Martingale

In probability theory, a martingale is a stochastic process that is defined by the conditional expected value and is characterized by the fact that it is fair on average . Martingales arise naturally from modeling fair games of chance . You were introduced to mathematics by Paul Lévy .

Closely related to the martingales are the supermartingales , these are stochastic processes in which a loss occurs on average, and submartingales , these are stochastic processes in which a profit occurs on average.

definition

Discreet case

A probability space and a filtration are given . A stochastic process is given , for which applies:

- The process is an integrable process , which means it is for everyone .

- The process is adapted to , that is, it is measurable for everyone .

Then a martingale is called (regarding ) if

applies.

The term denotes the conditional expected value of the random variable , given the σ-algebra .

General case

Is a probability space and an arbitrary ordered index set (mostly ) and a filtration given, is an integrable to adapted process a martingale (with respect to ) if for all true

- .

Supermartingales and submartingales

An integrable and adapted discrete stochastic process is called submartingale , if

- ,

and super martingale if

applies. In the continuous case, a submartingale is defined analogously via

- .

and a super martingale over

- .

In contrast to martingales, submartingales tend to rise, supermartingales tend to fall.

comment

The property of being a (sub- / super) martingale does not belong to stochastic processes alone, but always to a stochastic process in combination with a filtration. Therefore the filtration should always be indicated. Some authors do not include filtration when they use the filtration generated by the process itself , which is given by . If a martingale is related to filtration , then it is also a martingale related .

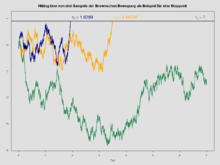

Motivating example

The term martingale can be understood as a formalization and generalization of a fair game of chance . To do this, be the starting capital of the player. In many cases this will be a constant, but random start-up capital is also conceivable. The random win in the first game is denoted by. It can be positive, zero, or negative (i.e. a loss). The player's capital after the first game is and generally after the -th game

if denotes the win in the -th game. In a fair game of chance, the expected value of any win is zero; i.e. it applies to everyone .

The course of the game is now observed up to and including the point in time , i.e. H. the capital levels are known. If the profit in the next, i.e. the -th, game is independent of the previous game, then the expected total capital after the next game is calculated using the calculation rules for conditional expected values, taking into account all available information

This shows that the capital of a player who takes part in a fair game of chance can be modeled as a martingale.

In real games of chance, such as roulette , however, the expected profit in each game is generally negative because of the bank advantage . Then the result is analogous to the above calculation

From the player's point of view, this is a supermartingale (motto: “Supermartingales are great for the casino”).

Examples

Martingale produced by a filtration

Is a probability space, a filtration and a P-integrable random variable . Then through

a martingale (regarding ) defined.

To show that it is a martingale, one recalculates the definition:

- .

So it is a martingale. The first transformation is the insertion of the definition, the second an application of the tower rule of the conditional expected value and the third re-insertion of the definition.

Doob martingale

A special case of the above martingale are Doob martingales : If a P-integrable random variable is given and the filtering is generated by a sequence of random variables , that is

- ,

that's the name of the martingale which goes through

is defined, a Doob martingale (named after Joseph L. Doob ).

Examples of continuous martingales

- A Wiener process is a martingale, just as the processes and the geometric Brownian movement without drift are martingales for a Wiener process .

- A Poisson process with rate , which is adjusted for its drift, therefore , is a martingale.

- According to Itō's lemma : Every Itō integral (with a bounded integrand) is a martingale. According to Ito's martingale representation theorem, conversely, every martingale (even every local martingale) with respect to a filtration generated by a Brownian movement can be represented as an Ito integral with respect to this same Brownian movement.

- Every continuous martingale is either of infinite variation or constant .

- Every stopped martingale is a martingale again.

properties

Calculation rules

- is a submartingale if and only if is a super martingale

- If (sub) supermartingales are and is , then is also a (sub) supermartingale.

- If there are martingales, then there is also a martingale for .

- If there are super martingales, then there is

- a super martingale.

- If there are submartingals, then is too

- a submartingale.

- If a convex function and a martingale are true , then is a submartingale.

Influence of filtration

If two filtrations given and is smaller than in the sense that for each valid , then each is -Martingal a -Martingal.

Quadratic variation and exponential martingale

If the quadratic variation of a continuous bounded martingale (or one with finite exponential moments) is finite, then the process is stochastic

also a martingale.

