Global financial system

The global financial system is the interaction of financial markets, regulated financial intermediaries (e.g. banks, insurance companies), little to unregulated shadow banks (e.g. investment funds), national and supranational financial market regulators , central banks and international organizations such as B. the International Monetary Fund .

So borrow z. B. Central banks lend money to banks, banks lend money to hedge funds, private equity institutions and governments. The interdependencies of these loans create a global systemic risk. Therefore z. For example, the American subprime crisis will become the international financial crisis from 2007 onwards.

The importance of the global financial system increased as a result of increasing globalization, which was promoted by technical innovations such as telecommunications and the Internet on the one hand and the victory of the free market economy model on the other. The importance of the global financial system is also demonstrated by the fact that, since the 1970s, the volume of international capital movements has been 100 times the volume of international goods movements.

introduction

Financial systems can be viewed on a regional, national or global level. Financial systems are the entirety of financial markets , financial intermediaries , service companies and other financial institutions. They are used to divert savings into investment projects. Financial systems have the following functions:

- To facilitate the creation of financial transactions (financing function).

- The monitoring and control function

- In the case of uncertain corporate investments, it enables the risk to be shared among different investors (risk allocation function).

- It provides information about various investment and financing functions (information creation and communication function).

In the global financial system, the interaction of financial markets, regulated financial intermediaries (e.g. banks, insurance companies), little to unregulated shadow banks (e.g. investment funds), national and supranational financial market regulators , central banks and international organizations such as B. the International Monetary Fund observed.

The risk that problems with one or more financial institutions, or markets, or market segments, or a payment transaction or securities settlement system spread to other areas or participants in the financial system is called systemic risk . The domino effect and / or the information effect come into question as the dissemination mechanism. The domino effect occurs when the following financial system components are infected. If, for example, a credit institute gets into dire straits that endangers its existence, the creditors have to write off their claims and can thus possibly get themselves into major financial difficulties. With the information effect, for example, a bank's existence-threatening imbalance leads to financial market participants fear of a domino effect and also to withdraw massive amounts of money from other banks ( bank run ), so that even healthy banks can get into major financial difficulties.

So borrow z. B. Central banks lend money to banks, banks lend money to hedge funds, private equity institutions and governments. The interdependencies of these loans create a global systemic risk. Therefore z. For example, the American subprime crisis will become the international financial crisis from 2007 onwards.

history

Various historical developments were decisive for the development of the global financial system as it exists today. On the one hand, the importance of real estate has been significantly outweighed by the importance of financial assets over time. The development of stock corporations was essential here . These allow business investments with smaller amounts of money and without a permit z. B. required by majority owners. This allowed large amounts of money to be accumulated and invested. Economies that were originally based largely on national family businesses are now more shaped by large international companies. A law in which guilty prisons were common has become a civil law with limitations on liability . The economic order changed from mercantilism to liberal economic orders. Primitive money evolved into the gold standard and further into paper money , deposit money, book money and electronic money . The success of paper money was only possible due to the development away from free banking towards central bank systems , the credibility of which can be confirmed or called into question by the development of the exchange rate. Trade and financial markets went from isolationism to globalization.

With the growth of large companies exploring the earth for raw materials and markets, the need for a global financial system grew. In order for this to develop, an internationally accepted monetary system first had to be created. For example, in the British colony of Virginia, tobacco had a monetary function ; in the colony of Canada, it was bearskin. However, trading between colonies on a Tash basis was time consuming. Carrying out goods transactions on a credit basis was only possible within the same legal area, as it was not possible for outsiders to legally enforce claims. An internationally accepted monetary system emerged for the first time with the gold standard , which enabled legally secure financial transactions free from currency devaluation risks.

Due to the gold automatism and the informal coordination by the Bank of England, the classic gold standard was the first de facto global financial system. The first global financial system created as a legal construct was the Bretton Woods system.

Classic gold standard (1870-1914)

The Gold Standard marks the beginning of the global financial system for many economists. The exchange rate of many important currencies was regulated by the gold automatism . The gold automatism also led (at least in theory) to the balance of payments adjustment in that countries with balance of payments surpluses increased inflation and deflation and depression occurred in countries with balance of payments deficits . According to Barry Eichengreen's analysis, the gold standard currency system worked in this phase mainly because the central banks coordinated their monetary policy under the leadership of the Bank of England . To a certain extent, some countries evaded the gold automatism through a protectionist foreign trade policy. International financial transactions were subject to little or no regulation. The telegraph accelerated global communications significantly.

