Economic cycle

The economic cycle is a model of an economy in which the essential exchange processes are represented as flows of money and flows of goods ( economic objects ) between economic subjects . Flows of money and goods correspond to each other in terms of value in a closed cycle, but run in opposite directions. The cycle analysis forms the basis of the national accounts and thus also of macroeconomics . The term should not be confused with the circular economy .

The idea came up with Richard Cantillon . François Quesnay later developed the Tableau économique . Important further developments of Quesnay's tableaus were Karl Marx 's reproduction schemes (in the second volume of “ Capital - Critique of Political Economy ”) and John Maynard Keynes ' “ General Theory of Employment, Interest and Money ”. On this basis Richard Stone created the basis for the systems used internationally today for the UN and the OECD .

Simple economic cycle

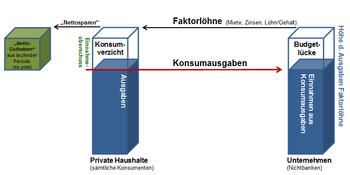

This model is limited to the relationships between the consumer and producer sectors . The economic cycle represents the essential flows of money and goods between the two. Influences from the state , credit institutions , capital collection agencies and foreign countries are not considered.

The flow of money consists of the income and consumption expenditure of households and the income and expenditure of entrepreneurs .

In the flow of goods , economic goods (goods and services) flow from companies to consumers and production factors (labor, land, capital) from private households to companies.

With this approach, households make the factors of production, especially labor, available to companies and do not produce any goods. In return, households receive income from the company (wages, interest, basic pension). Since these are payments for the factors of production (wages, interest, rent, lease), they are called factor income .

Income flows back from households to businesses for purchases of consumer goods. The companies, in turn, deliver consumer goods to households. Two flows of goods (factors of production, consumer goods) and two opposing flows of money (income, expenditure on consumer goods) flow between households and companies. Thus the cycle is closed, static (not growing).

Extended economic cycle (including lending)

The expanded economic cycle includes the possibility that households do not consume all of their income , but also save part of it . This includes any form of asset formation or asset management, e.g. B. also reserves in company balance sheets . The savings also generate income (apparently automatically), namely interest income. Interest income means an income surplus, which, however, has to be financed by a general partner group through an expenditure surplus.

In classical teachings, it is often presented in such a way that savings balances managed by banks are lent to economic subjects in the form of loans ( theory of the classical capital market ). In fact, this is not the case. Initially, lending does not require an opposing position in the form of savings deposits in the bank balance sheet. Book money is created by lending ( deposit creation ) and destroyed by repayment (the balance sheet shortened ) - from the mechanism of credit granting , credit money for investments and / or consumer spending is temporarily made available to the private (as well as to some extent to the public) sector (against monetary liabilities).

In an economy, (non-demanding) money saving must be compensated for by means of excess spending, i.e. by means of net borrowing across the entire sector . If, for example, there is insufficient demand for new loans (or even more loan volume repaid than newly granted), the economy will no longer have sufficient funds available (falling demand) (other things being equal), since the money for loan repayments (excluding interest) is not available flows back into the cycle.

If planned investments cannot be financed due to a lack of bank credit, economic activity falls, companies reduce their expenditures and thus also reduce the level of income within the economy.

Provided that there is no reduction in the deviation from the macroeconomic equilibrium of expenditure (and cumulative surpluses, i.e. money-saving assets within the respective economy, are not reduced either), it is necessary, in order to guarantee the smooth growth process of the national economies, to even push credit-financed investments by expanding the currency in circulation.

If the money flows between the private non-entrepreneurs and the private company considers the overall economy in a closed economy, is in any case a budget gap of enterprises in the amount of the surplus revenue of the private non-enterprises and financing needs to recognize - so (would the company provided that the amount of the funding gap is not self-indebtedness or is not compensated by other sectors ) the economic cycle is interrupted ( ex post ).

Business to Business Investments Every additional investment within the corporate sector increases the income of another entrepreneur, with which the latter, who receives income from the investment of the first, can in turn make investments and another company can generate income from it - insofar as the all of the entrepreneurs, so this in issue lockstep make investments financed their additional investment even itself and as such the company arises (among themselves) from no credit requirements. Wilhelm Lautenbach also formulates this apparent paradox as follows: "The demand of entrepreneurs is not a function of their income, but rather their income is a function of their demand."

If the companies build up more reserves (saving on expenditure), this has a cooling effect on the economy and continues when more households achieve reduced income (in relation to the usual level) and start themselves (due to the reduced income level) in limit their spending.

Complete economic cycle (including the state)

The state influences the economic cycle in several ways. On the one hand, it collects taxes and social security contributions from economic agents. Both households and businesses pay direct and indirect taxes . On the other hand, he pays income (wages and transfer income ) to households and makes purchases from companies (state consumption ), whereby he also has the option of providing subsidies to companies. Here, the flow of money is not offset by any direct consideration in the form of a flow of goods.

The relations between the state and the credit institutions illustrate the ambivalence of state activities. If new indebtedness by private individuals shows a downward trend in relation to the usual previous periods and if the decline in expenditure is not compensated by relieving savings, then state borrowing (domestic / foreign) can create a balance.

Economic cycle of an open economy

In this economic cycle, the international sector is added to the existing sectors. It can affect any household sector. For example, households can receive foreign factor income (e.g. worker is employed abroad and lives in Germany, so his income flows from abroad to domestic households) and conversely, domestic factor income can flow from companies abroad (e.g. guest workers in Germany take your wages abroad with you). In addition, savings payments from abroad can flow into domestic capital collection centers (e.g. foreign countries invest money in Germany in order to receive interest income), or savings payments from domestic households abroad (e.g. domestic residents try to generate higher interest income abroad generate). The most important part in this economic cycle is the (positive / negative) external contribution. This results from the two flows export and import . Example: If exports exceed imports, there is a positive external contribution domestically , i. In other words, money also flows from abroad to Germany ( net export ). Conversely, there is a negative external balance if exports are smaller than imports ( current account deficit ). The domestic money supply is decreasing as money flows abroad.

