Causes of the Great Depression

The causes of the Great Depression, the worldwide economic downturn that began in the late 1920s and persisted through the end of World War II, have been examined from a number of different theoretical standpoints, during the Great Depression itself and in the subsequent generations. The economic events of the Great Depression are largely agreed upon and have remained essentially unchanged since study of the period began: a deflationary spiral forced dramatic falls in asset and commodity prices, dramatic drops in demand and access to credit, and disruption of trade. However, the cause(s) and relationship among them, as well as the role of government policy in causing or ameliorating the Depression, continue to be debated.

Theories about the causes are important for three reasons. First the event was so huge and affected so many people that understanding is imperative. Second, debates in the 21st century about the best course of action to follow often use Depression examples (especially as warnings that if we do XYZ then we will have another Great Depression.) Third, macroeconomic models have to be able to explain the event to maintain their credibility.

In general, theories about the causes of the Great Depression can be classified into three economic groups: orthodox/classical liberal, Keynesian, and neoclassical economics, which focus on the macroeconomic effects of money supply including production and consumption; Marxist economics, which argues that the root causes of the Depression are based in the fundamental production relationships of capitalism; and heterodox theories that argue the Great Depression was caused by particularly acute cyclical factors. Many of these economic theories guided governmental policy responses at the time of the Depression, with varying results.

Political ideology may also play a role in determining which theory an individual believes. While conservative economists tend to blame the New Deal for prolonging the depression, and liberal economists tend to praise or at least condone it, the range of policy responses across the industrialized world was so complex that clear attempts to blame some particular government have not shown themselves to be robust in the face of economic modeling.

Orthodox economics

Broadly speaking, there are those in mainstream economics who hold that deflation caused contraction, and those that hold that contraction caused deflation. In the debate of the recovery, there are those who hold that the recovery required stimulus—that is demand from the government, which finally arrived in the form of the Second World War, and those that hold that it was structural distortions in the economy, primarily caused by government, that held back the recovery.

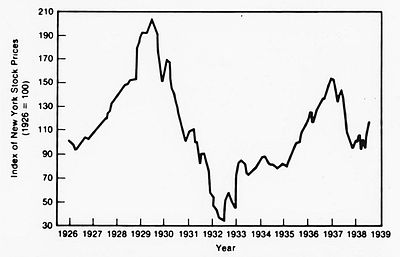

Stock Market Crash

Economists and historians debate how much responsibility to assign the Wall Street Crash of 1929. Most people at the time and since blame the stock market crash. The timing was right; the magnitude of the shock to expectations of future prosperity was high. Most analysts believe the market in 1928-29 was a "bubble" with prices far higher than justified by fundamentals. Economists agree that somehow it shared some blame--but how much no one has estimated. Milton Friedman concluded, "I don't doubt for a moment that the collapse of the stock market in 1929 played a role in the initial recession" [Parker p. 49] The debate has three sides: one group says the crash caused the depression by drastically lowering expectations about the future and by removing large sums of investment capital; a second group says the economy was slipping since summer 1929 and the crash ratified it; the third group says that in either scenario the crash could not have caused more than a recession. To move from a recession in 1930 to a deep depression in 1931-32 entirely different factors had to be in play. [White 1990].

Underconsumption and inequality

Two self-taught economists of the 1920s, Waddill Catchings and William Trufant Foster, popularized a theory that influenced many policy makers, including Herbert Hoover, Henry A. Wallace, Paul Douglas, and Marriner Eccles . It held the economy produced more than it consumed, because the consumers did not have enough income. Thus the unequal distribution of wealth throughout the 1920s caused the Great Depression. [Dorfman 1959] Roosevelt scrawled in his copy, "Too good to be true--you can't get something for nothing," but while he wanted to economize, most of his advisors bought the theory and wanted to spend.

According to this view, wages increased at a rate lower than productivity increases. Most of the benefit of the increased productivity went into profits, which went into the stock market bubble rather than into consumer purchases. Say's law no longer operated in this model (an idea picked up by Keynes).