Between the wars and the end of the gold standard

During the First World War, the gold standard was suspended in almost all countries. After the First World War, the United States became the main net exporter of capital with steady trade surpluses and low interest rates. At the same time the Bank of England lost its leading role in the organization of the gold standard without the Federal Reserve System (FED) taking it over. While in the time of the classic gold standard the capital flows were countercyclical, i.e. there was increased capital inflows during phases of economic weakness in a country, the capital flows in the interwar period were procyclical. The United States exported a great deal of capital in the 1920s. When the FED raised interest rates in 1928, capital exports stopped. Economic historians agree that the gold standard, a transmission mechanism for the dissemination of the global economic crisis was and contributed significantly to the origin and length of the Great Depression. Over time, the monetary policy flaw became apparent. Little by little, all states suspended the gold standard and adopted a reflation policy . The almost unanimous view is that there is a clear temporal and substantive connection between the global move away from the gold standard and the beginning of the economic recovery.

Bretton Woods System (1944–1973)

With the Bretton Woods system, a new global financial order was adopted in 1944. The individual currencies were linked to the US dollar as the anchor currency within exchange rate bands . The dollar, in turn, was tied to the gold price at an exchange rate of $ 35 per ounce. Only central banks were allowed to exchange dollars for gold. The devaluation of a currency was only permitted with the approval of the International Monetary Fund, but this approval was never refused. International capital flows were regulated by national capital controls and were essentially limited to long-term investments. The International Monetary Fund was set up to stabilize countries with balance of payments difficulties. The World Bank was founded to pursue development policy goals.

The Bretton Woods system represented a compromise between free trade and national autonomy, especially in monetary policy to maintain or restore a high level of employment and a high national income. The autonomy of national economic policy was secured to a certain extent by capital controls and fixed exchange rates.

Increasing financial globalization and the end of the Bretton Woods system

One of the weaving mistakes of the Bretton Woods system was the Triffin dilemma . Global trading required liquidity that could only be created by freeing up additional US dollars. As a result, however, the USA ran into balance of payments deficits . A Eurodollar market developed in Europe as early as the 1960s and 1970s . For one, large dollar holdings accumulated due to the US trade deficit. On the other hand, the Eurodollars were not subject to capital controls in either Europe or the USA , so that banks and international companies had an incentive to accumulate Eurodollars. A lively Eurobond market developed (a market for foreign currency bonds issued in dollars). The oil price crisis of 1973 led to a sharp increase in petrodollars due to rising profits from the oil business . The oil-producing countries invested a large part of the dollars coming from the oil business, so that the capital markets were also flooded with petrodollars.

As under the gold standard, difficulties in getting foreign trade deficits under control also became apparent in the Bretton Woods system. The simplest balance of payments mechanism , the exchange rate mechanism only works in a system of flexible exchange rates. In the Bretton Woods system, exchange rate adjustments required approval and were rather undesirable. Adjusting the balance of payments through internal devaluation was unpopular after the experience of the Great Depression. In the early 1970s, the US dollar came under devaluation pressure due to chronic trade deficits and increased inflation in the US . Maintaining the fixed exchange rate to the dollar would also have been the case for other countries such as B. Germany and Japan have to accept increased inflation. Some countries were not ready for this. Also, due to the strong growth in Eurodollar and Petrodollar stocks, the exchangeability of dollars for gold was no longer guaranteed. Since the dollars held outside the United States were not subject to any capital controls, speculation could be made that the dollar would depreciate in the financial markets. Therefore, the Bretton Woods system was abandoned in the early 1970s and the dollar depreciated.

Today's global financial system

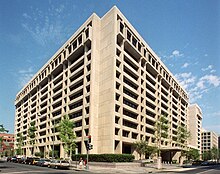

With the end of the Bretton Woods system, most countries switched to a system of flexible exchange rates . The International Monetary Fund (IMF) lost the task of supporting the Bretton Woods system. It soon became clear, however, that after the end of the Bretton Woods system, international financial and currency crises occurred much more frequently , in which the IMF saw itself responsible for providing crisis assistance. In the 1990s, the IMF also campaigned (in line with contemporary financial market theory ) for the deregulation of capital movements. With the abolition of capital controls in almost all OECD countries, the legal boundaries between the domestic and international capital markets no longer existed.

