Payment card

The payment card (including payment card ; English payment card ) is in payment , a cash that its owner the right, on the payment method affiliated contracting companies ( distributors , retailers ) bills on presentation of the card by cash payment to settle.

General

The cash is the only legal tender is getting stronger by the cashless payment displaced. The latter includes not only transfers , real-time transfers or direct debits , but also the payment process through card payments or similar systems. The pure bank cards differ from the payment cards in that the latter can only be used for cash withdrawals , cash deposits and bank statement printers .

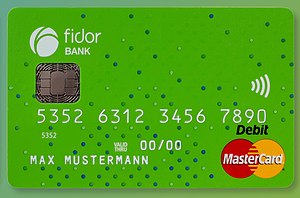

A payment card is understood today to be a commercially available plastic card in check card format . The card issuer uses a magnetic strip or chip to encode it to ensure that misuse or forgery is largely ruled out and that the holder is in a position to transfer money or a monetary value. The cardholder has to meet a monetary debt so that he can use the card itself or the monetary units stored on the magnetic strip or card chip - whose carrier is ultimately the card - for this purpose.

The Deutsche Bundesbank defines the payment card as an object “with which the holder can either carry out payment transactions or withdraw or deposit cash via a card system, be it with the help of a plastic card or a mobile device. A card system is a framework of technical and commercial regulations that has been set up to support one or more specific card brands. This framework contains the organizational and legal provisions as well as the framework conditions that are necessary for the services marketed by the brand to function. "

material

Plastic cards are made of multilayer PVC, laminated with a high gloss on both sides . The advantage of this multi-layer structure is its high ductility and almost unbreakability. The format of 85.6 mm × 53.98 mm × 0.76 mm rounded corners with a radius of 3.18 mm is specified by ISO 7810.

For payment cards in ID1 format the following formats currently apply: ISO 7810 for the appearance ( English ID cards Physical Characteristics ), ISO 7816 -2 for the placement of magnetic stripes and smart ( English ID cards dimension and location ot contacts ) and ISO 7816-3 for the electronic signals and the protocols used ( English ID cards Electronic Signals and transmission protocols ).

Components

Payment cards point to the front of the logo of the issuer , the name of the card holder and the account-holding bank , the integrated chip on the back are the specimen signature of the cardholder and the magnetic stripe. When the card is used, the chip is read by the chip card reader , the magnetic stripe by a swipe reader . The smart card conforms to the standard ISO 7816 -1, chip and magnetic stripe are both required even for a transitional period (ISO 7816-2).

species

A card payment is a payment in which account-related ( e.g. debit cards) and non-account-related payment cards (such as credit cards) are used.

- With debit cards ( English Pay Now Cards ), cashless payments (and cash withdrawals ) are charged to the card payer's current account for a short time . The cardholder's identity is mostly checked with a PIN . The most important debit card is the Maestro card . Other systems are V Pay and the German girocard .

- In the case of credit cards ( English Pay Later Cards ), cashless payments (and cash payments) are either billed once a month with a list of all payments ( English Charge Cards ) or credited to the minimum amount that has to be paid ( English Revolving Credit Cards ). The identity of the card holder is usually verified by means of a signature . The most important credit cards are Mastercard , Visa , American Express and Diners Club cards.

- In the case of electronic wallet cards ( English Pay Before Cards ), the chip must first be loaded with a credit in order to be able to make the later cashless payments. Recharging is required after consumption. When paying, as with cash, the identity is not checked, the buyer remains anonymous to the seller / dealer . Electronic wallets are usually found as an additional function on other cards. The electronic wallet in Germany is the money card and in Switzerland cash . The Austrian solution Quick was discontinued on July 31, 2017.

There is also mobile payment through smartphones , tablets or wearable computing , which is done through contactless payment . Technologies such as Bluetooth , QR codes or the contactless process through Near Field Communication (NFC) can be used here to transfer payment data. The NFC function is also partially taken into account for payment cards.

Payment cards can also be divided as follows:

- After the liquidity effect for the holder:

- Credit card: The period between payment and debit is at least one month.

- Charge card: The cardholder also receives a monthly invoice that is payable immediately or within a period of up to 30 days.

- Debit card: The cardholder will be charged immediately after payment.

- Prepaid card : The cardholder must make advance payments before he can pay with it.

- According to the area of application:

- international payment cards: for example American Express, Diners Club, Mastercard or Visa;

- national payment cards:

- from credit institutions: such as the bank card service network or girocard ;

- Customer cards from retail and service companies such as Payback or customer cards from railway companies ( e.g. Bahncard ).

- According to the storage medium :

- Magnetic stripe card : It contains a magnetic stripe usually attached to the back, the stored data of which can be read out using a swipe reader .

- Chip card: The chip is an integrated circuit and is used in e-money procedures as a specific storage medium with which the information about the card balance is managed.

- Hybrid card: contains both a magnetic stripe and a chip.

Customer cards or phone cards that only allow cashless purchases or phone calls are not payment cards .

Payment process

The payment card is accepted by the seller / dealer (contracting company), who determines the identity , connects the invoice amount with the card data for the service receipt and, if necessary, requests the PIN and signature from the card user. The card issuer's obligation to pay is triggered by the merchant with the addition “The cardholder's signature is on the service receipt ” ( English signature on file ). This payment obligation on the part of the card company only arises if the merchant uses the POS terminal to create proper service receipts. This regulation prescribes appropriate documentation of the transactions carried out, which is required in particular to deal with any complaints from a cardholder. The specification "signature on file" is always a necessary prerequisite for the credit card company's payment obligation in the face-to-face process ; the payment obligation in the mail order process arises even without the note "signature on file" on the service receipts when orders are sent by email / internet and to the contractor the cardholder's signatures are not available.

