Tax law (Switzerland)

Tax law refers to the entirety of the tax legislation , case law and administration applicable in Switzerland . Swiss tax law is shaped by a federal state structure and the extensive lack of a uniform legal regulation of direct taxes that applies to the entire national territory . According to the Swiss understanding of the state, the cantons have tax sovereignty; Since the founding of the federal state in 1848, the federal government (Confederation) has only gradually been allowed to raise some taxes to finance its tasks.

This is particularly evident in the fact that the federal government was only allowed to levy direct federal income tax and VAT for a limited period until 2020. This requirement is laid down in the Federal Constitution (Article 196, Paragraphs 13 and 14). An extension beyond 2020 therefore requires a constitutional amendment, which in turn must be approved by a majority of the people and cantons.

The Tax Harmonization Act (StHG for short) has been in force since January 1, 1993 and was enacted on the basis of the powers granted to the Federation in Article 129 of the Federal Constitution . The purpose of the StHG is to achieve formal tax harmonization under the tax law of the 26 cantons and around 2,500 municipalities. In contrast, the structure of taxes with regard to tax rates, tax rates and tax allowances is still not harmonized. Each canton has its own tax law and levies an income tax, a wealth tax, a profit tax, a capital tax, a withholding tax and a property profit tax. The municipalities have tax sovereignty insofar as cantonal law grants them one. The municipalities usually levy an income tax as a percentage of the respective cantonal income tax rate.

Constitutional principles

The Federal Constitution (BV) statuiert in Article 127 Principles of taxation that apply to the federal government, cantons and municipalities:

- Principle of legality: The subject of a tax, the group of taxpayers and the tax assessment must be laid down in a law in the formal sense .

- Generality of taxation, uniformity of taxation and taxation according to economic performance: These principles are a concretization of the legal equality anchored in Art. 8 BV .

- Prohibition of intercantonal double taxation

The general fundamental rights are also applicable, in particular the property guarantee stipulated in Art. 26 BV and the economic freedom stipulated in Art. 27 BV. The consequence of this is that confiscatory taxation and non-general trade taxes would be unconstitutional.

Finally, in accordance with the general clause in favor of the cantons in Art. 3 BV, the Confederation is prohibited from levying taxes other than those stipulated in the Federal Constitution. These are in particular direct taxes (Art. 128 BV), VAT (BV 130) as well as special consumption taxes (Art. 131 BV) and stamp duties (Art. 132 BV).

Federal taxes

Based on the constitutional basis set out above, the federal government levies both direct and indirect taxes .

The following direct taxes are levied:

| Tax type | |

|---|---|

| Direct federal tax | as income tax for natural persons and as profit tax for legal persons |

| Withholding tax | as security and capital gains tax |

| Casino tax | |

| Compulsory military compensation (actually a levy, not a tax) | as compensation for unfulfilled military service (not only for those unfit for military service) |

The following indirect taxes are levied:

| Tax type | |

|---|---|

| value added tax | as VAT at the standard rate of 7.7%, reduced rate 2.5% and on accommodation services 3.7% (as of 01/01/2018) |

| Stamp duties | Legal transfer taxes on the issue and trading of certain documents, in particular shares |

| Tobacco tax | |

| Beer tax | |

| Burnt water | as a tax on spirits |

| Mineral oil tax | |

| Automobile tax | |

| duties |

Taxes by the cantons

The 26 cantons of Switzerland also levy direct and, in exceptional cases, indirect taxes:

The following direct taxes are levied:

- Income tax and wealth tax (natural persons), with a few exceptions (small cantons) with a progressive tariff

- Profit tax and capital tax (legal persons)

- Inheritance tax and gift tax

- Property tax (only in some cantons, corresponds to property tax in Germany)

- Real estate transfer tax (corresponds to the real estate transfer tax in Germany and Austria )

- Property gains tax ; The difference between the investment costs and the sales price of a property is taxed; it is designed as a speculative tax . In some cantons, the proceeds are used for ecological measures.

- Motor vehicle tax

The following indirect taxes are levied:

- Ticket tax (only in a few cantons)

Taxes of the municipalities

The roughly 2500 municipalities in Switzerland have derived tax sovereignty, depending on cantonal law. They also levy direct and indirect taxes, mostly in the form of a flat tax rate :

The following direct taxes are levied:

- Income and wealth tax (natural persons)

- Profit and capital tax ( legal entities )

- Inheritance and gift taxes

- Property tax (only in some cantons)

- Transfer tax

- Property gains tax

- Lottery tax

The following indirect taxes are levied:

- Dog tax

- Ticket tax (only in a few cantons)

Despite the municipalities' own tax sovereignty, the assessment procedure for cantonal and communal taxes is usually carried out by the same authority.

The above list is not exhaustive. Some of the taxes mentioned above are not levied in all cantons. Examples are inheritance and gift taxes, which are levied excessively in some cantons (for example Geneva) and not at all in some cantons (for example Schwyz).