IMF

With the end of the Bretton Woods system, the International Monetary Fund lost a large part of its original functions. The members of the IMF amended Article 4 so that any currency system can be chosen, apart from a currency linked to gold. The IMF continued to oversee exchange rate adjustments. The organization increasingly turned to aid in the event of currency crises. Countries that want to use IMF loans must meet conditions agreed with the IMF ( conditionality ); Structural adjustment programs are often also included . At the beginning of the 1990s, the IMF's tasks were expanded to include the promotion and support of the liberalization of the capital markets and international capital movements. The IMF changed from a stabilization fund to an international financial institution, which mainly dealt with crises in over-indebted nations, as well as with development policy and the change of the former Eastern bloc nations from communism to capitalism . In the 1990s, the IMF was heavily oriented towards the controversial Washington Consensus .

World bank

The World Bank aims to promote the economic development of the member countries and a higher standard of living by facilitating private direct investment and foreign trade and supporting measures to combat poverty. The funds include the granting of loans (grants), the provision of technical assistance for development projects and the coordination of development aid. The World Bank Group consists of the following organizations:

- the International Bank for Reconstruction and Development ( International Bank for Reconstruction and Development , IBRD , the World Bank in the narrow sense)

- the International Development Association ( International Development Association , IDA )

- the International Finance Corporation ( International Finance Corporation , IFC )

- the Multilateral Investment Guarantee Agency ( Multilateral Investment Guarantee Agency , MIGA )

- the International Center for Settlement of Investment Disputes ( International Center for Settlement of Investment Disputes , ICSID )

The International Development Organization awards z. B. Loans on special terms for poorer developing countries. The International Finance Corporation promotes u. a. private direct investment in developing countries. The Multilateral Investment Guarantee Agency guarantees against political default risks in private direct investments.

Basel Committee on Banking Supervision

After it was observed that the banks were working with less and less equity , the G10 (industrialized nations) founded the Basel Committee . In 1988, with Basel I, he developed regulatory recommendations for the national banking supervision of the G10 countries, which essentially stipulated that banks must hold at least 8 percent equity in relation to their risk-weighted assets to cover default risks.

However, Basel I was unable to prevent the financial crisis from 2007 onwards because its capital requirements were circumvented. High-risk mortgage loans were transferred to special purpose vehicles of commercial banks by means of a conduit . These are referred to as shadow banks because they do bank-like business without being subject to banking regulation. The special purpose vehicles financed the purchase by issuing short-term money market paper. Capital could be acquired from short-term oriented investors (e.g. money market funds) via the commercial papers . Since this maturity transformation carried the risk that no follow-up refinancing could be obtained when the issue came due, the parent banks had to provide guarantees in the form of liquidity lines that were supposed to help protect the commercial paper investor from losses when the paper matured. These guarantees were usually given on a rolling basis with a term of 364 days, since the banking supervisory rules did not require equity capital for such off-balance sheet obligations with a term of less than one year before Basel II came into force . So it was possible to generate income without having to draw on regulatory capital. After the real estate bubble burst in July / August 2007, nobody was willing to buy money market paper from shadow banks. It was also no longer possible to sell the structured mortgage loans. The special purpose vehicles made use of the liquidity lines of their parent banks (see e.g. IKB Deutsche Industriebank , Sachsen LB ). The parent banks had to write off these loans because of the lack of solvency of the shadow banks.

In 2007, Basel II adopted improved regulations. With Basel II, short-term investments were also subject to the capital requirements. The capital requirements have been aligned more closely with the creditworthiness of the borrower. A short time later, the financial crisis from 2007 onwards showed that the credit ratings of rating agencies and banks were very unreliable. Based on this experience, Basel III was adopted in 2013 .

European Monetary Union

European states initially decided to react to the end of the Bretton Woods system by intensifying cooperation within the framework of the European monetary system . In the system, there were fixed exchange rates for the European national currencies such as franc or German mark within exchange rate ranges. This should prevent exchange rate uncertainties and currency wars.

