhard Dittler: Benefit assessment of projects . Ed .: Controlling - magazine for success-oriented corporate management. tape 13 , no. 2 , 2001, p. 96 f .

- ↑ a b Werner Gleißner: Risk analysis and replication for company valuation and value-oriented company management . Ed .: WiSt. CH Beck, Vahlen, 2011, p. 346 .

- ↑ T. Sonntag: Company valuation using the present value method - a brief review. June 8, 2017, accessed June 20, 2020 .

- ^ W. Gleißner, T. Berger: Simply learn! Risk management . Ed .: Ventus Publishing ApS. 2012, ISBN 978-87-7681-977-4 , pp. 10 .

- ^ S. Fink: valuation problems with the merger of cooperatives . Ed .: Research Institute for Cooperatives. 2008, ISBN 978-3-924677-36-7 , pp. 219-220 .

- ↑ Werner Gleißner: Capital market-oriented company valuation: Findings from empirical capital market research and alternative valuation methods . In: Corporate Finance . No. 4 , April 7, 2014, p. 162 .

- ↑ Werner Gleißner: Risk assessment for investments: determination of risk-appropriate financing structures and return requirements through simulations . In: The Controlling Consultant - Investment and Project Controlling . tape 30 . Haufe-Lexware-Verlag, 2013, p. 213-236 .

- ↑ a b Werner Gleißner: Quantification of Complex Risks - Case Study Project Risks . In: Risk Manager . No. 22 . Bank-Verlag, Cologne 2014, p. 1, 7-10 .

- ↑ P. Krebs, N. Müller, S. Reinhardt, H. Schellmann, M. von Bredow, G. Reinhart: Holistic risk assessment for manufacturing companies . In: magazine for economical factory operation . No. 3 , 2009, p. 174-181 .

- ↑ a b David Blanchett, Wade Pfau: The Power and Limitations of Monte Carlo Simulations. The Vanguard Group, 2014, accessed July 17, 2018 .

- ↑ Fred Wagner: Risk Preference - Detailed Definition. In: Gabler Wirtschaftslexikon. 2018, accessed July 17, 2018 .