As long as corporations had continued to expand their capital facilities (their factories, warehouses, heavy equipment, and other investments), the economy had flourished. Under pressure from the Coolidge administration and from business, the Federal Reserve Board kept the discount rate low, encouraging high--and excessive--investment. By the end of the 1920s, however, capital investments had created more plant space than could be profitably used, and factories were producing more than consumers could purchase.

According to this view, the root cause of the Great Depression was a global overinvestment in capacity compared to wages and earnings from independent businesses, such as farms. The solution was the government must pump money into consumers' pockets/ That is, it must redistribute purchasing power, maintain the industrial base, but reinflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending. The economy was overbuilt and new factories were not needed. Foster and Catchings recommended in The Road to Plenty (1928) that federal and state governments start large construction projects, a program followed by Hoover and Roosevelt.

The Federal Reserve and the money supply

Another theory of the Great Depression, forwarded most notably by economists Milton Friedman and Anna Schwartz, involves the quantity theory of money. According to this theory, most of the depression's severity was caused by poor decision-making at the Federal Reserve.

For the first four years of the Depression, the Federal Reserve Board contracted the money supply at a time when Friedman says they should have been expanding it. Friedman and Schwartz write: "From the cyclical peak in August 1929 to a cyclical trough in March 1933, the stock of money fell by over a third."

The result was what Friedman calls the "Great Contraction"— a period of falling income, prices, and employment caused by the choking effects of a restricted money supply. A corollary of this theory rejects the gold standard theory of the depression. It is a notable development because it implies that the depression's severity was caused by the Federal Reserve's mismanagement of the economy, not the absence of management. This theory is popular among the monetarist school of economics. Many give credence to Friedman's theory because the theory has robustly explained subsequent U.S. recessions and inflations.

The contraction in money supply is a factor in most theories of the Great Depression, and it is another way of saying that there was a tremendous fall in aggregate demand. From the perspective of monetarist explanations for the Depression, the depth of the financial collapse could have been averted by monetary policy, rather than requiring what eventually did happen, namely the use of regulations and fiscal policy to stabilize the economic activity in the U.S. and other nations. According to the monetarist formulation, the root cause of the global downturn was the failure to reestablish the gold standard at a level higher than the pre-war level, in order to account for inflation. This view was held by many observers at the time, even those who supported a return to the gold standard.

The debate over this theory centers on whether easing of monetary policy would have actually corrected structural imbalances in the economy, or whether it would have simply led to a secondary bubble which would have collapsed later, after increasing the U.S. deficit and depleting U.S. gold stocks. To monetarists, there were no structural imbalances to cure, the problem was strictly an ordinary downturn extended into a deeper one through poor monetary policy.

A lack of diversification

Another theory attributes the Depression to a serious lack of diversification in the American economy of the 1920s. Prosperity had been excessively dependent on a few basic industries, notably construction, automobiles and radio; in the late 1920s, those industries began to decline. Between 1926 and 1929, expenditures on construction fell from $11 billion to under $9 billion. Automobile sales began to decline somewhat later, but in the first nine months of 1929, they declined by more than one third. Once these two crucial industries began to weaken, there was not enough strength in the other sectors of the economy to take up the slack. Even while the automotive industry was thriving in the 1920s, some industries, agriculture in particular, were declining steadily. While the Ford Motor Company was reporting record assets, farm prices plummeted, and the price of food fell precipitously.

Postwar deflationary pressures

The Gold Standard theory of the Depression attributes it to postwar deflationary policies. During World War I many European nations abandoned the gold standard, forced by the enormous costs of the war. This resulted in inflation, because it was not matched with rationing and other forms of forced savings. The view of economic orthodoxy at the time was that the quantity of money determined inflation, and therefore, the cure to inflation was to reduce the amount of circulating medium. Because of the huge reparations that Germany had to pay France, Germany began a credit-fueled period of growth in order to export and sell enough abroad to gain gold to pay back reparations. The United States, as the world's gold sink, loaned money to Germany to industrialize, which was then the basis for Germany paying back France, and France paying back loans to the United Kingdom and United States. This arrangement was codified in the Dawes Plan.

