Federal Reserve System

| Headquarters |

Washington, DC , United States |

| founding | December 23, 1913 |

| president | Jerome Powell |

| country | The united states |

| currency | |

| ISO 4217 | USD |

| Base loan rate | 0-0.25% |

| Base investment rate | 0.75% |

| printer | Bureau of Engraving and Printing |

| Website | www.moneyfactory.gov |

| Mint (s) | United States Mint |

| Website | www.usmint.gov |

| Website | |

| predecessor |

Second Bank of the United States (until 1836) |

| List of central banks | |

The Federal Reserve System [ ˈfɛdə˞əl rɪˈzɜ˞ːv ˈsɪstəm ] ( German " Bundesreservesystem " ), often also the Federal Reserve ( German " Bundesreserve " ) or simply the Fed (as US central bank), is the central banking system of the United States . It essentially consists of three institutions: the Board of Governors , the twelve regional Federal Reserve banks and the Federal Open Market Committee (FOMC), as well as a large number of member banks (membership is mandatory from a certain size).

The US Federal Reserve sets the monetary policy of the United States of America, oversees and regulates banks, maintains the stability of the financial system and provides financial services to custodians, the US government and foreign institutions. The Fed regularly reports to the United States Congress on its monetary policy activities and plans . The day-to-day business and operational decisions of the Fed are determined independently. Congress can influence business laws.

history

predecessor

In 1790 the " First National Bank of the United States " was founded on the initiative of the then US Treasury Secretary Alexander Hamilton . The central bank was one of the reasons for the establishment of the first political parties in the United States. The federalists were in favor of a national bank , while Jefferson's Republicans were vehemently against it. The concession agreement of this first US central bank expired in 1811 during the tenure of Democratic Republican President James Madison and was not renewed.

Madison was forced by an uncontrollable inflation at the end of 1815 to work out a compromise with Congress to stabilize the currency, which led to the establishment of the Second Bank of the United States in 1816 . The “Second Bank” largely corresponded to the “First Bank” in terms of its task and structure. However, the renewal of the charter of the "Second Bank" was prevented by President Andrew Jackson's veto in 1832, and a slow process of dissolution began, which ended with the expiration of the charter in 1836.

In 1863 and 1864, based on the National Bank Acts, national banks were created, which were allowed to issue printed banknotes secured by the US Treasury. The main aim of these laws was to create a single currency and to solve the problem that banknotes from different member states were in circulation at the same time.

occurrence

At the end of the 19th century, the American economy experienced one of the worst financial crises, with bank failures and multiple fluctuations in the monetary system.

The proposal to establish a central bank based on the European model came from the banker Paul Moritz Warburg (1868–1932) from the Warburg banking dynasty of Hamburg . After arriving in New York in 1902, Paul M. Warburg was stunned by the primitive state of the American banking system. As a clear expert in the field of national central banks in Europe, Warburg criticized the lack of a US central bank and proposed the establishment of a private American central bank modeled on the German Reichsbank to take over monetary sovereignty from the state. In 1903 Warburg created a document entitled Plan for a Central Bank . Jakob "Jacob" Heinrich Schiff (1847–1920), Warburg's brother-in-law and senior partner at the leading Wall Street bank Kuhn, Loeb & Co. , took this expertise and presented it to his business partner James Jewett Stillmann, CEO of National City Bank (today Citibank ), the largest bank in the United States at the time.

A few days later, Warburg and Stillman met and a conflicted conversation ensued. Stillman warned Warburg not to show his expertise to anyone else, as the American people would strictly oppose a central bank where few can control everyone's deposits. The question of establishing a central bank was part of the ongoing internal American conflict between proponents of centralized power who wanted to expand the rights of the state as a whole ( federalism ) and those who wanted to leave the observance and preservation of the laws to the individual US states ( anti-federalists ). Warburg advised Stillman that if the financial markets panic, Stillman would regret the lack of a central bank, whereupon Stillman left the meeting with resentment.

After reading Warburg's plea for a US central bank, Jacob Schiff warned for years about the consequences of a financial crisis and, in a speech in early 1907, let the New York Chamber of Commerce know: “If we can't get a central bank with sufficient control over borrowing, then this country will experience the sharpest and deepest money panic in its history. ”In the autumn of the same year, a serious financial crisis, the panic of 1907 , actually occurred as a result of a temporary insolvency of the Knickerbocker Trust Company , then the third largest bank in New York . The crisis forced Stillman to resign from his position on the board of directors at the National City Bank and at the same time made Warburg and Schiff's call for the establishment of a US central bank fresh.

