Transaction cost theory

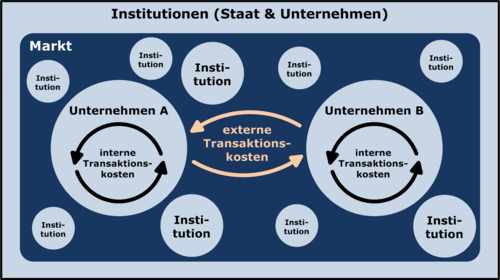

The transaction cost theory (or transaction cost approach , TKA; English transaction cost theory ) is an organization theory , which for new Institutionenökonomik is counted, and in which the contract is as an organizational form the focus of research interest. With the transaction cost theory one would like to explain why certain transactions in certain institutional arrangements, i.e. organizational forms of exchange, are more or less efficiently processed and organized. It assumes that any action in a market economy is associated with costs. In a perfect market assumed as a model, there are by definition no transaction costs.

Basic concepts

Transactions are the basic units of analysis in transaction cost theory. This refers to all transfers of rights of disposal to goods and services in exchange relationships between at least two contractual partners.

As an economic theory , transaction efficiency is an important driver. What is meant here is the economical use of scarce resources . These are not only used when the exchange goods or a service are created (income from production costs ), but also for the processing and organization of the exchange (income from transaction costs ).

Williamson , the most important representative of the TKA according to the theory giver Coase , differentiates even further between ex-ante and ex-post transaction costs . Ex-ante transaction costs such as information, negotiation and contract costs are costs that arise before the contract is concluded. Ex-post transaction costs are costs for control , enforcement and subsequent contract adjustments that may arise after the conclusion of the contract and the exchange of services.

Transactions are efficient when the actors choose a form of organization that has the lowest total production and transaction costs.

Behavioral assumptions

The transaction cost theory assumes the contractual partners:

- Limited rationality : Due to limitations with regard to their own skills, time, knowledge and the processing capacity of information, the respective players in the market can only act rationally to a limited extent. If future market conditions are uncertain, this has an impact on the contractual arrangements of companies, as not all possible conditions can be contractually determined.

- Opportunism : The economic actors pursue their own interests, in the sense of maximizing their own benefits, and resort to deception if the contractual partner lacks information to discover them. This includes delays by the supplier as well as less effort made by him to achieve the goal. Delays can be particularly problematic for manufacturers if the manufacture of their own products is dependent on the components of the supplier at a clearly defined and unchangeable point in time through interdependent manufacturing processes. It can lead to opportunistic behavior before and after the conclusion of the contract, e.g. B. in the form of renegotiations based on asymmetrical information distribution and thus the possibility of deception by the supplier. The higher the degree of uncertainty about future market conditions, the more difficult it is to set all the terms in the contract, which leads to the encouragement of possible opportunistic behavior.

- Risk neutrality : In the context of transaction cost theory, it is assumed for the sake of simplicity that the parties involved behave neutrally with regard to risk and that all show the same degree of willingness to take risks.

Based on these three behavioral assumptions, companies should design their processes of clarification and performance agreements in such a way that the problems that arise from the uncertainty of future market conditions, limited rationality and possible opportunistic behavior of business partners are minimized.

Transaction characteristics

In transaction cost theory, three factors influence costs:

-

Transaction- specific investment (factor specificity) : If an asset, which is required to manufacture a product, is specifically geared towards a company and cannot be used profitably for other applications, then one speaks of factor specificity.

A further distinction is made between four types of factor specificity:

- Location specificity : This occurs when a company settles in a location close to the contractual partner in order to reduce transport time, storage and production costs and it is difficult to use this location to enter into business relationships with other companies.

- Physical specificity : Here the product architecture of the own components or the machines and tools used for the manufacturing process are designed for the respective business partner and cannot be used for relationships with other potential business partners.

- Human specificity : The knowledge, skills, communication channels and problem-solving strategies of companies are specifically geared towards a business relationship between manufacturer and supplier.

- Purpose-driven specificity : Investments are made in facilities in order to meet the requirements of the respective business partner.

- Uncertainty : A distinction is made here between parametric uncertainty , which is the uncertainty about future environmental conditions under which the contractually agreed services are performed, and behavioral uncertaintyabout the possible opportunistic behavior of the respective partner. Both uncertainty factors contribute to the fact that the transaction costs rise before and after the contractual agreement, since several environmental conditions and behavior patterns have to be anticipated and agreed and the limited rationality usually leads to later adjustments and renegotiations.

