Eurocheque

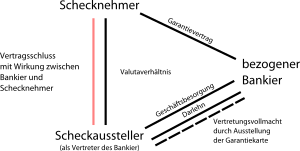

The Eurocheque (spelling: eurocheque ) was a cross-border guaranteed check of the European credit institutions , which was introduced in the 1960s and expired on January 1, 2002. The redemption of a Eurocheque was guaranteed by a guarantee contract between the check taker and the banker, which was concluded by the check taker and the check issuer, who identified himself as authorized by a special card ( Eurocheque card , EC card) .

In the course of time, the debit card function has been added to the EC card in order to be able to withdraw money at a bank or savings bank machine.

historical development

Background for card-guaranteed checks

Since the late 1950s and early 1960s, cashless wage , salary and pension payments have led to a surge in the number of private checking accounts . The check and statement could not satisfy the need to ensure better availability of the credit or a possibly granted overdraft loan.

The availability of the credit was mainly hindered by the fact that the creditor of the check issuer, who was supposed to accept the check to correct a liability on account of performance, could not be sure whether he was receiving the check from the issuer's banker due to the ban on accepting a check (check weakness) could also redeem. The solution for better availability was the check guarantee card (short: check card), which took into account the need for the banker drawn to guarantee that the claim was up to a certain maximum liability.

Due to the increase in tourism , the card-guaranteed check, initially only intended for domestic payment transactions, was no longer sufficient. A means of payment was required that could also be used abroad in the same way as at home.

Creation of the Eurocheque system

A single bank, a national bank group and even all banks and savings banks in a country were unable to cope with the implementation of a card-guaranteed check accepted throughout Europe. Hence, a network of bilateral arrangements for the mutual redemption of guaranteed checks began to overflow Europe. With an increase in such intergovernmental agreements, the cashing of checks by foreign check issuers would hardly have been manageable for the bank cashiers due to different redemption guidelines and would have been subject to considerable security risks.

In order to arrive at a better solution in the form of standardized processing, there was a conference on May 10, 1968 between financial institutions and their associations from 15 countries on the possibility of cross-border cooperation with card-guaranteed checks. The German banks and savings banks, encouraged by the successful creation of a joint bank-neutral check guarantee card, invited to this meeting in Frankfurt am Main . A fundamental agreement was reached, which laid the foundation for the Eurocheque system. The decisive factor, however, was the following conference, which took place in Paris on October 17 and 18, 1968 at the invitation of the French financial institutions . It was agreed on the Eurocheque logo, the names Eurocheque and Eurocheque card, the redemption conditions and the settlement.

Belgium , the Federal Republic of Germany , Denmark , Luxembourg , the Netherlands , Austria as well as Switzerland and Liechtenstein joined the procedure as "active states" and France as well as Monaco , Finland , Great Britain , Ireland , Italy as well as San Marino , Norway , Sweden and Spain as " Passive States ".

The active states brought their individual check card systems into the Eurocheque system. The respective checks from the active countries were provided with the Eurocheque logo. The checks were, as usual, the checks of the bank holding the account. So initially there were no standardized Eurocheque cards and no standardized Eurocheques.

Such checks could be cashed with check cards bearing the Eurocheque symbol at financial institutions in all participating countries (active and passive countries), whereby they were issued in the currency of the home country. The respective equivalent minus a commission was paid out in the local currency. Only in the country in which the Eurocheque card was issued and the Eurocheques were issued was it possible for Eurocheque cardholders to issue guaranteed checks to retail and service companies.

In the passive states that did not have a check card system or did not add them to the Eurocheque system until later, the financial institutions participated in the Eurocheque system by cashing checks in their branches. Their main motivation was to give tourism an additional boost through a convenient means of payment.

The guidelines for the Eurocheque system included the general conditions of redemption, which applied equally to all check guarantee cards, the special provisions for the individual check guarantee cards (in particular the respective maximum amount) as well as images of all check cards and checks.