Contrary to the international trend towards flexible exchange rates, the European states decided to expand the existing cooperation within the framework of the European monetary system into a currency union . On the basis of the Maastricht Treaty , the members of the European Union (EU) created the European Central Bank (ECB) to coordinate the central banks of the member states, introduced the euro as the common currency and agreed on a complete liberalization of capital movements. In order to lay the basis for monetary union, it was agreed to coordinate economic and monetary policy. The cornerstones were defined in the 5 convergence criteria:

- Price stability: The increase in consumer prices should not be more than 1.5 percentage points above that of the three most stable EU countries.

- Budget deficit: The annual budget deficit of individual countries should consistently not exceed 3% of the gross domestic product per year.

- Public debt: Public debt should not exceed 60% of GDP.

- Interest rates: Long-term interest rates should not be higher than two percentage points above the average in the three most stable countries.

- Currency stability: In the last few years before entering the monetary union within the framework of the European monetary system, the currency should not have appreciated or devalued to any major extent against the other EU currencies.

The actual monetary union began in 1999. The EU member states and the ECB have been working on the challenges posed by the euro crisis since 2010 .

Current developments and debates

Monetary policy

During the Bretton Woods system, individual states were unable to pursue an autonomous monetary policy. Since the currencies were pegged to the US dollar and the USA pursued an expansive monetary policy, all other countries also had to pursue an expansive monetary policy. At the end of the 1960s, the USA recorded economic growth, but also high budget deficits (due to the Vietnam War , among other things ), rising inflation and rising current account deficits . Maintaining the fixed exchange rate to the dollar would also have been the case for other countries such as B. Germany and Japan have to accept increased inflation. In the early 1970s, some countries were no longer willing to do this.

By abolishing fixed exchange rates with the end of the Bretton Woods system, the individual countries were able to operate an autonomous monetary policy again. However, the high level of financial mobility and the emergence of financial innovations limit the ability of the national central banks to control the national money supply and inflation. If a single state pursues an expansive economic policy, then this leads to an increase in inflation in the country being expected on the global financial markets. The interest on loans to this country will increase by the factor of the expected inflation. This can counteract the effect of expansionary economic policy and also make government bonds more expensive. For this reason, most countries followed a restrictive monetary policy that tended to hinder growth until the early 1990s after the end of the Bretton Woods system and led to the expectation of low inflation.

In the financial crisis from 2007 and the Great Recession of 2008/2009 reacted central banks at a low interest rate policy to a deflation to prevent and promote investment and consumption and so to combat the crisis. In 2017, the Bank for International Settlements spoke out in favor of ending the low interest rate policy in view of the good economic situation in order to strengthen the resilience of the economy and be better prepared for the next shock or downturn. At the 2018 IMF-World Bank meeting, the IMF ruled that the global financial system was stronger than it was before the financial crisis from 2007 onwards, but there are financial imbalances as the global debt burden has been significantly stronger since 2007, also because of economic stimulus programs against the global economic crisis and because of the loose monetary policy increased than economic output. The development is particularly clear in the USA and China. The IMF recommends gradually normalizing interest rate policy and creating financial leeway to combat the next downturn through solid national budgets. In a statement on 2018, the Bank for International Settlements considers monetary policy to be successful in the wake of the major crises, but warns that an expansive monetary policy over a very long period of time will increase the dangers to financial stability as well as mispricing of assets and the Underestimation of risks can result. It warned of the rapid rise in corporate debt, particularly among American companies with poor credit ratings. This is the "most visible symptom of possible overheating". The scope for monetary activism has become narrower. In addition to interest rate policy, Brexit, increasing trade disputes and, in particular, cyber attacks are viewed as threats to the global financial system. According to a study by the International Monetary Fund, the damage caused by cyberattacks to the financial system now amounts to more than one hundred billion dollars a year.

