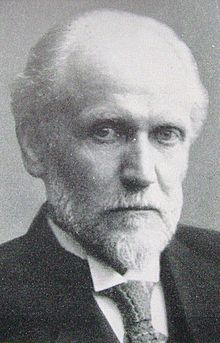

Gustav Cassel

Karl Gustav Cassel (born October 20, 1866 in Stockholm , † January 15, 1945 in Jönköping ) was a Swedish professor of economics . He first studied mathematics in Uppsala and then economics in Germany . He taught economics in Stockholm from 1903 to 1936. He was the founder of the Stockholm School together with Knut Wicksell and David Davidson. Cassel is considered to be the pioneer of purchasing power parity theory . His students include Eli Heckscher , Gunnar Myrdal and Bertil Ohlin .

Act

In his main work, Theoretical Social Economy , Cassel was the first to formulate a formula for continuous growth in which the amount saved is equal to the amount invested.

Like John Maynard Keynes , Gustav Cassel warned in the 1920s of a return to the gold standard and a severe deflationary depression by lowering the price level in line with the pre-war gold parities. He was one of the best-known economists in the early 1920s, so his warnings about the gold standard could not be easily ignored.

The Finance Committee of the League of Nations had appointed a Gold Commission in 1929, which discussed the problems with the gold standard from early summer 1930 to spring 1932. Gustav Cassel explained the global economic crisis with the deflationary policy enforced by the gold standard and pleaded for an expansive monetary policy . The German member of the Gold Commission was the staunch deflationist Moritz Julius Bonn , who argued resolutely against Cassel's theses. The final report of the Gold Commission in 1932, which pleaded for the maintenance of the international gold standard, was not signed by Gustav Cassel as the only member. Although England and the countries of the sterling bloc had given up the gold standard in September 1931, the two Englishmen Henry Strakosch and Reginald Mant and the Belgian Albert-Edouard Janssen limited themselves to a minority report and agreed to the basic position of the Gold Commission.

In his publications such as Postwar Monetary Stabilization (1928), The Crisis in the World's Monetary System (1932) and The Downfall of the Gold Standard (1936) as well as several lectures during this time, Gustav Cassel dealt with the problems of the economy and caused by monetary policy most recently pleaded for a currency system that is completely independent of gold.

In 1934 Cassel was elected to the American Academy of Arts and Sciences .

Works

- The right to full income from work. An introduction to theoretical economics , Göttingen 1900, Vandenhoeck & Ruprecht.

- The Nature and Necessity of Interest , New York 1903, Macmillan.

- Germany's economic resilience, Berlin 1916, Ullstein.

- Theoretical Social Economy , Leipzig 1918, CF Winter (5th edition Leipzig 1932).

- The World's Monetary Problems , London 1921, Constable and Co.

- The monetary system after 1914 , Leipzig 1925, Glöckner.

- Basic ideas of theoretical economics , Leipzig 1926, Deichert.

- The stabilization problem or the way to a solid monetary system , Leipzig 1926, Glöckner.

- Recent monopoly tendencies in industry and commerce. An investigation into the nature and causes of the poverty of nations , Berlin 1927, Springer.

- Socialism or Progress , Berlin 1929, Hobbing.

- The crisis in the world money system , 3 lectures given as Rhodes Memorial Lectures, Berlin 1933, Buchholz & Weisswange

- On quantitative thinking in economics , Oxford 1935, Clarendon Press.

- The collapse of the gold standard , Stuttgart 1937, Kohlhammer.

Festschrift

- Johan Åkerman (ed.): Economic essays in honor of Gustav Cassel , London 1933, Allen & Unwin.

Web links

- Literature by and about Gustav Cassel in the catalog of the German National Library

- Newspaper article about Gustav Cassel in the 20th century press kit of the ZBW - Leibniz Information Center for Economics .

- Ronald W. Batchelder / David Glasner: Pre-Keynesian Monetary Theories of the Great Depression: What Ever Happened to Hawtrey and Cassel? (PDF; 1.5 MB)

Individual evidence

- ^ Douglas A. Irwin: Anticipating the Great Depression? Gustav Cassel's Analysis of the Interwar Gold Standard, p. 5 (PDF, 45 p .; 152 kB)

- ^ MJ Bonn: How to make history , Paul List Verlag, Munich 1953, p. 308f

- ^ The collapse of the gold standard, 1937, p. IX

| personal data | |

|---|---|

| SURNAME | Cassel, Gustav |

| ALTERNATIVE NAMES | Cassel, Karl Gustav |

| BRIEF DESCRIPTION | Swedish economist |

| DATE OF BIRTH | October 20, 1866 |

| PLACE OF BIRTH | Stockholm |

| DATE OF DEATH | January 15, 1945 |

| Place of death | Jonkoping |