This had a number of economic consequences in its own right. However, what is of particular relevance is that following the war, most nations returned to the gold standard at the pre-war gold price, in part, because those who had loaned in nominal amounts hoped to recover the same value in gold that they had lent, and in part because the prevailing opinion at the time was that deflation was not a danger, while inflation, particularly the hyperinflation experienced by Weimar Germany, was an unbearable danger. Monetary policy was in effect put into a deflationary setting that would over the next decade slowly grind away at the health of many European economies. While the Banking Act of 1925 created currency controls and exchange restrictions, it set the new price of the Pound Sterling at parity with the pre-war price. At the time, this was criticized by John Maynard Keynes and others, who argued that in so doing, they were forcing a revaluation of wages without any tendency to equilibrium. Keynes' criticism of Winston Churchill's form of the return to the gold standard implicitly compared it to the consequences of the Versailles Treaty.

Deflation's impact is particularly hard on sectors of the economy that are in debt or that regularly use loans to finance activity, such as agriculture. Deflation erodes the price of commodities while increasing the real value of debt.

The credit structure

Farmers, already deeply in debt, saw farm prices plummet in the late 1920s and their implicit real interest rates on loans skyrocket; their land was already mortgaged, and crop prices were too low to allow them to pay off what they owed. Small banks, especially those tied to the agricultural economy, were in constant crisis in the 1920s as their customers defaulted on loans due to the sudden rise in real interest rates; there was a steady stream of failures among these smaller banks throughout the decade.

Although most American bankers in this error were staunchly conservative, some of the nation's largest banks were failing to maintain adequate reserves and were investing recklessly in the stock market or making unwise loans. In other words, the banking system was not well prepared to absorb the shock of a major recession. The banking system as a whole, moreover, was only very loosely regulated by the Federal Reserve System at this time.

The breakdown of international trade

One theory posits that the Smoot-Hawley tariff's negative effects on agriculture were especially harmful because it caused farmers to default on their loans. This event may have worsened or even caused the ensuing bank runs in the Midwest and west that caused the collapse of the banking system.

Prior to the Great Depression, a petition signed by over 1,000 economists was presented to the U.S. government warning that the Hawley-Smoot Tariff Act would bring disastrous economic repercussions; however, this did not stop the act from being signed into law.

Beginning late in the 1920s, European demand for U.S. goods began to decline. That was partly because European industry and agriculture were becoming more productive, and partly because some European nations (most notably Weimar Germany) were suffering serious financial crises and could not afford to buy goods overseas. However, the central issue causing the destabilization of the European economy in the late 1920s was the international debt structure that had emerged in the aftermath of World War I.

When the war came to an end in 1918, all European nations that had been allied with the United States owed large sums of money to American banks, sums much too large to be repaid out of their shattered treasuries. This is one reason why the Allies had insisted (to the consternation of the perhaps historically vindicated Woodrow Wilson) on demanding reparation payments from Germany and Austria. Reparations, they believed, would provide them with a way to pay off their own debts. However, Germany and Austria were themselves in deep economic trouble after the war; they were no more able to pay the reparations than the Allies were able to pay their debts.

The debtor nations put strong pressure on the United States in the 1920s to forgive the debts, or at least reduce them. The American government refused. Instead, U.S. banks began making large loans to the nations of Europe. Thus, debts (and reparations) were being paid only by augmenting old debts and piling up new ones. In the late 1920s, and particularly after the American economy began to weaken after 1929, the European nations found it much more difficult to borrow money from the United States. At the same time, high U.S. tariffs were making it much more difficult for them to sell their goods in U.S. markets. Without any source of revenue from foreign exchange with which to repay their loans, they began to default.

