Migros Bank

| Migros Bank AG | |

|---|---|

|

|

|

| Country |

|

| Seat | Zurich |

| legal form | Corporation |

| IID | 8401 |

| BIC | MIGRCHZZXXX |

| founding | 1958 |

| Website | www.migrosbank.ch |

| Business data 2019 | |

| Total assets | CHF 47.033 billion |

| Employee | 1362 |

| Offices | 67 |

| management | |

| Corporate management |

Fabrice Zumbrunnen |

The Migros Bank AG , based in Zurich , is a wholly owned subsidiary of the Swiss retail group Migros . As a universal bank, it is primarily active in business with retail and private customers as well as with small and medium-sized corporate customers . It was founded in 1958 by Gottlieb Duttweiler . At the beginning, savings accounts and mortgages were primarily offered. Funds and e-banking services were added in the 1990s .

history

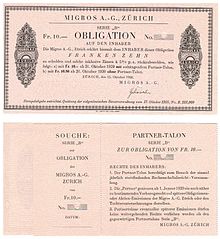

In the first years of its existence, Migros was regularly dependent on outside capital for its expansion, but Gottlieb Duttweiler wanted to become independent from the banks as quickly as possible. In 1928 Migros brought out the first “partner obligation”, which brought in 100,000 francs. In 1930 a Migros bond of 150,000 francs was oversubscribed three times , in 1932 another PAG miles of 250,000 francs was doubled. In 1937 the share capital of Migros was one million francs, the bond capital 1.7 million, which inspired Duttweiler to make the following statement: "Migros is at least as creditworthy as the credit institution ." Migros offered its bonds in small denominations and paid 1/4 to 1/2% more interest than usual on the market.

In the post-war period, the scope of Migros' financial activities increased by leaps and bounds, so that the establishment of an own bank became more and more important. On December 15, the Federation of Migros Cooperatives (MGB) entered Migros Bank in the Zurich commercial register with share capital of CHF 10 million. It was based on the third floor of the Migros store on Limmatplatz in Zurich and began its work on February 28, 1958. The first branch opened in 1961 in Winterthur . Migros Bank established itself as a medium-sized financial institution. In 1972, sales exceeded the one billion franc mark. As a special feature, it offered 1/4 percent more interest than the competition for savings deposits and mortgage loans, while it offered loans at 1/4 percent cheaper. Also in 1972 she acquired the insolvent Bankhaus Mühling in Düsseldorf , which from 1973 operated as Migros Bank AG Düsseldorf. The only foreign branch was never able to fully meet the expectations placed in it and, according to the MGB, tied up too many funds. It was therefore sold to the Stadtsparkasse Düsseldorf on March 1, 1992 .

In 2015, Migros Bank launched the E-Pay payment service and integrated it into some Migros online shops; At the same time, E-Pay made it possible for Migros Bank to be the first Swiss bank to offer the online payment method "Sofort" from the Swedish payment service provider Klarna . In summer 2018, Migros Bank acquired a majority stake in CSL Immobilien AG. At the end of 2018, Migros Bank announced that no more bonuses will be paid out from the 2019 financial year. Instead, the wages for affected bank employees will be increased once and individually. Migros Bank is involved in the Aduno Group and a member of the Swiss Payments Council . In addition to free cash withdrawals at the in-house ATMs and at various Migros Group sales outlets, and in addition to the paid withdrawals from third-party machines , since January 2020 cash can also be withdrawn from third-party sales outlets (e.g. at Volg and K Kiosk) for a corresponding fee with the Sonect app . Migros Bank issues the Mastercard and Visa credit cards in cooperation with Viseca . A new credit card in cooperation with Cembra Money Bank is due to come onto the market in 2020 .

numbers

| year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Balance sheet total in CHF million | 28,889 | 29,121 | 30,998 | 32,686 | 33'714 | 35,847 | 37,804 | 38,882 | 40,846 | 42'232 | 42,752 | 43,294 | 44,679 | 47,033 |

| Annual profit in million CHF | 95 | 101 | 124 | 138 | 173 | 175 | 172 | 174 | 225 | 226 | 215 | 223 | 228.1 | 231 |

| Client money in CHF million | 21,525 | 21,785 | 24,026 | 25,493 | 25,954 | 27'410 | 29'427 | 30,804 | 32,270 | 33,084 | 33,523 | 34,024 | 33,900 | 36,095 |

| Workforce | 1161 | 1207 | 1262 | 1290 | 1373 | 1395 | 1375 | 1354 | 1317 | 1334 | 1327 | 1327 | 1344 | 1362 |

| Number of branches | 44 | 45 | 52 | 56 | 59 | 64 | 63 | 65 | 66 | 66 | 67 | 67 | 67 | 67 |

Web links

Individual evidence

- ^ Migros Bank AG. Commercial Register of the Canton of Zurich, 2019, accessed on October 19, 2019 .

- ↑ a b Entry in the bank master of Swiss Interbank Clearing

- ↑ Annual Report 2019 , The 62nd Financial Report of Migros Bank AG, accessed on March 30, 2020 (PDF; 1.4 MB).

- ^ Alfred A. Häsler : The Migros Adventure. The 60 year old idea . Ed .: Federation of Migros Cooperatives. Migros Presse, Zurich 1985, p. 222 .

- ^ Häsler: The Migros Adventure. P. 326.

- ^ Häsler: The Migros Adventure. P. 223.

- ^ Migros -Genossenschafts-Bund (Ed.): Chronicle of Migros 1925–2012 - Portrait of a dynamic company . Zurich 2013, p. 77 ( online ).

- ↑ Shop safely and cheaply online. Migros Bank, January 29, 2018, accessed on May 18, 2020 .

- ↑ Migros Bank's participation in CSL Immobilien creates a unique range of services. In: swiss-press.com. September 3, 2018, accessed June 1, 2019 .

- ↑ Migros Bank is abolishing the bonuses. Handelszeitung , November 12, 2018, accessed on July 17, 2019 .

- ↑ Michael Heim: Apple boycott drives banks to white heat. Handelszeitung , May 23, 2017, accessed on May 30, 2019 .

- ^ Swiss Payments Council (SPC). SIX Group , accessed on October 19, 2018 .

- ↑ Migros Bank customers can now withdraw cash at many more locations. In: cash.ch. January 10, 2020, accessed January 10, 2020 .

- ↑ Michael Heim: New free card: Migros Bank becomes a test case for Cembra. In: handelszeitung.ch. February 21, 2020, accessed February 22, 2020 .

- ↑ Migros Bank annual reports: numbers, facts, insights. Migros Bank AG, accessed on March 30, 2020 .

Coordinates: 47 ° 22 '30.5 " N , 8 ° 32' 15.5" E ; CH1903: six hundred eighty-two thousand nine hundred ninety-nine / 247,724