The offsetting of mutual check costs was regulated bilaterally between the individual financial institutions in interbank transactions.

From May 1, 1969, checks were made out under the Eurocheque system. Around 175,000 paying agents were available from the start. In the following years, both the number of active and passive states increased to a total of 39. They were soon no longer limited to Europe, but also included countries in the Middle East and North Africa .

Uniform Eurocheque and uniform Eurocheque card

In 1972, a common check document and a uniform check guarantee card were introduced in the active states. The purpose of this standardization of documents was that the users would be just as familiar with them as the banknotes. The uniform Eurocheque also meant that the imprinted currency symbol was omitted, which was a prerequisite for cash payments in the local currency and cashless payment at retail and service companies. The non-banking sector was opened from 1975, although this development did not take place at the same speed in all countries. This has added the function of an international cashless payment method to the Eurocheque as an international cash withdrawal method.

As a result of issuing the Eurocheques in the respective local currency, the provisioning was also changed. If the bank receiving the check received the commission directly as a deduction from the payout amount when a check with the Eurocheque symbol was issued in its home currency, the check amount was paid out or used for payment without a commission being charged when a uniform Eurocheque was issued. The submitting bank received this as part of mutual cost allocation . The commission was only billed to the Eurocheque issuer when his current account was debited.

Due to the increasing cross-border use of the Eurocheque and the endeavor to rationalize the process of a payment with a Eurocheque, the mutual cost allocation of the banks was no longer carried out in interbank transactions, but via special Eurocheque clearing centers. Your activity consists of international clearing

- of uniform Eurocheques, which were issued in the currency of the respective country, and

- of uniform Eurocheques from the respective country, which were issued in different currencies abroad .

As a result of these measures, the number of active states was further increased, but it was not possible to involve all states in the issue of Eurocheque cards. Some states - such as France and Great Britain - were de jure active states , but only a few Eurocheque cards were issued. Other states in turn remained exclusively passive states.

functionality

The guarantee card for the Eurocheque bridged the weakness of a check that it could not be accepted by the drawee ( Art. 4 ScheckG ). Acceptance notes written on the check are deemed not to have been written. Therefore, ways were sought to reduce the cashing risk of the check taker. This happened through the conclusion of a guarantee contract between the check taker and the banker. The disadvantage of this procedure was that the banker had to bear the del credere risk .

Origin of the guarantee

The check issuer had to write the number of his guarantee card on the back of the Eurocheque. This enabled the bank to determine whether the person for whose solvency it was responsible for was an authorized customer of its. The guarantee contract between the check taker and the bank came about at:

- The number, the signature of the issuer, the name of the bank and the account number on the guarantee card and the form for the Eurocheque certificate match

- Issuance of the Eurocheque within the validity period of the guarantee card

- timely presentation of the check

The guarantee card did not have to be presented to the payee . The ownership of the guarantee card showed the check issuer to be a representative (aa as a messenger) of the banker drawn. The check issuer concluded a guarantee contract with the payee for the banker. With the delivery of the Eurocheque by the authorized check issuer to the check taker, the payee's guarantee claim of up to DM 400 arose. Due to this arrangement, the guarantee regulation of the Eurocheque did not violate the ban on acceptance .

The abstract nature of the guarantee claim

The payee's claim under the guarantee contract was abstract. The bank could not raise any objections to the guarantee claim arising from the relationship between the bank and the check issuer ( coverage ratio ). Such objections can consist , for example, of insufficient funds in the account of the check issuer or the revocation of the check by the issuer. Only insofar as defects in the formation or in the existence of the guarantee contract were reported, these were decisive. This was the case, among other things, if the card holder was not its rightful holder. If the customer lost the forms for the Eurocheque and an unauthorized person filled them in with the correct card number and falsified the signature, a guarantee contract, for example, was not concluded because the unauthorized person's lack of power of representation is a legal objection to the creation of the guarantee contract itself. However, the bank was liable to the check taker from a legal point of view. Other objections relating to the creation of the guarantee contract are all other errors in the creation of the guarantee contract (lack of signature, etc.).