The high tariff walls critically impeded the payment of war debts. As a result of high U.S. tariffs, only a sort of cycle kept the reparations and war-debt payments going. During the 1920s, the former allies paid the war-debt installments to the United States chiefly with funds obtained from German reparations payments, and Germany was able to make those payments only because of large private loans from the United States and Britain. Similarly, U.S. investments abroad provided the dollars, which alone made it possible for foreign nations to buy U.S. exports.

By 1931 the world was reeling from the worst depression of all time, and the entire structure of reparations and war debts collapsed.

In the scramble for liquidity that followed the 1929 stock market crash, funds flowed back from Europe to America, and Europe's fragile economies crumbled.

Cyclical theories

One entire family of theories of the Great Depression argues that the inherent cyclical nature of capitalist economics creates the potential for massive downturns if a series of cyclical factors align. First advanced by Joseph Schumpeter in the 1930s, cyclical theories can be divided into real interest credit cycles, some making use of Austrian economics, and exogenous cycles, which focus on the exogenous causes, or, to put it another way, the Great Depression was the result of self-fulfilling prophecies: namely a drop in confidence.

Long cycle theories

Schumpeter believed that there were three major cycles in economics, the long Kondratieff wave of fifty years duration, which represented major disruptive innovations, such as the introduction of telecommunications or internal combustion, the Juglar wave of roughly a decade duration that had to do with microeconomic allocation of resources geographically and consequently with population movements, and the Kitchin cycle, a short inventory cycle of overproduction, price reduction, retrenchment and expansion. According to Schumpeter the Great Depression was simply the point where these waves bottomed simultaneously, or nearly so, in the major world economies.

The theory rests on the demonstrability of stable wave patterns in economics, and on the relationship between these waves. Economic historians and economists such as Simon Kuznets have argued that there are stable waves of 15 to 20 years' length, which corresponded to periods of above trend line growth followed by periods of below trend line growth that culminated in a depression. This theory has termed the cause of the Great Depression as "secular stagnation", that is, a period of low entrepreneurial activity that was compounded by short-term business stagnation.

These theories tend to focus on one of two primary causes for secular stagnation. One is the demand side theories, which argue that population growth, tailed off after the population boom of the post-World War I period, which reduced the demand for consumer goods, and consequently the opportunities for business development. The other set of theories argues that there was a saturation of the consumer goods of the previous cycle, and that until a new wave of goods appeared there would be limited demand.

Both of these groups of theories have been criticized because while they may take into account the severity of the slide of the Depression, they do not explain the duration. Nor do they explain where there has been no depression of comparable magnitude since then.

It should be noted that these cyclical theories have analogs in many of the political theories of the time. For example, the "closing of the frontier" theory of the Depression—called the "frontier hypothesis," is closely related to the length of population movements. Demand shortage theories offer predictions similar to the population model. Finally, overproduction models are similar to cyclical theories that focus on capital concentration such as the work of Steindl.

Stiendl's work is particularly important because it had an influence on Keynesian theory, particularly in the problems created by price inflexibility, which in Keynsian analysis is called "price stickiness." The macroeconomic implication of this idea is that businesses will react to decreases in demand not by reducing prices, but by reducing output and keeping prices high, particularly in order to prevent the creation of deflationary expectations—that is a situation where consumers don't buy because they feel certain that prices will be lower later. Stiendl's formulation of the results of price inflexibility therefore resembles Keynesian predictions of a deflationary spiral—one argues that there is insufficient price reduction on the supply side, and the other insufficiency of aggregate demand. The difference being primarily the difference in the theory of money: for Steindl money is a commodity, where as in Keynsian theory Money, Interest and Labor make up a three-valued market.

"Sunspots"

One term among many for external factors being the primary cyclical causes of economic recessions is "sunspots." These differ from the supply and demand long cycle models in that they seek to model such non-price factors as "consumer confidence" and "expectations." In sunspot models, the collapse in production and demand in the Great Depression itself is a conventional macroeconomic event, but the slow recovery is explained by the shock to consumer confidence. These theories then invert the cause and effect of the typical Keynesian explanation: that is, rather than deflation causing a reduction in spending, which leads to retrenchment and lack of confidence of investment, first there is lack of confidence which becomes self-fulfilling when it produces a decline in aggregate demand.