As a result of the financial crisis, after the economic crisis had ended, the US Congress decided to create the framework for a secure and more flexible banking system. Warburg was appointed as unofficial advisor to the newly formed National Monetary Commission , which worked out proposals for reforming the US banking system. The National Monetary Commission applied for the establishment of an institution that would direct the banks, control loan procurements and prevent or reduce financial and monetary crises. Paul M. Warburg published numerous newspaper articles and gave speeches on the need to establish a central bank. Another milestone in Paul M. Warburg's efforts was a 10-day meeting at the extremely elite Jekyll Island Club (owned by John D. Rockefeller and JP Morgan ) on Jekyll Island off the coast of Georgia in November 1910. Warburg met three others here US bankers (Frank Vanderlip, Henry P. Davison, Arthur Shelton), influential Senator Nelson W. Aldrich, and Andrew Piatt, a leading Harvard economist . The five other participants were initially skeptical of Warburg due to his status as a foreigner and Jew, but he was ultimately able to convince them with his brilliance. Over the next few days, a detailed and comprehensive plan for the establishment of a US central bank was worked out, which, as the Aldrich Plan, initially resulted in the establishment of the National Reserve Association . The secret of the participants and the purpose of the meeting on November 20-30, 1910 on Jekyll Island were closely guarded until the 1930s.

The Federal Reserve System was created by the United States Congress to establish a "central banking system designed to add both flexibility and strength to the national financial system." The federal law was passed by Congress on September 18, 1913, with 287 votes to 85; the Senate also approved after several hearings on December 19, 1913 with 54 votes to 34. Differences between the agreed versions were revised by a joint commission; the revision was approved by Congress on December 22, 1913 by 298 votes to 60 and by the Senate the following day by 43 votes to 25, and was enacted as the Federal Reserve Act on December 23, 1913 by President Woodrow Wilson . The law provided for a system of several regional banks and a seven-member board of directors. Banks operating at the national level had to join the Federal Reserve System, other banks were free to participate. The member banks receive a fixed dividend of 6% for their shares, but do not participate in the profits that go to the Treasury .

Founded in 1913

After Woodrow Wilson's election as US president, the result of the efforts of the central bank advocates was the Federal Reserve Act of December 23, 1913, which sealed the founding of the US central bank FED that same day. The Federal Reserve Act was preceded by a congressional investigation by Samuel Untermyer , the Pujo Money Trust Investigation . Untermyer, as a lawyer, partner in the law firm Guggenheimer, Untermyer & Marshall, also assisted in drafting the law. The Federal Reserve Act enables the Federal Reserve to this day to create money with no intrinsic value as credit money and, for example, to lend it to the American government against interest (→ fractional-reserve banking ). As a recently naturalized German Jew, Paul M. Warburg declined the offer to chair the Central Bank. Instead, Warburg became a member of the first supervisory board in the history of the Fed. During the First World War, Warburg was appointed Vice Chairman of the Federal Reserve Board of Directors on August 10, 1916. He fulfilled this function until August 9, 1918. As a member of the Federal Advisory Council , Warburg remained connected to the US central bank between 1921 and 1926.

Further developments

Banking Act 1933

Since the beginning of the Great Depression in autumn 1929, there has been criticism of the Federal Reserve System and of the economic policy of the then President, Republican Herbert Hoover . It was also a campaign theme in 1932 and helped Roosevelt win the presidential election in late 1932 .

Originally, the heads of the regional banks were empowered to make decisions about the Fed's policy without taking into account the decisions of the Board of Governors, which could lead to conflict between the two parties. Roosevelt appointed Marriner S. Eccles ; he helped draft the Emergency Banking Act of 1933, the Banking Act of 1933 and the Federal Housing Act of 1934.

In view of the economic situation ( Great Depression ), the Fed changed its monetary policy. Eccles drafted the Eccles Bill , which, as the Banking Act of 1935, restructured the Federal Reserve System (see next section). Eccles was named chairman of the Federal Reserve System's board of governors; he held this office until January 31, 1948.

The original Federal Reserve Act has been expanded or reformed several times over the years (particularly in 1978 and 1981) to allow the Fed more flexibility and functionality.

