Foreign trade management

The foreign trade business studies are special business studies (so-called economic branch studies ) with the business studies of foreign trade . A foreign trade company is a trading company focused on import / export / transit trade and acts, among other things, according to foreign trade law .

Branch

A basic distinction is made in foreign trade as well as in wholesaling according to trade with

- Commodities : such as raw materials , goods etc .;

- Consumer goods ;

- Capital and production goods .

In addition, foreign trade companies can offer various service programs as full-range suppliers, service providers and information carriers for various foreign sources of supply and sales. Exporters offer their customers, for example, market knowledge abroad, arrange export formalities, offer favorable freight rates through groupage with the house forwarder, provide partial financing or even offer complete export outsourcing. Trading with third countries, especially with small order volumes, often entails high risks for the manufacturer, so that exporters who specialize in specific countries are interposed.

Trading functions

Similar to wholesaling, foreign trade has the following main functions:

- Distribution of goods : As a space bridge from the production facility to the place of consumption

- Time bridging : Through storage and conservation , a year-round, season-independent supply is to be guaranteed (for example tropical fruits) by delivering lots from the warehouses to the trade at times when required

- Volume regrouping : Purchase of a large batch and delivery in portions to retailers

- Assortment creation: Creation of a needs-based assortment according to customer requirements

- Financing function : For example, discounting for importers and wholesalers, wholesalers pass on credit to retailers. Foreign trade companies, as trade intermediaries, also often pay the purchase price for goods, they finance the goods.

- Service and support : sales advice, repair service, etc.

- V eredelung : processing and manipulation of natural products, processing of raw materials (for example, coffee roasting, Teefermentation, ripening of cheese, etc.)

Forms of foreign trade

- Import trade : sales contract between domestic buyer and foreign seller

- Indirect import: sales contract between domestic user and importer who concludes a sales contract with a foreign shipper . The importer has sources of supply and business contacts abroad and bears the delivery risk

- Merchanting : A domestic buyer buys goods from a foreign seller and acts as a reseller, whereby the goods do not affect the country of the sales agent for customs purposes

- Export trade : sales contract between domestic seller and foreign buyer

- Indirect export: sales contract between domestic manufacturer and exporter, which concludes a sales contract with a foreign customer in a third country / non-EU country

- Active / outward processing traffic : Goods are neither imported nor exported under customs law

Risks in foreign trade

Due to the geographical distance between seller and buyer, in contrast to domestic wholesaling, there are a number of special risks in foreign trade:

Risks in the import business

- Delivery risk : Delivery of non-agreed goods in the type / quantity at the wrong time

- Transport risk : For example, spoilage of the goods during transport

- Quality risk : The seller does not comply with the agreed quality

- Exchange rate risk at different times of the conclusion of the contract and the initial calculation or at the time of payment

- Customs risk: Imported goods are priced differently than intended.

Risks in the export business

- Acceptance risk: Buyer does not accept the goods

- Payment risk : Buyer does not pay the agreed sales price

- Exchange rate risk at different times of the conclusion of the contract and the initial calculation or at the time of payment

- Credit risk : Buyer takes disparate credit from seller due to late payment

- Conversion risk : Foreign government sanctions the exchange of national currency for foreign currency

- Political risk ( force majeure ): Foreign countries confiscate the imported goods.

Document handling

Transport documents

The foreign trader concludes a freight contract with the shipper to transport the goods. The freight contract gives rise to a number of rights and obligations for the carrier ( carrier ). For land transport, the consignment note is the usual transport document, which acts as a document of evidence, accompanying documents , receipt / receipt from the recipient, the basis for the freight billing and as a blocking paper . Freight forwarders usually offer a range of services: arranging freight contracts, their own transport or via subcontractors, storage, customs formalities, cargo handling, packaging, marking and labeling of freight items, transport insurance, document handling, etc. The most important transport documents are the accompanying documents:

- Bill of lading ( English Bill of Lading ): Transport document for the sea as the basis of sea freight contract with traditional , legitimacy and probative.

- Railway waybill ( English Railroad Waybill ).

- Air Waybill ( english Air Waybill ).

- Seefrachtbrief ( English Sea Waybill ).