One reason that such theories have had difficulty gaining attention is that they resemble many conservative theories of the Depression from the time period: that is a lack of business confidence created by budget deficits was the cause of the Depression. Since this theory, when applied at the time, worsened the economic crisis, and when applied later, slowed recovery, confidence models of the Great Depression tend to have to overcome a hurdle.

The difference between confidence models in the 1930s and the modern ones is that modern confidence models assert a closer microeconomic foundation for the relationship between confidence and macroeconomic variables that they propose as the causes of lack of confidence. In particular, they argue that, rather than interest rates driving business cycles, those interest rates are simply responding to self-fulfilling expectations of agents. And that rather than high real interest rates causing downturns, sunspot theories argue that a decline in credit demand leads to increased real interest rates, which in turn aggravates a reduction in confidence.

Ideological perspectives on the causes of the Great Depression

Socialist and communist perspectives

At the time of the Great Depression ideas abounded that the Great Depression was the result of systematic failure. Many in the U.S. believed that it represented, alternately, the result of too much government interference in the economy, or conversely the failure of the "cut throat capitalist system based on the profit motive," as Commerce Secretary Henry Wallace described it. Many Marxist and socialist writers of that time thought the Great Depression was the predicted crisis of capitalism brought on by internal contradictions.

Many ideological theories drive other more mathematical theories of the Great Depression, and several observers have noted that the Great Depression tends to produce theories, which confirm the policy preferences of the researcher. The three broad categories of ideological theory can be described as internal critique of capitalism from within a liberal democratic framework, critiques of democracy from within a liberal capitalist framework, and critiques of capitalism from a Marxist framework.

For Communists in the 1930s and since then, the existence of the Soviet Union was taken as proof that "socialism" would eventually triumph, and the Great Depression was seen as the result of the failure of capitalist societies. Since the USSR hid the results of the famines taking place at the time, there was even credence to this view from the outside. Since the liberal democratic critique of the Great Depression included elements of over-concentration of wealth, there was a correspondence in the two theories. Hence, even some who were adamantly opposed to Bolshevism and Communism accepted that some form of public planning of consumption to prevent a general glut was essential.

Liberal perspectives

An influential book at the time was The Modern Corporation and Private Property by Berle and Means. In it, they argued that the managerial class had possession of the mechanisms of power to the exclusion of shareholders who were the real owners. They linked this criticism to the criticism of corporate capitalism that the population as a whole constituted the shareholders of the economy. They argued that this misallocation of power in the hands of those who had a chance to gain profit, but were not exposed to the full consequences of risk, was the root cause of the economic downturn. The critiques of the "profit motive" argued that in national emergencies it was iniquitous for some to be insulated from the general effects. They also argued that since profit was not connected to the general good, that pursuit of profit before all else would lead to general misery, as decisions were made based on temporary flows of money.

These critiques, rooted in populism and in the suspicion of large concentrations of wealth, as well as the deprivation of the Depression, were reflected in the drive for greater government regulation over the economy, a push for higher marginal tax rates, and in attempts for more "cooperative" economic organization. While often derided as wholly headed and anti-business, some of these formulations have found support in Game Theory, which shows how actors with dominant strategies can force sub-pareto optimal solutions on a larger system.

Under these ideas, there was a relaxation of the anti-trust laws of the time, and an introduction of price and production planning under the National Recovery Act. However, these failed to stem the tide of the Depression, and many of them were abandoned by the time of the "Second Hundred Days." What remained behind was an increasing attempt, rather than to regulate away competition, to ensure competition, and instead of trying to prop up prices by government means, to prop up demand by government spending.

Anarcho-capitalist perspectives

Another class of ideological theories holds the reverse—that rather than the Depression being the result of insufficient democracy and social accountability of corporations, that it was instead an interference in the capitalist market by government that was the cause of the Great Depression. Murray Rothbard is one such theorist.