Banking Act 1935

The Banking Act of 1935 gave the Board of Governors greater scrutiny. It was passed by Congress on March 9, 1935 under the Emergency Banking Act. The law included the following:

- The Federal Reserve banks were given the authority to regulate the amount of loans approved for securities by member banks.

- Requested the board of directors to oversee the Federal Reserve banks' overseas relations.

- Liberalized the regulations for member banks (association banks) to set up branch offices, primarily by eliminating or reducing previously defined geographical borders.

- Banned the association banks from trading in securities and demanded separation from association companies that dealt with the same.

- Member banks were not allowed to pay interest on sight deposits.

- Requested the Federal Reserve banks to raise funds equal to half of their reserves for the Federal Deposit Insurance Corporation.

- The Board of Directors was empowered to regulate the interest rate on time deposits and savings deposits in member banks.

- Provided a backup for bank balances of $ 2500 or more for a specified time.

The Fed also played an important role during World War II. The Fed's policy during wartime was twofold:

- To keep interest rates low in favor of corporations and governments to finance war debt.

- Stabilization of the monetary system due to seasonal fluctuations in deposits or unexpected payouts, also to increase security in banking.

Federal Reserve Act 1977 and Humphrey-Hawkins Act 1978

The link between the Fed and the US Congress was relatively weak until the mid-1970s. This changed with the Federal Reserve Reform Act of 1977 and the Humphrey – Hawkins Full Employment Act ( signed or enacted by then US President Jimmy Carter in October). The independence of the Fed was restricted by these two laws; it was henceforth obliged to submit a binding report twice a year on its plans regarding the size of various monetary aggregates.

Federal Banking Agency Audit Act 1978

The Fed was not subject to external auditing by the United States Government Accountability Office (GAO) until 1978 . Until then, only the Fed's activities in the context of the state's funding were examined. Since 1978 (Federal Banking Agency Audit Act) the GAO has been allowed to audit everything with the following exceptions:

- Transactions for and with foreign central banks, governments or non-private international financial organizations

- Regulations, decisions and actions of monetary policy, including interest rates, minimum reserves and open market operations

- Open Market Committee transactions

- Discussions and communication between the members of the Central Bank Council and Fed staff on items 1 to 3

Monetary Control Act 1980

The Monetary Control Act , which came into effect in June 1981, gave the Federal Reserve Banks, among other things, the authority to acquire not only US government debt, but also government debt of other countries.

organization

Building the Federal Reserve System

The Federal Reserve System consists of the following five components:

- Board of Governors

- 7 members, which serve 14 years to be nominated by the President and Senate appointed

- Federal Open Market Committee (FOMC)

- consists of the 7 members of the Board of Governors and the Presidents of the Reserve Banks

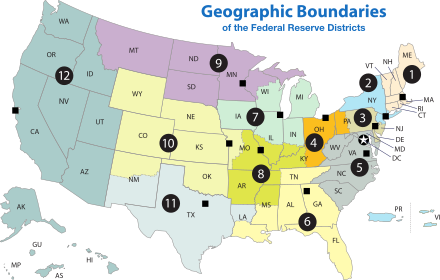

- Federal Reserve Banks (District Central Banks)

- 12 regional Federal Reserve banks with 25 branches

- affiliated commercial banks (member banks)

- various advisory councils

- are subordinate to the Board of Governors and make recommendations to it

The Federal Reserve System consists of twelve banking districts, each with a Federal Reserve Bank. The regional Fed banks do not finance themselves directly from taxpayers' money, but mainly from interest income on the government bonds they hold and from loans to commercial banks. Each of these banks are financed from the financial capital of their private member banks. However, these are not shares that are traded on the market; rather, banks in the USA above a certain size are legally obliged to be members of the Federal Reserve System. The largest is the Federal Reserve Bank of New York in New York City , which is also the only one of them to conduct business abroad.

| Banking districts | Federal Reserve Banks | Branches | Websites | President |

|---|---|---|---|---|

| 1 | Boston | http://www.bos.frb.org/ | Eric S. Rosengren | |

| 2 | New York City | http://www.newyorkfed.org/ | John C. Williams | |

| 3 | Philadelphia | http://www.philadelphiafed.org/ | Patrick T. Harker | |

| 4th | Cleveland | Cincinnati, Ohio Pittsburgh, Pennsylvania |

http://www.clevelandfed.org/ | Loretta J. Mester |

| 5 | Richmond | Baltimore, Maryland Charlotte, North Carolina |

http://www.richmondfed.org/ | Thomas Barkin |

| 6th | Atlanta | Birmingham, Alabama Jacksonville, Florida Miami, Florida Nashville, Tennessee New Orleans, Louisiana |