Legal issues

According to Art. 2 No. 15 Regulation (EU) 2015/751 of the European Parliament and of the Council of April 29, 2015 on interchange fees for card-based payment transactions , the payment card is a payment instrument that enables the payer to initiate debit or credit card transactions . In the case of "guaranteed" payment cards, the issuer ( issuer or acquirer ) assumes a payment guarantee based on an abstract promise of debt in accordance with Section 780 BGB .

The criminal knows payment cards as a legal concept , which they as object of the crime treated. The counterpart to the criminal offense of counterfeiting cash is credit card fraud . Section 152a StGB regulates the forgery of payment cards without a guarantee function and Section 152b StGB regulates the forgery of payment cards with a guarantee function . Payment cards without a guarantee function are account-based cards (debit cards) issued by a credit institute or financial services institute ; payment cards with a guarantee function include non-account-based credit cards. Section 152a of the Criminal Code does not cover customer cards and telephone cards.

Electronic wallets can be attacked by hackers . As Data espionage ( English hacking ) is defined as the unauthorized entry into a foreign computer system or computer network, overcoming the access security to gain or other unauthorized access to data not intended for him and which are specially protected against unauthorized access ( § 202a StGB). In addition, computer fraud according to Section 263a of the Criminal Code can be committed in which someone influences the result of a data processing operation by incorrectly designing the program, by using incorrect or incomplete data, by unauthorized use of data or otherwise by unauthorized influence on the process.

economic aspects

Payment cards are the most widespread and most widely used cashless payment method in Europe and the Eurozone . The number of payment cards in circulation in the euro area increased by 4.0% in 2018 to 544.0 million. With a total population in the euro area of 341 million, this corresponds to around 1.6 payment cards per inhabitant. The number of card payments rose by 13.0% to 41.4 billion with a total value of 1.8 trillion euros. This corresponds to an average value of around 44 euros per card payment. Already 46% of all cashless transactions in the euro area were card payments, 23% were each accounted for by transfers (including real-time transfers) and direct debits. The highest share of card payments with 70.5% was in Portugal and that of transfers with 43.6% in Slovakia , while with direct debits the highest national share with 46.9% - as in previous years - was in Germany .

In Germany alone, a total of 158.8 million payment cards were in circulation to customers in 2018, far more than in any other European country. However, the share of card payments at 23.4% was still below the share of transfers (28.5%). At the same time, the share of cash payments in sales fell steadily from 53.1% (2011) to 47.6% (2017), while debit cards rose from 28.3% to 34.0%. In terms of transactions, cash payments led with a share of 74.3%, debit cards increased to 18.4%, credit cards remained at 1.5%.

Since 2011, the number of card payments per inhabitant in Germany has risen from 36.6 (2011) to 45 (2013) to 54.4 (2017), i.e. every inhabitant made an average of 54.4 card payments in 2017. For amounts up to 5 euros, the cash payment portion in Germany is 96%, between 5 and 20 euros 88%, 20 to 50 euros still 60%. The debit card only prevails for amounts from 50 to 100 euros (45%), from 100 euros the cash portion is 24%.

See also

- Cash withdrawal card (without payment function)

Web links

Individual evidence

- ↑ Heinz Beck / Carl-Theodor Samm, Commentary on the KWG , 2003, § 1 margin no. 239

- ↑ Ingeborguppe , in: Nomos Commentary on the StGB , 2008, § 152a Rn. 6th

- ↑ Mey Marianne Unruh, Banking Supervision in the Area of Electronic Payment Options , 2004, p. 14.

- ↑ Deutsche Bundesbank, Statistics of Banks and Other Financial Institutions: Guidelines, Special Statistical Publication 1 , July 2019, p. 595.

- ↑ Mey Marianne Unruh, Banking Supervision in the Area of Electronic Payment Options , 2004, p. 13 FN 22

- ↑ Jochen Kißling, Payment with electronic units of value , 2003, p. 34.

- ↑ Springer Fachmedien Wiesbaden (Ed.): 250 Keywords Bankwirtschaft , 2016, p. 192.

- ↑ BGH WM 2004, 1130 , 1131

- ↑ BGH WM 2004, 1130, 1132

- ^ BGH, judgment of July 12, 2005, Az .: XI ZR 412/04 = BGHZ 157, 256

- ↑ Julia Haas, Promise and Acknowledgment of Debt , 2011, p. 173.

- ^ Jörg Eisele, Criminal Law: Property Offenses, Property Offenses and Document Offenses , 2009, p. 460.

- ↑ European Central Bank , Payment Statistics , 2018, p. 1.

- ↑ European Central Bank, Payment Statistics , 2018, p. 6.

- ^ Deutsche Bundesbank, Payment and Securities Settlement Statistics in Germany 2014–2018 , July 2019, p. 4.

- ↑ Deutsche Bundesbank, Payment behavior in Germany 2017 , 2018, p. 25.

- ↑ Statista The Statistics Portal , 2019, number of card payments per inhabitant in Germany from 2011 to 2017

- ↑ Statista The Statistics Portal , 2019, Share of payment instruments used in Germany in 2017 by amount range