An economic cycle with the private households, government and foreign sectors is described as open .

Economic cycle as a subsystem of the environment

In more recent approaches, such as the Stock-Flow Consistent Model , attempts are increasingly being made to integrate resources, waste, energy and global warming into models of the economic cycle.

literature

- Carl Föhl: Money creation and the economic cycle . (1st edition 1937) Berlin 1997.

- Emery K. Hunt, Howard J. Sherman: Economics. Volume 2. Macroeconomics. Frankfurt 1993. In particular p. 47 ff.

See also

Web links

- Ralf Wagner: Guide to Economics: Economic Cycle

- GJ Krol: (Presentation) ( Memento from May 17, 2014 in the Internet Archive ) (PDF; 31 kB)

- Rolf Hüpen: Economic cycle and national accounts (PDF; 220 kB)

Individual evidence

-

^ Hans Gestrich: Credit and saving. Jena 1944. (1st edition) p. 73:

“Essentially, saving by accumulating bank balances is about converting circulating bank money into non-circulating deposit money.” […] “It has been a long time that this form of saving also inhibits credit has been disputed. It is precisely here that the contrast between traditional view and modern credit theory emerges most sharply. " - ↑ Deutsche Bundesbank, 2012: Geld und Geldpolitik ( Memento of the original from July 29, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF) p. 72: "Commercial banks create money by lending."

- ↑ Deutsche Bundesbank, 2012: Geld und Geldpolitik ( Memento of the original from July 29, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF) p. 101.

- ↑ Wilhelm Lautenbach (Ed. Wolfgang Stützel): Interest, credit and production (PDF; 1.2 MB), Tübingen 1952, p. 62: “If the saved amounts are held as deposits with the banks, ceteris paribus, the liquidity deteriorates [of the overall banking system]. The credit volume grows with the same fund, so that the ratio of total deposits to fund deteriorates. For if the savers had not saved but spent their income, the amounts of money would inevitably have come to the banks in the same way after they had flowed through the retail trade; the banks' cash holdings would have been the same, but the credit volume would have been lower, because the amounts spent for consumption would have been collected by entrepreneurs, with the result that their credit needs would have been correspondingly lower, but their sales would have been higher. That is a paradoxical result in every direction. Earnings, liquidity and, as a result, the propensity to invest are greater when wage earners save less. Saving is only just generating the need for credit with reduced sales, and conversely, when savers consume earlier savings, the liquidity of both banks and companies is increased and at the same time the entrepreneur's income. "

-

↑ Alexander Mahr: Collected treatises on economic theory. Berlin 1967. ( online ) p. 151:

"One of the prerequisites for a trouble-free growth process is that the investments are higher than the savings, with the additional investment being financed by expanding the currency." -

↑ Deutsche Bundesbank, 2012: Geld und Geldpolitik ( Memento of the original from July 29, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF) p. 78:

"Lending and the associated money creation therefore tend to lead to investments and preferred consumption - and in this way to increased production and economic value creation."

-

↑ Wolfgang Stützel: Economic balance mechanics. (Reprint of the 2nd edition) Tübingen 2011. p. 80:

"The entrepreneurial profits always only lag behind the entrepreneurial expenditure for consumption and investment by exactly the amount by which the non-entrepreneurs create income surpluses." -

↑ Erich Schneider: Money, Credit, National Income and Employment. Tübingen 1964. (8th edition) p. 129:

“If the intended saving from income Y is equal to S, then this income can remain if and only if the entrepreneurs voluntarily invest in an amount equal to the intended savings . " -

^ Wilhelm Lautenbach: Interest, credit and production. (Ed. Wolfgang Stützel) Tübingen 1952. ( PDF ( Memento of the original from October 17, 2013 in the Internet Archive ) Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. ) P. 49: "The entrepreneur's need for credit arises from the fact that non-entrepreneurs save, regardless of whether they are private or public [...]."

- ↑ Wolfgang Stützel: Economic balance mechanics. A contribution to monetary theory. Tübingen 2011 (reprint of the 2nd edition). P. 73.

- ^ Wilhelm Lautenbach: Interest credit and production. (Ed. Wolfgang Stützel) Tübingen 1952. p. 22.

-

↑ Erich Schneider: Money, Credit, National Income and Employment. Tübingen 1964. (8th edition) p. 128:

"If the intended net savings from a certain income are greater than the intended net investment, a process that restricts national income is triggered." -

^ Ewald Nowotny: Reasons and Limits of Public Debt. In: Economics in theory and practice. Berlin u. Heidelberg 2002. ( online ) p. 261:

“Typically, private households have considerable surpluses (net savings). [...] In terms of economic policy, the mandatory balance mechanical relationship is important, ... " -

^ Leonhard Gleske: The liquidity in the credit industry. Frankfurt 1954. p. 64:

“The accumulation of liquid funds, which flowed into the economy as surplus revenues and“ invested ”in deposit accounts, as well as the formation of savings in the production factors, insofar as they take place in savings accounts in the credit system, initially mean the shutdown of money was previously tied in the money cycle. The continuation of the production process at the previous level is only possible with such a set-aside through a "compensatory" money creation of the banking system, because this is necessary in order to keep the "active" money supply serving to satisfy the circulatory money requirement at its old level. "