- Frequency : With an increasing number of identical or similar transactions between the parties involved, there can be a degression of fixed costs, learning, scale and synergy effects , which reduce the average production and transaction costs. Compared to the first two influencing variables, however, this effect is of minor importance.

Features of institutional arrangements

Williamson distinguishes three types of contractual relationships that justify institutional forms of organization:

- Classic contracts - processing transactions on the market : As an example, a normal sales contract for a simple product can be used. The terms of the contract are fixed in advance, the transaction is short-lived and none of the partners is anticipating subsequent adjustments to the contract.

- Neoclassical contracts - processing via long-term contracts : These are transactions in which the contractual partners cannot specify all conditions in advance and therefore expect adjustments. This is done through security, adjustment and guarantee clauses. Joint ventures or franchises can be named as examples . Williamson calls this institutional arrangement the hybrid form.

- Relational contractual relationships - processing in organizations : This contractual relationship describes a complex social relationship that requires joint decisions by the transaction partners and coordinated adjustments and development. Williamson cites as an example the processing of transactions in organizations themselves, i.e. the provision of services in the company.

Main message

An exchange of goods or services that shows little uncertainty and is not associated with transaction-specific investments (factor-specificity) will be processed via the institutional arrangement market . Due to the large number of existing competitors , opportunistic action by the contractual partner is restricted. In addition, a subsequent contract adjustment is associated with low costs and can also be enforced autonomously by a contractual partner, for example by looking for a new provider.

With the increasing dependency of the contractual partners through high transaction-specific investments (factor-specificity), for example in a new production plant, the incentive for the contractual partners to act opportunistically in order to acquire the quasi- rents increases.

Thus, a hybrid organizational form is the most suitable form in which the contractual partners protect themselves from opportunistic behavior by agreeing information obligations or sanctions in the event of non-fulfillment of the contract and anticipate possible renegotiation or adjustment costs .

An organization-internal provision of services is the most cost-effective institutional arrangement in the case of very great uncertainty and large transaction-specific investments (factor-specificity). Transaction costs such as obtaining information, negotiation and contract costs can be saved in advance ; and later adjustments are also much easier to process internally. With a separate management and control system in the organization, opportunistic behavior can possibly be completely eliminated.

The aim is to choose the type of organization in which the transaction costs of coordination (information and communication) are minimal and the greatest possible efficiency of the exchange and the protection of investments are guaranteed.

The success of the transaction depends largely on the actors' propensity for opportunism . The smaller the number of actors, the greater the tendency towards opportunism (small numbers problem).

The graphic market vs. Hierarchy depending on the specificity shows the connections between the possible institutional arrangements and the factor specificity. Here, internal provision of services, i.e. the form of the relational contractual relationship, is called a hierarchy and the hybrid organizational form is called a network . According to this, transactions with high specificity are better processed in the hierarchical form, while those with low specificity are processed via the market .

The classification of the corporate networks (independent organizational form between market and hierarchy or an intermediate form) is still questionable.

Areas of application

The problem of determining the transaction costs has not yet been solved. At the same time, the theory helps to formulate some basic findings on the advantages of the following decisions:

-

Make-or-buy decisions : The transaction cost theory has often been empirically investigated in connection with the decision between self- or third-party production . Examples can be found here in the automotive industry when it comes to the acquisition or integration of entire companies, but also in the public sector (see also market test (controlling) ). The higher the factor specificity and the uncertainty, the more likely it is that companies will decide to purchase the necessary product components within their own company boundaries if the components are interdependent. If the transaction is carried out within the confines of a company, this gives the actors involved incentives to carry out more efficient processing. At the same time, this reduces the likelihood of possible opportunistic behavior on the part of the actors, since the employees are subject to the same authority within the same corporate boundaries and contractual agreements are easier to enforce and violations of these are easier to punish. Discrepancies between those involved can also be resolved more efficiently using the authority that exists within a company. In the case of modular products, the possibility of opportunistic behavior on the part of the suppliers decreases, since these can be exchanged more easily by the manufacturing company. This reduces the manufacturers' susceptibility to delays caused by their suppliers.

- Internationalization strategies of multinational companies : Here, the institutional design of international strategic alliances , such as joint ventures, was examined .

- Design of employment relationships: What is meant here are studies of employment contracts, rights of co-determination and protection against dismissal from the perspective of transaction cost theory.