Eurocheque card as an electronic debit card

With the advent of ATMs since the late 1970s / early 1980s, the Eurocheque card was used as a service medium in several countries - in addition to its traditional function as a guarantee card for Eurocheques. At the same time, thought has been given in these countries to approve the Eurocheque card for use at POS terminals . This started the third phase of the development of the Eurocheque system and the first step towards the abolition of the Eurocheque.

In 1981 the Eurocheque assembly decided to create the conditions for the international use of the Eurocheque card at ATMs. In 1982/1983 a study was carried out which had the national ATM networks as a starting point, took into account the country-specific requirements for ATM standards and on this basis developed a common standard. This made it possible to carry out cross-border pilot tests from June 1, 1984. This service soon became a standard feature of Eurocheque cards and European ATMs under the “ec pictogram”. This cross-border ATM function “ ec-pictogram ” was not only available on Eurocheque cards, but was also linked to bank customer cards that could not perform a Eurocheque guarantee function.

The next step in the further development of the Eurocheque system was decided in 1984 in the Eurocheque assembly, in which the establishment of POS systems should be analyzed and solutions should be considered for the cross-border use of the Eurocheque card at POS terminals. However, due to the initially hesitant national implementation of POS systems, concrete measures could only be discussed in 1987 and initiated in 1988. “ Edc ”, an “electronic debit card”, was developed in a project . In 1989, Eurocard International was included in the project in order to be able to offer the European financial institutions a coordinated “Europackage” and to be able to expand the areas of application of the “edc” function in cooperation with MasterCard International to non-European countries. This project was subsequently implemented, with Maestro International as the lead manager . This company was established for cross-border electronic debit functions ( ATM and POS) and is 50% owned by Europay International, a company formed in 1992 from the merger of Eurocheque International and Eurocard International, and 50% owned by MasterCard International.

As a result, “edc” as a European POS function has become a further function on the Eurocheque card and on bank customer cards without the Eurocheque function, in addition to the “ec pictogram” as a European ATM function.

Due to the increasing globalization of the economy with special consideration of cross-border payment transactions, Maestro International offered global debit functions for ATM and POS use under the logo “Maestro” in addition to the two European debit functions “ec-pictogram” and “edc”. The Maestro function very soon replaced the European debit functions from both European Eurocheque cards and European bank customer cards.

The Eurocheque card had thus become an electronic debit card that could be used worldwide, although national use retained the greatest importance , with the check guarantee function increasingly taking a back seat.

Development of Eurocheque countries, Eurocheque cards and cross-border Eurocheques

Eurocheque states

1969 - in the first year of the Eurocheque - 14 countries took part in the Eurocheque system: seven actively with card issuance and acceptance (Belgium, FR Germany, France, Great Britain, Netherlands, Austria and Switzerland), seven passively only with acceptance (Denmark, Italy, Ireland, Luxembourg, Norway, Sweden, Spain). The Eurocheque symbol also appeared on Carte Bleue and Barclays credit cards at that time. After these nationally valid credit cards joined the Visa credit card system, they lost the Eurocheque function, which in 1983 and 1989 led to a decline in the number of non-uniform Eurocheque cards.

The Europe-wide spread of the Eurocheque system was shown in the status at the end of 1998. At that time, the Eurocheque system had 46 participating countries, 22 of which were active (Belgium, Denmark, Germany, Finland, France, Great Britain, Ireland , Israel , Italy , Croatia , Luxembourg, Malta , the Netherlands , Austria, Poland , Portugal , Switzerland, Slovenia , Spain, the Czech Republic, Hungary, Cyprus) and 24 passive (Egypt, Albania, Algeria, Andorra, Armenia, Azerbaijan, Bosnia-Herzegovina, Bulgaria , Georgia , Gibraltar, Greece, Iceland, Lebanon, Lithuania, Latvia, Morocco, Macedonia, Romania, Russia, Slovakia, Tunisia, Turkey, Ukraine, Belarus). The Eurocheque system was thus present in almost all European countries.