http://www.frbatlanta.org/ | Raphael Bostic |

| 7th | Chicago | Detroit, Michigan Des Moines, Iowa |

http://www.chicagofed.org/ | Charles L. Evans |

| 8th | St Louis | Little Rock, Arkansas Louisville, Kentucky Memphis, Tennessee |

http://www.stlouisfed.org/ | James B. Bullard |

| 9 | Minneapolis | Helena, Montana | https://www.minneapolisfed.org/ | Neel Kashkari |

| 10 | Kansas City | Denver, Colorado Oklahoma City, Oklahoma Omaha, Nebraska |

http://www.kansascityfed.org/ | Esther George |

| 11 | Dallas | El Paso, Texas Houston, Texas San Antonio, Texas |

http://www.dallasfed.org/ | Robert Steven Kaplan |

| 12 | San Francisco | Los Angeles, California Portland, Oregon Salt Lake City, Utah Seattle, Washington |

http://www.frbsf.org/ | Mary C. Daly |

Bodies of the Federal Reserve System

The Federal Open Market Committee (FOMC to German "FOMC") operates the monetary and currency policies of the United States; he is considered the most important body of the Fed. Its chairman was Paul Volcker from August 1979 to August 1987 , Alan Greenspan from August 11, 1987 to January 31, 2006 , Ben Bernanke from February 1, 2006 to January 31, 2014, and Janet Yellen on February 1, 2014 . The board of directors of the Fed is the Board of Governors of the Federal Reserve System in Washington, DC. It consists of seven members appointed by the President of the United States and elected for 14 years with the approval of the Senate . The members of the Board of Management cannot be re-elected immediately after their term of office. The board consists of (as of June 13, 2019):

- Jerome Powell , President (since 2018)

- Richard Clarida , Vice President

- Randal Quarles

- Michelle Bowman

- Lael Brainard

- unoccupied

- unoccupied

The task of the board is to implement the decisions made by the Federal Open Market Committee ( FOMC ). In addition to its economic policy powers, the council also appoints three directors for each of the twelve Federal Reserve Banks. The remaining six directors of each Federal Reserve Bank are appointed by the member banks.

The Federal Open Market Committee ( FOMC ) is the Fed's most important body in terms of economic policy . a. in the implementation of open market operations . The FOMC decides whether to change the US prime rate (the target rate of the federal funds rate ). In addition, the committee can also decide to intervene in the foreign exchange market and thus influence the exchange rate of the US dollar to other currencies. Therefore, meetings of the FOMC and statements by its members from the financial markets are objects of public interest.

The FOMC consists of twelve members: the President of the Federal Reserve Bank of New York, the seven members of the Board of Governors, and four members who are elected annually from the twelve chairmen of the regional Federal Reserve Banks. For this purpose, eleven of the twelve banks are grouped into four geographical groups, each with one member of the FOMC. Within the groups, there is a rotation between the individual Federal Reserve Banks. For historical reasons, the Federal Reserve Bank of New York does not participate in this rotation process - it has permanent voting rights in the FOMC. In addition, the individual Reserve Bank Presidents take part in the meetings, but are not entitled to vote. The committee meets eight times a year.

The Federal Reserve Police report to the board .

State institution with private shareholders

and phases of economic recession in the US (gray bars)

The Federal Reserve System is a state body, although it has private shareholders. It was founded by federal law, changes to its structure and tasks are therefore only possible by the legislature. It is true that the twelve regional Federal Reserve Banks are organized as public companies, the shareholders of which are the private banks operating in their districts. However, in the case of the Federal Reserve Banks, shareholder rights have little in common with those of private banks. The private banks are by law shareholders in the Federal Reserve Banks and have no free choice as to whether or how much to invest. Also, unlike stocks, the shares in the Federal Reserve Banks are not transferable. However, the shares of the private banks, which are shareholders of the twelve Federal Reserve Banks, are freely transferable under private law, depending on their legal form. The members of the bodies that decide on the monetary policy of the Fed are not elected by the shareholders, as would be done in a private corporation, but are politically appointed (nomination by the US President and confirmation by the Senate).