Exchange rates and balance of payments imbalances

With the end of the Bretton Woods system, it was no longer forbidden for individual countries to manipulate exchange rates . At times, some economists assumed that foreign exchange market interventions would hardly have any effect due to financial market globalization and the abolition of capital controls. This thesis was refuted by the experience with the Plaza Agreement . When the USA pursued a high interest rate policy in the 1980s to contain inflation and at the same time pushed an expansive fiscal policy to mitigate the growth-retarding effect of high interest rates, this led to a strong appreciation of the US dollar. As a result, there was a sharp increase in imports from Germany, primarily even from Japan, and at the same time there was a period of economic weakness in the USA. In the Plaza Agreement of 1985, it was therefore agreed between the G5 countries that measures would be taken to appreciate the other currencies against the dollar. The foreign exchange market interventions and the coordinated monetary policy led to a sharp devaluation of the US dollar, especially against the yen and the DM. The exchange rate policy caused major economic problems , especially in Japan . The Louvre Agreement tried in vain to stop the devaluation of the dollar.

Asian emerging economies, especially China, pursued an exchange rate policy, also known as the Bretton Woods II regime , until at least 2007 , because China, like many European countries (including Germany) in the 1950s and 60s, tried under the actual Bretton -Woods system did, with an undervalued currency, to create as many jobs as possible in the export sector and to accumulate large stocks of dollar currencies. Some economists see the resulting savings glut as one of the trailblazers for the 2007 financial crisis.

International financial flows and sudden stop

In principle, access to international loans is advantageous for developing and emerging countries. With this capital, however, prosperity can only be increased if it is used productively in such a way that the benefits exceed the cost of capital. However, it happens again and again that more investments and loans flow into certain regions than can be used productively there. Then there are financial and economic crises, such as the Latin American debt crisis of the 1980s, the tequila crisis in the mid-1990s, and the Asian crisis in the late 1990s. Even in the run-up to the financial crisis from 2007 , a disproportionately large amount of money flowed into the US real estate market. Unhindered flows of capital did not turn out to be welfare-enhancing.

Short-term funds often lead to poorly planned investments because investors think short-term and herd behavior deteriorates. If they recognize exaggerations and bad investments, this leads to a sudden stop , i.e. an exaggeration downwards. They withdraw their capital equally from unproductive and productive assets. The credit crunch resulting from general mistrust means that intact and productive economic structures also suffer from a lack of capital.

An example of how such problems can be reduced was Chile in the early 1990s. The strong inflow of foreign capital was regulated by a reserve requirement (indirect capital controls ). This ensured that a massive withdrawal of foreign capital would not cause a financial crisis so quickly. The tequila crisis of 1994/95 could not spread to Chile.

literature

- Ross P. Buckley, Douglas W. Arner: From Crisis to Crisis. The Global Financial System and Regulatory Failure (= International Banking and Finance Law Series. NF 14). Kluwer Law International, Alphen aan den Rijn 2011, ISBN 978-90-411-3354-0 .

- David Held , Anthony McGrew, David Goldblatt, Jonathan Perraton: Global Transformations. Politics, Economics and Culture. Stanford University Press, Stanford CA 1999, ISBN 0-8047-3625-1 .

Individual evidence

- ^ Buckley, Arner: From Crisis to Crisis. 2011, pp. 19-20

- ↑ Svetlozar R. Nikolov, The role of banks in the financial system: a comparative analysis of the banking systems in Germany and the USA , Tectum Verlag DE, 2000, ISBN 9783828881129 , pp. 18, 19

- ^ Financial Times Lexicon, Definition of global financial system

- ↑ Marcel Lähn, Hedge Funds, Banks and Financial Crises: The Significance of Off-Balance Sheet Leverage Effects from Financial Derivatives for Risk Management in Financial Institutions and the Systemic Risk of the Global Financial System , Springer-Verlag, 2013, ISBN 9783322817655 , pp. 35–38

- ^ Financial Times Lexicon, Definition of global financial system

- ^ Larry Allen, Global Financial System 1750-2000 , Reaction Books, 2004, ISBN 9781861895707 , p. 9

- ↑ Larry Allen, Global Financial System 1750-2000 , Reaction Books, 2004, ISBN 9781861895707 , pp. 10, 11

- ↑ Held et al .: Global Transformations. 1999, p. 192.

- ↑ Dietmar Dorn, Rainer Fischbach: Economic theory and policy (= Economics. Vol. 2). 4th, revised edition. Oldenbourg, Munich 2002, ISBN 3-486-25870-2 , p. 212.

- ↑ Held et al .: Global Transformations. 1999, pp. 196-197.

- ↑ Held et al .: Global Transformations. 1999, p. 192.

- ↑ Held et al .: Global Transformations. 1999, p. 199.