Social control mechanisms

Based on the original assumption of opportunism as the “worst case”, the existing social control mechanisms in the institutional arrangement (market) are significant for the development of the theory for the development of transaction costs. A distinction is made between the following.

trust

- Efficiency-increasing means

- Lower control costs

- Shortening the negotiation time

- Trust as an understanding of risk

Both opportunities and dangers of cooperation arise in the scope. A fair amount of leeway is an essential condition of cooperation.

→ Trust is not an issue in the TKA! Opportunism is the assumption of behavior.

Culture

Similarities in preferences , values, goals and competencies minimize coordination costs. This facilitates mutual coordination and learning. The efficiency aspects dominate. In the case of longer-term relationships, however, very uniform cultures can lead to higher transaction-specific investments that increase dependencies and allow the weaker to be exploited and to behave opportunistically. This creates coordination costs that undermine the efficiency benefits.

reputation

Reputation can be interpreted as specific capital that needs to be defended the more opportunities there are for opportunism . Good reputation reduces the incentive to behave opportunistically. This reduces information and negotiation costs as well as search costs.

history

The starting point of the transaction cost theory is the work The Nature of the Firm by Ronald Coase , published in 1937 , who received the Alfred Nobel Memorial Prize for Economics in 1991 . In this essay, Coase asks why there are companies that have no place in the theory of perfect markets that had prevailed until then. Coase concluded that the Invisible Hand postulated by Adam Smith , which regulates market events, may be invisible, but not free of charge. He does not yet use the term transaction costs, but speaks (literally translated) of costs for using the price mechanism (i.e. the market). Williamson later linked this conception by Coase with the concept of transaction costs by Arrow (1969).

Another important theoretical work was presented by Kenneth Arrow , who dealt with transactions and transaction costs. At the beginning of the 1970s, institutional economics was interpreted as a transaction cost approach. Finally, in 1985 Oliver Williamson published The Economic Institutions of Capitalism: Firms, Markets, Relational Contracting, a treatise that constituted a comprehensive and detailed description of the theory of transaction costs.

The transaction cost approach has also been applied to political science , whereby the goods exchanged are not so clearly definable. When politicians exchange votes for election promises, transaction costs such as information costs arise .

criticism

Positive :

- Transaction cost theory helps to explain why organizations exist at all and illustrates why it is better in certain situations to process and organize certain types of transactions in certain institutional arrangements.

- It also offers an analysis of the forms of organization that exist between companies. In empirical studies, the theses of the transaction cost theory have largely proven themselves (Shelanski / Klein 1995).

Negative :

- The theory makes few statements about relevant external influencing factors, such as the distribution of power between the two transaction partners. Nor does it establish a connection between transactions.

- The description of the institutional arrangements is a very simple concept and can only distinguish a few alternatives .

- The assumption of opportunism is questionable because transactions and the transaction partners are embedded in social relationships and such relationship dimensions are neglected in theory .

Conclusion

The transaction cost theory, together with the knowledge-based company view, enables the explanation of the interaction between companies , the market and cooperation between companies. It gives advice on the choice of organizational form and form of cooperation for companies. However, transaction costs are often difficult to operationalize.

literature

- AA Alchian, S. Woodward: Review: The Firm Is Dead; Long Live The Firm a Review of Oliver E. Williamson's The Economic Institutions of Capitalism. In: Journal of Economic Literature. Vol. 26, No. 1, 1988, pp. 65-79.

- M. Blocher: Marketization - an arrangement to determine the optimum depth of service for public in-house operations? An evaluation from the perspectives of transaction cost theory, new public management and governance. In: Kai Birkholz, Christian Maaß, Patrick Maravic, Patricia Siebart (Eds.): Public Management - A New Generation in Science and Practice: Festschrift for Christoph Reichard. Universitätsverlag, Potsdam 2006., ISBN 978-3-939469-09-4 . ( opus.kobv.de; PDF; 244 kB)

- E. Bössmann: Why are there companies? The explanatory approach of Ronald H. Coase. In: Journal for the whole political science. 1981, pp. 667-674.

- Ronald Coase: The Nature of the Firm. In: Economica. 4, 16, 1937, pp. 386-405. (PDF) ( Memento from June 25, 2008 in the Internet Archive )

- Carl-Thomas Fritz: The transaction cost theory and its criticism as well as its relation to the sociological neo-institutionalism. Peter Lang, Frankfurt am Main 2005, ISBN 3-631-54370-0 .

- S. Ghoshal, P. Moran: Bad for Practice: A Critique of the Transaction Cost Theory. In: Academy of Management Review. Vol. 21, No. 1, 1996, pp. 13-47.

- E. Göbel: New Institutional Economics: Concept and Business Applications. Stuttgart 2002.