The Fed's distribution of profits also differs significantly from that of private corporations, with the private banks that hold shares in the Federal Reserve banks receiving a pre-determined dividend. Any remaining profit goes to the US federal budget. In relation, the dividends to the shareholders are negligible, so in 2011 the dividend payments to the private banks amounted to 1.6 billion dollars, the profit distribution to the federal budget amounted to 78.4 billion dollars.

In view of these differences from private stock corporations, the Federal Reserve System describes itself as an “ independent entity within the government ”. American federal courts have already ruled that the Federal Reserve banks are federal institutions (“federal instrumentalities”).

tasks and responsibilities

The main responsibilities of the Federal Reserve are:

- Maintaining a functioning payment system

- Monitoring the amount of money that is produced and destroyed on a daily basis (in collaboration with the United States Mint and the Bureau of Minting and Printing )

- Supervision and regulation of banking

- Implementation of monetary policy through open market operations, adjusting the discount rate and changing the minimum reserve

- Publication of the economic report “ Beige Book ”.

Monetary Policy Objectives and Instruments

| interest rate | height |

|---|---|

| European Central Bank (valid from: September 18, 2019) | |

| Deposit rate (deposit facility) | −0.50% |

| Base rate (main refinancing operations) | 0.00% |

| Marginal lending rate (marginal lending facility) | 0.25% |

| Swiss National Bank (valid from: June 13, 2019) | |

| SNB policy rate | −0.75% |

| Federal Reserve System (effective March 16, 2020) | |

| Federal funds rate target range | 0.0 to 0.25% |

| Primary Credit Rate | 0.25% |

| Bank of Japan (effective December 19, 2008) | |

| Discount rate (basic discount / loan rate) | 0.30% |

| Bank of England (effective March 19, 2020) | |

| Official Bank Rate | 0.1% |

| Chinese People's Bank (valid from: February 20, 2020) | |

| Discount rate (one-year lending rate) | 4.05% |

The objectives of the Fed's monetary policy are defined in the Federal Reserve Act :

- High employment

- moderate long-term rates

- Price level stability

Your monetary policy instruments are:

- Discount credit

- Reserve

- Open market operations

- Interest on prescribed reserve stocks and excess stocks

- Overnight Purchase Agreement Facility

- Deadline Security Facility

Economic criticism

The Federal Reserve System has been criticized from various quarters since it was founded in 1913. The Federal Reserve Act of 1913, which is still in force today , was only discussed across party lines after US President Woodrow Wilson put considerable political pressure on the congressmen to get approval. The earliest controversies over central banks in the United States have centered on their constitutionality, the private status of banks, and the extent to which the economy should be centrally directed. Some of the best known early critics of a central banking system were Thomas Jefferson , James Madison, and Andrew Jackson . The criticism is based primarily on the fact that the member banks and owners of the Federal Reserve Bank are private companies. To this day, critics such as the Republican Congressman Ron Paul criticize the fact that with the establishment of the Fed as the US central bank, the private sector influence of these member banks on the monetary and interest rate policy of the US is too great. Woodrow Wilson is said to have repeatedly called the law a mistake after his tenure.

The economists Milton Friedman and Anna J. Schwartz criticized for the first time: The Fed had intensified the recession of 1929 and thus triggered the Great Depression . After the stock market crash in 1929, the Fed did nothing to prevent the money supply from shrinking and refused to save banks from collapse. This mistake led to a comparatively mild recession ending in catastrophe. Friedman and Schwartz suspect that the Depression was "a tragic testimony to the importance of monetary forces".

Some economists, such as John B. Taylor, claim that the Fed was at least partially responsible for the 2007 financial crisis in the US: The Fed kept interest rates too low for too long after the 2001 recession. Supporters of the heterodox Austrian school start from their overinvestment theory and blame the deviation of the Fed's interest rate policy from “natural interest rates” for the 2007 financial crisis.

In November 2009, Senator Chris Dodd of the Democratic Party , then chairman of the US Senate Banking Committee , introduced a bill that would restrict the powers of the US Federal Reserve and create a new regulator for the banking sector. In Dodd's view, the Fed has "failed across the board" in overcoming the current financial crisis. Risky business of the banks, which led to the financial crisis, was not stopped by the Fed.

Conspiracy Theories and Coded Anti-Semitism

Above all, German - speaking anti - Semites since 1913 often pointed to the participation of individual Jews like Paul Warburg in the founding of the FED in order to assert or imply that the Fed and the Reichsbank , which it allegedly steered, were controlled by “financial Jewry”, for example the National Socialist Gottfried Feder (1926) and anti-Semitic leaflets of the Nazi regime in World War II .