- Forwarder shipping documents such as FCR (Forwarder's Certificate of Receipt), FCT (Forwarder's Certificate of Transport) etc.

Due to the special foreign trade risks, D / A or, in the case of trusting business relationships, D / P transactions have established themselves as opposed to sales on open account.

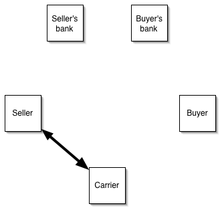

D / A business (document collection)

Documents against Accept The customer undertakes to pay the document countervalue for an accepted bill of exchange (certificate) . In a documentary collection is a train-to-train business and power of banks in the document and payment processing. The exporter issues an agency agreement to his remitting bank. The banks check the suitability of the submitted documents to be trusted, but not the correctness and legal validity of the submitted documents. The International Chamber of Commerce establishes uniform guidelines for document collection. The main risk against D / A transactions is the surrender of the goods against an accepted bill of exchange, which may not be redeemed.

D / P business

Documents against payment (Documents against Payment) The customer undertakes to pay the document countervalue; the due date is when the documents are first presented. Different payment terms, such as "D / P payment 30 days after sight / upon arrival of the ship" can also be agreed. Risks in D / P transactions are delayed or failure to take documents as well as goods not delivered to the customer, which then have to be sold for a reduced profit.

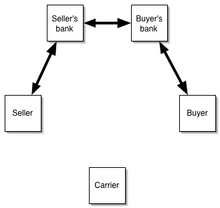

L / C business

A documentary credit is the most complex form of processing and contains details about delivery conditions ( Incoterms ), description of goods, quantity of goods, payment amount, currency , port of shipment, port of destination, beneficiary, type of shipping, payment, type of documents to be presented, deadlines for shipping and validity of the credit, due dates (for first presentation of the documents, upon sight or upon arrival of the steamer), processing costs, type of letter of credit, named buyer (importer as client and exporter as beneficiary) and corresponding banks (advising bank and opening bank). A documentary credit is an abstract promise of debt and expresses a credit relationship. Letters of credit differ according to the type of different service, such as payment on sight, postponed payment term, acceptance or negotiation when the documents are purchased by the opening bank.

Other commercial documents are:

- Commercial invoice (certified, legalized by the chamber of commerce, consulate, etc.)

- Consulate invoice

- Customs invoice

- Certificate of Origin

- Insurance certificate

- Inspection certificate ( inspection before shipment ): Clean Report of Findings

Transport insurance

Transport insurance refers to the sum insured, which relates to the sales price plus the imaginary profit. Bank charges, financing costs, export guarantees and the sales agent's commission also relate to the sales price.

Purchase contract

In foreign trade, the purchase contract regulates the purchasing and sales conditions of both parties via the agreed purchase / sales price, delivery time, delivery and payment conditions, etc.

Special forms of sales contracts in foreign trade

- Warehousing / drop shipment: Goods are delivered directly by the manufacturer and do not affect the dealer's warehouse

- Unloading business / Loco business: Goods are delivered from a seaport to a destination port via a bill of lading

- Fixed trade: Fulfillment of the sales contract is based solely on compliance with a fixed delivery date

Terms of contract

The following characteristics can be contractual conditions in foreign trade:

- Packaging (neutral packaging) and marking

- Denomination of Origin

- Quality determination: provenance, product types and standards

- Quantity determination

- date of delivery

- Dispatch advice

- Reservation of self-supply

Delivery conditions according to Incoterms

The Incoterms regulate the transfer of costs and risks of the goods from the seller to the buyer, the most common are:

- EXW - ex works: The seller's obligations end with the provision and marking of the respective goods in the warehouse

- FCA - free carrier: Risks and costs are transferred to the buyer when the goods are handed over to the first carrier

- FOB - free on board, for example FOB Hamburg: Risks and costs are transferred to the buyer when the goods are placed on the ship in the Hamburg shipping port

- CIF - cost, insurance, freight, for example CIF Santos: So-called 2-point clause, risk and cost transfer take place at 2 different points. The risk is transferred to the buyer when the goods are placed on the ship in the port of shipment; the transfer of costs takes place when the ship arrives at the port of destination. The buyer bears the costs from handling in the port of destination.