- Rudolf Richter, Eric G. Furubotn: New Institutional Economics: An Introduction and Critical Appreciation. 3. Edition. Mohr-Siebeck, Tübingen 2003, ISBN 3-16-148060-0 .

- Joachim Rotering: Inter-company cooperation as an alternative form of organization: an explanatory approach based on transaction costs . Schäffer-Poeschel, Stuttgart 1993, ISBN 3-7910-0690-8 .

- J. Schumann, U. Meyer, W. Ströbele: Basics of the microeconomic theory. 8th edition. Berlin u. a. 2007.

- Stefan Voigt: Institutional Economics. UTB, Munich 2002, ISBN 3-8252-2339-6 .

- Oliver E. Williamson: Markets and hierarchies: analysis and antitrust implications: a study in the economics of internal organization. The Free Press, New York 1975, ISBN 0-02-935360-2 .

- Oliver E. Williamson: The economic institutions of capitalism: firms, markets, relational contracting. The Free Press, New York 1985, ISBN 0-684-86374-X . (German translation: Oliver E. Williamson: The economic institutions of capitalism: companies, markets, cooperations. Mohr, Tübingen 1990, ISBN 3-16-345433-X ).

- Oliver E. Williamson: The Mechanisms of Governance. New York et al. a. 1996.

- Oliver E. Williamson: Transaction Cost Economics: How It Works; Where It is Headed. In: De Economist. Vol. 146, No. 1, 1998, pp. 23-58.

- Oliver E. Williamson, The Theory of the Firm as Governance Structure: From Choice to Contract. In: Journal of Economic Perspectives. Vol. 16, No. 3, 2002, pp. 171-195.

Web links

Individual evidence

- ↑ M. Ebers, W. Gotsch: Institutional economic theories of organization. In: A. Kieser (Ed.): Organization theories. 3rd, revised. Edition. Kohlhammer, Stuttgart 1995, ISBN 3-17-013777-8 , p. 225.

- ↑ a b Oliver E. Williamson: Strategy Research: Governance and Competence Perspectives . In: Strategic Management Journal . tape 20 , no. 12 , 1999, p. 1087-1108 .

- ^ A b c d e Arnold Picot: Transaction cost approach in organizational theory. Status of the discussion and informative value . In: Business Administration . No. 42 , 1982, pp. 267-284 .

- ^ A b Oliver E. Williamson: Comparative Economic Organization: The Analysis of Discrete Structural Alternatives . In: Administrative Science Quarterly . tape 36 , no. 2 , 1991, p. 269-296 , doi : 10.2307 / 2393356 .

- ↑ a b c Allan Afuah: Dynamic Boundaries of the Firm: Are Firms Better off Being Vertically Integrated in the Face of a Technological Change? In: The Academy of Management Journal . tape 44 , no. 6 , 2001, p. 1211-1228 .

- ↑ Oliver E. Williamson: Markets and Hierarchies: Some Elementary Considerations . In: The American Economic Review . tape 63 , no. 2 , 1973, p. 316-325 .

- ↑ See Olaf N. Rank: Formal and informal organizational structures - A network analysis of the strategic planning and decision-making process of multinational companies. (at Google Books) ; Secondary sources: Williamson (1991, pp. 277-281); Sydow (1992, p. 98); Thorelli (1986, p. 37); Tröndle (1987, pp. 24-25); Picot (1982); Stinchcombe (1985, pp. 121-127); Rath (1990, pp. 12-20). It should be noted here that not all authors speak of networks . For example, Tröndle and Rath use the more general term corporate cooperation, while Stinchcombe speaks of contracts.

- ↑ Glenn Hötker: Do Modular Products Lead to Modular Organizations? In: Strategic Management Journal . tape 27 , no. 6 , 2006, p. 501-518 , doi : 10.1002 / smj.528 .

- ^ KJ Arrow: The Organization of Economic Activity: Issues Pertinent to the Choice of Market versus Non-market Allocation. In: W. Patman, W. Proxmire (Eds.): The Analysis and Evolution of Public Expenditure: The PPB system. Vol. 1, US Joint Economic Committee, 91st Congress, 1st Session, United States Government Printing Office , Washington DC 1969 , Pp. 47-64.

- ↑ Kenneth Joseph Arrow: The limits of organization. Norton, New York 1974, ISBN 0-393-05507-8 . (German: Kenneth Joseph Arrow: Where organization ends: Management at the limits of what is possible. Gabler, Wiesbaden 1980, ISBN 3-409-96571-8 )