Tax disparities in Switzerland

The federal tax system causes enormous tax competition and, as a result, a very different tax burden in the various cantons , but also between the municipalities. The cantons and communes differ in the tax rates, but also in the calculation of taxable income. There are also various indirect taxes and fees.

While few taxes have to be paid in the cantons of Uri , Zug , Nidwalden and Schwyz , the cantons of Jura and Valais are at the other end of the scale . The tax burden in the canton of Obwalden has changed significantly in recent years. A massive reduction in tax rates and the introduction of degressive taxation on January 1, 2006, made it the most expensive canton in Switzerland, before the Federal Supreme Court declared the degressive tax to be unconstitutional on June 7, 2007, as it stipulated that in Art. 127 para. 2 BV contradicts the principle of taxation based on economic capacity.

The tax system and the tax burden play an important role in the public discussion, because tax competition acts - in addition to the fact that the people usually decide on the level of taxes - as a revenue-side regulator for the various expenditure-side competitions (for the cultural offer, which Infrastructure, transport, education, etc.), as tax systematists and proponents of tax competition point out. Critics argue that the pressure to lower taxes will at some point endanger the important tasks of the state. Cities, in particular, which also provide services for the surrounding area at special costs, so-called center loads, see tax competition as a dangerous development.

The repartition value is intended to remedy the differences in the valuation of real estate in the individual cantons.

Natural people

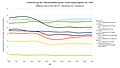

Average income - tax competition between communes and cantons 1997–2007

Natural persons are taxed differently in the different communes and cantons. From 1997 to 2007, a total of 18 cantons of the 26 cantons reduced the burdens on low incomes by around 45,000 francs. Geneva has the lowest rate of all the main cities with a pollution rate of 1.7%. The Glarus has the highest rate with 6.87%. The difference within Switzerland is therefore 5.2 percentage points.

For median incomes of around 90,000 francs, the tax rate was also reduced in 18 of the 26 cantons in the same period from 1997 to 2007. The largest tax cut was in the city of Geneva with a reduction of 2.9%. The lowest you pay in Schwyz with 7.3% or 6,500 francs, the natural person has to deliver the most in Delsberg with 13.25% and approx. 12,000 francs and thus almost double that. Here the competition plays a stronger role with a difference of 8.7 percentage points.

The large incomes of around 180,000 francs are taxed minimally in Zug at 8.17% or around 15,000 francs. In comparison, you pay CHF 35,000 cantonal and communal taxes for the same income in Neuchâtel . This corresponds to a difference of 20,000 francs or 11.3 percentage points. This means that tax competition for the highest income is strongest.

Legal persons

Corporation

The net profit and capital burden from cantonal, communal and church taxes as well as direct federal taxes as a percentage of net profit is not the same everywhere.

For smaller stock corporations with capital and reserves of 100,000 francs, between 12.9% and 34.3% are paid for taxes, depending on the profit made.

For larger joint-stock companies with a capital and reserves of 2,000,000 francs, Sarnen was on average the cheapest location in 2007 with a saving of 6.9 percentage points compared to the rest of Switzerland. At the other end of the scale is Geneva , which levies 5.2 percentage points more and thus around 12% more taxes.

Swiss holding

The Holding Taxation is a source of money for the cantons with approximately three billion Swiss francs (1.84 billion euros) tax revenue per year. Thanks to the double taxation agreement , dividends are exempt from withholding tax in the parent-subsidiary relationship , unless there is an abuse. Participation gains from the holding structure are de facto tax-free in Switzerland (see “Tax competition in Switzerland: Holding - capital burden from cantonal tax in percent 2007”). The federal tax burden of 8.5% is also not applicable to holding companies due to the participation deduction for participation profits.

The Swiss holding company is founded and operated as an active group management company, for example in order to realize the tax advantages. In Germany, this is seen as participation in general economic activity and, from the German point of view, profits are therefore taxable in Switzerland. For most double taxation agreements, such constructs exist in order to use the holding company as a tax saving vehicle. In return, many countries have tax systems that avoid the economic double burden of dividends (box privilege in Germany).

See also

literature

- Peter Mäusli-Allenspach, Mathias Oertli: Swiss tax law .

- Ernst Höhn, Robert Waldburger: Tax law .

- Francis Cagianut, Ernst Höhn: Corporate Tax Law .

- Daniel R. Gygax, Thomas L. Gerber: The federal tax laws .

- Blumenstein, Locher: System of Swiss Tax Law .

Web links

Individual evidence

- ↑ admin.ch

- ^ Mathias Oertli: Intercantonal tax law taxprotal.ch, 1/2018

- ↑ Fabian Petrus: Intercantonal tax elimination: The elimination of real estate in private assets March 27, 2015

- ↑ Page no longer available , search in web archives: estv.admin.ch

- ↑ at-taxes-remains-die-switzerland-hard at www.handelsblatt.com

- ↑ Special study: Holding companies in Switzerland: Is Switzerland with its holding companies a tax haven for companies? (PDF)