In the German Democratic Republic , Eurocheques were first approved on August 25, 1986.

Eurocheque cards

At first there were only - as they were later called - non-uniform Eurocheque cards in the design of the respective bank card with an imprint of the ec logo. From 1972 the so-called uniform Eurocheque cards with the familiar appearance came onto the market. As a result, more and more active states were added, mostly initially with non-uniform Eurocheque cards, which were then converted into uniform Eurocheque cards. There were cuts in 1983 when British banks no longer equipped their credit cards with the ec logo. The same thing happened in 1989 with the French credit cards, with which the last non-uniform Eurocheque cards disappeared from the market. After that there were only standardized Eurocheque cards, at the end of 2001 72.0 million.

| year | Uniform Eurocheque card (in millions) | Non-uniform Eurocheque card (in millions) | Uniform and non-uniform EC cards (in millions) |

| 1969 | - | 4.9 | 4.9 |

| 1970 | - | 7.3 | 7.3 |

| 1971 | - | 11.2 | 11.2 |

| 1972 | 5.3 | 8.7 | 14.0 |

| 1973 | 6.9 | 10.4 | 17.3 |

| 1974 | 8.6 | 11.4 | 20.0 |

| 1975 | 9.8 | 11.8 | 21.6 |

| 1976 | 11.4 | 12.2 | 23.6 |

| 1977 | 13.9 | 13.6 | 27.5 |

| 1978 | 15.8 | 14.0 | 29.8 |

| 1979 | 17.6 | 15.9 | 33.5 |

| 1980 | 19.6 | 17.4 | 37.0 |

| 1981 | 20.2 | 17.6 | 37.8 |

| 1982 | 20.5 | 17.7 | 38.2 |

| 1983 | 24.4 | 7.6 | 32.0 |

| 1984 | 25.3 | 7.7 | 33.0 |

| 1985 | 26.9 | 8.3 | 35.2 |

| 1986 | 30.4 | 8.7 | 39.1 |

| 1987 | 32.9 | 9.1 | 42.0 |

| 1988 | 34.4 | 9.9 | 44.3 |

| 1989 | 37.1 | - | 37.1 |

| 1990 | 40.3 | - | 40.3 |

| 1991 | 46.6 | - | 46.6 |

| 1992 | 50.2 | - | 50.2 |

| 1993 | 52.7 | - | 52.7 |

| 1994 | 53.7 | - | 53.7 |

| 1995 | 55.2 | - | 55.2 |

| 1996 | 58.4 | - | 58.4 |

| 1997 | 59.8 | - | 59.8 |

| 1998 | 62.5 | - | 62.5 |

| 1999 | 66.0 | - | 66.0 |

| 2000 | 70.8 | - | 70.8 |

| 2001 | 72.0 | - | 72.0 |

Eurocheques

All the figures that only refer to cross-border Eurocheques reflect only a fraction of the importance of the Eurocheque as a means of payment, because the Eurocheque was also the national check used in most of the countries actively participating in the Eurocheque system. In these countries, the number of cross-border Eurocheques rarely exceeded 5% of all checks issued. In 1988, the peak year of the Eurocheques, in addition to the 50 million cross-border Eurocheques, around 950 million Eurocheques were issued in the respective countries. In total, the total amount of Eurocheques issued in 1988 was over 75 billion euros. In the following, only the number of Eurocheques issued across borders and the check amounts represented by them are given.