These theories are often closely related to monetarist theories of the Great Depression, arguing that the existence of a central banking system in the major nations created a misallocation of supply and demand, and that attempts to interfere with the microeconomic allocation of goods by attempts at central planning turned the down turn into an unworkable and prolonged depression.

While often framed in moralizing terms attacking FDR and the liberal program of the time, these theories found support even in the Roosevelt administration. The belief within the administration was that the government had, indeed, "lived beyond its means" and that previous attempts at cooperation had lead to corporate collusion. The solution was to enforce greater competition in markets, which had had monopolies develop.

Political Perspectives on Causes and Cures

There are multiple competing interpretations about what caused the Great Depression. The debate is important because the public and policy makers ever since 1929 have demanded that such a disaster never again happen, so it is imperative to explain why. Economist have not agreed on what caused the depression or what prolonged it. The political interpretations especially important in the USA are as follows:

New Dealers: Business to Blame

Roosevelt and most of the New Dealers primarily blamed the excesses of big business for causing an unstable bubble-like economy. The problem was that business had too much power, and the New Deal intended to remedy that by empowering labor unions and farmers, and by raising taxes on corporate profits. Regulation of the economy was a favorite remedy. Some of the regulations, such as the Securities and Exchange Commission which regulates Wall Street, won widespread support and continue in 2006. Most of the other regulations were abolished or scaled back in a bipartisan wave of deregulation 1975-85.

Free Traders: Restrictions to Blame

Many economists at the time argued that the sharp decline in international trade caused the depression. They usually blame the Smoot-Hawley Tariff of 1930, which raised rates and caused other countries to retaliate. The British Empire promoted trade inside the Empire (and not with the U.S.A.) Germany promoted economic autarky in which countries received benefits (or threats) for trading with Germany. The remedy, pushed strongly by Secretary of State Cordell Hull was lower trade barriers. This approach led to the Bretton Woods agreement and postware trade programs especially General Agreement on Tariffs and Trade.

The Left: Capitalism to blame

The far left, socialists and communists, said the final collapse of capitalism is at hand. Their remedy was to build up their movements to take over the labor unions, and perhaps eventually the government. The New Deal did change the laws to help unions grow--but they split into warring AFL and CIO factions and neutralized much of their potential political influence. Unions grew even faster during the war.

Keynesianism: the people to blame

The British economist John Maynard Keynes coined the term "the paradox of thrift" to describe the deepening of the Great Depression after 1929. The paradox of thrift indicates that when people decide to save more this may end up causing people to save less. The increased savings (reduced spending) due to the panic following the stock market crash of 1929 left markets saturated, contributing to price deflation, perpetuating the Great Depression. When people decided to save more (spend less) businesses responded by cutting back on production and laying off workers. Businesses, cutting back on investment spending because they were pessimistic about the future as well, were also doing their share of causing a reduction in aggregate expenditures, reducing their investments, setting in motion a dangerous cycle: less investment, fewer jobs, less consumption and even less reason for business to invest. The lower aggregate expenditures in the economy contributed to a multiple decline in income well below full employment. The economy may reach perfect balance, but at a cost of high unemployment and social misery. At the lower income levels during the Great Depression savings was much lower than before-- hence, the paradox of thrift. As a result, a few young Keynesian economists were increasingly calling for government to take up the slack. This Keynesian approach indeed justifies some spending programs, and therefore was popular with politicians who wanted to spend money anyway.

Monetarism: Federal Reserve to Blame

Milton Friedman and Chairman of the Federal Reserve Ben Bernanke, the economists who have paid most attention to the history of the 1930s, stress the negative role of the Federal Reserve System. It cut the money supply by one-third from 1929 to 1932. There was much less money to go around, businessmen could not get new loans--and could not even get their old loans renewed. They had to stop investing. Not because they did not want to (as the Keynesian model said), but because banks could not lend them the money they needed. This interpretation blames the government and calls for a much more careful Federal Reserve policy.