The main representatives of the German vigil for peace in 2014 portrayed the Fed as the alleged main cause of past and current wars and crises. The vigil founder Lars Mährholz said at the Berlin vigil on April 7, 2014 that the Fed was behind all world wars and conflicts of the last 100 Years, and stressed that it was a private bank . This was criticized as an anti-Semitic code and a historical revisionist denial of German responsibility for the world wars. The cross front -Propagandist Jürgen Elsässer said on 21 April 2014 of the Berlin vigil:

“The crime has an address and a phone number. And you can certainly name a few names. Who is part of this financial oligarchy? Messrs Rockefeller , Rothschild , Soros , Khodorkovsky , the English and Saudi royal families . And why would it be anti-Semitism when you talk about how this tiny little layer of money aristocrats are using the Federal Reserve to throw the whole world into chaos? "

This highlighting of certain Jewish people as the alleged rulers of the global financial system is considered a variant of the conspiracy theory of world Jewry . Even if Jews are not mentioned, this form of criticism of the Fed is regarded as structural anti-Semitism , because it ascribes enormous global steering power and secret control over historical events to the small group of people in a single bank. Such abbreviated criticism of capitalism was common in anti-Semitism and National Socialism. They see anti-Semites as confirmation of their worldview, as the alleged masterminds can easily be linked to, identified or exchanged with Jews. By portraying Jews as the real perpetrators of Nazi rule and the Second World War, vigil speakers are reinterpreting German history and warding off guilt and responsibility for the Nazi era. According to political scientist Laura Luise Hammel, this amounts to a “strategy to relativize or even deny the Holocaust ”.

In the United States, G. Edward Griffin has been claiming since 1976 that a satanic Illuminati conspiracy , older than the world, was planning a New World Order . To do this, they instigated the French and Russian revolutions and also founded the Federal Reserve Bank. As evidence, Griffin extensively cites the Protocols of the Elders of Zion , an early 20th century anti-Semitic pamphlet purporting to prove a world Jewish conspiracy. Khalid Abdul Muhammad , a prominent spokesman for the Nation of Islam , an African American Muslim organization , said in a 1993 speech that the Federal Reserve was owned by Jews. Based on the conspiracy-theoretical book The Creature from Jekyll Island by the American author Griffin, various rumors are spread on the Internet that the participants outwitted the American Parliament in a “conspiratorial coup when the Fed was founded”.

literature

- Robert Latham Owen: The Federal Reserve Act. Century Co., New York 1919.

- Jerry Voorhis: Out Of Debt, Out Of Danger. Public Action Committee, 1943, renewed 1991 edition.

- Gertrude Coogan: Money Creators. Bound Money Press, Chicago 1935.

- J. Lawrence Broz: The International Origins of the Federal Reserve System , Cornell University Press, 1997, ISBN 0-8014-3332-0 , ISBN 978-0-8014-3332-0 .

- Carl H. Moore: The Federal Reserve System A History of the First 75 Years , ISBN 0-89950-503-1 .

- The Federal Reserve System: Purposes and Functions.

- Gabler Bank Lexicon, 10th edition.

- Edward Flaherty: A Brief History of Central Banking in the United States , University of Groningen, Netherlands.

- Eustace Mullins: The Secrets of the Federal Reserve , 1952. Reprinted in 1983, ISBN 0-9656492-1-0 .

- Roger Lowenstein: America's Bank: The Epic Struggle to Create the Federal Reserve . Penguin Press, New York City 2015, ISBN 978-1-101-61412-9

See also

Web links

- Official Fed website

- Euro system and Fed (English, PDF, 142 KiB)

- Interactions in the federal system of the Fed (English)

- on the objective of the Fed by Glenn T. Potts and Dudley G. Luckett (English)

- FAZ.net: Link list

- December 20, 2013: Too many mistakes in the first 100 years (Author: Allan Meltzer , * 1928)

- December 20, 2013: Bernanke's monetary policy voodoo (The Fed is moderately reducing its bond purchases by ten billion dollars a month. Is the biggest experiment in the Fed's hundred-year history now coming to an end?)

- Business journalist Ernst Wolff: The Wolff of Wall Street: Federal Reserve System, YouTube v. June 21, 2019

Individual evidence

- ↑ http://www.frbsf.org/publications/federalreserve/fedinbrief/organize.html

- ^ Gale Encyclopedia of US Economic History. Detroit: Gale, 2000.