| year | Number of cross-border Eurocheques (in millions) | Volume of cross-border Eurocheques (in billion euros) |

| 1969 | 2.8 | 0.4 |

| 1970 | 4.1 | 0.6 |

| 1971 | 5.1 | 0.8 |

| 1972 | 6.4 | 1.0 |

| 1973 | 8.1 | 1.1 |

| 1974 | 11.6 | 1.4 |

| 1975 | 12.7 | 1.6 |

| 1976 | 13.8 | 1.7 |

| 1977 | 16.5 | 2.1 |

| 1978 | 17.9 | 2.4 |

| 1979 | 20.4 | 2.8 |

| 1980 | 22.8 | 3.2 |

| 1981 | 23.5 | 3.4 |

| 1982 | 23.9 | 3.5 |

| 1983 | 24.6 | 3.6 |

| 1984 | 28.0 | 4.1 |

| 1985 | 36.7 | 4.8 |

| 1986 | 42.0 | 5.5 |

| 1987 | 45.9 | 6.4 |

| 1988 | 50.0 | 6.7 |

| 1989 | 42.1 | 5.8 |

| 1990 | 40.1 | 5.4 |

| 1991 | 39.1 | 5.3 |

| 1992 | 37.0 | 5.3 |

| 1993 | 33.8 | 5.2 |

| 1994 | 31.2 | 5.0 |

| 1995 | 26.8 | 4.5 |

| 1996 | 22.5 | 3.9 |

| 1997 | 18.2 | 3.1 |

| 1998 | 14.6 | 2.6 |

| 1999 | 10.8 | 2.1 |

| 2000 | 7.5 | 1.6 |

| 2001 | 4.6 | 1.1 |

Expiry of the Eurocheque guarantee

Due to the rapidly increasing electronic debit functions at POS and ATM and the decreasing importance of the paper-based Eurocheque, the Board of Directors of Europay International decided on April 22, 1999 to discontinue the Eurocheque guarantee at the end of 2001. As a consequence of this decision, the European financial institutions no longer issued Eurocheque cards with an expiry date beyond 2001 and the number of Eurocheque forms still issued was reduced, so that by the end of 2001 only a small number of Eurocheque forms were still in the possession of authorized persons was. Since the beginning of 2002 the checks made out on a Eurocheque form have only been normal checks due to the respective check laws.

Reasons for leakage

The main disadvantage of any check-based payment method is that it was not possible to make the check machine-compatible. The Eurocheque system was always associated with relatively high costs due to paper-based processing. These costs, which are by no means covered by the fee charged by the Eurocheque issuer, were initially accepted by the financial institutions due to the small number of pieces. However, such a high number of Eurocheque payments was not expected. Price increases could not solve this problem either.

Another feature of the Eurocheque system was that the people who accepted a Eurocheque on account of performance did not have to make any contribution to the costs of payment transactions. For the Eurocheque cardholder, this had the advantage that a broad network of acceptance was established very quickly. However, it also meant that the Eurocheque system was never cost-covering. The introduction of a submission fee was only possible to a limited extent and therefore not sufficient.

In addition, there was an increasing risk of costs arising from the loss, theft and forgery of Eurocheques and Eurocheque cards, which the financial institutions were unable to bear in full. The financial institutions themselves had to bear the del credere costs that were incurred through abuse of the Eurocheque issuer themselves. These could only be reduced by issuing fewer Eurocheques, as a Eurocheque issued once was guaranteed.

further reading

- Ewald Judt: The eurocheque 1968-2001. In: Bank-Archiv 4/2000, p. 291 ff

- Ewald Judt: The eurocheque 1968-2001 - a supplement. In: Bank-Archiv 2/2003, p. 136 ff

Trivia

Around 1975 a Eurocheque card advertisement appeared, in which the name Michaela May could be found on oversized check cards in all bank branches.

Individual evidence

- ↑ Michaela May. A dairymaid to fall in love with. ( Memento of the original from March 23, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved March 16, 2016.