Likewise the so-called exponential martingale of , is given by

a martingale. This follows from the Kazamaki criterion .

Important statements about martingales

Inequalities

The most important inequalities related to Martingale are Doob's maximum inequality and the crossing inequality . Doob's maximum inequality provides an estimate of which maximum value of a martingale will not be exceeded up to a given point in time. The crossover inequality provides information about how often a submartingale crosses a given interval from bottom to top.

Combination with stop times

The optional stopping theorem and the optional sampling theorem combine stopping times with martingales and deal with the properties and expected values of the stopped processes. With these results it can be shown that there is no fair game abort strategy that is beneficial to the player.

Martingale transformation

A martingale and a predictable, locally restricted process can be combined to form a new martingale using the discrete stochastic integral . This process is then called the martingale transform of the original martingale. The martingale transformed is again a martingale. This has far-reaching consequences for the existence of game strategies in fair games which, on average, bring the player profit. If the martingale models the fair game and the predictable, locally restricted process the game strategy, then it follows from the martingale transformation that there is no game strategy that generally brings the player an advantage.

Doob decomposition

The Doob decomposition allows for every adapted, integrable stochastic process to be decomposed into a martingale and a predictable process .

Martingale Convergence Theorem

The martingale convergence theorem provides criteria for random variables that form a martingale under which they converge almost certainly or in the p-th mean .

Derived process classes

Local martingales

Local martingales are processes for which there is a monotonically increasing sequence of stop times, so that the stopped process is a martingale for every stop time .

Semimartingales

Semimartingales are a class of adapted processes with Càdlàg paths (the paths are continuous on the right and the limits on the left exist), which can be broken down into a local martingale, a process with locally finite variation and an almost certainly finite portion.

Backward martingales

Backward martingales are martingales in which the index set is reversed. You run "the wrong way round" or from back to front.

Origin of the word

The Martingale has been a gambling strategy that has been known since the 18th century, in which after a lost game the stake is increased, in the simplest case doubled, so that in the hypothetical case of inexhaustible wealth, inexhaustible time, and the non-existence of a maximum stake, certain profit would occur.

Since the Martingale was and is the most famous game system, the term was also used as a synonym for "game system" and found its way into mathematical literature.

The word "Martingale" itself comes from Provençal and is derived from the French town of Martigues in the Bouches-du-Rhône department on the edge of the Camargue , whose inhabitants used to be considered somewhat naive. The Provencal expression jouga a la martegalo means something like to play very daring.

The “martingale” called auxiliary reins is also said to be named after the town of Martigues, this is an optional part of the horse equipment that is supposed to prevent the horse from pulling its head up and climbing. The pioneers of the martingale theory did not know that this auxiliary rein is also called martingale - and has nothing to do with the formation of mathematical concepts.

Web links

- TO Shiryaev: Martingale . In: Michiel Hazewinkel (Ed.): Encyclopaedia of Mathematics . Springer-Verlag , Berlin 2002, ISBN 978-1-55608-010-4 (English, online ).

- Eric W. Weisstein : Martingale . In: MathWorld (English).

literature

- Historical literature

- Paul Lévy : Calcul de probabilités. Gauthier-Villars, Paris 1925.

- JL Doob : Stochastic Processes. Wiley, New York 1953.

- Introductions

- David Williams: Probability with Martingales. Cambridge University Press, Cambridge 1991, ISBN 0-521-40605-6 .

- Heinz Bauer : Probability Theory . 5th edition, de Gruyter, Berlin 2002, ISBN 3-11-017236-4 .

- Discrete Martingales

- Harald Luschgy: Martingales in discrete time. Theory and applications. Springer, Berlin / Heidelberg 2013, ISBN 978-3-642-29960-5 .

- J. Neveu: Discrete-Parameter Martingales . North Holland, Amsterdam 1975.

- YS Chow and H. Teicher: Probability Theory: Independence, Interchangeability, Martingales . Springer, New York 1997.

- Steady Martingale

- C. Dellacherie, P.-A. Meyer: Probabilités et potentiel I-IV , Hermann Paris, 1975–1987. (English translation by North Holland.)

- Applications

- R. Bouss: Optimization of the credit business with martingales . Haupt, Bern 2003.

Individual evidence

- ↑ H. Bauer: Probability Theory. de Gruyter, Berlin 1991, p. 144.

- ↑ a b The Origins of the Word "Martingale" on jehps.net, p. 1 f.