- ^ Grossman, Richard S .: US Banking History, Civil War to WWII. ( Memento of the original from September 1, 2012 on WebCite ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Economic History Services. 2010.

- ^ Edward Flaherty: A Brief History of Central Banking in the United States . University of Groningen, Netherlands.

- ^ Richard W. Fischer, President and Chairman of the Board of Directors of the Federal Reserve Bank of Dallas A US Economic Update and Perspective on Monetary Policy. Speech to the Australian Business Economists on November 4, 2013

- ^ A b Federal Reserve Bank of St. Louis: Chapter Two - Banking Reform 1907–1913 Official History of the Fed of the Federal Reserve Bank of St. Louis

- ^ Gary Richardson, Jessie Romero: The Meeting at Jekyll Island. Federal Reserve Bank of Richmond / Official Journal of the Federal Reserve History

- ^ "[...] established a new central bank designed to add both flexibility and strength to the nation's financial system" , Federal Reserve Act of 1913

- ^ Johnson, Roger T .: historical beginnings ...: the federal reserve. (PDF; 12.9 MB) Federal Reserve Bank of Boston, February 2011, pp. 29–32 , accessed October 18, 2012 .

- ^ The Federal Reserve Act of 1913 - A Legislative History. Llsdc.org, accessed October 18, 2011 .

- ↑ Archive link ( Memento of the original from February 17, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Federal Reserver FAQ

- ↑ http://www.law.cornell.edu/uscode/12/usc_sec_12_00000290----000-.html United States Code 12/290 (English)

- ^ Roger Lowenstein: The US Federal Bank Reserve's Jewish Origins. Haaretz, November 30, 2015

- ^ Biography of Paul M. Warburg. Official Federal Reserve History Paul M. Warburg biography

- ^ [Carl H. Moore: The Federal Reserve System, A History of the First 75 Years, p. 87]

- ↑ The Federal Reserve Board: Selection and Function (pdf, 2 MB)

- ^ Composition of the Board of Governors. Retrieved September 5, 2013 .

- ↑ https://www.federalreserve.gov/newsevents/pressreleases/other20180205a.htm

- ↑ The FOMC: Selection and Function (pdf, 2 MB)

- ↑ a b http://www.federalreserve.gov/faqs/about_14986.htm

- ↑ http://www.federalreserve.gov/newsevents/press/other/20110110a.htm

- ^ Federal Reserve Bank of St Louis v Metrocentre Improvement District # 1, City of Little Rock, Arkansas. US Court of Appeals, 8th Circuit. August 11, 1981. 657 F2d 183

- ^ Johnson, Roger (December 1999) "Historical Beginnings ... The Federal Reserve," Federal Reserve Bank of Boston. Page 53, accessed on September 7, 2011 (PDF; 12.9 MB)

- ↑ WSJ.com:The Fed and the Crisis: A Reply to Ben Bernanke

- ^ O'Driscoll, Gerald P. Jr. (April 20, 2010). "An Economy of Liars". The Wall Street Journal. Retrieved June 23, 2010.

- ↑ Hannah Ahlheim: “Germans, don't buy from Jews!” Anti-Semitism and political boycott in Germany from 1924 to 1935. Wallstein, 2011, ISBN 3-8353-0883-1 , p. 81, fn. 109

- ↑ Klaus Kirchner (Ed.): Flyer propaganda in World War II Volume 19: Anti-Semitic leaflets from Germany 1939-1945. 2nd edition, D + C, Erlangen 2008, ISBN 3-921295-37-8 , p. 47.

- ↑ Erik Peter: New rights “peace movement”: In the fight against the media mafia. In: taz , April 18, 2014; Lucius Teidelbaum: The new Monday vigils: A cross front for peace? In: HaGalil , July 2, 2014.

- ↑ Laura Luise Hammel: Conspiracy, Populism and Protest. In: Politikum , Heft 3 (2017), p. 35.

- ↑ Michael Barkun : A Culture of Conspiracy. Apocalyptic Visions in Contemporary America. University of California Press, Berkeley 2013, p. 54 f.

- ^ Leonard P. Zakim: Confronting Antisemitism. A Practical Guide. KTAV Publishing House, Hoboken 2000, p. 20.

- ↑ The Federal Reserve System. Development history, principles, structure , elaboration of the Scientific Service of the German Bundestag (2008), p. 6.