- ^ Peter J. Montiel: International Macroeconomics. Wiley-Blackwell, Malden MA et al. 2009, ISBN 978-1-4051-8386-4 , p. 154.

- ↑ Randall E. Parker, Reflections on the Great Depression. Elgar Publishing, Cheltenham et al. 2003, ISBN 1-84376-335-4 , p. 22.

- ↑ Carmen M. Reinhart, Kenneth S. Rogoff : This Time is Different. Eight Centuries of Financial Folly. Princeton University Press, Princeton NJ et al. 2009, ISBN 978-0-691-14216-6 .

- ↑ Held et al .: Global Transformations. 1999, pp. 199-201.

- ↑ Held et al .: Global Transformations. 1999, p. 201.

- ↑ Held et al .: Global Transformations. 1999, p. 202.

- ^ Buckley, Arner: From Crisis to Crisis. 2011, pp. 12, 13.

- ↑ Held et al .: Global Transformations. 1999, p. 202.

- ^ Buckley, Arner: From Crisis to Crisis. 2011, p. 14.

- ↑ Held et al .: Global Transformations. 1999, p. 216.

- ^ Buckley, Arner: From Crisis to Crisis. 2011, pp. 13, 14.

- ↑ Federal Agency for Political Education, World Bank

- ^ Chris Brummer, Soft Law and the Global Financial System: Rule Making in the 21st Century , Cambridge University Press, 2012, ISBN 9781107004849 , p. 263

- ↑ Mastering the financial crisis - strengthening growth forces. Annual report 2008/2009 of the Advisory Council on the assessment of macroeconomic development , item 174.

- ^ Markus K. Brunnermeier: Deciphering the Liquidity and Credit Crunch . P. 79.

- ↑ Mastering the financial crisis - strengthening growth forces. Annual report 2008/2009 of the Advisory Council on the assessment of macroeconomic development , item 174.

- ↑ On the shadow banking system, see also CESifo Group Munich: The EEAG Report on the European Community 2009, passim, ISSN 1865-4568 .

- ^ Chris Brummer, Soft Law and the Global Financial System: Rule Making in the 21st Century , Cambridge University Press, 2012, ISBN 9781107004849 , p. 263

- ↑ Held et al .: Global Transformations. 1999, p. 132.

- ↑ Federal Agency for Civic Education, European Economic and Monetary Union

- ↑ Held et al .: Global Transformations. 1999, p. 229.

- ^ Buckley, Arner: From Crisis to Crisis. 2011, pp. 12, 13.

- ↑ Held et al .: Global Transformations. 1999, p. 202.

- ↑ Held et al .: Global Transformations. 1999, p. 229.

- ↑ Federal Agency for Political Education, Low Interest Policy, Duden Economy from A to Z: Basic knowledge for school and study, work and everyday life. 6th edition Mannheim: Bibliographisches Institut 2016. Licensed edition Bonn: Federal Agency for Civic Education 2016

- ^ FAZ, Bank der Zentralbanken calls for a turnaround in monetary policy , June 25, 2017

- ↑ FAZ, IMF warns of new dangers , October 10, 2018

- ↑ FAZ, Bank of Central Banks recognizes first signal of crisis , June 30, 2019

- ↑ See z. B. Helmut Ettl: "I have never seen so many actors working to possibly trigger a crisis" in: Christine Klafl "Thick bundle of dangers for the financial system" in Der Kurier on November 28, 2018.

- ↑ David Flath, The Japanese Economy , Oxford University Press, 2014, ISBN 9780198702405 , pp. 139–141

- ↑ Held et al .: Global Transformations. 1999, pp. 131-132.

- ↑ Benedikt Fehr, "Bretton Woods II is dead. Long live Bretton Woods III" , Frankfurter Allgemeine Zeitung, May 13, 2009

- ^ Buckley, Arner: From Crisis to Crisis. 2011, p. 23.

- ^ Journal for Parliamentary Questions, Gerhard Illing, Sebastian Jauch and Michael Zabel, The discussion about the euro , pp. 161–162

- ^ Ricardo Ffrench-Davis: Economic Reforms in Chile: From Dictatorship to Democracy. University of Michigan Press, 2002, ISBN 0-472-11232-5 , pp. 17-19.