The New Deal and Keynesian economics

In the early 1930s, before John Maynard Keynes wrote The General Theory, he was advocating public works programs and deficits as a way to get the British economy out of the Depression. Although Keynes never mentions fiscal policy in The General Theory, and instead advocates the need to socialize investments, Keynes ushered in more of a theoretical revolution than a policy one. Keynes's basic idea was simple. In order to keep people fully employed, governments have to run deficits when the economy is slowing because the private sector won't invest enough. Many politicians, however, failed to understand his idea.

As the Depression wore on, Franklin D. Roosevelt tried public works, farm subsidies and other devices to restart the economy, but he never completely gave up trying to balance the budget. As a result, unemployment remained high throughout the New Deal years; consumption, investment, and net exports-- the pillars of economic growth-- remained low. With fiscal policy, however, government could provide the needed increased spending by decreasing taxes, increasing government spending, increasing individuals' incomes. As individuals incomes would increase, they would spend more. As they spent more, the multiplier process would take over and expand the effect on the initial spending. Expansionary fiscal policy thus involves decreasing taxes or increasing government spending to counteract cyclical unemployment and slow growth during a recession.

It was World War II, not the New Deal, that finally ended the crisis. Nor did the New Deal substantially alter the distribution of power within American capitalism; and it had only a small impact on the distribution of wealth among the American people. A study by Harold L. Cole and Lee E. Ohanian concludes that the "New Deal labor and industrial policies did not lift the economy out of the Depression as President Roosevelt and his economic planners had hoped," but that the "New Deal policies are an important contributing factor to the persistence of the Great Depression." They conclude that the New Deal "cartelization policies are a key factor behind the weak recovery." The say that the "abandonment of these policies coincided with the strong economic recovery of the 1940s."[1] Lowell E. Gallaway, Richard K. Vedder conclude that the "Great Depression was very significantly prolonged in both its duration and its magnitude by the impact of New Deal programs." They argue that without Social Security and unemployment insurance, and especially without the labor unions, business would have hired more workers and the unemployment rate during the New Deal years would have been 6.7% instead of 17.2 percent.[2]

Keynes's visit to the White House in 1934 to urge President Roosevelt to do more deficit spending was a debacle. A dazed, overwhelmed Roosevelt complained to Labor Secretary Frances Perkins, "He left a whole rigmarole of figures-- he must be a mathematician rather than a political economist." Keynes, equally frustrated with the encounter, later told Secretary Perkins that he had "supposed the President was more literate, economically speaking."

The recession of 1937 and recovery

The Roosevelt administration was under assault during FDR's second term, which presided over a new dip in the Great Depression in the fall of 1937 that continued through most of 1938. Production declined sharply, as did profits and employment. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. It was, in the largest measure, a result of a premature effort by the administration to balance the budget by reducing federal spending.

The administration reacted by launching a rhetorical campaign against monopoly power, which was cast as the cause of the new dip. The president appointed an aggressive new direction of the antitrust division of the Justice Department, but this effort lost its effectiveness once World War II, a far more pressing concern, began.

But the administration's other response to the 1937 deepening of the Great Depression had more tangible results. Ignoring the vitriolic pleas of the Treasury Department and responding to the urgings of the converts to Keynesian economics and others in his administration, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power. The New Deal had in fact engaged in deficit spending since 1933, but it was apologetic about it, because a rise in the national debt was opposite of what the Democratic party had always preached. Now they had a theory to justify what they were doing. Roosevelt explained his program in a fireside chat in which he finally acknowledged that it was therefore up to the government to "create an economic upturn" by making "additions to the purchasing power of the nation." Business-oriented observers explained the recession and recovery in very different terms from the Keynesians. They argued that the New Deal had been very hostile to business expansion in 1935-37, had encouraged massive strikes which had a negative impact on major industries such as automobiles, and had threatened massive anti-trust legal attacks on big corporations. All those threats diminished sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than corporations, and tax policy became more favorable to long-term growth.