Payment terms

Exchange rates

Since suppliers and customers are based abroad, payment is based on the respective type / exchange rate of the agreed currency . The bid rate describes the buying rate and the ask rate the selling rate of the bank . Forward exchange deals are decided at a certain forward rate . The swap rate (see foreign exchange swap ) describes the difference between the forward and the respective daily rate.

Payment terms without bank participation

- Prepayment , prepayment ,

- Deposit ,

- Payment term ( English clean payment ).

Financing in foreign trade

- Supplier credit with an agreed payment term,

- Current account credit ,

- Acceptance credit on an accepted bill of exchange,

- Lombard loan ,

- Guarantee credit .

Foreign trade risks

Calculation in the foreign trade company

Progressive export calculation

Listeneinkaufspreis (ohne USt) - Exporteurrabatt = Zieleinkaufspreis - Lieferskonto = Einkaufspreis + Bezugskosten = Bezugspreis, zum Beispiel FOB Verschiffungshafen + Transportkosten = Preis FOB verschifft + Seefracht = Preis CFR Bestimmungshafen + Seeversicherung (Vertriebsaufwand/-kosten) + Finanzierungskosten (Vertriebsaufwand/-kosten) + Kreditversicherung (Vertriebsaufwand/-kosten) + Bankgebühren (Vertriebsaufwand/-kosten) + Verkaufsprovision (Vertriebsaufwand/-kosten) + Nutzen = Angebotspreis CIF Bestimmungshafen

Umsatzerlöse - Wareneinsatz (Warenkosten) = Rohgewinn - Vertriebskosten = Nutzen (Außenhandel)

20 percent of the benefit is a “reasonable profit”, 80 percent is required to cover overhead costs such as handling costs , personnel costs , business premises rent and depreciation on property, plant and equipment .

Production account of a foreign trade company

Debit account

- Purchases of intermediate consumption

- Depreciation

- indirect taxes ./. Subsidies

- Factor income: wages, salaries, rents and interest

Have account

- Sales of intermediate goods

- Sales of consumer goods to households

- Sales of capital goods

- Change in stocks

- Self-made systems

- Sales to abroad / export

See also

literature

- Edith Ullmer-Schulz: Traffic theory of foreign trade. Feldhaus Verlag, Hamburg 1995, ISBN 3-88264-201-7 .

- Gerhard Kühn, Helmut Schlick: Special economics in wholesale and foreign trade. Vol. 1–2, Verlag Dr. Max Gehlen, Bad Homburg 1996, ISBN 3-441-74110-2 .

- Sheets on professional studies: businessman in foreign trade. W. Bertelsmann Verlag, Bielefeld

- Reinhold Schütt: Import-Export Business. Schütt Verlag, 2010, ISBN 978-3-9800299-0-2 .

- Fritz-Ulrich Jahrmann, Klaus Olfert: Foreign trade (compendium of practical business administration). Kiehl, 2007, ISBN 978-3-470-54262-1 .

- Helmut Schlick: Foreign trade. International trade. Bildungsverlag Eins, 2005, ISBN 978-3-427-55000-6 .

- Clemens Büter: Foreign trade: Basics of global and intra-community trade relations. Physica-Verlag, 2007, ISBN 978-3-7908-1724-9 .

- Hans-Jürgen Bazan, Margit Bentin, Jürgen Böker, Klaus Richter, Dirk Scharf: Handbook for merchants in wholesale and foreign trade. Winklers, 2009, ISBN 978-3-8045-3528-2 .

Web links

- Federal Association of Wholesale, Foreign Trade Services e. V.

- Federal Ministry for Economic Affairs and Energy

- HDE trade association Germany

Individual evidence

- ↑ Typed raw materials traded on the stock exchange

- ↑ Place where payment is to be made, see: http://www.finanz-lexikon.de/zahlbarstellung_3661.html

- ↑ http: //www.wirtschaftslexikon ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. 24.net/d/negoziierung/negoziierung.htm

- ↑ http: //www.wirtschaftslexikon ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. 24.net/d/streckengeschaeft/streckengeschaeft.htm