Works cited

- ^ Cole, Harold L and Ohanian, Lee E. New Deal Policies and the Persistence of the Great Depression: A General Equilibrium Analysis, 2004.

- ^ Gallaway, Lowell E. and Vedder, Richard K. Out of Work: Unemployment and Government in Twentieth-Century America, New York University Press; Updated edition (July 1997).

References

Bibliography: World

- Ambrosius, G. and W. Hibbard, A Social and Economic History of Twentieth-Century Europe (1989)

- Bordo, Michael, and Anna J. Schwartz, eds. A Retrospective on the Classical Gold Standard, 1821–1931 (1984) (National Bureau of Economic Research Conference Report)

- Bordo, Michael et al eds. The Gold Standard and Related Regimes : Collected Essays (1999)

- Brown, Ian. The Economies of Africa and Asia in the inter-war depression (1989)

- Davis, Joseph S., The World Between the Wars, 1919-39: An Economist's View (1974)

- Eichengreen, Barry. Golden Fetters: The Gold Standard and the Great Depression, 1919–1939 (NBER Series on Long-Term Factors in Economic Development), 1996, ISBN 0195101138

- Eichengreen, Barry, and Marc Flandreau, eds. The Gold Standard in Theory and History (1997)

- Feinstein. Charles H. The European economy between the wars (1997)

- Garraty, John A., The Great Depression: An Inquiry into the causes, course, and Consquences of the Worldwide Depression of the Nineteen-Thirties, as Seen by Contemporaries and in Light of History (1986)

- Garraty John A. Unemployment in History. (1978)

- Garside, William R. Capitalism in crisis: international responses to the Great Depression (1993)

- Haberler, Gottfried. The world economy, money, and the great depression 1919-1939 (1976)

- Kaiser, David E. Economic diplomacy and the origins of the Second World War: Germany, Britain, France and Eastern Europe, 1930-1939 (1980)

- Kindleberger, Charles P. The World in Depression, 1929-1939 (1983);

- Tipton, F. and R. Aldrich, An Economic and Social History of Europe, 1890–1939 (1987)

Bibliography: USA

- Bernstein, Michael A. The Great Depression: Delayed Recovery and Economic Change in America, 1929-1939 (1989) focus on low-growth and high-growth industries

- Bordo, Michael D., Claudia Goldin, and Eugene N. White , eds., The Defining Moment: The Great Depression and the American Economy in the Twentieth Century(1998). Advanced economic history.

- Chandler, Lester. America's Greatest Depression (1970). economic history overview.

- Dorfman, Joseph. Economic Mind in American Civilization (1959) vol 4 and 5 cover the ideas of all American economists of 1918-1933.

- Friedman, Milton, and Anna J. Schwartz, A Monetary History of the United States, 1867-1960 (1963)

- Jensen, Richard J. "The Causes and Cures of Unemployment in the Great Depression," Journal of Interdisciplinary History 19 (1989) 553-83. online at JSTOR in most academic libraries

- McElvaine Robert S. The Great Depression 2nd ed (1993) social history

- Mitchell, Broadus. Depression Decade: From New Era through New Deal, 1929-1941 (1964), standard economic history overview.

- Parker, Randall E. Reflections on the Great Depression (2002) interviews with 11 leading economists

- Singleton, Jeff. The American Dole: Unemployment Relief and the Welfare State in the Great Depression (2000)

- Temin, Peter. Did monetary forces cause the great depression (1976) disputes friedman's monetary theory

- Warren, Harris Gaylord. Herbert Hoover and the Great Depression (1959).

- White, Eugene N. "The Stock Market Boom and Crash of 1929 Revisited" Journal of Economic Perspectives, Vol. 4, No. 2 (Spring, 1990), pp. 67-83; examines different theories

External links

- An Overview of the Great Depression from EH.NET by Randall Parker

- Great Myths of the Great Depression by Lawrence Reed